Stock Markets at Risk After November Surge as Global Recession Looms

Stock Markets at Risk After November Surge as Global Recession Looms

By:Ilya Spivak

Stocks roared higher in November on the hope that central banks are finished raising interest rates. The onset of recession will soon test their resilience.

- Shrugging off would-be risks, stocks are on pace for a blistering rally in this month.

- The end of the global interest rate hike cycle seems to be front and center for traders.

- Before long, global recession will test market resilience as huge debt rollover looms.

November is shaping up as a month of emphatic celebration for financial markets. The bellwether S&P 500 index of U.S. stocks is on pace to finish the month up close to 8%, the best performance since July 2022.

Investors have shrugged off the outbreak of another war in the Middle East and pushed the ongoing conflict in Ukraine to the back burner. Gold has tellingly stalled at the top of a range capping prices for over three years and crude oil is on track for a second consecutive month of losses. This signals markets aren’t worried about contagion risk.

Corporate chaos at OpenAI, the darling of a resurgent tech sector that powered Wall Street for most of the year, was hardly noticed by the Nasdaq. It is aiming to finish November with a gain of over 10%. Even the beaten down Russell 2000, the small-cap equity benchmark weighed down by sickly regional banks, is angling for the biggest rise in five months.

November stock market rally: Its all about the Fed

The expectation that borrowing costs have stopped rising seems to be driving optimism. The markets were seemingly convinced the Federal Reserve is finished with interest rate hikes after the November meeting of the policy-steering Federal Open Markets Committee (FOMC).

Signs of reversal are on display across the rates structure. The benchmark 10-year Treasury bond is poised to end a six-month losing streak. The same story is playing out at the longer end with 30-year paper. At the front end, two-year Treasury notes are trying for the biggest rise since May 2022. Bond prices move inversely of yields.

The threat of losing money on a trade gone wrong is comparatively less worrisome for investors when the cost of capital—the price at which lost money can be replaced—is expected to be lower in the future. That is a tailwind for risk appetite, with traders more willing to position offensively and overlook potential landmines.

Global recession still menaces the markets

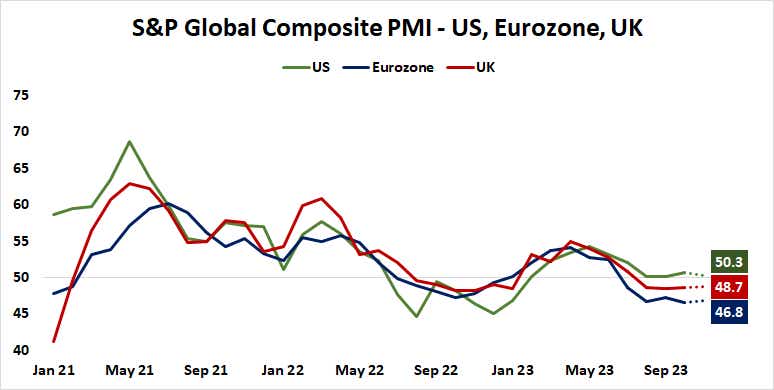

Nevertheless, the way forward looks perilous as the calendar turns to 2024. Most worrying of all, the global economy is stalling. Purchasing managers’ index (PMI) data due this week is expected to show the Eurozone economy shrank for a sixth consecutive month. The U.S. is seen growing, but just barely so.

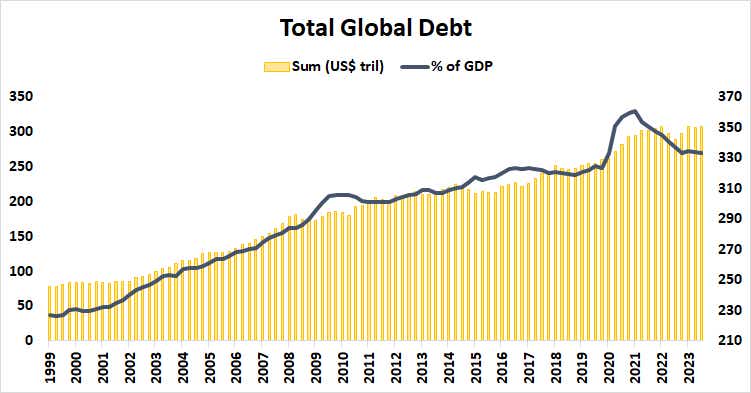

This is a scary prospect at a time when markets must contend with refinancing a historically large pile of private- and public-sector debt at sharply higher interest rates. The Institute of International Finance (IIF) expects the worldwide debt-to-GDP ratio will hit a record 337% this year.

The onset of global recession would diminish this quotient’s “GDP” denominator, driving the debt load higher relative to income and making it more difficult to shoulder. That would still be the case if the numerator stopped growing, but such a prospect at a time of wanton deficit spending seems akin to fantasy. This makes the situation even trickier.

Global financing costs are up by a staggering 500 basis points (bps) on average in less than two years, so rolling over trillions of dollars in debt was going to be difficult under any circumstances. Doing so without the benefit of positive economic growth may mean assets must be sold to raise cash for repayment.

The spectrum of riskier assets is vulnerable in a liquidation scenario, with stock markets front and center. Meanwhile, any scramble for cash is likely to buoy the U.S. dollar.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices