Filter

Contents

Options Expiration: All You Need to Know

Contents

What Is an Expiration Date in Options?

In the trading and investments industry, the term "expiration" refers to the fact that certain trading instruments exist for a finite period of time.

For example, options, futures, and futures options only exist through their expiration date, after which these contracts are invalid. The term “expiration date” refers to the calendar date and time in which a trading instrument stops trading (i.e. “expires”), and all contracts are exercised or become worthless.

That means when evaluating a potential options position, most investors and traders consider not only price, but also time until expiration. Time until expiration may also be referred to as “days-to-expiration,” or DTE.

Regular Monthly Expiration

Due to the varying expiration details of different products, it's critical that investors and traders be aware of the exact date and time that a given product will expire before deploying a new position.

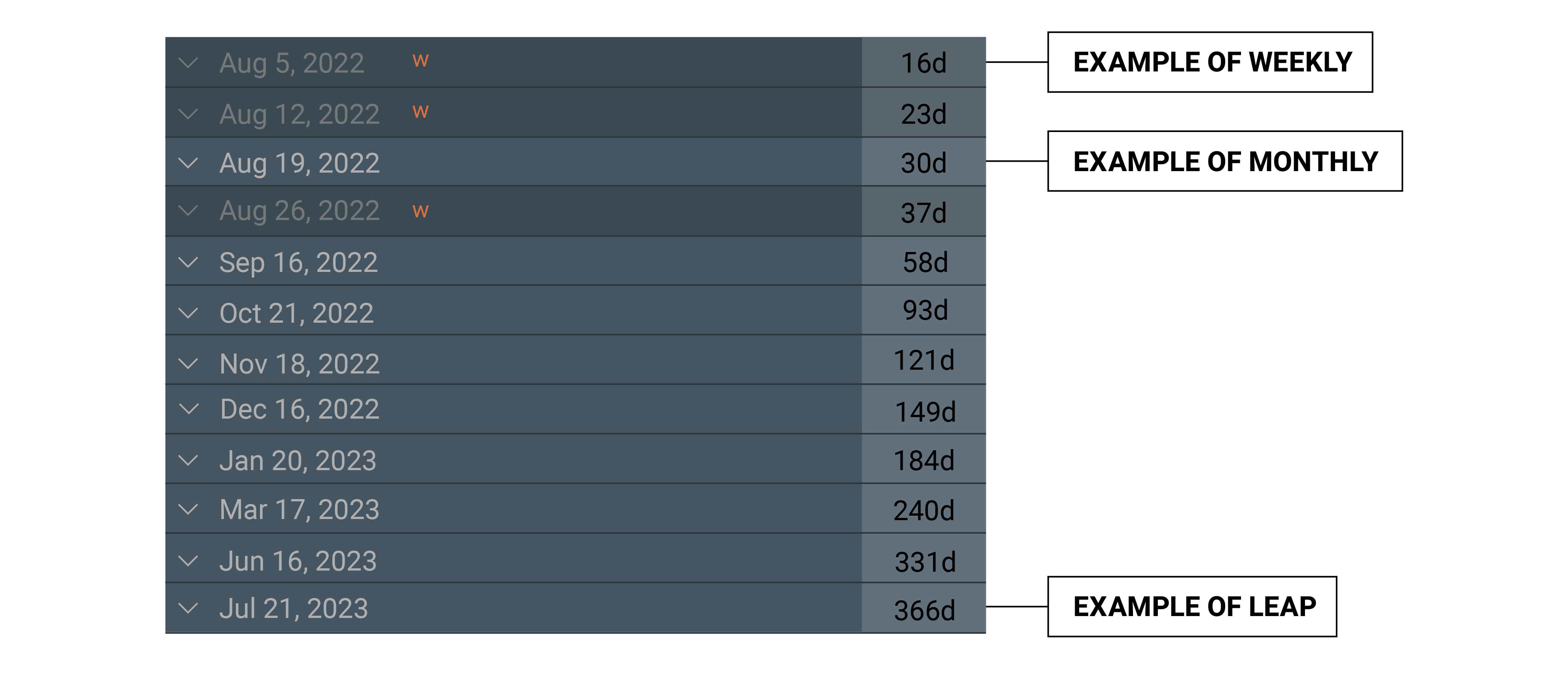

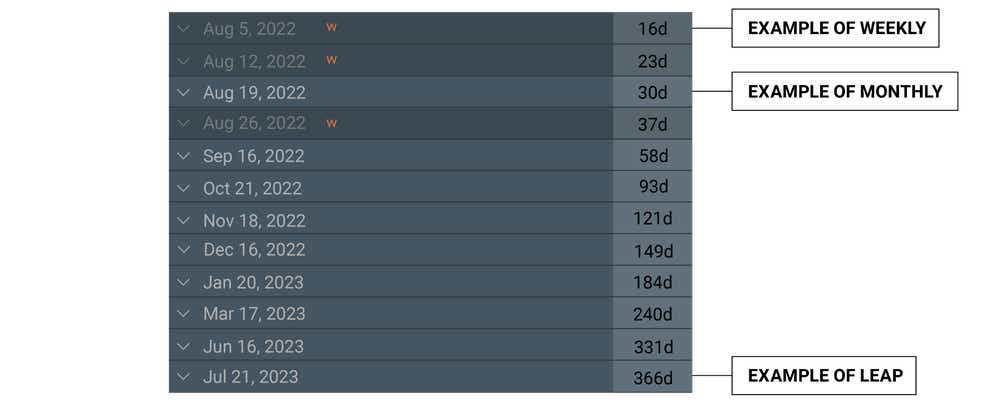

In the equity options universe, investors and traders can choose from three different types of option contracts—weeklies, monthlies, and longer-term options known as Long-Term Equity Anticipation Securities (LEAPS). The primary difference between these three contracts is the time until expiration, often referenced as "days-to-expiration" (DTE). Some very active products like SPX and SPY even offer multiple expirations within the same week!

The term “regular monthly expiration” (aka “monthlies'') refers to the standard expiration cycle of listed stocks options in the United States. The expiration date for listed monthly stock options in the United States is normally the third Friday of the contract month at 3:00 p.m. Central Standard Time (CST). But if the third Friday falls on a holiday, the expiration date will instead occur on the Thursday immediately prior to the third Friday.

Weekly options are available with expiration ranges between one and five weeks, while monthly options are generally available from one to 11 months out. Weekly options are identical to monthly options in every respect except for the shorter expiration date. They are typically introduced each Thursday and they expire eight days later on Friday.

Options with longer than one year until expiration are generally referred to as Long-Term Equity Anticipation Securities (LEAPS). Aside from possessing extended expiration dates, LEAPS are identical to regular monthly options and expire the third Friday of the contract month at 3:00 p.m. CST.

Weekly Expiration

Weekly options are available with expiration ranges between one and five weeks, while monthly options are generally available from one to 11 months out. Weekly options are identical to monthly options in every respect except for the shorter expiration date. They are typically introduced each Thursday and they expire eight days later on Friday.

Some underlyings will list weekly options with up to five consecutive weekly expirations provided the weekly listing does not expire on the same date as a regular monthly contract.

Like regular monthly options, weekly contracts also expire on the indicated expiration date at 3:00 p.m. CST. And like regular monthlies, the expiration date will normally fall on a Friday, unless it falls on a holiday, in which case it will be adjusted for Thursday.

After the meme-stock craze, the demand for more near-term options skyrocketed. Many ETFs and indices like SPY and SPX now have expiration contracts that conclude after every single market day, within the weekly option ecosystem. These options are known as zero days-to-expiration or 0DTE options contracts.

This creates an environment for cheap options speculation and protection, and engaging in 0DTE options has become very popular. Trading 0DTE options is brand new to the world of trading, so it's important to fully understand the potential risk and reward in doing so.

Long-Term Equity Anticipation Securities (LEAPS)

Options with longer than one year until expiration are generally referred to as Long-Term Equity Anticipation Securities (LEAPS). Aside from possessing extended expiration dates, LEAPS are identical to regular monthly options and expire the third Friday of the contract month at 3:00 p.m. CST. But if the third Friday falls on a holiday, the expiration date will instead occur on the Thursday immediately prior to the third Friday.

How to Pick the Right Options Expiration Date?

When evaluating a potential options position, most investors and traders consider not only price, but also time until expiration. Time until expiration may also be referred to as “days-to-expiration,” or DTE.

Choosing an expiration date depends heavily on the type of strategy utilized by the investor/trader, and his or her outlook for a given position.

For example, if a trader or investor is trying to capitalize on a potential opportunity in the immediate future, he or she might opt for a short-term option position, such as a weekly or the front–month regular monthly contract. The term “front month,” also known as "near month" or "spot month," refers to the nearest expiration date for a regular monthly options contract.

On the other hand, if the investor/trader is attempting to capitalize on a potential opportunity that may develop over a longer window of time, he/she might opt for an option with two, three, or even more months until expiration. Options with longer duration are typically referred to as “back month” or “far month” contracts.

Another component of options expiration is trade management. A key consideration regarding trade management is deciding when one should close a position. Because options have a finite life, traders basically have two choices when it comes to the trade management of any given position. The trade can be left on until it expires, or it can be closed at some point prior to expiration.

tastylive has covered the expiration topic extensively and conducted a detailed series of market studies to provide additional context and insight into the expiration process.

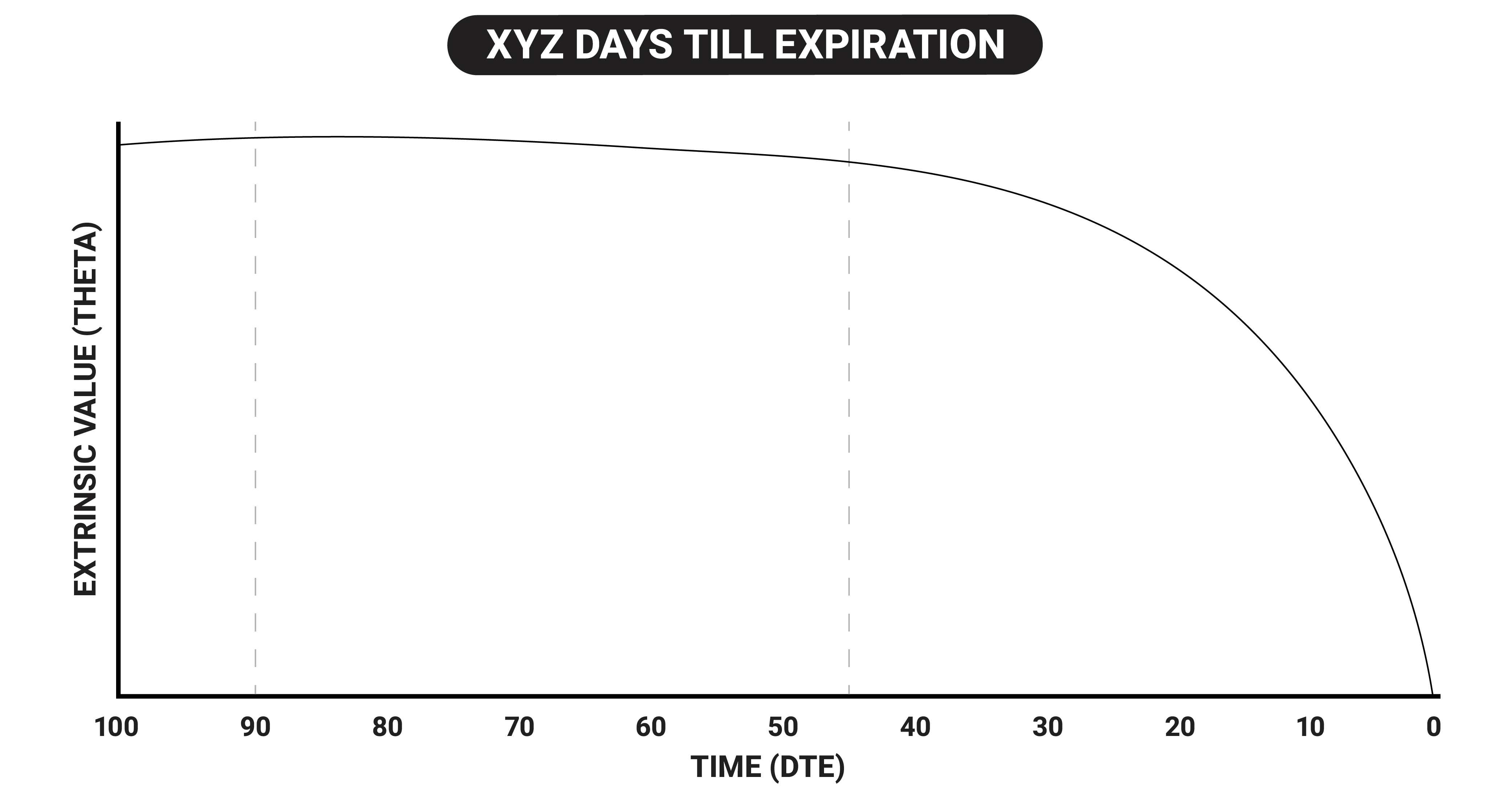

One theme studied extensively by tastylive is the optimal duration of short option trades. While the trade duration depends heavily on a trader's outlook, strategic approach, and risk profile, the research studies conducted by tastylive on short options revealed that a 45-day duration (i.e. 45 days-to-expiration) has a nice blend of an accelerating extrinsic value decay curve, while still providing a decent amount of space away from the stock price to obtain extrinsic value premium on trade entry.

What Happens When Options Expire?

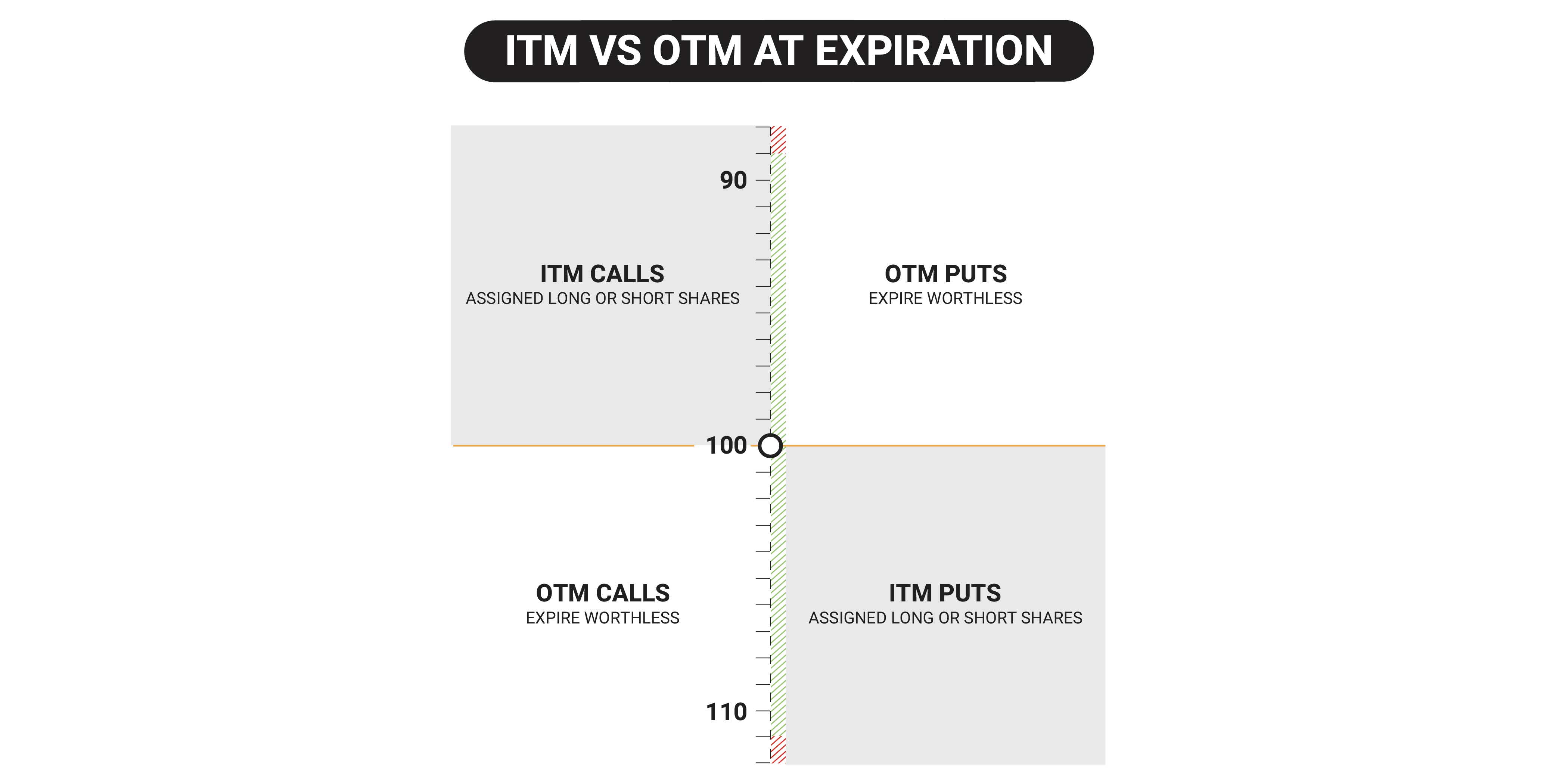

At expiration, one of two things happens depending on whether the option is in-the-money (ITM) or out-of-the-money (OTM). If an option has intrinsic value to the owner, it is considered ITM. If it does not, it is considered OTM.

Put Options OTM vs. ITM

Put options below the stock price are OTM, and put options above the stock price are ITM.

Call Options OTM vs. ITM

Call options below the stock price are ITM, and call options above the stock price are OTM.

If an option expires in-the-money, it will be automatically converted into 100 long or short shares of stock in the associated underlying.

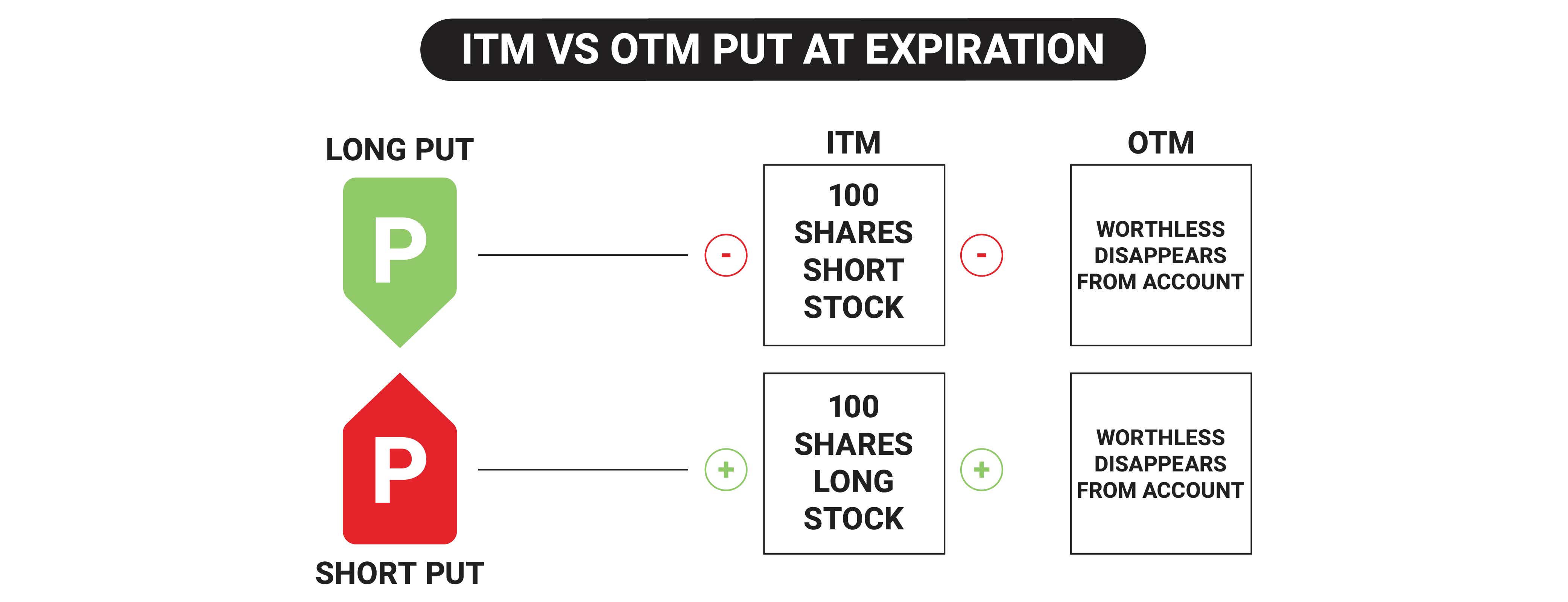

Long/Short Puts ITM

Long puts are converted to 100 short shares of stock at the strike price. Short puts are converted to 100 long shares of stock at the strike price.

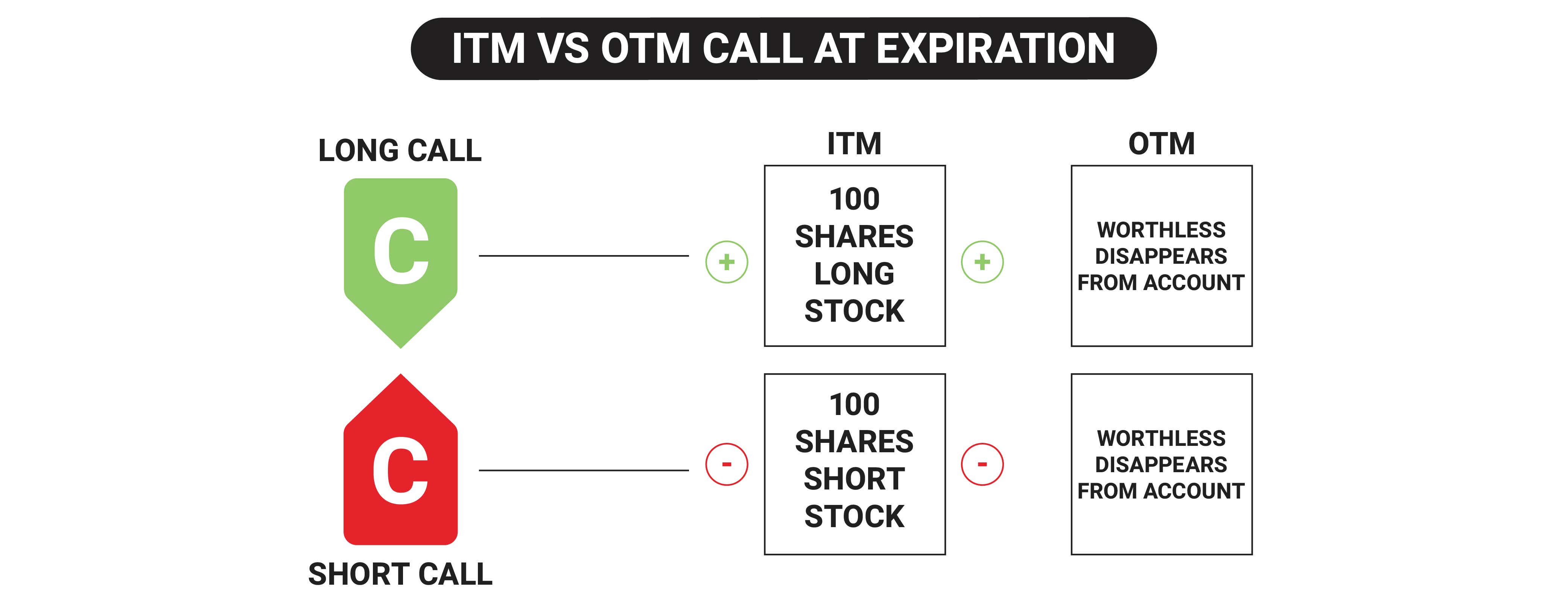

Long/Short Calls ITM

Long calls are converted to 100 long shares of stock at the strike price. Short calls are converted to 100 short shares of stock at the strike price.

For long in-the-money options, market participants may decide (in certain cases) not to exercise a given option.

In such cases, the investor/trader submits a Do Not Exercise Request (DNE Request) to their broker. The cutoff time for submitting a DNE Request may vary by broker. Generally speaking, market participants planning to submit a DNE request should do so promptly after the close of trading on the day of expiration, or close the trade prior to expiration.

What Happens When An Option Expires In-The-Money (ITM)?

If an option expires in-the-money, it will be automatically converted into 100 long or short shares of stock in the associated underlying.

There are some cash-settled products like SPX that do not have shares, so ITM options simply settle to cash at expiration.

For long in-the-money options, market participants may decide (in certain cases) not to exercise a given option.

In such cases, the investor/trader submits a Do Not Exercise Request (DNE Request) to their broker. The cutoff time for submitting a DNE Request may vary by broker. Generally speaking, market participants planning to submit a DNE request should do so promptly after the close of trading on the day of expiration.

What Happens When An Option Expires Out-Of-The-Money (OTM)?

If an option expires out-of-the-money, it therefore expires worthless, and it disappears from the account. An OTM option has no intrinsic value to the option holder, so it has no worth to the owner at expiration.

What Happens When A Spread Expires Partially ITM?

Spread traders need to be careful holding ATM spreads through expiration, because if only one option expires ITM and the other expires OTM, spreads that begin as defined risk trades will be converted to 100 shares of long or short stock depending on the option type. In high priced stocks, a narrow spread that only had a few hundred dollars of risk can be converted to thousands of dollars of share risk if one option is exercised and the other expires worthless, so be mindful of spreads that are teetering on the stock price close to expiration. To avoid this risk, traders can close the spread just prior to expiration.

FAQ

What Happens When Options Expire?

At expiration, one of two things happens depending on whether one’s option is in-the-money (ITM) or out-of-the-money (OTM). If an option has intrinsic value to the owner, it is considered ITM. If it does not, it is considered OTM.

Put options below the stock price are OTM, and put options above the stock price are ITM.

Call options below the stock price are ITM, and call options above the stock price are OTM.

If an option expires in-the-money, it will be automatically converted to long or short shares of stock in the associated underlying.

Long calls are converted to 100 long shares of stock at the strike price.

Short calls are converted to 100 short shares of stock at the strike price.

Long puts are converted to 100 short shares of stock at the strike price.

Short puts are converted to 100 long shares of stock at the strike price.

If an option expires out-of-the-money, it therefore expires worthless, and it disappears from the account.

For long in-the-money options, market participants may decide (in certain cases) not to exercise a given option.

In such cases, the investor/trader submits a Do Not Exercise Request (DNE Request) to their broker. The cutoff time for submitting a DNE Request may vary by broker. Generally speaking, market participants planning to submit a DNE request should do so promptly after the close of trading on the day of expiration.

How Long Do Options Take to Expire?

In the equity options universe, investors and traders can choose from three different types of option contracts—weeklies, monthlies, and longer-term options known as Long-Term Equity Anticipation Securities (LEAPS). The primary difference between these three contracts is the time until expiration, often referenced as "days-to-expiration" (DTE).

“Regular monthly expiration” (aka “monthlies) refers to the standard expiration cycle of listed stocks options in the United States. The expiration date for listed monthly stock options in the United States is normally the third Friday of the contract month at 3pm Central Standard Time (CST).

Weekly options are identical to monthly options in every respect except for the shorter expiration date. They are typically introduced each Thursday and they expire eight days later on Friday.

Options with longer than one year until expiration are generally referred to as Long-Term Equity Anticipation Securities (LEAPS). Aside from possessing extended expiration dates, LEAPS are identical to regular monthly options and expire the third Friday of the contract month at 3:00 p.m. CST.

If expiration Friday falls on a holiday, the expiration date will instead occur on the Thursday immediately prior to that Friday.

Do Options Expire at the Open or the Close of Trading?

In the United States, options expire at the close of trading on Friday, typically 3.00 p.m. Central Standard Time (CST).

There are some underlyings, like SPX, that expire to a settlement price (SET) the morning of expiration - for these monthly expirations, the last day to trade the contract is actually Thursday before the market closes, as they settle on Friday morning. Weekly expirations in SPX are P.M. settled, which means they expire normally at 3pm CST.

It's critical that investors and traders be aware of the exact date and time that a given product will expire before entering a new position. Expiration dates and times can usually be easily identified in the contract details.

What Time Do Options Expire?

In the United States, options expire at the close of trading, typically 3pm Central Standard Time.

It's critical that investors and traders be aware of the exact date and time that a given product will expire before entering a new position. Expiration dates and times can usually be easily identified in the contract details.

What Happens If I Don’t Sell My Options on Expiration?

At expiration, one of two things happens depending on whether one’s option is in-the-money (ITM) or out-of-the-money (OTM).

If an option expires in-the-money, it will be automatically converted into long or short shares of stock in the associated underlying.

If an option expires out-of-the-money, it therefore expires worthless, and it disappears from the account.

There are some cash-settled products like SPX that do not have shares, so ITM options simply settle to cash at expiration.

For long in-the-money options, market participants may decide (in certain cases) not to exercise a given option. In such cases, the investor/trader submits a Do Not Exercise Request (DNE Request) to their broker. The cutoff time for submitting a DNE Request may vary by broker. Generally speaking, market participants planning to submit a DNE request should do so promptly after the close of trading on the day of expiration.

What Happens If An Option Expires Out-Of-The-Money?

If an option expires out-of-the-money, it therefore expires worthless, and it disappears from the account. If an option does not have intrinsic value to the option owner, they can execute the same trade for a better price in the market itself, like buying 100 shares of stock at the market price instead of executing an OTM call at a higher stock price to buy 100 shares.

What Happens If An Option Expires In-The-Money?

If an option expires in-the-money, it will be automatically converted into long or short shares of stock in the associated underlying.

For long in-the-money options, market participants may decide (in certain cases) not to exercise a given option.

In such cases, the investor/trader submits a Do Not Exercise Request (DNE Request) to their broker. The cutoff time for submitting a DNE Request may vary by broker. Generally speaking, market participants planning to submit a DNE request should do so promptly after the close of trading on the day of expiration.

Supplemental Content

EPISODES ON OPTIONS EXPIRATION

No episodes available at this time. Check back later!

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices