Filter

What Are Naked Options & How Should Traders Use Them?

What is a naked option?

The term “naked option” refers to an options-focused position that is not hedged with stock. In that regard, naked options positions are viewed as “pure play” options positions.

For example, a covered call position involves selling a call option against an existing long stock position. That means the investor/trader owns enough stock against the short call(s) to “cover” any potential assignment.

On the other hand, if an investor/trader sells a call option, and does not own the underlying stock, that position would instead be referred to as a “naked” short call.

A naked option position may take the form of a long call, a short call, a long put, or a short put—all of which have clearly defined risk parameters.

Naked options vs covered options: what are the differences?

The key difference between a naked option position and a covered option position lies in the presence or absence of ownership of the underlying asset associated with the option contract.

For example, a covered call position involves selling a call option against an existing long stock position. That means the investor/trader owns enough stock against the short call(s) to “cover” any potential assignment.

On the other hand, if an investor/trader sells a call option, and does not own the underlying stock, that position would instead be referred to as a “naked” short call.

Naked short options possess very different risk profiles as compared to naked long options, because in the case of the latter, the maximum loss is the premium paid to enter the position.

Additional details on the difference between naked short options positions and covered short positions are detailed below.

Naked Short Options Positions

Definition: In a naked option position, the seller (writer) of the option does not own the underlying asset. This is true for both naked calls and naked puts.

Naked Short Call: Involves selling a call option without owning the underlying stock. The risk is significant because if the stock price rises sharply, the seller faces potentially unlimited losses.

Naked Short Put: Involves selling a put option without a corresponding short position in the underlying stock. If the stock price falls, the seller may incur substantial losses.

Risk Profile: High risk due to the unlimited loss potential. The maximum profit is limited to the premium received.

Investor Profile: Generally utilized by experienced investors/traders with high risk tolerance and the financial capability to cover large losses.

Covered Option Position

Definition: In a covered option position, the seller of the option owns the underlying stock, or has a position in another option that offsets the risk.

Covered Call: Involves holding the underlying stock and selling a call option on the same stock. The stock ownership covers the obligation to deliver the stock if the option is exercised.

Risk Profile: Lower risk compared to naked options. The risk is limited to the potential decline in the stock's value, offset by the premium received. However, there is a cap on the maximum profit potential.

Investor Profile: Suitable for investors/traders seeking to generate income from their stock holdings or those looking for a conservative strategy to potentially exit a stock position.

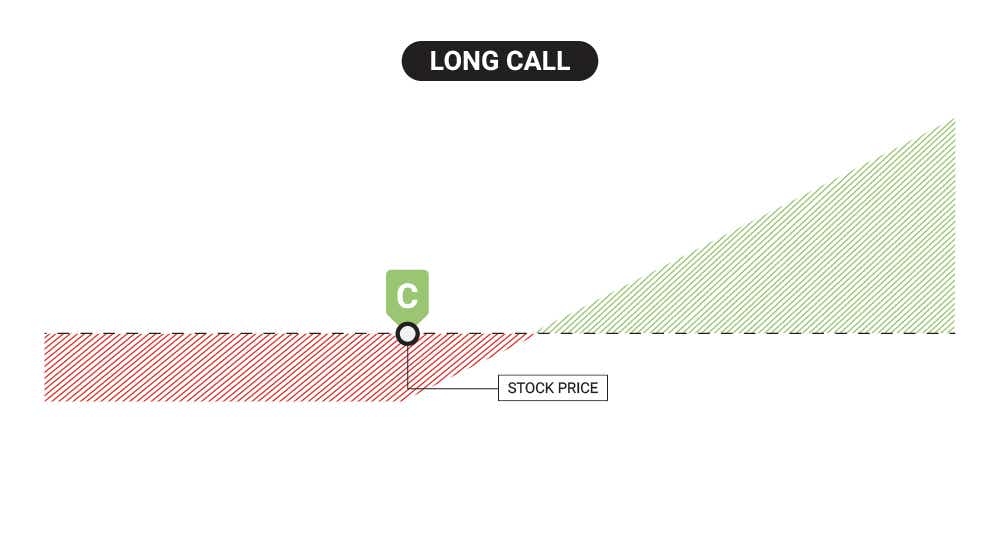

Naked long call

A naked long call is an options trading strategy where an investor buys a call option contract without simultaneously holding a position in the underlying asset (e.g., stock or commodity).

More details on naked long calls are outlined below.

Basic Overview

With a naked long call, the investor purchases a call option, which gives the investor the right (but not the obligation) to buy the underlying asset at a specified price (strike price) within a specified period (until expiration).

The investor pays a premium to the option seller (option writer) for this right, and the loss of this premium represents the maximum potential loss in this strategy.

The goal of a naked long call is to profit from an anticipated increase in the price of the underlying asset. If the asset's price rises significantly, the investor can exercise the call option and buy the asset at the lower strike price, then sell it at the higher market price, realizing a profit.

Risk Profile

The maximum risk with a naked long call strategy is limited to the premium paid for the call option. If the underlying asset's price doesn't rise enough to cover the premium cost, the investor may incur a loss equal to the premium.

Profit Potential

A naked long call strategy profits when the price of the underlying asset rises above the strike price by an amount greater than the premium paid for the call option.

The higher the asset's price goes above the strike price, the greater the potential profit.

The profit potential is theoretically unlimited because there is no cap on how much the underlying asset's price can rise.

Market Outlook and Usage

A naked long call is typically used when an investor has a bullish outlook on the underlying asset. The investor anticipates that the asset's price will rise, and wants to participate in the potential gains.

This strategy is considered speculative because it involves paying a premium upfront and requires the underlying asset's price to move significantly in the desired direction to be profitable.

Naked long calls have a finite lifespan determined by the expiration date of the associated call option. Investors need the asset's price to move in the desired direction before the option expires.

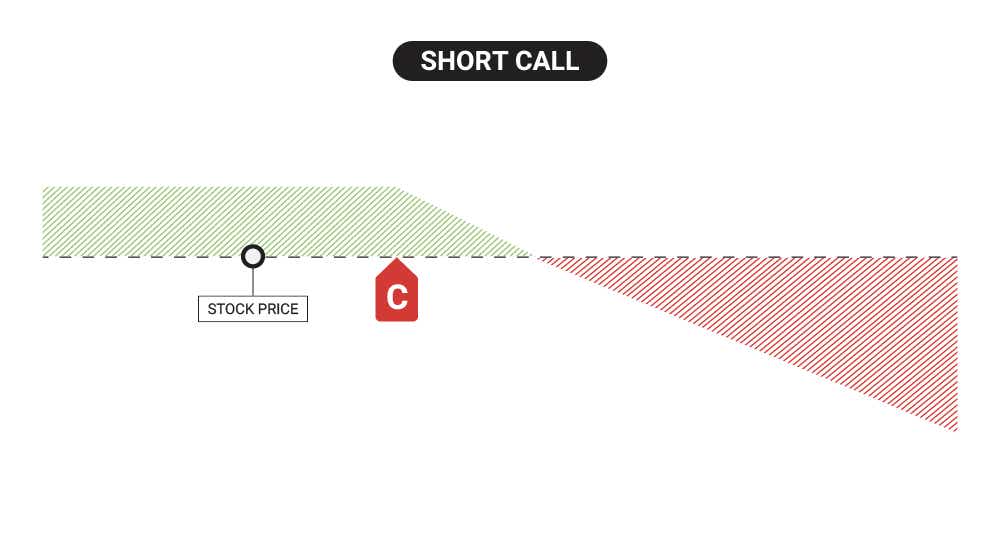

Naked short call

Naked short calls possess very different risk profiles as compared to naked long calls, because in the case of the latter, the maximum loss is the premium paid to enter the position.

With naked short calls, the investor/trader sells (writes) call options without owning the underlying stock or security. This approach is considered "naked" because the seller does not have the security in their portfolio to cover the option if it is exercised. Naked short call positions therefore possess substantial risk.

More details on naked short calls are highlighted below.

Basic Overview

The seller of a naked call option grants the buyer the right to purchase a stock or another asset at a specified price (the strike price) within a certain time frame.

The seller receives a premium from the buyer for selling this option.

Absence of Stock Hedge

Unlike a covered call, where the seller owns the underlying stock, in a naked call, the seller does not hold the stock they are obligated to deliver if the option is exercised.

Risk Profile

The risk associated with writing a naked call is significant. If the stock's price rises above the strike price, the seller may be forced to purchase the stock at the market price, which could be much higher, and then sell it to the option holder at the lower strike price.

This strategy has potentially unlimited loss potential because there is no cap on how high the stock price can rise.

Profit Potential

The profit for the seller is limited to the premium received when selling the call option. This contrasts sharply with the risk of unlimited loss.

Broker Requirements

Due to the high risk involved, selling naked calls is typically restricted to experienced investors with substantial financial resources.

These positions may require additional margin.

Market Outlook and Usage

Investors/traders who write naked calls usually expect that the stock price will trade sideways or decline.

Often utilized by speculators or those with a strong belief that the underlying stock will not exceed the strike price before expiration.

How to sell (write) naked calls?

Selling naked calls can involve substantial risk. Investors and traders considering this approach can review the information highlighted below.

Considerations When Selling Naked Calls

Understand the Risks: First and foremost, you need to fully understand the risks involved. Selling naked calls has potentially unlimited loss potential, as you're obligated to deliver the stock at the strike price if the option is exercised and the stock's price could rise significantly.

Have an Appropriate Account: Ensure you have a brokerage account that permits the selling of naked calls. Not all accounts or brokers allow this due to the associated risk.

Meet Broker Requirements: Brokers typically have specific requirements for investors wishing to engage in this strategy, including experience levels, account size, and financial standing. You may need to provide proof of your trading experience and financial resources.

Choose the Underlying Stock: Choose a stock that you believe will not rise above the strike price of the option before expiration. This involves thorough market research and analysis.

Choose the Option to Sell: Select the call option you want to sell. Consider the strike price, expiration date, and the premium you will receive. Options with higher premiums typically come with higher risk (higher likelihood of the option being exercised).

Sell the Call Option: Place an order to sell the call option through your brokerage platform. You will receive the premium from the sale.

Monitor the Position: Continuously monitor the market and the performance of the underlying stock. Be prepared for potential actions if the market moves against your position.

Manage the Position: If the stock price rises above the strike price, you may face significant losses. Have a plan in place for such scenarios, whether it's buying back the option to close the position or setting aside funds to fulfill the obligation if the option is exercised.

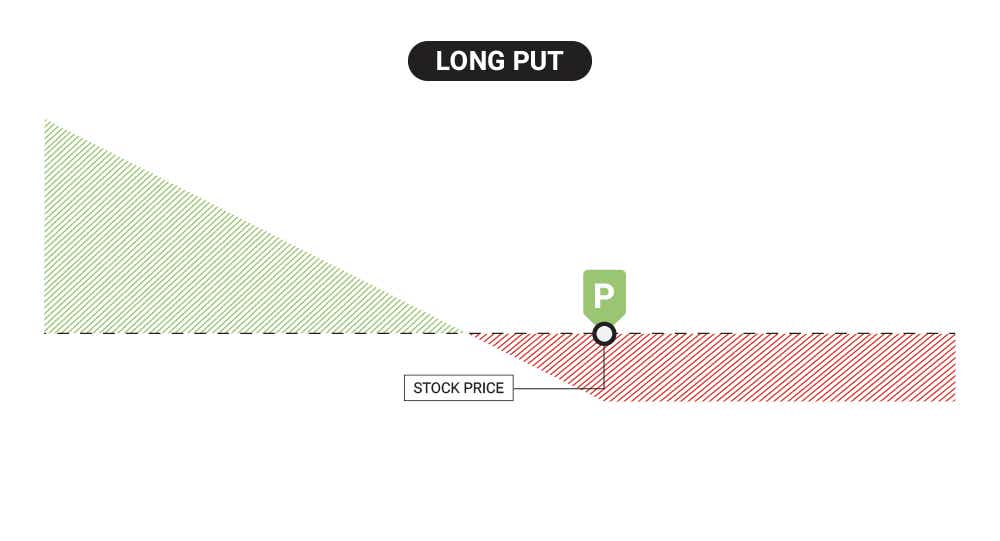

Naked long put

A naked long put is an options trading strategy where an investor buys a put option contract without simultaneously holding a position in the underlying asset (e.g., stock or commodity).

More details on naked long puts are outlined below.

Basic Overview

With a naked long put, the investor purchases a put option, which gives the investor the right (but not the obligation) to sell the underlying asset at a specified price (strike price) within a specified period (until expiration).

The investor pays a premium to the option seller (option writer) for this right, and the loss of this premium represents the maximum potential loss in this strategy.

The goal of a naked long put is to profit from an anticipated decrease in the price of the underlying asset. If the underlying asset's price falls significantly, the investor can exercise the put option and sell the underlying asset at the higher strike price, potentially realizing a profit.

Risk Profile

The maximum risk with a naked long put strategy is limited to the premium paid for the put option. If the underlying asset's price doesn't decline enough to cover the premium cost, the investor may incur a loss equal to the premium.

Profit Potential

A naked long put strategy profits when the price of the underlying asset falls below the strike price by an amount greater than the premium paid for the put option.

The lower the asset's price goes below the strike price, the greater the potential profit.

The maximum profit potential of a naked long put is limited to the difference between the strike price of the put option and zero. In other words, the maximum profit occurs when the underlying asset's price falls to zero.

Market Outlook and Usage

A naked long put is typically used when an investor has a bearish outlook on the underlying asset. The investor anticipates that the asset's price will decline, and wants to profit from the potential drop.

This strategy is considered speculative because it involves paying a premium upfront and requires the underlying asset's price to move significantly in the desired direction to be profitable.

Naked long puts have a finite lifespan determined by the expiration date of the put option. Investors need the asset's price to move in the desired direction before the option expires.

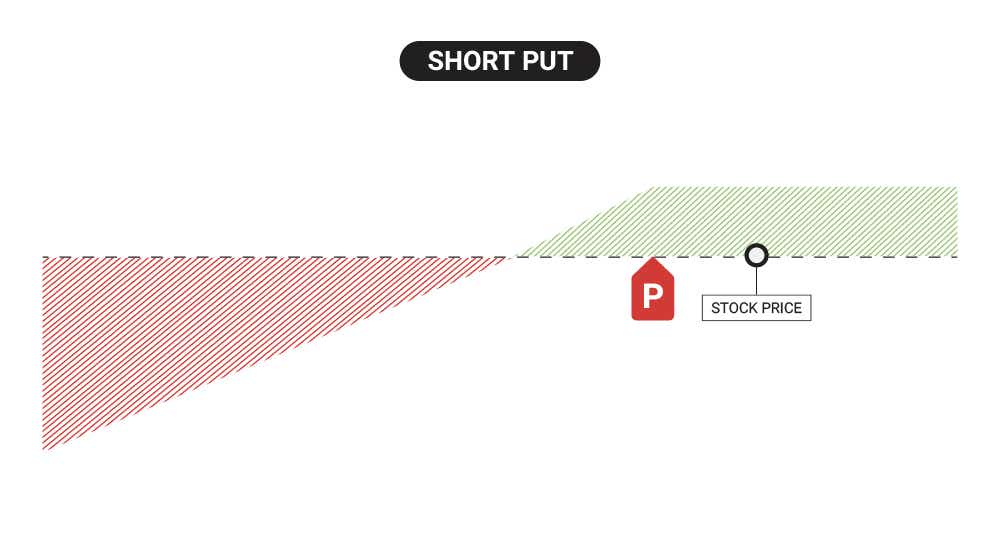

Naked short put

Naked short puts possess very different risk profiles as compared to naked long puts, because in the case of the latter, the maximum loss is the premium paid to enter the position.

With naked short puts, the investor/trader sells (writes) put options without holding a short position in the underlying asset. In this strategy, the seller is speculating that the price of the underlying asset will not fall below the strike price of the put option before expiration.

Naked short put positions possess substantial risk.

More details on naked short puts are highlighted below.

Basic Overview

The seller of a naked put option grants the buyer the right to sell a stock or another asset at a specified price (the strike price) within a certain time frame.

The seller receives a premium from the buyer for selling this option.

Absence of Stock Hedge

Unlike a covered put, where the seller has a short position in the underlying stock, in a naked put, the seller does not have such a position. This means they are not hedged against the risk of the option.

Risk Profile

The risk associated with writing a naked put is substantial, though not as extreme as with a naked call. If the stock's price falls below the strike price, the seller may be forced to buy the stock at the strike price, which could be higher than the market price.

The maximum loss is limited to the strike price minus the premium received, which occurs if the stock price falls to zero.

Profit Potential

The profit for the seller is limited to the premium received when selling the put option. This contrasts with the potentially significant loss if the stock price declines sharply.

Broker Requirements

Due to the high risk involved, selling naked puts is typically restricted to experienced investors with substantial financial resources.

These positions may require additional margin.

Market Outlook and Usage

Investors/traders who write naked puts generally expect that the stock price will trade sideways or increase.

Often utilized by investors as a way to generate income or potentially enter a stock position at a lower net cost (if the investor/trader is willing and able to buy the stock at the strike price).

How to sell (write) naked puts?

Selling naked puts can involve substantial risk. Investors and traders considering this approach can review the information highlighted below.

Considerations When Selling Naked Puts

Understand the Risks: It’s crucial to understand the risks involved in selling naked puts. The primary risk is that you may be required to buy the underlying stock at a price higher than the current market value if the stock's price falls below the strike price.

Have an Appropriate Account: Ensure that your brokerage account is authorized for selling naked puts. This usually requires a margin account since selling naked puts can involve significant margin requirements.

Meet Broker Requirements: Brokers typically have specific requirements for investors wishing to engage in this strategy, including experience levels, account size, and financial standing. You may need to provide proof of your trading experience and financial resources.

Choose the Underlying Stock: Carefully select the stock on which you want to sell put options. Look for stocks where you have a bullish or at least neutral outlook, as the ideal scenario is for the stock to stay above the strike price of the put option.

Choose the Option to Sell: Decide on the specific put option you want to sell, considering the strike price, expiration date, and premium. Options with higher premiums typically come with higher risk (higher likelihood of the option being exercised).

Sell the Put Option: Through your brokerage platform, place an order to sell the put option. You will receive the premium from the sale.

Monitor the Position: Continuously monitor the market and the performance of the underlying stock. Be prepared for potential actions if the market moves against your position.

Manage the Position: If the stock price starts approaching or drops below the strike price, consider your options. You might buy back the put to close the position or be prepared to purchase the stock at the strike price if the option is exercised.

Pros and cons of naked options

Naked options, involving both calls and puts, represent advanced trading strategies with distinct advantages and disadvantages. An overview of some of the associated pros and cons are highlighted below.

Pros of Naked Options

Income Generation: One of the primary advantages of selling naked options is the ability to generate income through the premiums received from the buyers of the options.

Flexibility: Naked options allow investors and traders to express a variety of market views. For instance, by selling a naked call, an investor or trader can express the view that a stock will trade sideways, or lower. On the other hand, by selling a naked put, an investor or trader can express the view that a stock will trade higher, or sideways.

Potential for Profit in Sideways Markets: If the underlying trades sideways, naked short options can expire worthless, allowing the seller to keep the full premium.

Leverage: Options provide a leveraged way to speculate on stock price movements. That means a relatively small amount of capital can control a much larger value in stocks.

Cons of Naked Options

Unlimited Loss Potential (Naked Short Calls): When you sell a naked call, your potential loss is theoretically unlimited, as there is no cap on how high a stock's price can rise.

Substantial Loss Potential (Naked Short Puts): While the loss is not unlimited like in naked calls, selling naked puts can still lead to substantial losses if the underlying stock price falls significantly.

Margin Requirements: Naked options often require significant margin requirements, tying up more of your capital and potentially leading to margin calls if the position moves against you.

Requires Frequent Monitoring: Given the risks involved, naked options require constant market monitoring. Significant market movements can occur quickly and dramatically affect the value of your position.

Broker Restrictions: Due to their risk, there are often stringent regulatory and broker-imposed restrictions on who can trade naked options, typically requiring proof of experience and financial resources.

Not Suitable for Beginners: Given the complexities and risks, naked options are generally not suitable for novice investors/traders.

Naked options summed up

The term “naked option” refers to an options-focused position that is not hedged with stock. In that regard, naked options positions are viewed as “pure play” options positions.

A naked option position may take the form of a long call, a short call, a long put, or a short put—all of which have clearly defined risk parameters.

The key difference between a naked option position and a covered option position lies in the presence or absence of ownership of the underlying asset associated with the option contract.

For example, a covered call position involves selling a call option against an existing long stock position. That means the investor/trader owns enough stock against the short call(s) to “cover” any potential assignment.

On the other hand, if an investor/trader sells a call option, and does not own the underlying stock, that position would instead be referred to as a “naked” short call.

Selling naked options can involve substantial risk. Investors/traders considering this approach should therefore ensure they understand the potential risks and rewards before deploying them in the marketplace.

Investors and traders new to naked options may also want to mock trade (i.e. paper trade) this approach before deploying it live. Mock trading allows market participants to gain experience managing such positions while avoiding the risk of capital losses.

SUPPLEMENTAL CONTENT

Episodes on Naked Options

No episodes available at this time. Check back later!

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices