Filter

What is an Option Assignment & How Does it Work?

What is an Assignment in Options?

Options assignment refers to the process in which the obligations of an options contract are fulfilled. This happens when the holder of an options contract decides to exercise their rights.

When an option holder decides to exercise, the Options Clearing Corporation (OCC) will randomly assign the exercise notice to one of the option writers.

A call option gives the holder the right to buy an underlying asset at a specified price (the strike price) within a certain period. If the holder decides to exercise a call option, the seller (writer) of the option is obligated to sell the underlying asset at the strike price. In this case, the option seller is said to be "assigned."

A put option gives the holder the right to sell an underlying asset at a specified price within a certain period. If the holder decides to exercise a put option, the seller of the option is obligated to buy the underlying asset at the strike price. Again, the option seller is "assigned" in this scenario.

Importantly, being assigned on an option can lead to significant financial obligations, particularly if the option writer does not already own the underlying asset for a call option (known as a naked call) or does not have the cash to buy the underlying asset for a put option. Therefore, option writers should be prepared for the possibility of assignment.

How Does Assignment Work?

Options assignment works in tandem with the exercise of an options contract. It's the process of fulfilling the obligations of the options contract when the option holder decides to exercise their contractual right as outlined above.

When an option owner exercises their right to convert the option to stock, the option writer is assigned and the option is converted to 100 shares of stock per option contract. Simply put, assignment refers to an options contract being converted to 100 shares of stock, regardless of whether it is a naked option or part of a multi-leg options strategy.

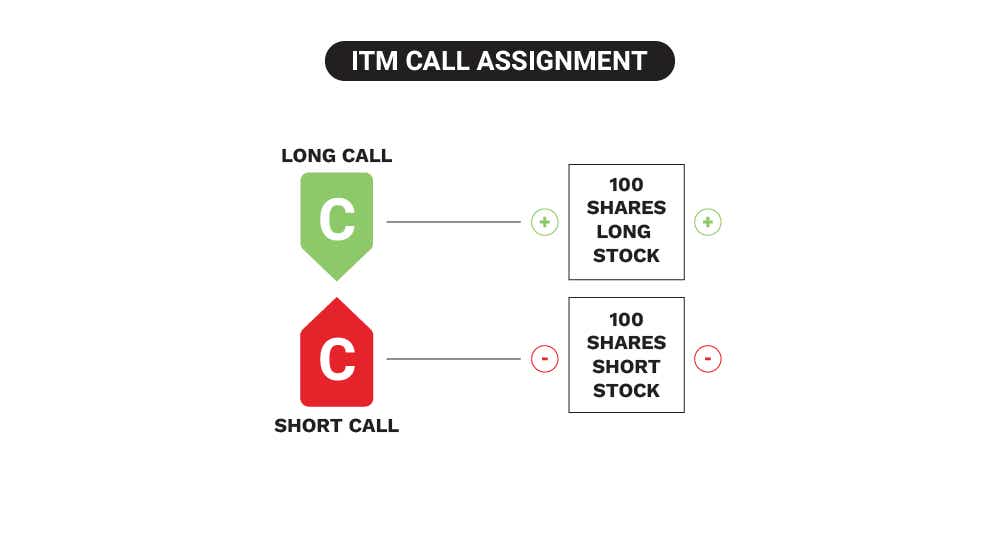

Long call options convert to 100 shares of long stock, and short call options convert to 100 shares of short stock at the strike price.

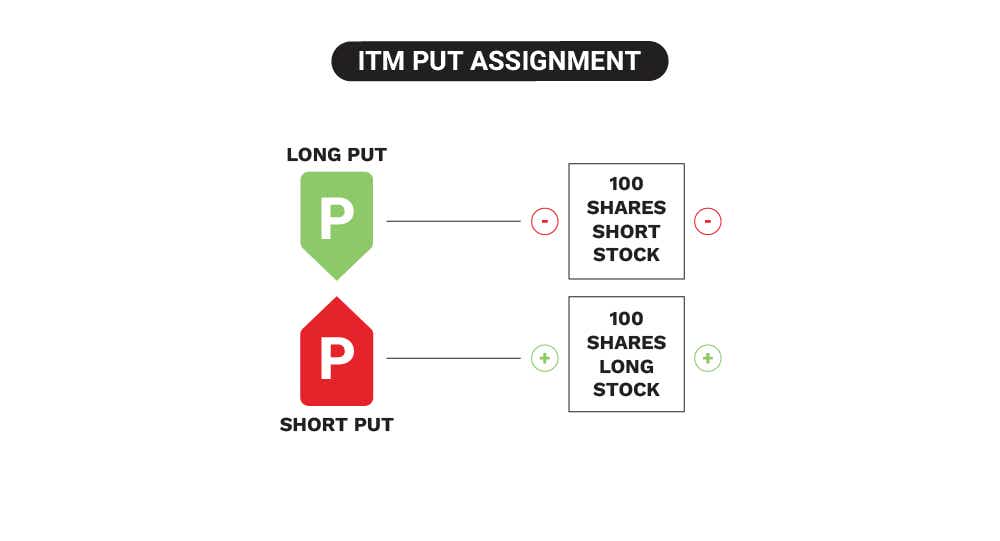

Long put option contracts convert to 100 shares of short stock, and short put option contracts convert to 100 shares of long stock at the strike price.

In general, the options assignment process includes four steps, as outlined below:

Option Exercise: The holder of the option (the investor who purchased the option) decides to exercise the option. This decision is typically made when it is beneficial for the option holder to do so. For example, if the market price of the underlying asset is favorable compared to the strike price in the option contract.

Notification: When the option is exercised, the Options Clearing Corporation (OCC) is notified. The OCC then selects a member brokerage firm, which in turn chooses one of its clients who has written (sold) an options contract of the same series (same underlying asset, strike price, and expiration date) to be assigned.

Assignment: The selected option writer (the investor who sold the option) is then assigned by the brokerage. The assignment means that the option writer now has the obligation to fulfill the terms of the options contract.

Fulfillment: If it was a call option that was exercised, the assigned writer must sell the underlying asset to the option holder at the agreed-upon strike price. If it was a put option that was exercised, the assigned writer must buy the underlying asset from the option holder at the strike price.

It's important to note that assignment cannot happen when the market is open - these transactions take place when the options market is closed.

What Does “Write an Option” Mean?

Writing an option refers to the act of selling an options contract.

This term is used because the seller is essentially creating (or "writing") a new contract that gives the buyer the right, but not the obligation, to buy or sell a security at a predetermined price within a specific period. In this case, "writing a put or call" and "shorting a put or call" refers to the same thing.

There are two types of options that investors/traders can write: a call option or a put option. Further details for each are outlined below:

Writing a Call Option: This process involves selling someone the right to buy a security from you at a specified price (the strike price) before the option expires. If the buyer decides to exercise their right, you, as the writer, must sell them the security at that strike price, regardless of the market price. If you don't own the underlying security, this is known as writing a naked call, which can involve substantial risk as there is no cap to how high a stock price can go. A short call holder assumes the risk of 100 shares of short stock above the strike price.

Writing a Put Option: This process involves selling someone the right to sell a security to you at a specified price before the option expires. If the buyer decides to exercise their right, you, as the writer, must buy the security from them at that strike price, regardless of the market price. A short put holder assumes the risk of 100 shares of long stock below the strike price.

When an investor/trader writes an option, he/she receives the option’s extrinsic value premium associated with assuming the intrinsic value risk of the options contract. This extrinsic value premium is theirs to keep if held through expiration, regardless of whether the option is exercised or expires worthless.

As such, writing options (i.e. selling options) is typically reserved for experienced investors/traders who are comfortable with the risks involved, as short options assume the risk of 100 shares of long or short stock depending on the options type.

How do you Know if an Option Position will be Assigned?

It’s impossible to know for certain if a given option will be assigned, but the more extrinsic value there is associated with an option, the less likely it is to be assigned (excluding dividend risk associated with ITM short call options).

There are several situations in which an options assignment becomes more likely, as detailed below:

In-the-money (ITM) Options: An option is more likely to be exercised, and therefore assigned, if it's in the money. That means the market price of the underlying asset is above the strike price for a call option, or below the strike price for a put option. This is because exercising the option in such a scenario could start to make sense for the option owner as the option would have intrinsic value. OTM options are not likely to be assigned as the trader or investor could just buy or sell shares of stock at a better price in the outright market.

Near Expiration: Options are also more likely to be exercised as they approach their expiration date, particularly if they are in the money. This is because the extrinsic value of the option (a component of its price) diminishes as the option nears expiration, leaving only the intrinsic value (the difference between the market price of the underlying asset and the strike price).

Dividend Payments: For ITM call options, if the underlying security is due to pay a dividend, and the amount of the dividend is larger than the extrinsic value remaining in the option's price, it might make sense for the holder to exercise the option early to capture the dividend. This could lead to early assignment for the writer of the option.

Remember, even if the above scenarios exist, it does not guarantee assignment, as the option holder might not choose to exercise the option. The decision to exercise is entirely up to the option holder.

Therefore, when writing (i.e. selling) options, investors and traders should be prepared for the possibility of assignment at any time until the option expires.

What Happens after an Option is Assigned?

In general, the options assignment process includes four steps, as outlined below:

Option Exercise: The holder of the option (the investor who purchased the option) decides to exercise the option. This decision is typically made when it is beneficial for the option holder to do so. For example, if the market price of the underlying asset is favorable compared to the strike price in the option contract.

Notification: When the option is exercised, the Options Clearing Corporation (OCC) is notified. The OCC then selects a member brokerage firm, which in turn chooses one of its clients who has written (sold) an options contract of the same series (same underlying asset, strike price, and expiration date) to be assigned.

Assignment: The selected option writer (the investor who sold the option) is then assigned by the brokerage. The assignment means that the option writer now has the obligation to fulfill the terms of the options contract.

Fulfillment: If it was a call option that was exercised, the assigned writer must sell the underlying asset to the option holder at the agreed-upon strike price. If it was a put option that was exercised, the assigned writer must buy the underlying asset from the option holder at the strike price.

Remember, as the writer of the option, you receive and keep the premium regardless of whether the option is exercised or not. But this premium may not be sufficient to offset any loss from the assignment. That's why writing options involves risk and requires careful consideration.

Short Put vs. Short Call

This term is used because the seller is essentially creating (or "writing") a new contract that gives the buyer the right, but not the obligation, to buy or sell a security at a predetermined price within a specific period.

There are two types of options that investors/traders can write: a call option or a put option. Further details for each are outlined below:

Writing a Call Option: This process involves selling someone the right to buy a security from you at a specified price (the strike price) before the option expires. If the buyer decides to exercise their right, you, as the writer, must sell them the security at that strike price, regardless of the market price. If you don't own the underlying security, this is known as writing a naked call, which can involve substantial risk.

Writing a Put Option: This process involves selling someone the right to sell a security to you at a specified price before the option expires. If the buyer decides to exercise their right, you, as the writer, must buy the security from them at that strike price, regardless of the market price.

Remember, as the writer of the option, you receive and keep the premium regardless of whether the option is exercised or not. But this premium may not be sufficient to offset any loss from the assignment. That's why writing options involves risk and requires careful consideration.

Option Assignment Examples

1. Call Option Assignment:

Imagine a scenario in which you've written (sold) a call option for ABC stock. The call option has a strike price of $60 and the expiration date is in one month. For selling this option, you've received a premium of $5.

Now, let's say the stock price of ABC stock shoots up to $70 before the expiration date. The option holder can choose to exercise the option since it is now "in-the-money" (the current stock price is higher than the strike price). If the option holder decides to exercise their right, you, as the writer, are then assigned.

Being assigned means you have to sell ABC shares to the option holder for the strike price of $60, even though the current market price is $70. If you already own the ABC shares, then you simply deliver them. If you don't own them, you must buy the shares at the current market price ($70) and sell them at the strike price ($60), incurring a loss.

2. Put Option Assignment:

Suppose you've written a put option for XYZ stock. The put option has a strike price of $50 and expires in one month. You receive a premium of $5 for writing this option.

Now, if the stock price of XYZ stock drops to $40 before the option's expiration date, the option holder may choose to exercise the option since it's "in-the-money" (the current stock price is lower than the strike price). If the holder exercises the option, you, as the writer, are assigned.

Being assigned in this scenario means you have to buy XYZ shares from the option holder at the strike price of $50, even though the current market price is $40. This means you pay more for the stock than its current market value, incurring a loss.

Option Assignment Summed up

Options assignment refers to the process in which the obligations of an options contract are fulfilled. This happens when the holder of an options contract decides to exercise their rights.

In general, the options assignment process includes four steps, as outlined below:

Option Exercise: The holder of the option (the investor who purchased the option) decides to exercise the option. This decision is typically made when it is beneficial for the option holder to do so. For example, if the market price of the underlying asset is favorable compared to the strike price in the option contract.

Notification: When the option is exercised, the Options Clearing Corporation (OCC) is notified. The OCC then selects a member brokerage firm, which in turn chooses one of its clients who has written (sold) an options contract of the same series (same underlying asset, strike price, and expiration date) to be assigned.

Assignment: The selected option writer (the investor who sold the option) is then assigned by the brokerage. The assignment means that the option writer now has the obligation to fulfill the terms of the options contract.

Fulfillment: If it was a call option that was exercised, the assigned writer must sell the underlying asset to the option holder at the agreed-upon strike price. If it was a put option that was exercised, the assigned writer must buy the underlying asset from the option holder at the strike price.

Remember, as the writer of the option, you receive and keep the premium regardless of whether the option is exercised or not. But this premium may not be sufficient to offset any loss from the assignment. That's why writing options involves risk and requires careful consideration.

As such, writing options (i.e. selling options) is typically reserved for experienced investors/traders who are comfortable with the risks involved.

FAQ

What does an option assignment mean?

Options assignment refers to the process in which the obligations of an options contract are fulfilled. This happens when the holder of an options contract decides to exercise their rights.

When an option holder decides to exercise, the Options Clearing Corporation (OCC) will randomly assign the exercise notice to one of the option writers.

A call option gives the holder the right to buy an underlying asset at a specified price (the strike price) within a certain period. If the holder decides to exercise a call option, the seller (writer) of the option is obligated to sell the underlying asset at the strike price. In this case, the option seller is said to be "assigned."

A put option gives the holder the right to sell an underlying asset at a specified price within a certain period. If the holder decides to exercise a put option, the seller of the option is obligated to buy the underlying asset at the strike price. Again, the option seller is "assigned" in this scenario.

What happens when a call is assigned?

A call option gives the holder the right to buy an underlying asset at a specified price (the strike price) within a certain period. If the holder decides to exercise a call option, the seller (writer) of the option is obligated to sell the underlying asset at the strike price. In this case, the option seller is said to be "assigned."

If it was a call option that was exercised, the assigned writer must sell the underlying asset to the option holder at the agreed-upon strike price.

What happens when a short option is assigned?

Writing an option refers to the act of selling an options contract.

This term is used because the seller is essentially creating (or "writing") a new contract that gives the buyer the right, but not the obligation, to buy or sell a security at a predetermined price within a specific period.

There are two types of options that investors/traders can write: a call option or a put option. Further details for each are outlined below:

Writing a Call Option: This process involves selling someone the right to buy a security from you at a specified price (the strike price) before the option expires. If the buyer decides to exercise their right, you, as the writer, must sell them the security at that strike price, regardless of the market price. If you don't own the underlying security, this is known as writing a naked call, which can involve substantial risk.

Writing a Put Option: This process involves selling someone the right to sell a security to you at a specified price before the option expires. If the buyer decides to exercise their right, you, as the writer, must buy the security from them at that strike price, regardless of the market price.

How often do options get assigned?

The frequency with which options get assigned can vary significantly, depending on a number of factors. These can include the type of option, its moneyness (whether it's in, at, or out of the money), time to expiration, volatility of the underlying asset, and dividends.

According to FINRA, only about 7% of options positions are typically exercised. But that does not imply that investors can expect to be assigned on only 7% of their short positions. Investors may have some, all, or none of their short options positions assigned.

How often do options get assigned early?

According to FINRA, only 7% of all options are exercised, which indicates that early assignment options constitute an even lower percentage of the total than 7%.

How late can options be assigned?

In most cases, options can be exercised (and thus assigned to the writer) at any time up to the expiration date for American style options. However, the exact timing can depend on the rules of the specific exchange where the option is traded.

Typically, the holder of an American style option has until the close of business on the expiration date to decide whether to exercise it. Once the decision is made and the exercise notice is submitted, the Options Clearing Corporation (OCC) randomly assigns the exercise notice to one of the member brokerage firms with clients who have written (sold) options in the same series. The brokerage firm then assigns one of its clients.

Do I keep the premium if I get assigned?

As the writer of the option, you receive and keep the premium regardless of whether the option is exercised or not. But this premium may not be sufficient to offset any loss from the assignment. That's why writing options involves risk and requires careful consideration.

Supplemental Content

Episodes on Assignment

No episodes available at this time. Check back later!

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices