Top 4 Stocks to Watch in February 2023

Top 4 Stocks to Watch in February 2023

Market Update: S&P 500 Futures edge higher

The E-Mini S&P 500 Futures (/ES) contract is currently trading at $4047.00, up 3.87% from its opening price of 2023. So far in 2023, the S&P 500 has taken a slight bullish stance. Price is currently breaking out of the down trend channel that governed most of 2022.

The bond market yield curve is still relatively flat. Although analysts seem to be bullish on bonds in the near term, we have yet to see significant movement from bond prices in 2023. If you are bullish on bonds in 2023, look for an opportunity to place a steepener trade. However, bond price movement, as well as spreads, will likely be slow moving trades in 2023.

February earnings reports for big name companies will give us insight into the economy and how consumers are behaving in 2023. This insight will likely be the catalyst for market movement in February. It feels like market participants are vacillating before we get into the meat of Q1’23 earnings next week.

Top Stocks to Watch in February

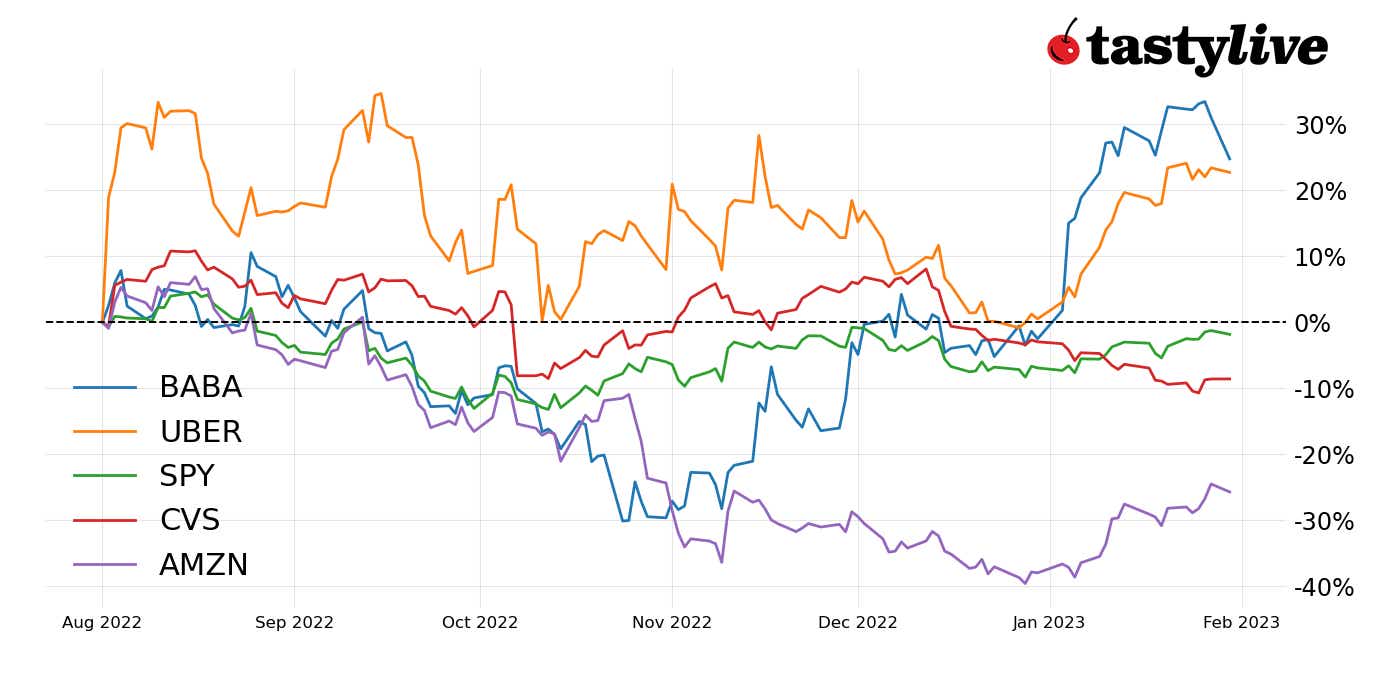

- Amazon (AMZN)

- CVS Corp. (CVS)

- Uber Technologies Inc (UBER)

- Alibaba Group Holding (BABA)

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

Amazon (AMZN)

Earnings Date: February 2nd, 2023 (After the close)

Amazon is currently trading at $99.28, up 16.17% from its opening price of 2023. Since Amazon is such a large company with its hands in so many industries, the results of each quarter's earnings usually have some impact on the market. Traders will make decisions based on how well or how poorly companies like AMZN do each quarter.

Amazon’s earnings reports in 2022 were mixed. Amazon did well throughout the pandemic and now that much of the globe has returned to pre-covid restrictions, Amazon’s valuation has decreased slightly to compensate. That being said, AMZN remains a juggernaut for now.

If you would like to place an earnings trade for AMZN, use February’s options. They are liquid and the markets are tight. By placing your earnings trade in February options, you have the opportunity to roll your position out to March if earnings go against your trade.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

CVS Corp. (CVS)

Earnings Date: February 8th, 2023 (Before the Open)

CVS is currently trading at $87.62, down 4.48% from its opening price of 2023. CVS Health Corporation is a pharmacy innovation company. The last five quarters of earnings have been mostly positive for CVS. It appears as though CVS tightened their belt throughout the Covid pandemic in an effort to cut costs.

CVS earnings will give us insight into the pharmaceutical retail sector. The success or failure of CVS will reflect consumer spending behavior. It will also give us insight into the pharmaceutical industry as well.

If you would like to place an earnings trade for CVS, also use February’s options. They are liquid and the markets are tight. Again, that leaves you with the option to roll out to March after earnings if you need to.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

Uber Technologies Inc (UBER)

Earnings Date: February 8th, 2023 (Before the Open)

Uber is currently trading at $29.95, up 18.1% from its opening price of 2023. Uber has taken a slightly bullish stance since July of 2022. However, the last few months of trading have been mostly sideways.

Uber provides a platform which allows users to access transportation and food ordering services. Their business relies on technology to make transportation and delivery services more efficient. If we see positive earnings reports from Uber, we can infer some positive spending behavior from consumers. This type of spending indicates consumers have extra money to spend on Uber services rather than cheaper alternatives for transportation and delivery.

If you’d like to place a trade going into earnings for Uber use February options. February options have the most volatility and will contract the most after earnings are released. This also gives you the option to roll the position out to March if you need to or want to.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

Alibaba Group Holding (BABA)

Earnings Date: February 23rd, 2023 (Before the Open)

BABA is currently trading at $112.22, up 23.17% from its opening price of 2023. BABA has been governed by a down trend that started at the end of 2020. Since October of 2022, BABA has seen a strong rally. On January 10th, 2023, BABA broke through the bear trend and closed above resistance. This resistance has now turned into support. We have not fallen below the bear trend line since.

BABA is one of the leading e-commerce giants in China. BABA has transformed itself from a traditional e-commerce company to a conglomerate that has businesses ranging from logistics to cloud computing. The operations of BABA give use great insight into China and Asia in general. Earnings reports for BABA have the ability to give us insight into the economy as a whole.

BABA earnings are toward the end of February, which means March options will need to be used if you’d like to take an earnings trade. IV Rank is currently too low in BABA to place a trade, but as earnings approach look for volatility to rise and an earnings trade to present itself.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices