The Best & Worst Performing S&P500 Sectors in 2022

The Best & Worst Performing S&P500 Sectors in 2022

For many investors and traders, 2022 was a year to forget. The bears were firmly in charge last year, with the S&P 500 dropping by 19%, and the Nasdaq Composite pulling back by 33%.

That said, a down year in the major indices doesn’t mean that every stock was down in 2022. In fact, there were plenty of upside single-stock winners last year, just as there were plenty of downside single-stock losers.

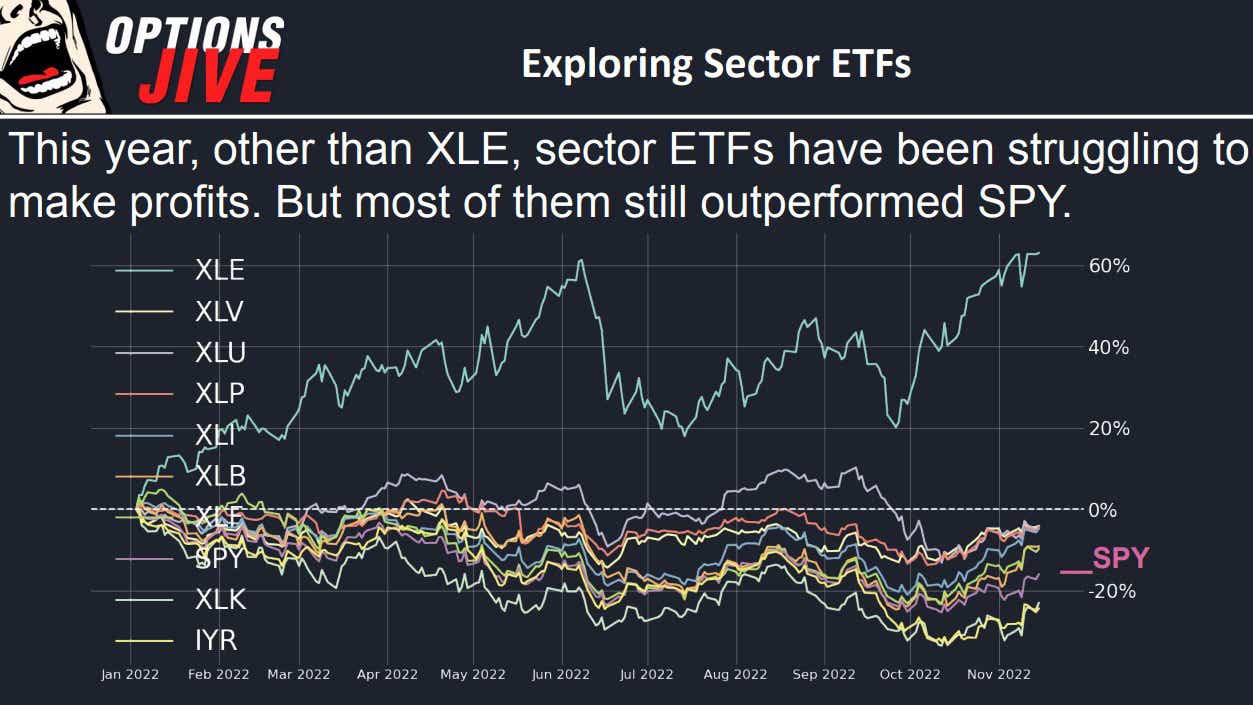

However, when it comes to the 11 market sectors within the S&P 500, only a single one ended the year in the green. That was the energy sector, as illustrated below.

As highlighted above, the energy sector was up about 60% last year, as evidenced by the +57% return in the Energy Select Sector SPDR Fund (XLE) during 2022.

Not surprisingly, the list of single-stock winners and losers from 2022 closely mirrors overall sector performance, with energy stocks producing some of the most attractive returns, and technology stocks posting some of the worst.

Listed below are the 10 biggest winners from the S&P 500 during 2022, as well as the 10 biggest losers.

Top-Performing S&P 500 Stocks in 2022

- Occidental Petroleum (OXY), +117%

- Constellation Energy (CEG), +109%

- Hess Corp (HES), +94%

- Marathon Petroleum (MPC), +87%

- Exxon Mobil (XOM), +87%

- Schlumberger (SLB), +78%

- Apache (APA), +74%

- First Solar (FSLR), +72%

- Halliburton (HAL), +72%

- Marathon Oil (MRO),+65%

Worst-Performing S&P 500 Stocks in 2022

- Generac Holdings (GNRC), -74%

- Match Group (MTCH), -69%

- Align Technology (ALGN), -68%

- Tesla (TSLA), -67% SVB

- Financial (SIVB), -66%

- Meta (META), -65%

- Signature Bank-New York (SBNY), -64%

- Catalent (CTLT), -64%

- PayPal (PYPL), -62%

- Carnival (CCL), -61%

Last year, companies in the energy sector clearly benefited from surging prices for oil and gas—primarily driven by Russia’s invasion of Ukraine. The energy sector saw considerable earnings growth in 2022, which was contrary to the broader market trend.

On the flip side, the technology and communications sectors experienced sharp reversals in 2022, with higher financing costs (via higher interest rates) taking a big bite out of profits.

The recent slowdown in the global economy was another strong headwind for many businesses in 2022, resulting in softening demand.

From the Nasdaq 100, the best-performing stock in 2022 was Enphase Energy (ENPH), which jumped by 45%. The biggest loser in the Nasdaq 100 during 2022 was Rivian Automotive (RIVN), which crashed by 82%. Lucid Group (LCID) was the second-biggest loser in the Nasdaq 100 last year, dropping by almost as much as Rivian.

Depending on one’s unique market outlook and trading approach, the biggest winners and losers from 2022 may offer some fresh ideas for the new trading year. For more details on stock market performance in 2022, readers can check out this new installment of Options Trading Concepts Live.

To follow everything moving the markets in 2023, readers can monitor tastylive, weekdays from 7 a.m. to 4 p.m. CDT.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices