EUR/USD, GBP/USD, AUD/USD – US Dollar at Key Crossroads in 2023

EUR/USD, GBP/USD, AUD/USD – US Dollar at Key Crossroads in 2023

By:Ilya Spivak

The US Dollar enjoyed a banner year in 2022 but the currency now stands at a crossroads. Another year of strength would probably align with grave turmoil in most other markets.

Key Takeaways

- Fed rate hike speculation delivered impressive gains for the US Dollar last year

- If risk appetite holds up, the Euro and British Pound may play catch-up in 2023

- Worries about credit market instability may stoke liquidity-haven USD demand

The US Dollar enjoyed a banner year in 2022, adding a commanding 8.7 percent against an average of its major currency counterparts. An aggressive inflation-fighting effort at the Federal Reserve powered the rise. Policymakers delivered a blistering 425 basis points (bps) in rate hikes between March and December, amounting to the most aggressive pace of tightening since Paul Volcker famously led the Fed to vanquish runway inflation in the early 1980s.

This proved doubly supportive for the Greenback. First, the rapid rate rise burnished the currency’s interest-bearing appeal. Owning USD-denominated assets suddenly offered the highest yield net of inflation in close to 20 years. Second, markets that had enjoyed ultra-cheap borrowing now faced a historic rise in financing costs. That cooled risk appetite, pushing capital from stocks and crypto to bonds and fiat. The Dollar’s unrivaled liquidity was a familiar attraction in such an environment.

What kind of US Dollar will we get in 2023?

As the calendar turns to a new year, investors are questioning whether both influences can remain supportive.

The Fed is conspicuously signaling that the time of back-to-back 75bps rate hikes has passed, and a more measured fine-tuning is now underway. Its latest forecasts envision a peak (‘terminal’) rate of close to 5 percent being reached sometime this year, with a pause and then a moderation toward approximately 3 percent over the course of 2024 and 2025. Current market pricing is broadly in alignment, implying more limited scope for volatility-driving speculation than last year.

Meanwhile, some major central banks that lagged the Fed in joining the inflation fight have more room for catch-up. That means the yield advantage that USD now enjoys will be diminished somewhat in the months to come as rate spreads with other currencies are narrowed. Current expectations implied in market pricing put the European Central Bank (ECB) and the Bank of England (BOE) out in front with close to 150bps in upcoming rate hikes. By contrast, the Fed is seen adding just 25-50bps more. That projects out a relative swing of close to 100bps in the Euro and Sterling’s favor.

Such thinking only works if markets are in a reasonably steady mood, however. Investors prioritize returns in their decision-making when the global economy in aggregate is growing, and market conditions are generally hospitable. This offers a spectrum of diverse opportunities that may then be analyzed, and the most attractive chosen. Conversely, an all-encompassing recession or a systemic disruption in vital market plumbing put capital preservation at the forefront. These often go in-hand. For example, the 2008 global financial crisis (GFC) evolved from the latter into the former.

USD may rise if rapid rate hikes trigger credit market stress

The cost of US Dollar borrowing – a vital barometer of financial health considering the Greenback’s unrivaled role as medium of exchange in global commerce – was pinned near record lows for an exceedingly long time over the past 15 years. That created ample opportunities for making risky bets without significant capital constraints. With rates now sharply higher, such ventures are likely to be stressed. Hefty layoffs in the financing-sensitive tech sector and the collapse of crypto exchange FTX are a case in point.

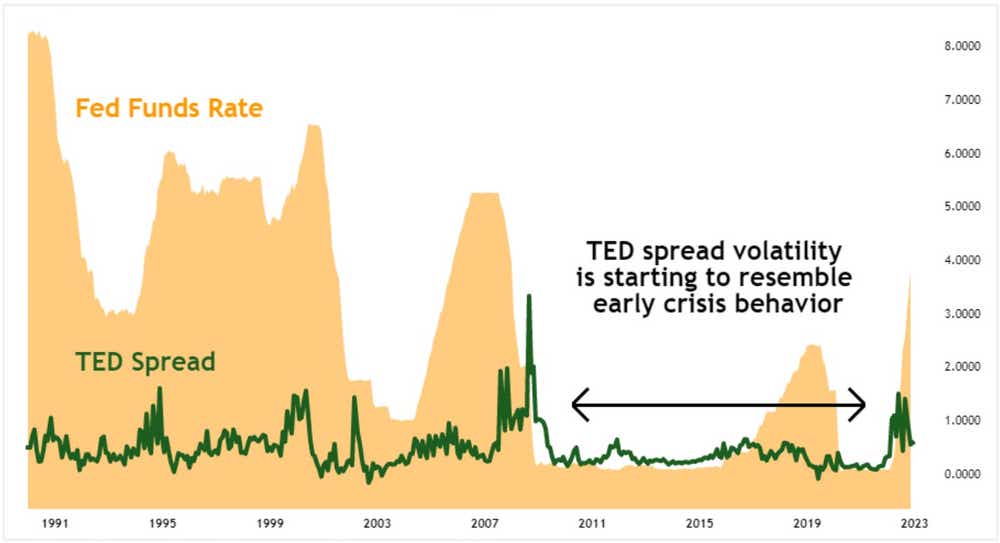

Indeed, the TED spread – the extra cost of borrowing USD outside (‘offshore’) versus within the United States – is hitting peaks and displaying volatility unseen since the early rumblings of the GFC in 2007. That points to lenders turning leery of parting with cash, lest they need it to weather another bout of market-wide liquidation. Traders seem plainly worried that the sharp rise in rates will find another critical weakness in the credit structure akin to housing-related obligations in the last go-round, triggering a panic.

The US Dollar tends to thrive against such a backdrop. Close to 80 percent of global monetary transactions are settled in the currency, making it a uniquely liquid instrument. This translates into an abundance of buyers and sellers at just about any price level, which works to dull volatility. That makes the Greenback a go-to destination when traders “cash out” en masse.

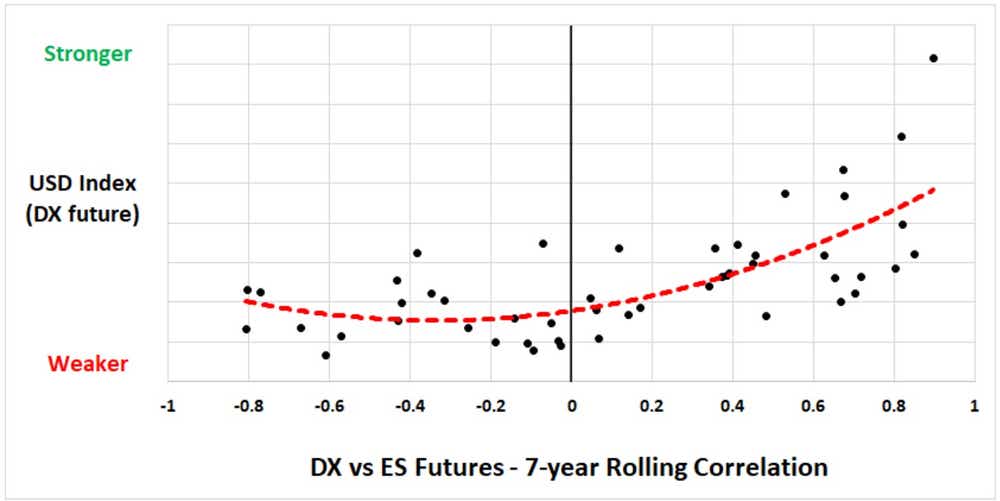

Tellingly, the relationship between the US Dollar Index – a benchmark for the currency’s average value – and its correlation with the bellwether S&P 500 stock index takes on a “smile”-like shape (this is an extrapolation of the well-worn Dollar Smile Theory, which relates USD to the spread between US and other G7 countries’ growth rates). This highlights that the currency does best when its correlation to underlying risk trends is strongly positive or negative.

The right side of the chart tells most of the story of 2022. If the markets’ worries about the consequences of the Fed’s actions grow more acute, the left side may be what 2023 is all about. Gains may be most pronounced against sentiment-sensitive alternatives, with commodity currencies like the Australian Dollar high up on the list.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices