Filter

Contents

Long Butterfly Spread

Contents

What is a long butterfly spread?

A long butterfly spread is an advanced options strategy that is used when an investor or trader expects little to no volatility in the price of the underlying security. Alternatively, a short butterfly spread can be used when an investor or trader expects a high degree of volatility.

A butterfly spread is constructed using three different strikes within the same underlying and expiration month. The key with a butterfly is that twice the amount of contracts are traded on the middle strike (the "body" of the spread) as compared to the outer strikes (the "wings" of the spread).

A long butterfly spread is a debit spread, and involves selling the ”body” and purchasing the “wings,” and can be implemented using either all call options or all put options.

A long butterfly produces its maximum profit when the underlying expires right at the middle strike price. Maximum loss (which is limited) occurs when the underlying closes at either the lower or higher strike prices.

DIRECTIONAL ASSUMPTION

IDEAL IMPLIED VOLATILITY ENVIRONMENT

PROFIT / LOSS CHART

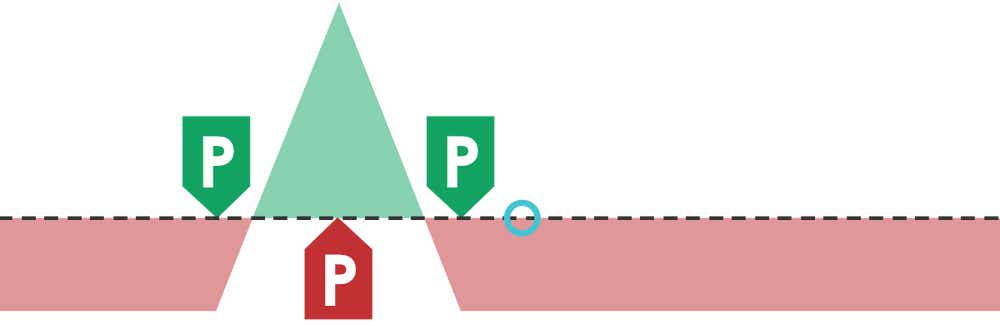

Long Put Butterfly Spread

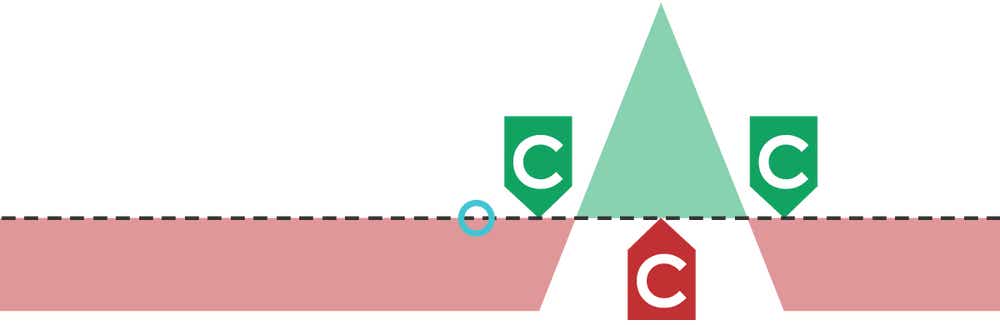

Long Call Butterfly Spread

How does a long butterfly spread work?

A butterfly spread is constructed using three different strikes within the same underlying and expiration month. The key with a butterfly is that twice the amount of contracts are traded on the middle strike (the "body" of the spread) as compared to the outer strikes (the "wings" of the spread).

A long butterfly spread is a debit spread, and involves selling the ”body” and purchasing the “wings,” and can be implemented using either all call options or all put options.

A long butterfly produces its maximum profit when the underlying expires right at the middle strike price. Maximum loss (which is limited) occurs when the underlying closes at either the lower or higher strike prices.

One of the most confusing aspects of butterfly spreads actually relates to the naming convention as opposed to the actual risk profile of the position. Butterflies are classified as "long" or "short" depending on the exposure of the wings. For example, a long butterfly spread involves selling the body and purchasing the wings.

What's confusing is that "long premium" in the options universe usually means the position does well when the underlying makes a big move. However, in the case of the long butterfly, the position actually performs best when the underlying sits right on the short, middle strike.

That means that a short butterfly performs best when the underlying breaks through the short strikes at the wings. Again, that's slightly confusing because options traders typically think of "short" positions as those in which they want the underlying to sit still.

How to construct a long butterfly spread?

A butterfly spread is constructed using three different strikes within the same underlying and expiration month. The key with a butterfly is that twice the amount of contracts are traded on the middle strike (the "body" of the spread) as compared to the outer strikes (the "wings" of the spread).

A long butterfly spread is a debit spread, and involves selling the ”body” and purchasing the “wings,” and can be implemented using either all call options or all put options.

SETUP

This spread is typically created using a ratio of 1-2-1 (1 ITM option, 2 ATM options, 1 OTM option).

tastylive Approach

At tastylive, we tend to buy call or put butterfly spreads to take advantage of the non-movement of an underlying stock. This is a low probability trade, but we use this strategy when implied volatility is high, as the butterfly spread then trades cheaper. The spread trades cheaper in this situation since the price of the in-the-money option consists primarily of intrinsic value. Therefore selling the ATM options covers a higher percentage of the cost of purchasing both of the long options.

CLOSE / MANAGE

WHEN TO CLOSE

Since achieving maximum profit on a butterfly is highly unlikely, the profit target on this position is generally lower. A reasonable profit target on a long butterfly is 25-50% of the maximum profit.

WHEN TO MANAGE

Long butterfly spreads are low probability, low risk trades. For this reason, losses generally aren’t managed.

Long butterfly spread example

Imagine it's January and you believe that Stock XYZ, currently trading at $50, will not move much over the next month. You decide to set up a long butterfly spread that expires in February.

Setting up the Long Butterfly Spread:

Buy one $45 call for $6.50 (This is an in-the-money option)

Sell two $50 calls for $3.00 each (These are at-the-money options. By selling these, you're collecting a total of $6.00 in premium)

Buy one $55 call for $1.00 (This is an out-of-the-money option)

Net Cost:

The net debit (cost) to set up the spread is equal to the cost of the $45 call + the cost of the $55 call - Less the cost of two $50 calls 2.

Or, $6.50 + $1.00 - $6.00 = $1.50

So, you've spent a total of $1.50 per contract to set up this butterfly spread.

Potential Outcomes

Scenario #1: The stock closes at $50 (middle strike). This is the preferred scenario. The $45 call would be worth $5.00, both $50 calls would expire worthless, and the $55 call would also expire worthless. Your profit would be equal to the value of the $45 call - initial cost, or $5.00 - $1.50 = $3.50 per contract.

Scenario #2: The stock closes below $45 or above $55: In this worst-case scenario, all options expire worthless. Your loss is limited to the initial debit, which is $1.50 per contract.

Scenario #3: Stock closes between $45 and $50, or $50 and $55. Under these scenarios, your profit or loss will vary within these ranges. It gets closer to the maximum profit as you approach $50 and closer to the maximum loss as you move away from $50 in either direction.

Investors and traders should keep in mind that options strategies like the long butterfly spread are complex and may not be suitable for all market participants. It’s important to understand the risks before entering into a new position, product or strategy.

Butterfly spread types

Let’s examine the different butterfly spread types

1) Long Call Butterfly Spread

Setup: A long call butterfly spread involves:

Buying one lower strike call (in-the-money)

Selling two middle strike calls (at-the-money)

Buying one higher strike call (out-of-the-money)

Objective: To profit from minimal price movement. The maximum profit is made when the stock closes at the middle strike price at expiration.

Risk & Reward:

Maximum Profit: Limited to the difference between the middle and lower strike minus the net cost of the spread.

Maximum Loss: Limited to the net cost of establishing the spread.

2) Short Call Butterfly Spread

Setup: A short call butterfly spread is the opposite of the long call butterfly spread, and involves the following:

Selling one lower strike call (in-the-money)

Buying two middle strike calls (at-the-money)

Selling one higher strike call (out-of-the-money)

Objective: To profit from a significant price movement, either up or down. You profit when the stock moves significantly away from the middle strike price.

Risk & Reward:

Maximum Profit: Limited to the net credit received when entering the trade.

Maximum Loss: Limited to the difference between the middle and lower strike prices minus the net credit received.

3) Long Put Butterfly Spread

Setup: Similar to the long call butterfly spread, but instead uses puts:

Buying one lower strike put (out-of-the-money)

Selling two middle strike puts (at-the-money)

Buying one higher strike put (in-the-money)

Objective: Just like with the long call butterfly, you're aiming to profit from little to no movement in the stock's price. The maximum profit is realized when the stock closes at the middle strike price at expiration.

Risk & Reward:

Maximum Profit: Limited to the difference between the middle and lower strike minus the net cost of the spread.

Maximum Loss: Limited to the net cost of establishing the spread.

4) Short Put Butterfly Spread

Setup: The short put butterfly spread is the opposite of the long put butterfly spread, and involves:

Selling one lower strike put (out-of-the-money)

Buying two middle strike puts (at-the-money)

Selling one higher strike put (in-the-money)

Objective: The trader is hoping for a significant price move in either direction. The profit is maximized when the stock moves significantly away from the middle strike price.

Risk & Reward:

Maximum Profit: Limited to the net credit received when entering the trade.

Maximum Loss: Limited to the difference between the middle and lower strike prices minus the net credit received.

In all these strategies, it's crucial to factor in transaction costs since butterfly spreads involve multiple option legs, potentially increasing commissions. Always ensure you understand a strategy and its associated risks before deploying it.

Iron butterfly spread

An iron butterfly spread is an advanced options strategy that involves four options with the same expiration date but at three different strike prices. It's a combination of a bull put spread and a bear call spread. The goal of the strategy is to profit from minimal price movement in the underlying security.

Setting up an iron butterfly:

Sell an at-the-money call option (this will be your middle strike price)

Sell an at-the-money put option (this should have the same middle strike price as the call option you sold)

Buy an out-of-the-money call option (this will be a higher strike price than the at-the-money call)

Buy an out-of-the-money put option (this will be a lower strike price than the at-the-money put)

Risk & Reward

Maximum Profit: The net credit received when entering the trade. This occurs when the stock price closes exactly at the middle strike price at expiration.

Maximum Loss: The difference between the middle and the outer strike prices minus the net credit received. This occurs when the stock price closes above the higher strike price or below the lower strike price at expiration.

Reverse iron butterfly spread

A reverse iron butterfly spread is an advanced options strategy, quite similar to the iron butterfly but with an opposing market outlook. While an iron butterfly seeks to profit from the underlying security staying relatively stable, the reverse iron butterfly seeks to profit from a significant price move in either direction.

Setting up a reverse iron butterfly:

Buy an at-the-money call option (this will be your middle strike price)

Buy an at-the-money put option (this should have the same middle strike price as the call option you bought)

Sell an out-of-the-money call option (this will be a higher strike price than the at-the-money call)

Sell an out-of-the-money put option (this will be a lower strike price than the at-the-money put)

Risk & Reward

Maximum Profit: The difference between the middle and the outer strike prices minus the net debit paid when entering the trade. This occurs when the stock price closes either above the higher strike price or below the lower strike price at expiration.

Maximum Loss: Limited to the net debit paid to establish the position. This occurs when the stock price closes exactly at the middle strike price at expiration.

How to calculate max profit and breakevens

A butterfly spread is an options strategy composed of three strike prices involving either calls or puts. The trader profits most when the underlying asset closes at the middle strike price at expiration.

Maximum Profit for a Long Butterfly Spread

When calculating the maximum profit for a butterfly spread, you're essentially looking at the premium of the middle strike minus the net cost (or net premium paid) for setting up the spread. That’s because your best-case scenario is for the underlying asset to expire at the middle strike price.

Max Profit = Middle Strike Option Premium - Net Premium Paid

Breakeven Points for a Long Butterfly Spread

There are two breakeven points for a butterfly spread:

Lower Breakeven = Lowest Strike Price + Net Premium Paid

Upper Breakeven = Highest Strike Price - Net Premium Paid

Long butterfly spread summed up

A long butterfly spread is an advanced options strategy that is used when an investor or trader expects little to no volatility in the price of the underlying security. Alternatively, a short butterfly spread can be used when an investor or trader expects a high degree of volatility.

A butterfly spread is constructed using three different strikes within the same underlying and expiration month. The key with a butterfly is that twice the amount of contracts are traded on the middle strike (the "body" of the spread) as compared to the outer strikes (the "wings" of the spread).

A long butterfly spread is a debit spread, and involves selling the ”body” and purchasing the “wings,” and can be implemented using either all call options or all put options.

A long butterfly produces its maximum profit when the underlying expires right at the middle strike price. Maximum loss (which is limited) occurs when the underlying closes at either the lower or higher strike prices.

FAQ

What is a long call butterfly spread option strategy?

A long butterfly spread is an advanced options strategy that is used when an investor or trader expects little to no volatility in the price of the underlying security. Alternatively, a short butterfly spread can be used when an investor or trader expects a high degree of volatility.

A butterfly spread is constructed using three different strikes within the same underlying and expiration month. The key with a butterfly is that twice the amount of contracts are traded on the middle strike (the "body" of the spread) as compared to the outer strikes (the "wings" of the spread).

A long butterfly spread is a debit spread, and involves selling the ”body” and purchasing the “wings,” and can be implemented using either all call options or all put options.

A long butterfly produces its maximum profit when the underlying expires right at the middle strike price. Maximum loss (which is limited) occurs when the underlying closes at either the lower or higher strike prices.

How do I close a long call butterfly spread?

To close a long call butterfly spread before expiration, you simply execute the reverse transactions you executed to open the spread. Remember, a long call butterfly spread involves buying one lower strike call, selling two middle strike calls, and buying one higher strike call.

Here's how to close a long butterfly spread:

Sell the lower strike call. This is the in-the-money option you initially bought.

Buy back the two middle strike calls. ou initially sold these, so now you'll buy them back to close out the position.

Sell the higher strike call. This is the out-of-the-money option you initially bought.

For each strike listed above you’ll execute the same number of contracts that were deployed in the original spread.

What is the OTM butterfly spread?

An OTM (out-of-the-money) butterfly spread is a variation of the standard butterfly spread where all the option legs are out-of-the-money at the time the position is initiated.

Like a regular butterfly spread, an OTM butterfly spread involves three strike prices, but in this case, even the lowest strike (in a call butterfly) or the highest strike (in a put butterfly) is out-of-the-money.

The OTM butterfly spread is a more speculative strategy compared to the standard butterfly, as it requires a more significant move in the underlying to reach its maximum potential profit.

Episodes on Long Butterfly Spread

No episodes available at this time. Check back later!

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices