Filter

Jade Lizard Option Strategy

What is the jade lizard option strategy?

In the financial markets, a “jade lizard” refers to an options trading strategy that combines a short put with a short call spread. Jade lizards are typically utilized when an investor/trader holds a neutral or slightly bullish outlook.

Jade lizards are somewhat similar to short strangles, which are created by selling an upside call and a downside put. The difference with a jade lizard is that it also involves buying another upside call, with a strike price greater than the short call. That extra long call reduces the upside risk of the position, as compared to a traditional short strangle.

Ideally, a jade lizard is deployed such that the total credit received from the short call and the short put is greater than the width of the upside call spread. If deployed as such, the primary risk of the position is to the downside. However, if the stock moves lower, some of the losses from the short put will be offset by the gains from the short call spread.

DIRECTIONAL ASSUMPTION

IDEAL IMPLIED VOLATILITY ENVIRONMENT

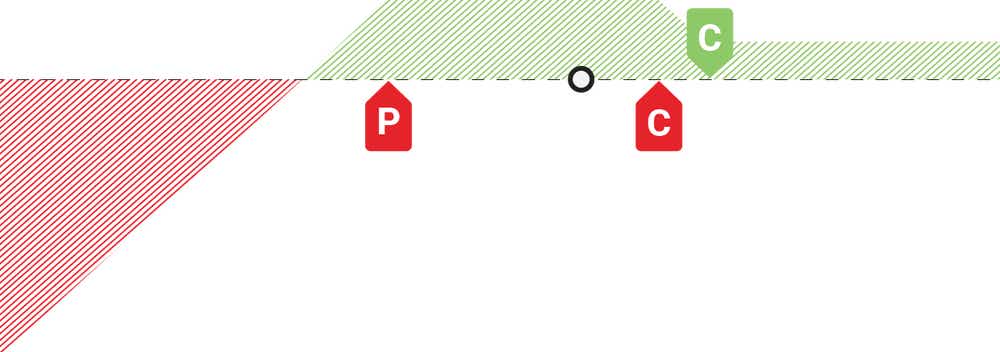

PROFIT/LOSS CHART

jade lizard: how it works

A jade lizard is designed to generate income from premium received from selling the put option and call spread. This income is referred to as the “net credit” received from deployment of these option positions.

The net credit received from the sale of the options also represents the maximum potential profit from this position. Jade lizards are constructed as follows:

Jade Lizard Structure

Short Put Option

One portion of the jade lizard involves selling a short put.

The sale of the short put produces a credit for the option seller.

The strike price of the short put is usually below the current market price of the underlying stock/ETF.

Short Call Spread

The other portion of the jade lizard is a short call spread, typically referred to as a “bear call spread.”

A bear call spread involves selling one call option with a strike price that’s closer to at-the-money (ATM) and simultaneously buying another call option with a higher strike price.

The sale of this call spread produces another premium credit for the option seller.

Together, the premium from the short put and the short call spread are referred to as the “net credit” received.

It’s preferred if the net credit is greater than the width of the call spread, as that removes upside risk in the strategy.

Potential Outcomes

1. The underlying price remains between the strike prices of the short put and short call:

Both short options expire worthless

The option seller keeps the net premium received from the jade lizard.

2. The underlying price falls below the strike price of the short put:

The option seller may be obligated to buy the underlying asset at the put's strike price, using the premium from the short put to help offset the cost.

The premium received from the short call spread also helps to offset/limit potential losses.

3. The underlying price rises above the strike price of the short call:

The option seller may be obligated to sell the underlying asset at the short call's strike price.

The long call in the spread helps limit losses to the upside, as does the premium received from the short put.

How to set up a jade lizard?

The first step to setting up a jade lizard is to identify a potential underlying with which you have a neutral or slightly bullish outlook. After that, you might evaluate whether the options in that stock/ETF look attractively priced. This can be done using a metric such as Implied Volatility Rank (aka IV Rank).

Now let’s assume the investor/trader in question wants to deploy a jade lizard in hypothetical stock XYZ, which is trading for $50/share.

Setting Up A Jade Lizard

Sell the Short Put Option

Sell to open 1 contract of the $45 strike put option on stock XYZ for $2

Receive $2 per share ($200) in premium

Sell the Short Call Option and Buy the Long Call Option (e.g. sell call spread)

Sell to open 1 contract of the $55 strike call option on stock XYZ, receiving $1 per share ($100) in premium.

Simultaneously, buy to open 1 contract of the $57 strike call option on stock XYZ, paying $0.50 per share ($50) as premium.

The Net Credit Received from the the Jade Lizard

Premium received from selling the put: $200

Premium received from selling the short call: $100

Premium paid for the long call: -$50

Net Credit = $200 + $100 - $50 = $250

Potential Scenarios

The price of stock XYZ remains between $45 and $55 through expiration:

The short put and short call options expire worthless.

The options seller keeps the entire $250 net credit as profit.

The price of stock XYZ falls below $45 prior to expiration:

The option seller may be assigned on the short put and have to buy 100 shares of XYZ at $45 per share.

The premium received from the short call spread helps to offset potential losses from the short put.

The price of stock XYZ rises above $55 prior to expiration:

The option seller may be assigned on the short call and have to sell 100 shares of XYZ at $55 per share.

The premium received from the short put helps to offset potential losses from the short call spread.

If the stock rises above $57, there is no upside risk as the call credit spread can only appreciate to a maximum of $200 intrinsic value, but $250 in credit was received up front for the opening trade.

Maximum profit and loss of a jade lizard

The maximum potential profit from the jade lizard is limited to the net credit received when entering the trade. This is the total premium collected from selling the put option and the call spread.

On the other hand, the maximum potential loss is represented by the difference between the strike prices of the short options used in the strategy and the net credit received.

In the previous example, the maximum potential profit is therefore $250, which was the net credit received.

Alternatively, the maximum loss to the downside is $45 per share (the difference between the short put strike and the stock price) plus the net credit received ($250). Therefore, the maximum potential loss to the downside is $4500 - $250 = $4250 per contract.

In this example, there is no risk to the upside as the credit received of $250 exceeds the width of the 55/57 short call spread ($200). In the case where the credit received is not greater than the width of the call spread, the max loss to the upside is the width of the credit spread less the credit received up front.

HOW TO CALCULATE MAX PROFIT / BREAKEVEN(S)

MAX PROFIT

Credit Received

Max profit is realized when the stock price is between the short strikes at expiration.

BREAKEVEN(S)

Upside:

When set up correctly, we have no risk to the upside.

Downside:

Strike Price of Short Put - Credit Received

How to exit a jade lizard

Depending on the outcome of the trade, the holder of a jade lizard might opt to close the trade in a variety of different ways. For example, by allowing the options to expire naturally at expiration, by actively closing the position, or by rolling it out to a different expiration, as outlined in greater detail below.

Allowing the Options to Expire

If the price of the underlying asset remains within the range defined by the strike prices of the short put and the short call at expiration, both options will expire worthless.

In this scenario, the option seller can let the options expire without taking any further action.

Close the Entire Jade Lizard Position

If the jade lizard holder no longer wants exposure to the trade, due to a shift in outlook or market conditions, he/she can close the position by buying back the short put to close and buying back the short call spread (e.g. buying the short call to close, and selling the long call to close).

This would terminate all obligations and remove any remaining risk associated with the trade.

Roll the Jade Lizard

If the price of the underlying asset approaches one of the strike prices (either the short put or the short call), the jade lizard holder may elect to roll the position.

Rolling involves closing out the existing options and simultaneously re-opening the position with a later expiration date. Depending on the situation, one might also elect to roll the jade lizard into different strike prices, as well.

Rolling can help extend the duration of the trade - a tactic that might be employed when an investor/trader still believes in the original premise of the trade.

tastylive approach

A jade lizard is typically considered when an investor/trader has a neutral to bullish assumption on the underlying stock/ETF, but isn’t extremely bullish, because the position involves a short call spread.

This structure may be suitable for stocks/ETFs that have sold off and have high Implied Volatility Rank. This allows for additional premium to be collected, while having reduced upside risk if the underlying stock/ETF were to trade through the short call spread.

If the investor/trader is extremely bullish on the underlying stock/ETF, a jade lizard may not be optimal, and the investor/trader might instead consider a different type of options-focused position.

Pros and cons of jade lizard

Like any investing or trading strategy, the jade lizard comes with certain pros and cons. The primary pros and cons of the jade lizard are outlined below.

Pros of a Jade Lizard

Income Generation: The primary goal of the jade lizard is to generate income through the premiums received from the short options options.

Allows for Movement in the Underlying: The jade lizard strategy has a wide profit range between the strike prices of the short put and the short call. That means the underlying stock/ETF can move within a relatively broad range without resulting in a loss.

Beneficial in Neutral to Bullish Markets: The jade lizard is well-suited for traders who have a neutral to slightly bullish outlook on the underlying asset. It can profit in scenarios where the asset's price remains stable or experiences moderate upward movement.

Conducive for High Volatility Environments: The jade lizard can benefit from relatively high implied volatility, because this can lead to higher premiums when selling the associated options.

Cons of a Jade Lizard

Limited Maximum Profit: While the jade lizard offers the potential for income generation, the maximum potential profit is limited to the net credit received when entering the trade.

Risks of Selling Options: Selling options involves potential obligations. If the short put or short call options are assigned, the trader may be required to buy or sell the underlying asset at the associated strike prices, which could lead to potential losses.

Underlying Stock Moves Outside the Breakevens: If the underlying stock/ETF price moves significantly beyond the breakeven points (outside the strike prices of the short options), a jade lizard can result in losses. The trader may face challenges in managing such situations.

Margin Requirements: Depending on the specific options contracts used, maintaining a jade lizard may require significant margin or collateral, which can tie up capital.

Complexity and Skill Required: The jade lizard is considered an advanced options strategy and requires a good understanding of options pricing, strategies, and risk management. This could be a negative for new option traders, or those with minimal experience.

Jade lizard summed up

In financial markets, a "jade lizard" denotes an options trading strategy combining a short put with a short call spread. This strategy is employed when an investor or trader holds a neutral or slightly bullish outlook. Unlike short strangles, which involve selling both an upside call and a downside put, the jade lizard includes buying an additional upside call with a higher strike price than the short call. This addition mitigates the upside risk compared to a traditional short strangle.

The primary goal of a jade lizard is to generate income from the premium received by selling the put option and call spread, known as the "net credit." This strategy is ideal for investors with a neutral to slightly bullish outlook on the underlying stock or ETF, but who are not extremely bullish due to the short call spread involved.

The maximum potential profit is capped at the net credit received from initiating the trade, which is the total premium collected. Conversely, the maximum potential loss is the difference between the strike prices of the short options minus the net credit received.

SUPPLEMENTAL CONTENT

Episodes on Jade Lizard

No episodes available at this time. Check back later!

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices