Boeing (BA) Stock Earnings Preview: Traders See Rosy Results

Boeing (BA) Stock Earnings Preview: Traders See Rosy Results

Boeing Stock Rally Cools as Earning Results Near

Boeing (BA) is set to report its fourth-quarter earnings on the morning of Wednesday, January 25, and investors have rosy expectations. Seven months ago, the aircraft maker was trading near $113 per share, the lowest since March 2020, when uncertainty around the economy and regulatory issues weighed on investor sentiment.

Today, investors have a clearer picture of the economy and certification issues, and Boeing has rallied about 70% since September to trade around $207. The stock fell a little over 3% amid a broader equity selloff in the last full week of trading prior to the announcement. A continuation higher is on the cards if the numbers impress.

Analysts expect to see earnings per share (EPS) and revenue cross the wires at 0.25 on just over $20 billion in revenue. The company’s performance in its fixed-price defense development programs will be a key focus after a surprise loss of $2.8 billion in the third quarter. Supply chain developments and cost management are other areas investors are keen to analyze.

Fundamental Conditions Improve as Orders Increase

The Federal Aviation Administration (FAA) cleared Boeing to resume 787 deliveries in August, ending a 15-month ordeal. And in December, Congress cleared a path for the FAA to certify the 737 Max 7 and max 10. Last week, the jet maker announced strong order results for December, securing 203 net orders to bring its total for the year to 774, almost double from 2021.

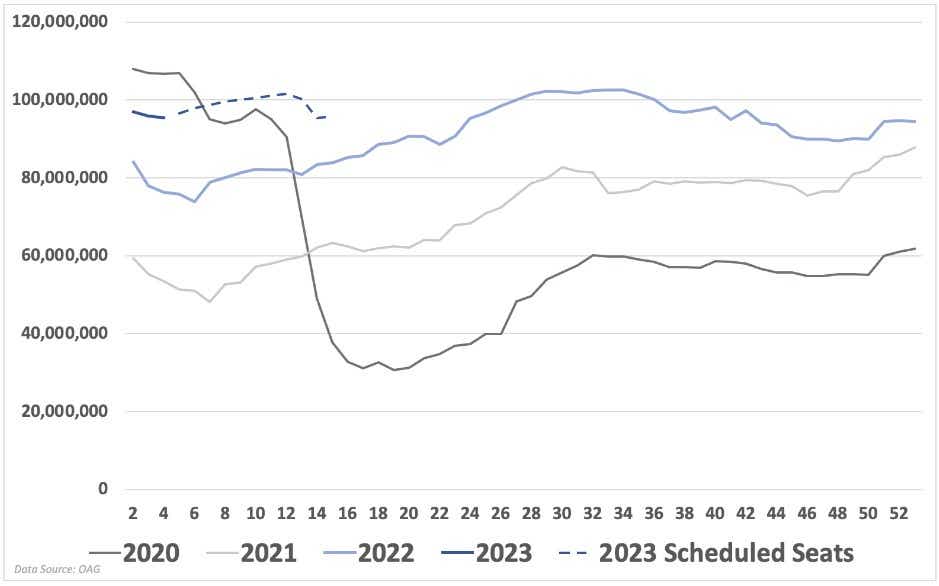

Global air travel has largely recovered to pre-pandemic levels, and China’s reopening should aid the recovery further. The number of global seats booked in commercial air travel for 2023 is off to the best start since 2020, before Covid caused a massive lull in flying. This is encouraging for airlines and should incentivize a strong year of aircraft orders for Boeing.

Options Market Pricing for Boeing

The options market was pricing in an expected move of 14.26 for the February 17 expiration. A good portion of that is likely from the upcoming earnings announcement. An iron condor is one strategy commonly used to play earnings that give a defined risk. With the stock price around 207, the expected move puts a theoretical range of about 193 to 221.

Setting the iron condor’s short strikes near or slightly outside that range provides some confidence in the trade. A decrease in implied volatility is likely due to the volatility crush once earnings are announced, but that would help the position if the stock price stayed within the short strikes. The chart below illustrates an example of the P/L dynamics on such a trade.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices