Filter

Contents

How to Short Sell a Stock

Contents

Shorting a Stock: What Does It Mean?

Shorting a stock means that you’re speculating on a decrease in the share price. At any given time, the price action of any stock, like in other markets, typically consists of upward and downward movements. Unlike investors, i.e. owners of a stock’s physical shares, who hope for a general rise in price in the long run, more active traders can take either directional assumption: speculating on a rise or fall in a stock’s price.

Investing and owning physical shares, as well as long trading positions, have increased potential of profit in bull markets. Short selling – which is also referred to as ‘going short’ or 'being short' – is often employed in stocks experiencing a bear market. Shorting can also be used to hedge portfolio risk in cases where particular stocks have a strong correlation with another underlying.

How to Short a Stock

1. Understand How Shorting Works

Understanding how shorting works is key for your desired outcome. So, what does short selling mean? Short selling is defined as the speculation that an underlying asset’s market price will fall. In this method of trading, profits are realized when there’s a decline in the price of the asset in question. On the flipside, if it rises instead, a loss is incurred.

This question is often asked with relation to shorting: how do you sell something that you didn’t own to begin with? In trading, buying (going long) and selling (going short), means you won’t have physical ownership of the underlying.

In the case of short selling, you assume the risk of lending shares of long stock to someone else, which means you assume the opposite profit or loss as the long stock owner. If the stock goes up $1.00, you lose $1.00 per share. If it goes down $1.00, you make $1.00 per share. To close the position, you would simply buy back the shares at the market price. It is a bearish position for that reason, since your goal would be to short shares at a higher price than what you buy the shares back for to close the position. It is the exact opposite of owning 100 shares of stock, except there is no cap to how high a stock price can go, which is important to keep in mind.

PROFIT/LOSS CHARTS

Long Stock | Short Stock |

|  |

2. Identify the Stock That You Want to Short Sell

When identifying the stock that you want to short, there are a number of factors to consider which could boost your probability of success. For instance, you’d want to look into factors that might cause a drop in share price: e.g. accounting irregularities, poor management and obsolete business models.

The reasoning behind shorting a certain stock's price doesn’t necessarily mean that the long-term outlook is looking glum. Sometimes factors leading to price drops are short lived, e.g. binary events and market corrections.

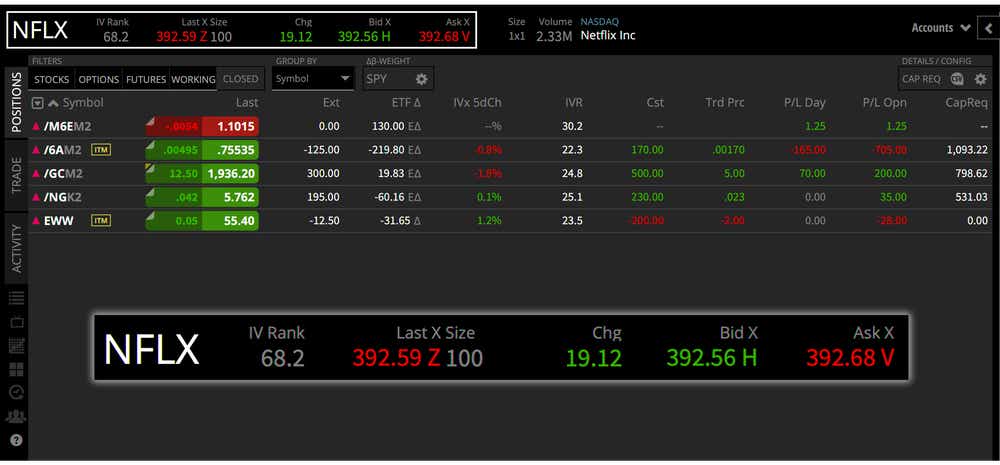

Another way to identify opportunities for long and short positions is to let the trading technology help you. For instance, at tastytrade, you can examine a watchlist of over- and under-performing stocks. If you sell a stock near it’s 52 week high (like the list below), you’d be hoping for a pullback from its recent strong rally. On the flipside, if you sold a stock trading near its 52 weak low, you’d be making the assumption there would be continued weakness in the underlying.

3. Create a tastytrade Margin Account or Log In

With tastytrade, you can short stocks using your margin account with 'The Works' trading level. If you don’t already have one, you can get started and create a tastytrade account. If you’re already part of the tastynation, and you have a margin account with 'The Works' permissions, all you need to do log in.

Before taking your position, you need to make sure that you’ve created a comprehensive trading plan and that you’ve got a solid risk management strategy in place. This way, you’d enter a stock position knowing how you want to manage various aspects of your trade and your risk tolerance will be clearly defined.

4. Decide How You Want to Short the Stock

Before you open your short position, it’s worth considering the various ways to capitalize on a bearish move in a stock. Shorting stocks outright, or via short call or long put options gives you exposure based on your speculation that the market will go down.

Let’s look at some key factors in how shorting stocks outright compares to using options contracts to short sell stocks.

Short Sell Stocks Outright

- A market order to be filled immediately, or as soon as reasonably possible

- Once the market order has been filled, your trade is active, and you can manage it accordingly

- The position must be closed to cut losses or lock in profits

Short Sell Stocks Via Options

- The trade is exercised by a certain expiration date

- With short calls assignment occurs if the trade expires ITM; whereas long puts mean you have the right, but not the obligation to convert to short shares

- Ability to let the contract expire worthless, only forgoing the premium for a long put, or keeping the premium from a short call

5. Open Your Short Position

Once you’ve done your research, and you believe that you’ve identified a stock that will experience a drop in share price, you can open your short position.

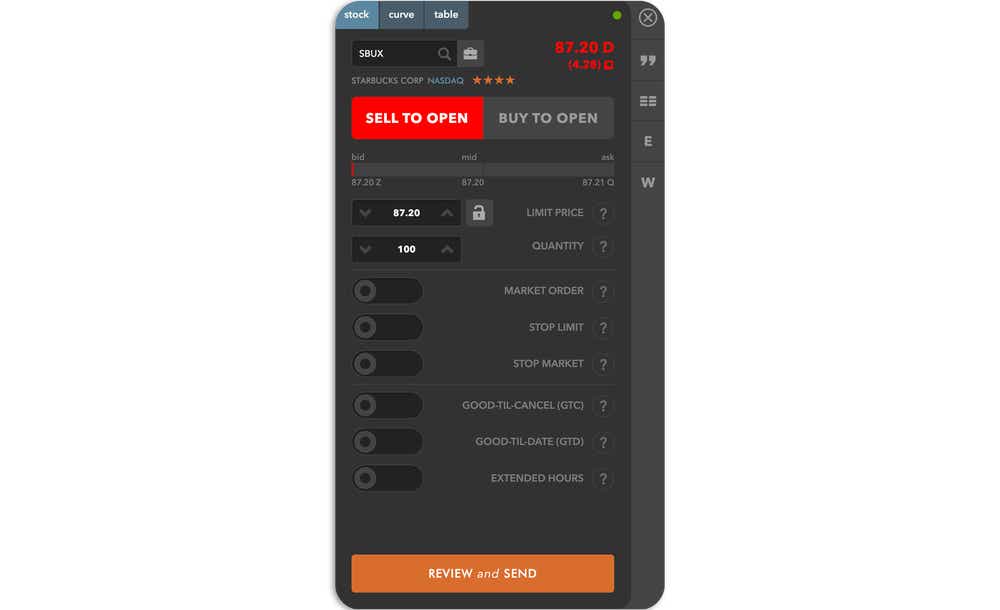

Same as with going long, you can simply search for the stock’s ticker symbol, or its full name on the tastytrade platform. Of course, the difference would be your directional assumption: you’d click ‘Bid’ when shorting the position, and ‘Ask’ when buying. On the web version of tastytrade, you can also utilize the stock trader interface to set up your long or short equity position.

6. Monitor and Close Your Open Short Position

A trading plan can help you monitor your trade with specific guidelines that you outlined beforehand. Among other things, you’ll know when to enter and exit the trade as well as how to take advantage of binary events, market volatility and correlated positions.

Like with your entire portfolio and all other individual positions within, you need to frequently monitor your short stock trade. But this doesn’t necessarily mean that you have to be staring at your screen non-stop. Automated orders and alerts enable you to manage your portfolio the way you want without actively tracking the performance manually.

If the Stock Price Falls

If the stock’s price falls, as predicted, you could close the position to lock in profits. By doing this, you’d be buying back the same number of shares you borrowed from the brokerage at a lower price and returning them. The price difference is the amount of profit you’d make, multiplied by the number of shares sold. This excludes the interest on the borrowed shares and other costs such as commission and regulatory fees.

If the Stock Price Increases

If the stock price increases from the original short price (against your directional assumption) you’d pay more to buy the shares back. The change in value would be the loss you’d incur. Same as in the case of the market moving in your favor and making a profit, you’d have to pay additional fees such as interest on the borrowed shares as well as commission and regulatory fees.

Short Selling a Stock Example

An example of short selling stock can provide some clarity on what putting theory into practice might look like. Let’s go through an example of shorting 10 shares of Company XYZ stock at $50.00 each.

After your order fills, the stock’s price drops steadily. When it reaches $40.00, you decide to close the positions to ensure that you lock in profits. Having borrowed 10 shares at $50.00 each to sell, you shorted them for $500.00 in total.

Buying them back at $40.00 each means that you’d make a $10.00 profit on each share. You’d return 10 shares to the broker. Only now, they’d have a total value of $400.00. The difference in value as well as profit would be $100.00, of which fees such as interest, commission and regulatory fees aren’t included.

Short Selling Stock Tips

Like with any type of trading, preparation can help you maximize potential profits or minimize possible losses. You can do this by researching the company and factors that might impact its share price, employing a solid strategy and creating a comprehensive trading plan.

Let’s look at some more tips that can be useful when short selling stocks:

- Do fundamental and a technical analysis as part of your research

- Compare the company’s business model to its competitors’

- Check whether there are regular changes in the company’s management structure

- Watch out for bold moves in how earnings are handled and accounting irregularities

- Keep your position size aligned with your risk tolerance

- Set alerts to notify you when certain price points have been reached

- Manage potential profits and possible losses

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices