Could Spotify Afford to Keep, or Lose, Joe Rogan?

Could Spotify Afford to Keep, or Lose, Joe Rogan?

SPOT stock has nearly doubled so far this year. Will Rogan remain on their roster?

Joe Rogan never needed Spotify. And he likely doesn’t need them now. But with his Spotify contract ending at some point in early 2024, the streaming service will have to determine whether they need Rogan, or if they can even afford to keep him.

The Joe Rogan Experience debuted on Spotify in September 2020, after Rogan signed a 3.5-year contract with the audio platform, and his show went exclusive in December that same year. The Joe Rogan Experience has been at the top of the platform’s podcasts ever since. Not to mention Spotify’s stock saw an 8% jump the day his podcast deal with the service was announced in May 2020—which is said to have been over $200 million.

Alex Cooper is in a similar position with her podcast, Call Her Daddy, which has been exclusive to Spotify since 2021. Cooper’s Spotify contract is expected to end in 2024 as well, after signing a $60 million three-year deal. Her show was the most popular podcast globally behind Rogan on Spotify Wrapped for 2022.

With more than 11 million listeners per episode, according to MIDiA Research, Rogan has helped Spotify secure its spot in the podcast industry. And as of June 2023, The Joe Rogan Experience had the biggest weekly audience in the U.S. so far this year, according to Edison Research.

Rogan was brought on the platform for his ability to tackle controversial topics and bring on interesting guests, but it has also raised issues for Spotify. Artists including Neil Young and Joni Mitchell left Spotify temporarily, removing their music catalogs, in response to Rogan’s podcast topics. In response, Spotify created a Safety Advisory Council and ended up removing some of Rogan’s episodes from the platform.

Does Spotify need Rogan?

So, why does this matter? Many of Spotify’s other exclusive podcast contracts have unraveled recently, and with layoffs hitting the company, Spotify CEO Daniel Ek stated the company would not “overpay or overinvest” in future podcast deals. With Rogan’s Spotify contract ending within the next year, the company will have to decide if it’s worth spending more on the podcast host in order to keep him, or dissolve the exclusivity of his podcast content on the platform.

It’s a tough decision because it's difficult to produce a hit podcast, and Rogan’s has grown Spotify’s podcast user base. But recent MIDiA Research indicates it could be an all or nothing deal.

Spotify stock

Spotify has around 5 million podcast titles, according to Demand Sage. By the start of 2021, about 25% of Spotify users, or roughly 86 million people, listened to podcasts on the platform. The stock traded at more than $300 a share, valuing the company at more than $50 billion.

Spotify, the largest audio service in the world, has more than 420 million users and about 182 million paid subscribers. It’s the dominant platform in music streaming, “but the company has struggled to convince Wall Street that its spending spree has been worth it,” Bloomberg noted last year.

Spotify Technology S.A. (SPOT) has provided mixed revenue results recently. In Q2 2023, it reported good subscriber estimates, but missed on profitability—with gross margin now down to 24.1%.

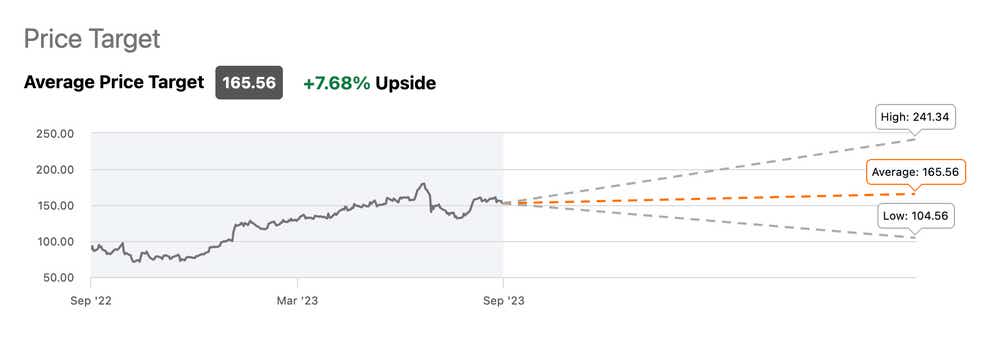

Spotify’s price at publication is $153.75, with an average price target of $165.56.

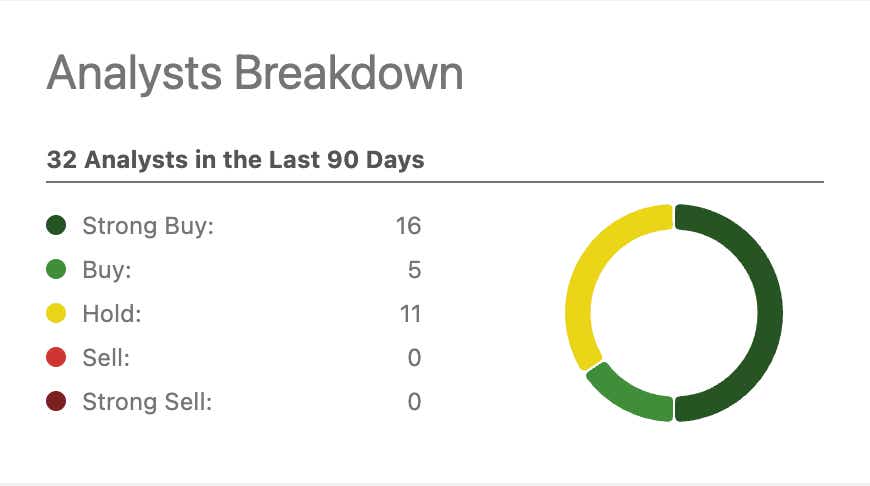

And despite Spotify’s iffy revenue outlook, its stock remains a strong buy according to analysts consensus.

Some market experts warn of risks associated with Spotify, shown through a significant quarterly loss, plummeting free cash flow and a stock that dropped 14% in one day.

But others offer two arguments: Spotify is still a growth story with monthly active user growth (MAUG) of 551 million in Q2 2023—and the company is increasing its premium subscription prices. Those actions will likely push Spotify’s gross margin to ~27.5% and break-even, according to Cavenagh Research.

Spotify invested around $1 billion on podcasts at the onset, and with the help of shows like Rogan’s the platform has become the leading service for podcasts. By growing its advertising arsenal, the company could soon see the investment start paying off. But the platform’s leading shows might not renew their exclusive contracts next year, leaving it unclear what direction the company will take.

Kendall Polidori is an associate editor, music industry reporter and resident rock music critic at Luckbox Magazine. Follow her music reviews on Instagram and X @rockhoundlb.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices