Are Stocks Too Optimistic About China, Tech Earnings, and the Fed?

Are Stocks Too Optimistic About China, Tech Earnings, and the Fed?

By:Ilya Spivak

Stocks seem priced for perfection, so what could go even more right to keep the rally going?

- Wall Street cheered as US CPI inflation data kept Fed rate cut bets intact

- US-China trade tensions seem to ease before Trump-Xi meeting this week

- Reporting season heats up with top tier tech names due to report results

Stock markets scored a second consecutive week of gains, erasing the violent but ultimately brief selloff triggered on October 10. The bellwether S&P 500 and the tech-tilted Nasdaq 100 set new record highs. The critical upward push came late in the week on Friday as US inflation data crossed the wires.

Official economic data has been scarce amid the ongoing US government shutdown, so the markets were understandably wound up as the Bureau of Labor Statistics (BLS) released September’s consumer price index (CPI) report by special dispensation. It showed cooler inflation than expected.

US inflation data keeps the Fed on track to cut interest rates as expected

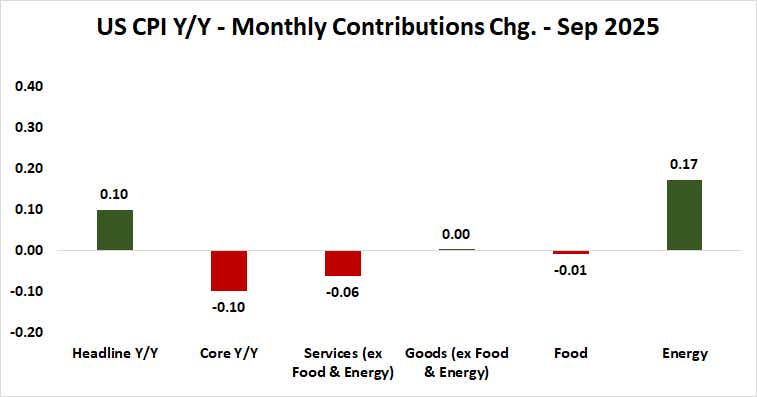

Headline and core price growth – the latter excluding volatile food and energy prices – matched up at 3% year-on-year. That was a touch softer than the 3.1% result envisioned by consensus forecasts. Most of the uptick seemed to come from energy costs. Perhaps most critically, steady goods inflation was a welcome pause in tariff-linked price gains.

Traders seemed to celebrate after the data passed into the rearview mirror without upsetting Federal Reserve interest rate cut expectations. Since the central bank’s last conclave in September, the markets have been all-but-fully priced for 25-basis-point (bps) rate cuts at this week’s policy meeting and at the one to follow in December.

Risk appetite got another fillip at the start of this week after trade talks between the US and China over the weekend in Malaysia produced a raft of agreements ready to be endorsed by presidents Donald Trump and Xi Jinping when they meet later this week. That marks the clearest sign yet that both sides are keen to walk back recent escalation.

Do stocks need to worry as top tech earnings reports loom ahead?

With two key macro risks – an upending of Fed rate cut bets and US-China trade war escalation – thus seemingly defused, the earnings docket comes into focus. A flood of third-quarter results is on the menu, but the spotlight will almost certainly shine brightest on mega-cap tech names once again.

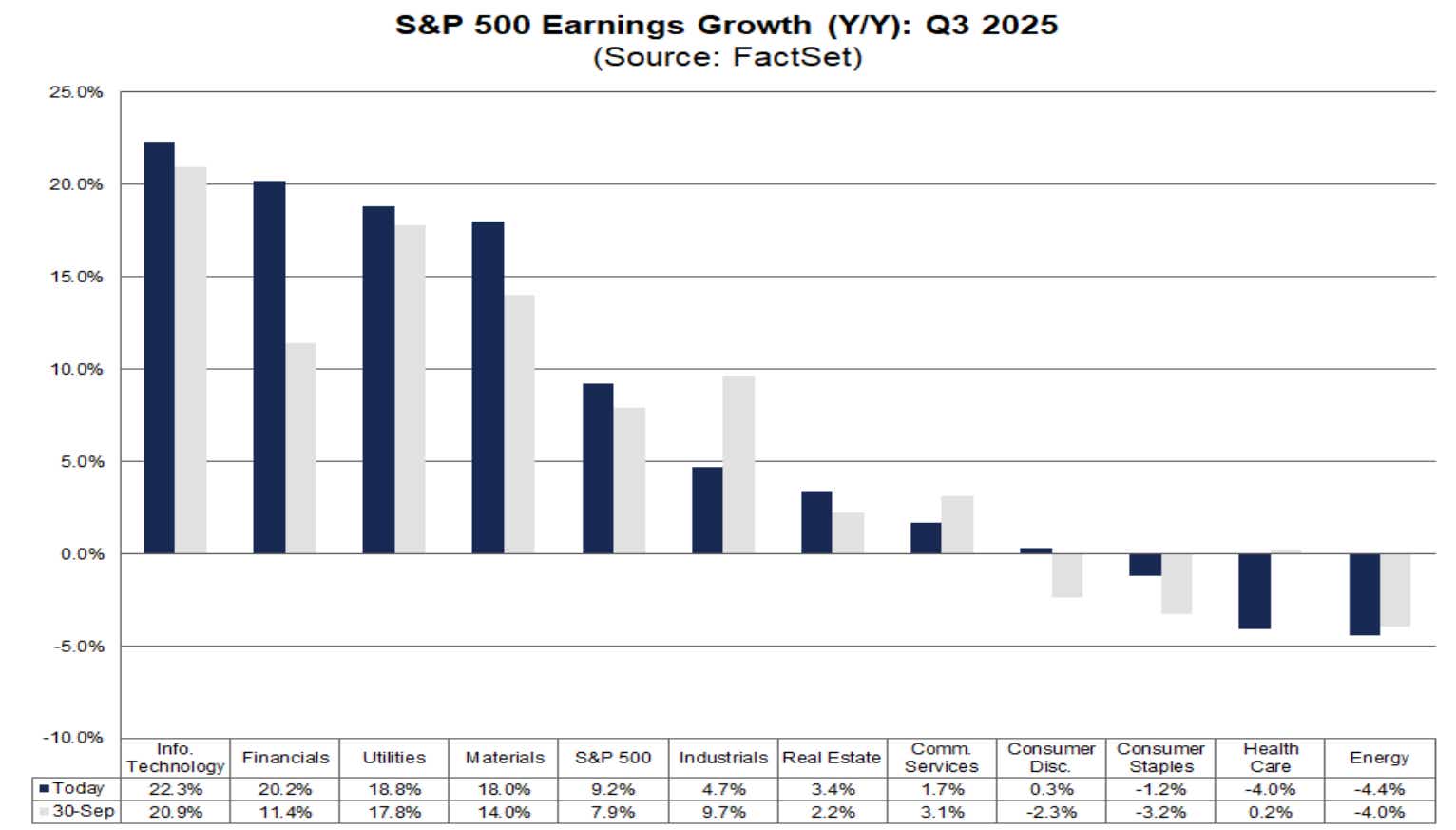

Updates from Microsoft Corp. (MSFT), Alphabet Inc. (GOOG), Meta Platforms (META), Apple Inc. (AAPL), and Amzon.com (AMZN) are due. So far, tech has outperformed with third-quarter earnings growth of 22.3%. Semiconductors lead the way. The average for the S&P 500 stands at 9.2% for now, with 29% of companies having reported.

That seems like a relatively rosy backdrop, hinting that – absent an unlikely shock result for one of the tech sector giants – news on the earnings front is unlikely to derail risk appetite. For speculators, this raises an important question: with stock benchmarks hugging record highs, how much of this benign backdrop has been priced in already?

Markets priced for perfection may find little impetus for gains as traders’ cheery expectations are validated. That could leave them vulnerable to a “buy the rumor, sell the news” dynamic. Moreover, the slightest bit of disappointment might generate an outsized “risk off” response as skewed sentiment resets.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices