Stock Markets After US Jobs Data: Will This Spur Fed Rate Cuts?

Stock Markets After US Jobs Data: Will This Spur Fed Rate Cuts?

By:Ilya Spivak

Did stock markets find more than they bargained for in downbeat US jobs data?

- Stock markets briefly cheered weak US jobs data, but optimism was quick to fizzle out

- Belated October and November payrolls numbers seem to support the Fed on rate cuts

- Price action on Wall Street seems to warn that recession worries might be returning

At long last, the markets got a look at official US labor market data. The Bureau of Labor Statistics (BLS) stopped reporting the figures amid the US government shutdown that started on October 1 and lasted for a record-breaking 43 days. The belated release of October and November figures seems to have offered little solace to shell-shocked traders.

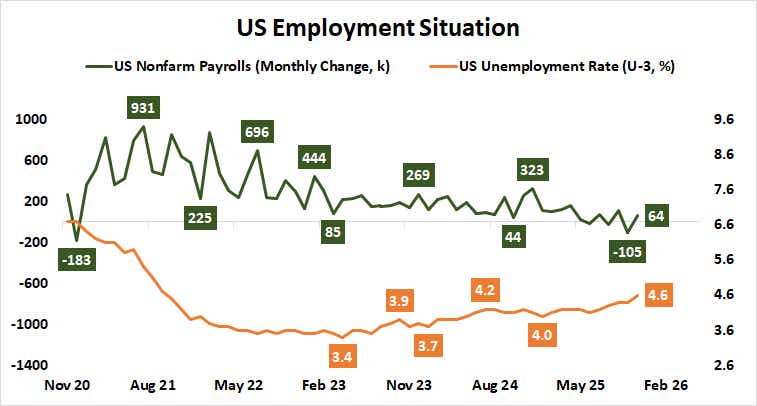

The numbers showed that the US economy shed 105,000 jobs October, then added 64,000 in November. September’s result was revised down to a rise of 108,000, from the initially reported gain 119,000. August’s result was also downgraded to a drop of 26,000, compared with the earlier estimate a 4,000-job decline.

US jobs data seems to endorse the Fed argument for lower rates

The unemployment rate – unavailable for October because of a lapse in data collection – rose to 4.6% last month, the highest in four years. Average hourly earnings grew 3.5% year-on-year, making for the weakest rise in wages since May 2021. These figures seem to endorse the Federal Reserve’s view that a shaky labor market demanded rate cuts.

The larger question for market participants is whether these numbers have the potential to alter the central bank’s calculus next year. Officials’ baseline forecast – revealed in an updated Summary of Economic Projections (SEP) last week – called for just one 25-basis-point (bps) rate cut in 2026. The markets are angling for at least two of them.

Fed Chair Jerome Powell has warned that BLS statistics are overstating payrolls growth by approximately 60k per month, implying that the reported monthly job creation average of about 40k actually translates to trend losses of 20k. The numbers now on hand paint a darker picture: average gains of 10.3k adjust to monthly losses of almost 50k.

Soggy stock markets warn not all rate cuts are created equal

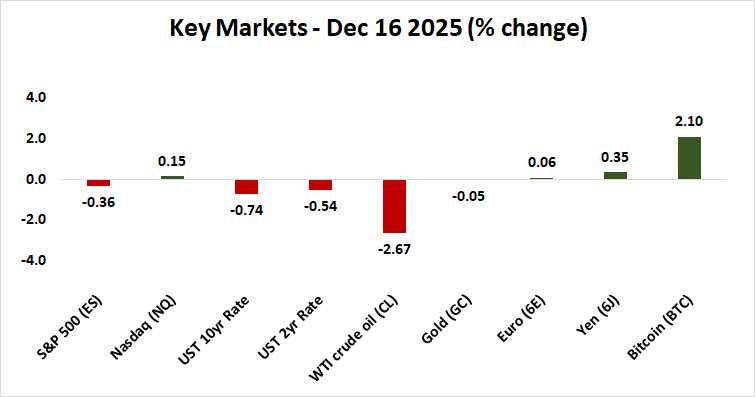

The markets initially cheered as these results came across the wires, with the bellwether S&P 500 index of US stocks popping briefly higher. A parallel spike down in two-year Treasury bond rates implies that traders saw the figures as helping to make the case for a more dovish posture next year.

This optimism proved to be short-lived, however. The priced-in probability of a 25bps rate cut in January inched up ever so slightly to 25.5% from 24.4% previously, and stocks crumbled after a mere five minutes of digestion. The S&P 500 finished the day down 0.36%, completing the first three-day losing streak in a month.

The tech-tilted Nasdaq 100 outperformed, finishing the session up 0.15%. The small-cap Russell 2000 index took an outsized beating, shedding 0.56%. Taken together, this price action configuration hints that the jobs numbers were weak enough to fuel recession fears, making the rate cuts they imply seem ominous rather than supportive.

Ilya Spivak, tastylive head of global macro, has over 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive.com or @tastyliveshow on YouTube

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices