Micron Technology Earnings Preview: 13% Stock Price Move Expected

Micron Technology Earnings Preview: 13% Stock Price Move Expected

By:Mike Butler

The company’s stock skyrocketed to a recent high of $157.53—an 87.5% increase

- Micron Technology will report earnings Wednesday after the stock market closes at 3:05 p.m. CDT.

- Micron has exceeded earnings expectations four quarters in a row, with a positive earnings-per-share (EPS) expectation this week for the first time in a year.

- Micron is expected to post an EPS of $0.53 on $6.67 billion in revenue.

- MU has massive implied volatility ahead of earnings, with an expected stock price move of +/-13%.

Micron Technology (MU) earnings preview

Micron Technology (MU) posted a huge earnings surprise last quarter, with earnings per share (EPS) of $0.42 on an expected loss of ($0.24).

Sanjay Mehrotra, the company’s president and CEO, offered a strong statement about the rest of 2024 in the last earnings press release.

"Our preeminent product portfolio positions us well to deliver a strong fiscal second half of 2024,” the release said. “We believe Micron is one of the biggest beneficiaries in the semiconductor industry of the multi-year opportunity enabled by AI."

With many tech stocks reaping the benefits of the AI boom, it's no surprise to see such huge earnings figures and plenty of optimism around the sector. But big expectations can result in big surprises to the upside and downside, so we should expect to see plenty of volatility.

Micron has had a very strong 2024 so far, opening the year at $84 per share and skyrocketing to a recent high of $157.53—an 87.5% increase in the first half of the year.

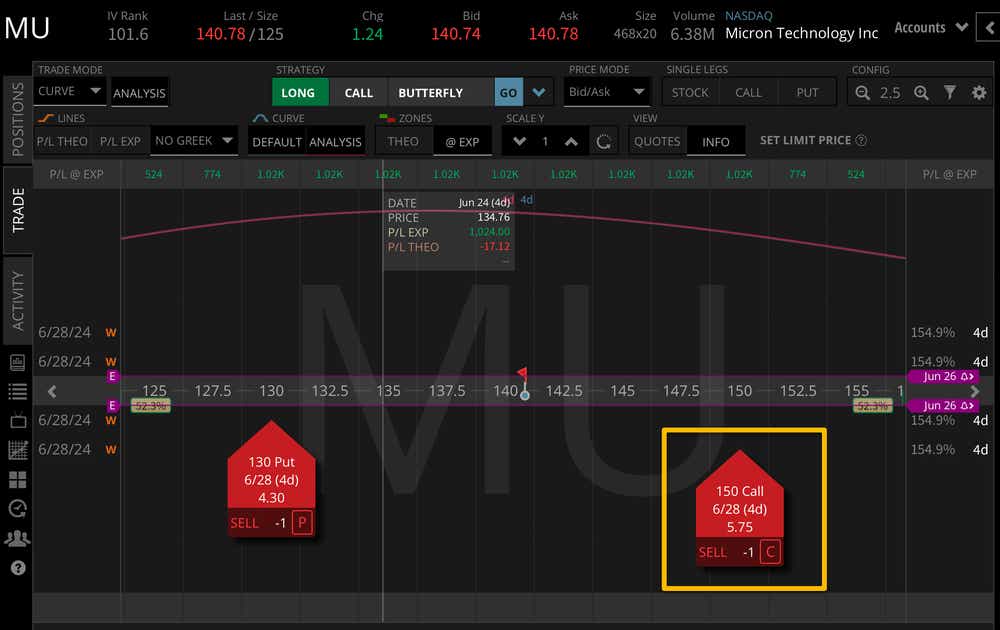

The stock currently sits around $140, with a massive +/-$18.06 expected stock price move based on this week's implied volatility for the earnings announcement. This is well over 10% of the stock price, which is on the higher end of the range for all expected stock price moves for earnings announcements.

Looking to the end of the year, we can see this week's expected move makes up just under 50% of the expected move through January 2025 and just under a third of the expected move through January 2026.

Plenty of weight is being placed on Micron earnings this week, after a 273.75% EPS beat last quarter, flipping the script from a company that has recently posted EPS losses to a pretty sizable gain. Many traders and investors see Micron's high-bandwidth-memory (HBM) chips playing a key role in the continued surge in AI.

These chips are designed to fit inside of larger semiconductors like Nvidia (NVDA) and enhance performance while reducing power usage.

Like many high-flying tech stocks, Micron exhibits call skew. That means the velocity of risk is perceived to be to the upside. It's more expensive to participate in upside movement or hedge upside risk than to participate to the downside. This doesn't mean the stock is moving that direction—it's just how the market is perceiving velocity risk.

Bullish on MU stock for earnings

If you are bullish on Micron, you likely believe the last earnings beat was not a fluke. Micron executives have stated how optimistic they are on the company's performance opportunity through this year and beyond, and the stock market is not taking this earnings announcement lightly with a +/-13% stock price expected move. With Micron's product suite so closely tied to demand, we could see a bullish move after earnings if the company crushes expectations again and offers a positive sentiment for the rest of the year.

Bearish on MU stock for earnings

If you are bearish on Micron for earnings, you may think the company is going to miss on EPS and/or revenue estimates. Misses are generally not good for stock price reaction after the announcement, especially when there has been such an influx in demand in the sector over the past few quarters. A large earnings expectation may not always be good for the stock price, as it creates immense pressure on results—any sort of miss or lack of positive sentiment this Wednesday could send the stock price lower.

Tune in to Options Trading Concepts Live at 11 a.m. CDT every market day, but especially this Wednesday as we analyze earnings options trades ahead of the announcement!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices