Filter

Contents

3 Types of Crypto Wallets for Beginners

Contents

If you want to transact on a blockchain network like Bitcoin or Ethereum, you will first need a place to store your cryptocurrency. This storage location is called a cryptocurrency wallet.

There are three types of crypto wallets:

In this guide, we will explore the 3 different types of crypto wallets, as well as the difference between custodial and non-custodial wallets and hot and cold wallets.

New to crypto? Read our Crypto for Beginners guide here!

What Is A Crypto Wallet?

A blockchain wallet allows users to store, manage, and trade cryptocurrency assets. It also allows users to interact with DeFi (decentralized finance) and trade NFTs (non-fungible tokens).

The primary function of a crypto wallet is to store your private key, which is necessary to transact on any blockchain network.

It is important to note that your crypto is never stored on a wallet itself, but on a blockchain (such as Bitcoin or Ethereum). The private key held in your wallet simply unlocks your blockchain address, which is where the crypto is actually stored.

Before we explore the different types of cryptocurrency wallets, let's take a moment to understand what exactly ‘public’ and ‘private’ keys are.

Note: Interested in learning what you can do with a crypto wallet? Read 3 Ways to Earn Yield in DeFi

Public Key vs Private Key

When you first open your crypto wallet, you will be automatically assigned a public key and a private key.

- A public key is a large string of digits that allows its owner to receive cryptocurrency by encrypting sensitive data.

- The primary function of a private key is to verify both transactions and ownership of a wallet address. A private key achieves this with an algorithm that both decrypts and encrypts sensitive data.

A public key is like a mailbox in that anyone can see this address and send mail (crypto) to it.

However, only the owner of this mailbox has the key to open the it and receive the messages. This key is akin to the “private key’ in crypto.

Although the private key and public key are mathematically linked together, it is impossible to derive a private key from a public key alone.

Never reveal your private key to anyone. If you do so, that party could steal all of your cryptocurrency.

Note: Most modern wallets use ‘seed phrases’ instead of private keys. A seed phrase is a long series of random words which are linked to a private key.

Custodial vs Non-Custodial Wallets: What Are the Differences?

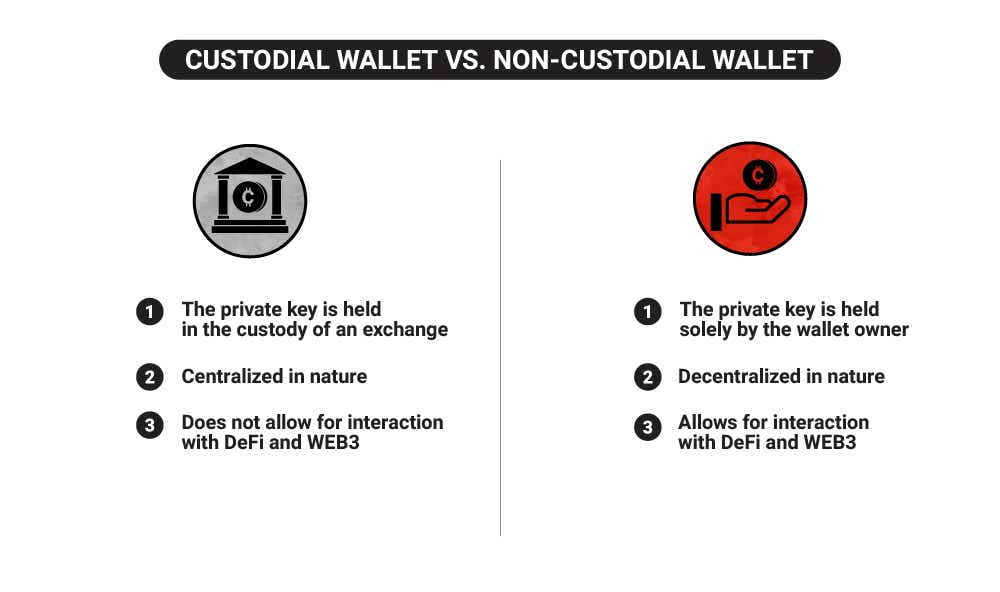

All crypto wallets come in two forms: custodial and non-custodial.

- In a custodial wallet, an exchange holds your private key for you. A popular example of such an exchange is Coinbase. Custodial wallets do not allow for interaction with Web3 as a user does not have direct access to their keys.

- In non-custodial wallets (sometimes called self-custody wallets), the user has direct access to their keys, and, therefore, complete control over their digital assets. This control permits the owners of non-custodial wallets' direct interaction with a blockchain. With self-custody wallets, crypto is traded on decentralized crypto exchanges (DEXs), such as Uniswap. If you'd like to learn more about the tastycrypto non-custodial crypto wallet, check it out here!

This article will focus mainly on the three different types of non-custodial wallets. For a deeper dive into this subject, check out our custodial vs self-custody wallet article.

Note: New to crypto? Check out our crypto glossary for beginners!

3 Types Of Crypto Wallets

Paper Wallets: How Do They Work?

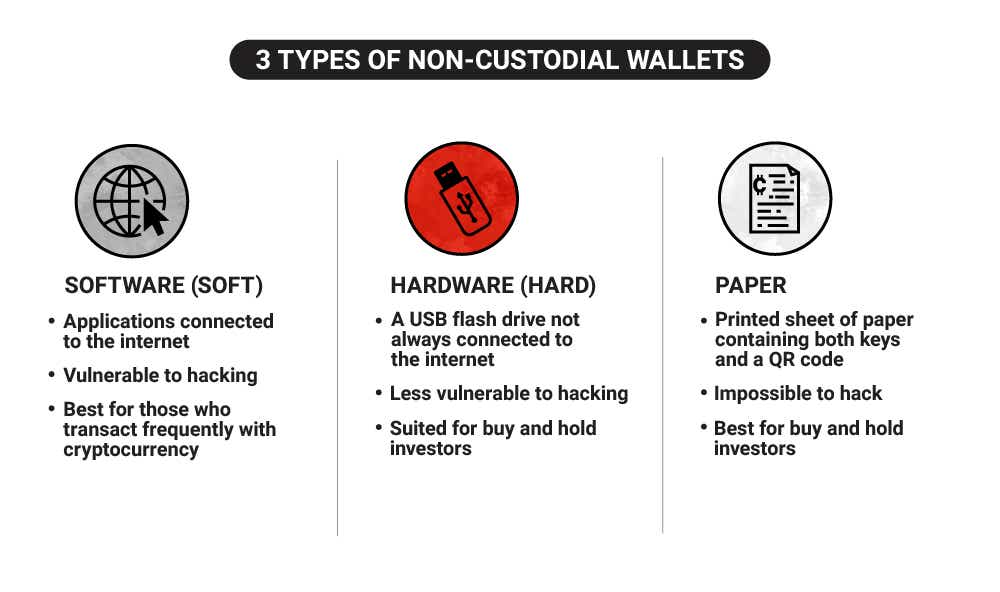

- A paper wallet is a printed piece of paper that has your private key written on it.

- Paper wallets are best for users who rarely plan on interacting with their owned cryptocurrencies.

- Paper wallets in themselves are not secure.

The first kind of crypto wallet on our list is the most basic: the paper crypto wallet.

A paper wallet is simply a printed (or hand-written) sheet of paper that has written on it your private key and possibly scannable QR codes.

Though paper wallets are completely disconnected from both the internet and blockchain, the keys on them do indeed represent keys on the blockchain which are still active and can be used to locate cryptocurrency.

One of the biggest drawbacks of paper wallets is the fact that they are stored on paper. If the paper gets wet or is burnt in a fire, you will not be able to read your private key (or seed phrase) and the representative crypto will be lost forever. A water/fireproof safe is necessary for the secure storage of a paper wallet.

Paper wallets also make the process of transacting with blockchain networks tedious: a Bitcoin private key is a 256-bit string.

Hardware Wallets: How Do They Work?

- Hardware wallets are physical devices that store the private key.

- Hardware wallets can be both connected and disconnected from the internet.

- Hardware wallets offer a more secure place to store cryptocurrency than paper wallets.

In blockchain technology, a hardware wallet is a cryptocurrency wallet that stores private keys on a hardware device, such as a USB drive.

The hardware wallet has features of both ‘hot’ and ‘cold’ wallets (which we will soon discuss).

Hardware wallets are like paper wallets in that they allow their owners to safely store their private keys offline.

In addition to safeguarding your private keys offline (where they can never be hacked), most hardware wallets allow users to sign and confirm blockchain transactions by simply plugging their device into a computer.

After a transaction is complete, a user can unplug their device, and not have to worry about it being constantly connected to the internet. This constant connection makes a wallet vulnerable to threat.

Two of the more popular hardware wallet providers include Ledger and Trezor.

Software Wallets: How Do They Work?

- Software wallets are both the most efficient and risky type of wallet.

- Software wallets include browser extension wallets, mobile app wallets, and desktop app wallets.

Software wallets are the most popular wallets in the crypto world. This type of wallet is always connected to the internet. This constant connectivity allows users to seamlessly and speedily interact with DeFi protocols. Borrowing and lending, staking, swapping tokens, and trading on DEXs (decentralized cryptocurrency exchanges) are a breeze with a software wallet. All DEXs deploy smart contracts to swap crypto between parties.

However, this connectivity does indeed come with some downsides. Since a software wallet is constantly connected to the internet, it is at constant risk of being hacked.

Threats to software wallets are not limited to cyberspace.

If you misplace or lose an unlocked device upon which your wallet is located, the recovering party could very easily gain access and drain the crypto from your wallet. It is therefore important to always have any device that contains a software wallet safeguarded by a password.

Let’s explore the different types of these online wallets.

3 Types of Software Wallets

There are three primary types of software wallets.

- Web wallets

- Mobile wallets

- Desktop wallets

Web wallets (browser-extension wallets)

Web wallets come in the form of a web browser extension. The software that powers a web wallet is stored on your internet browser, which can introduce security risks.

If you want to swap crypto on a crypto exchange, you simply need to visit that protocol's website and connect your wallet. The transaction is set up on the protocol but confirmed on the wallet. A browser extension wallet is the fastest and most user-friendly way to interact with blockchain technology.

Web wallets are frequently targeted by malware, so it is important to have a healthy computer before downloading one. Security measures, such as scanning your computer before downloading browser extension wallets, can help to mitigate risk.

Mobile wallets

In a mobile device wallet, your crypto keys are stored on your actual phone. This type of wallet comes in the form of an application, which is typically downloaded from the Google Play store for Androids or the Apple App Store for iPhones.

Many mobile wallets have a built-in browser that allows you to connect to decentralized applications (dApps). MetaMask and Exodus are two popular mobile wallets.

Desktop wallets

A desktop wallet is exactly the same as a mobile wallet with one exception: your private key is stored on a desktop application rather than a mobile application.

2-factor authentication is recommended for both mobile and desktop wallets.

Hot Wallet vs. Cold Wallet: What Are The Differences?

Sometimes, people refer to a wallet as simply a ‘hot’ or ‘cold’ wallet.

- A hot wallet is any wallet that is always connected to the internet, and therefore always at risk of being hacked.

- A cold wallet is any wallet that is not connected to the internet. A paper wallet would be an example of a cold wallet.

Hardware wallets share features of both hot and cold wallets. When a USB flash drive is not connected to the internet, a hardware wallet is considered a cold wallet. Once that USB gets plugged into an internet-connected computer, it becomes a hot wallet.

Bitcoin Wallet vs Ethereum Wallet

The Ethereum blockchain is not compatible with the Bitcoin blockchain. For this reason, you will need to have a wallet for each network if you want to interact with both of these networks.

Electrum and Mycelium are two widely-used Bitcoin wallets while MetaMask and Coinbase both offer popular Ethereum-based wallets.

The third most popular blockchain network is Binance. This network also has its own distinct wallet: Trust Wallet.

Which Type of Crypto Wallet Is Best for Me?

Determining the type of wallet best suited for you depends on a few factors.

How often do you plan on interacting with blockchain?

If you want to purchase popular cryptocurrencies like BTC or ETH to hold over a long duration, a cold storage wallet solution may be best for you. An example of cold storage would be a USB flash drive. When crypto is held on devices like these, your wallet is not connected to the internet and therefore not at risk of being hacked.

If you plan on swapping crypto and/or interacting with decentralized finance applications frequently, a software wallet may be your best option. Within these types of wallets, desktop and mobile wallet applications offer the best security.

Do you tend to lose or forget things easily?

If you tend to misplace things and are generally not well organized, you may want to consider a custodial wallet. Unlike non-custodial wallets, if you forget your password credentials for a custodial wallet, you will be able to recover them through your broker.

tastytrade offers a custodial wallet. With this wallet, you can trade: Bitcoin, Bitcoin Cash Ethereum, and Litecoin.

After your tastytrade account is open, you will need to enable cryptocurrency trading.

Takeaways

- The main purpose of a crypto wallet is to store a private key.

- In a custodial wallet, an exchange safeguards your private key for you.

- In a non-custodial wallet, you alone are responsible for managing your private key.

- Three types of crypto wallets include paper wallets, software wallets, and hardware wallets.

- Hot wallets are always connected to the internet while cold wallets can be disconnected from the internet.

FAQs

Which type of crypto wallet is best?

Cold storage wallets are best for crypto users who plan on simply investing in crypto long-term. Hot wallets are best for crypto users who interact frequently with blockchain.

What are the three types of wallets?

The three types of crypto wallets are paper wallets, software wallets, and hardware wallets.

What are the 4 types of cryptocurrency?

4 popular types of cryptocurrency include bitcoin, ether, solana, and polygon. All of these cryptocurrencies are the native coins of a blockchain network.

What is a cryptocurrency wallet?

A cryptocurrency wallet is used to store private keys. Crypto wallets can either be hardware, software, or paper.

What Is A Browser Extension Wallet?

A browser extension wallet is cryptocurrency wallet that saves a private key on an internet browser, such as Chrome. This type of crypto wallet is the most user-friendly but also the least secure.

What is the safest type of crypto wallet?

Hardware wallets are generally considered to be the safest type of crypto wallet. These wallets can be stored offline and are therefore not subject to hacker and malware risks.

tastytrade, Inc. and tastylive, Inc. are separate but affiliated companies.

tastytrade, Inc. provides its brokerage customers with access to cryptocurrency trading with Zero Hash Liquidity Services LLC, MSB # 31000181510564, and Zero Hash LLC NMLS # 169937. Zero Hash LLC is licensed to engage in Virtual Currency Business Activity by the New York State Department of Financial Services. tastytrade, Inc. is a separate company and isn’t an affiliate company of Zero Hash Liquidity Services LLC or Zero Hash LLC. Cryptocurrency accounts aren’t protected by SIPC coverage. Cryptocurrencies aren’t covered by the FDIC, which covers fiat currency. Cryptocurrency trading isn’t suitable for all investors due to the number of risks involved, including volatile market prices, illiquid market conditions, lack of regulatory oversight, market manipulation, and other risks. You’re solely responsible for evaluating your financial circumstances and determining whether or not trading cryptocurrencies is appropriate for you. Only the following cryptocurrencies are currently available for customers who reside in New York: AAVE, BAT, BTC, BCH, LINK, ETH, LTC, PAXG, and MATIC. Cryptocurrency trading isn’t yet available for customers who reside in Hawaii.

TASTYTRADE, INC. IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices