Sluggish US Stocks, Battered Dollar May Find Fuel Amid Grim Earnings Season

Sluggish US Stocks, Battered Dollar May Find Fuel Amid Grim Earnings Season

By:Ilya Spivak

US stocks have been slow to capitalize while the Dollar has plunged as markets cheer an incoming turn in Fed monetary policy. A grim fourth-quarter earnings season may offer both a lifeline.

- US stocks struggle relative to global peers as market cheer Fed rate hikes end

- Grim guidance amid earnings season might cool market-wide risk appetite

- The Dollar may benefit alongside Wall St if capital flows seek liquidity anew

Speculating on the path of US monetary policy continues to preoccupy financial markets at the start of 2023. The US Dollar has plunged while gold has soared as deepening signs of disinflation and economic slowdown solidify bets that Federal Reserve officials will stop once the benchmark overnight lending rate has reached a target range of 4.75-5.00 percent. That is a mere 50 basis points (bps) or 0.50 percent away and is now priced in to happen by the second quarter.

US stock markets have been curiously sluggish against this backdrop. Through much of the run-up to the Fed’s rate-hike cycle in the second half of 2021 and the actual tightening effort last year, they could be relied on for a vigorous advance at the mere hint of something that might convince hawkish policy officials to slow down. So, it feels out of place to see Wall Street limping higher now, even as the celebration rages elsewhere.

Wall Street Struggles to Keep Up as Global Stock Markets Rise

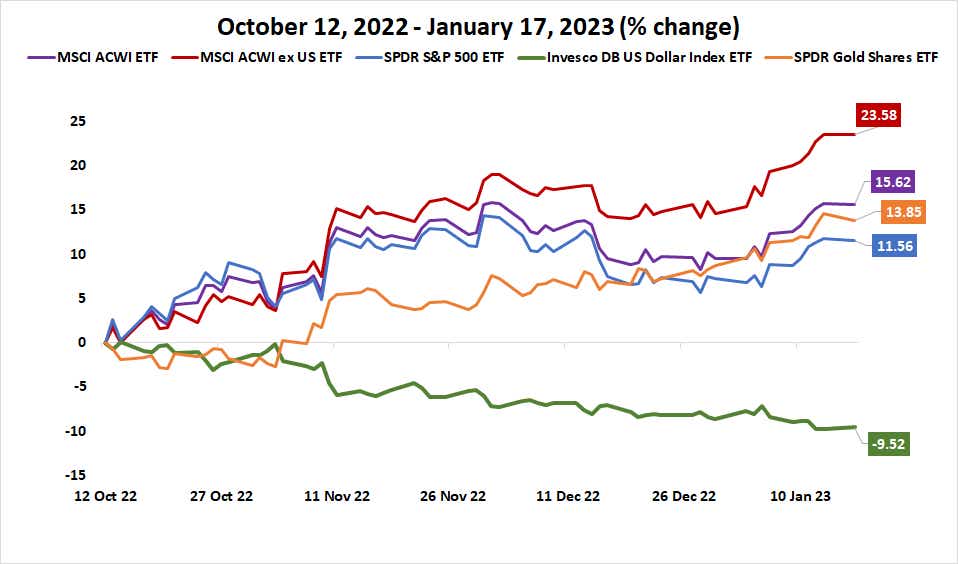

The ACWI ETF tracking global stock performance has added 15.6 percent in the three months since establishing the lows in mid-October. The ACWX ETF that excludes the US but leaves the rest intact added a more commanding 23.6 percent over the same period. This underperformance might reflect the Fed’s outsized rate-hike effort – it added a leading 425bps to the target lending rate in 2022 – as well as a sense of the reasons why it may be ready for a pause.

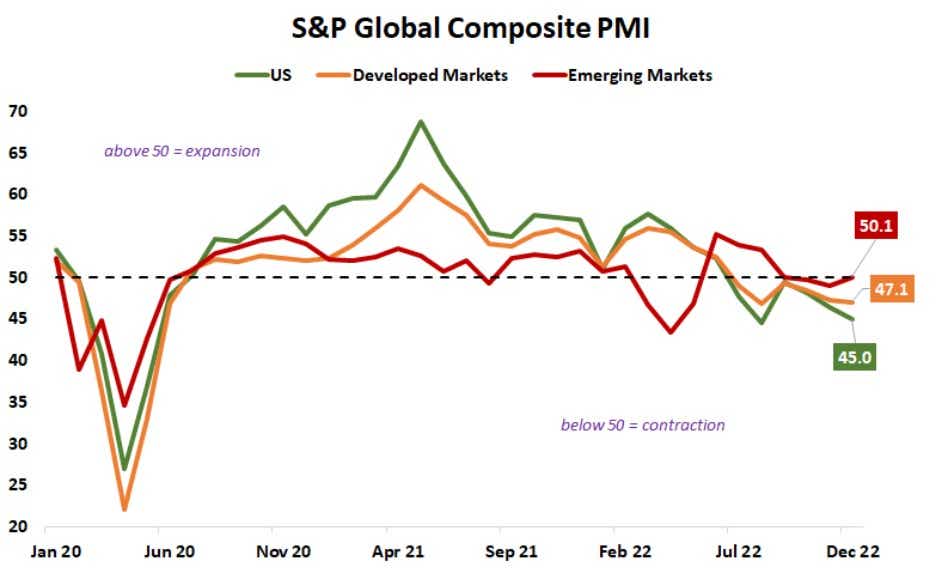

Data from S&P Global suggests the US economy has shrunk every month since July. In all but one of those months, the pace of contraction has been greater than that of other developed economies. In this group, the scale of fiscal countermeasures amid Covid-19 lockdowns as well as the follow-on inflationary surge and central bank response have been relatively larger. Emerging economies – where smaller stimulus translated to lower price growth – enjoyed expansion for most of that period.

Grim Earnings Season Looms Amid Recession Fears

The durability of even laggard US stock market gains may now be in question as the fourth-quarter reporting season gets underway. Survey data compiled by Bloomberg suggests that earnings for the companies making up the benchmark S&P 500 index are expected to fall by nearly 6 percent on average. That would mark the worst performance since the third quarter of 2020, when earnings per share (EPS) fell 5.7 percent.

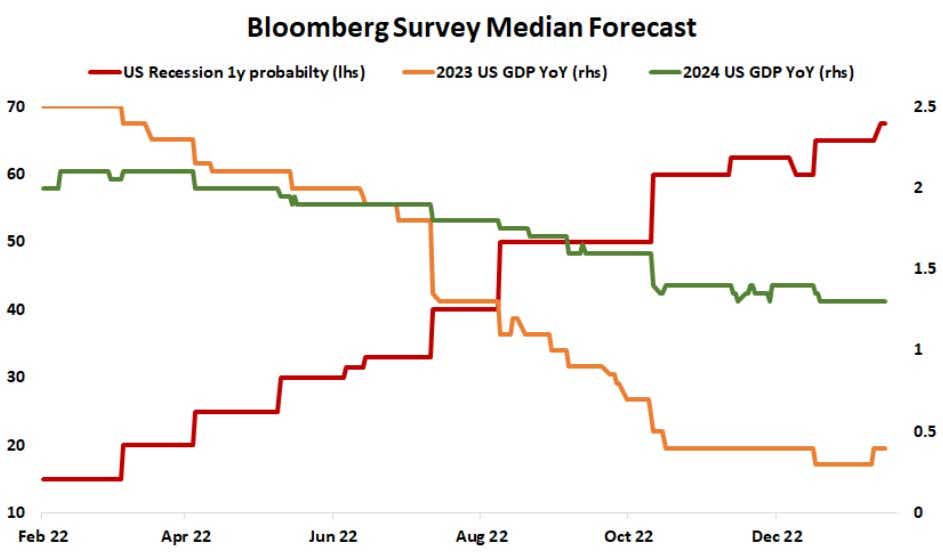

Signs of trouble in the fundamental backdrop appear plentiful. Surveys of top market-watchers by Bloomberg reveal that 2023 and 2024 US economic growth expectations have not improved amid the three-month cooling in Fed rate hike expectations. The pace of deterioration has admittedly slowed, but this is cold comfort considering recession risk appears to have grown more acute. The likelihood of such an outturn in the US within one year increased from 50 to 65 percent even as stocks rose. Numbers from Citigroup show economic data outcomes have deteriorated relative to forecasts over the same period.

US Stocks, Dollar May Find Footing vs. Global Peers

If guidance from key firms highlights the pain suffered in the name of taming inflation and paints a bleak picture of what is ahead, a shift in market focus may be in the cards. Investors’ perspective may broaden from a narrow concentration on the immediate Fed policy path to the broader business cycle trends that underpin it, encouraging a more defensive posture. This might bode ill for equities in general, across geographies and development levels.

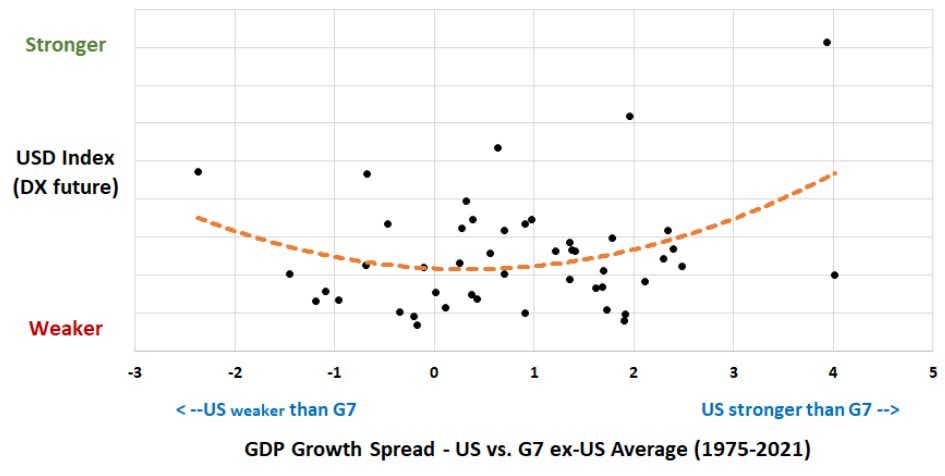

Curiously, the cooling of risk appetite against this backdrop may see US-listed names begin to outperform in relative terms even as the overall asset class is battered. That would reflect safety-minded capital flows moving toward greater liquidity. A similar dynamic may revive the battered US Dollar. The well-worn Dollar Smile Theory captures the tendency for USD to rise when US growth diverges from other G7 countries in either direction, positive or negative.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices