Filter

Contents

Straddle Options Strategy Explained: Example & How to Use it

Contents

What is a straddle?

In the options world, a straddle is an options strategy that involves simultaneously purchasing or selling both a call option and a put option with the same strike price and expiration date for a particular underlying asset. If the call and put are both purchased, the associated trade structure is called a “long straddle.” But if the call and put are both sold, the associated trade structure is called a “short straddle.”

A long straddle is typically favored when implied volatility is low and the investor expects a substantial move in the price of the underlying asset. In this scenario, the cost of purchasing both the call and put options may be relatively lower, making it more attractive to initiate a straddle position. If the price of the underlying asset experiences a significant movement beyond the breakeven points, the long straddle holder stands to profit from the increased volatility. Long straddles are often deployed ahead of events such as earnings announcements, regulatory decisions, or major economic reports, where significant price swings are anticipated.

On the other hand, a short straddle is preferred when implied volatility is elevated, and the investor expects the price of the underlying asset to remain relatively stable or trade within a narrow range until the options expire. In this case, the seller of the straddle receives premium income from both the call and put options. If the price of the underlying asset remains within the range around the strike price until expiration, the short straddle seller keeps the premiums received as profit. Short straddles are commonly used in sideways or range-bound markets, where implied volatility is inflated due to uncertainty but the investor believes that the asset's price will not experience significant movements.

Determining the appropriate straddle strategy involves the assessment of market conditions, volatility levels, and the investor's outlook for the underlying asset. Long straddles capitalize on expected volatility expansions, while short straddles aim to profit from implied volatility contractions. Both strategies offer distinct risk-return profiles, and investors should carefully consider their risk tolerance and market expectations before implementing a straddle position.

How does a straddle work?

When a trader initiates a long straddle position, they are essentially combining two separate options positions: one that benefits from price increases (the call option) and another that benefits from price decreases (the put option). By purchasing both options, the trader is hedging their bets, because the position benefits if the underlying asset makes a significant move in either direction beyond the breakeven points. However, if the price movement in the underlying is not substantial enough to surpass the breakeven points, the trader may incur losses.

The short straddle is effectively the direct opposite of the long straddle strategy, offering traders a different approach to capitalize on depressed market volatility or sideways movement in the underlying. With a short straddle, the trader sells both a call option and a put option with the same strike price and expiration date. This strategy is preferred when the trader expects the underlying asset to remain relatively stable or trade within a narrow range until expiration. Unlike the long straddle, where the trader profits from significant price movements, the short straddle thrives in low-volatility environments.

How to create a straddle?

The key details associated with long and short straddles are highlighted below.

Long Straddle

Overall Risk Profile: The long straddle strategy involves buying both a call option and a put option with the same strike price and expiration date for the same underlying asset. This strategy is initiated when the trader expects significant price volatility in the underlying asset but is unsure about the direction of the price movement.

Maximum Profit: The maximum profit potential for a long straddle is theoretically unlimited. Profits increase as the price of the underlying asset moves substantially in either direction beyond the breakeven points, which are determined by adding or subtracting the combined premium paid for both options from the strike price.

Maximum Loss: The maximum loss for a long straddle is limited to the total premium paid for both the call and put options. This occurs if the price of the underlying asset remains relatively stable and fails to move significantly in either direction.

Optimal Outcome: The ideal scenario for a long straddle is when the underlying asset experiences a significant gap move in either direction, and pushes the underlying well beyond the associated breakeven points of the position.

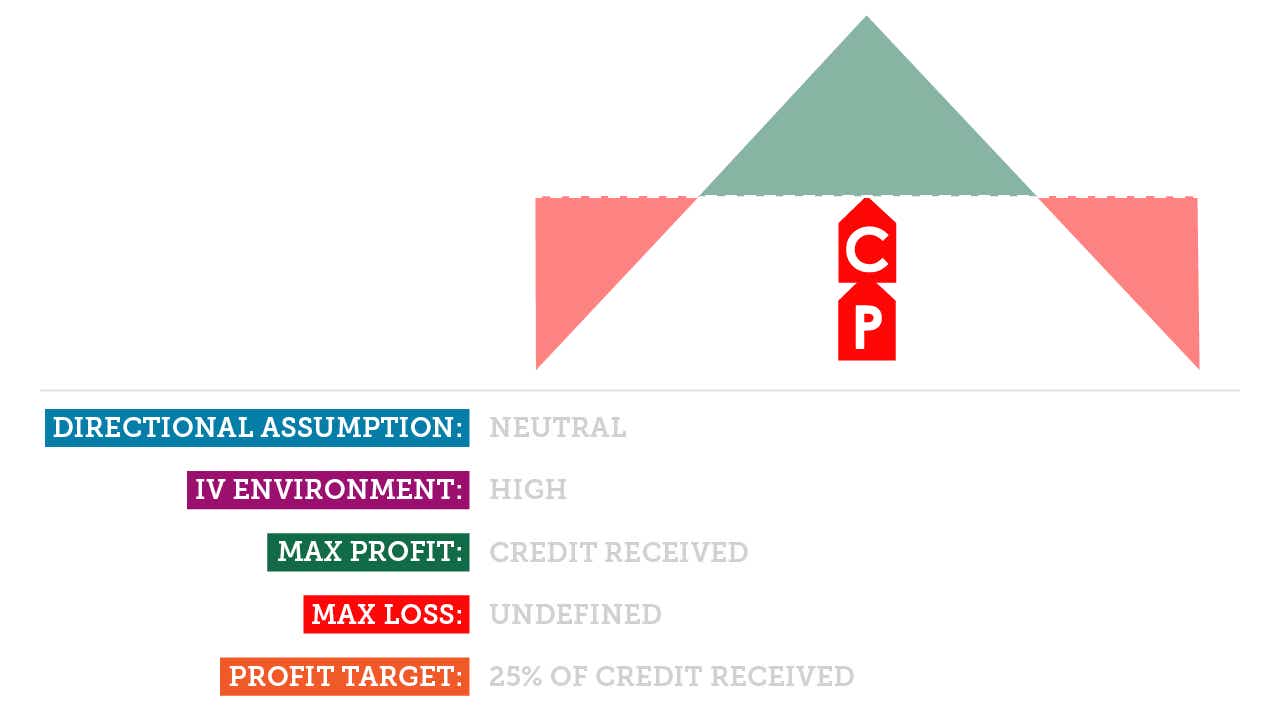

Short Straddle

Overall Risk Profile: The short straddle strategy involves selling both a call option and a put option with the same strike price and expiration date for the same underlying asset. This strategy is employed when the trader expects the price of the underlying asset to remain relatively stable or trade within a narrow range until expiration.

Maximum Profit: The maximum profit potential for a short straddle is limited to the premiums received from selling both options. Profits are realized if the price of the underlying asset remains within a specific price range around the strike price through expiration, allowing both options to expire worthless.

Maximum Loss: The maximum loss for a short straddle is theoretically unlimited. This occurs if the price of the underlying asset moves significantly beyond the breakeven points, resulting in potential losses for the seller, as they are obligated to buy or sell the asset (due to options assignment ) at the agreed-upon strike price, regardless of the market price.

Optimal Outcome: The ideal scenario for a short straddle is when the underlying asset moves sideways or stays within a narrow range around the strike price until expiration. This strategy thrives in low-volatility environments, where time decay erodes the value of both options, allowing the seller to profit from the premiums received.

When to use a straddle

The optimal trading conditions for a long straddle involve high volatility and uncertainty about the direction of the price movement, while the optimal conditions for a short straddle involve low volatility and expectations of stable or range-bound market conditions. Understanding these conditions and employing the appropriate straddle strategy can help traders maximize their profit potential in different market environments.

More details on the optimal trading conditions for long and short straddles are outlined below.

Long Straddle

Optimal Trading Conditions: The long straddle strategy is most effective in highly volatile markets or when significant price movement is expected, but the direction of the movement is uncertain. This strategy is ideal when implied volatility is low, as it allows traders to capitalize on potential volatility expansions.

Maximum Profit Scenario: The maximum profit for a long straddle occurs if the price of the underlying asset makes a substantial move in either direction beyond the breakeven points. The highest profit potential is therefore achieved when the market experiences significant volatility, resulting in a dramatic increase in the value of the call or put position.

Short Straddle

Optimal Trading Conditions: The short straddle strategy thrives in low-volatility environments or when the trader expects the underlying asset to remain relatively stable or trade within a narrow range until expiration. This strategy benefits from time decay and works best when implied volatility is high, as it allows traders to profit from the erosion of elevated options premium over time.

Maximum Profit Scenario: The maximum profit for a short straddle occurs if the price of the underlying asset remains within a specific price range around the strike price until expiration. In order to profit from a short straddle, the underlying price needs to remain within the breakeven points. In the optimal scenario, both the call and put options expire worthless, allowing the seller to keep all of the premium received from the sale of the options.

Straddle strategy example

Hypothetical examples of long and short straddles are outlined below.

Long Straddle Example

Imagine that a trader believes hypothetical stock XYZ, currently trading at $100/share, is about to experience significant volatility due to an upcoming earnings announcement. The trader decides to implement a long straddle strategy, as outlined below:

The trader purchases one call option with a strike price of $100 for $5 and one put option with the same strike price of $100 for $5, spending a total of $10 on premiums. The breakeven points are calculated by adding together the total premium spent. In this case, that would be $10. That means that the underlying stock needs to climb above $110/share, or drop below $90/share, for this long straddle to turn a profit.

If the stock makes a big move, say it jumps to $120, the call option will be "in the money," allowing the trader to profit from the upward movement. Similarly, if the stock plunges to $80, the put option will be "in the money," allowing the trader to profit from the downward movement.

The preferred outcome for the long straddle is a significant price movement in either direction beyond the breakeven points (in this case $110 and $90)). The maximum profit potential is theoretically unlimited, because there’s theoretically no cap on the upside potential of the stock. On the other hand, if the underlying trades in sideways fashion, the position will likely produce a loss, due to the loss of premium paid for the two long options.

Short Straddle Example

Imagine that a trader expects hypothetical stock ABC, currently trading at $50/share, to trade in range-bound fashion over the next month. The trader decides to implement a short straddle strategy, as outlined below:

The trader sells one call option with a strike price of $50 for $3 and one put option with the same strike price of $50 for $3, receiving a total of $6 in options premium. The breakeven points are calculated by adding together the total premium received. In this case, that would be $6. That means that the underlying stock needs remain between $44 and $56 per share for this short straddle to turn a profit.

Ideally, both options will expire worthless, allowing the trader to keep the entire premium received from the sale of the options.

The preferred outcome for the short straddle is for the stock price to remain stable within the breakeven points (in this case, above $44 and below $56). The maximum profit potential is limited to the premiums received, as the trader profits from time decay and the erosion of option premiums. However, if the stock moves significantly beyond the breakeven points, the position will produce a loss.

Straddle strategy max profit and loss

The maximum profit for a long straddle is unlimited, while the maximum profit for a short straddle is limited to the premiums received. Conversely, the maximum loss for a long straddle is limited to the total premium paid, while the maximum loss for a short straddle is theoretically unlimited. Traders should carefully consider these risk factors when implementing straddle strategies and employ proper risk management techniques to mitigate potential losses.

More details on the maximum profit and loss of long and short straddles are outlined below.

Long Straddle Max Profit and Loss

Maximum Profit: The maximum profit for a long straddle is theoretically unlimited. This occurs if the price of the underlying asset makes a significant move in either direction, moving well beyond the breakeven points. The further the price moves beyond the breakeven points, the higher the profit potential for the position.

Maximum Loss: The maximum loss for a long straddle is limited to the total premium paid for both the call and put options. This occurs if the price of the underlying asset remains relatively stable and fails to move significantly in either direction. If the price movement is not substantial enough to surpass the breakeven points, the trader will incur losses.

Short Straddle Max Profit and Loss

Maximum Profit: The maximum profit for a short straddle is limited to the premiums received for selling both the call and put options. This occurs if the price of the underlying asset remains within a specific price range around the strike price until expiration. In the optimal scenario, both the call and put options expire worthless, allowing the seller to keep all of the premium received from the sale of the options.

Maximum Loss: The maximum loss for a short straddle is theoretically unlimited. This occurs if the price of the underlying asset moves significantly beyond the breakeven points, resulting in losses for the straddle seller. As the price moves further away from the strike price, the losses for the short straddle increase, potentially leading to significant losses if the price movement is substantial.

Straddle Options Strategy: tastylive Approach

With straddles, it is important to remember that we are working with truly undefined risk in selling a naked call. We focus on probabilities at trade entry, and make sure to keep our risk / reward relationship at a reasonable level.

Implied volatility (IV) plays a huge role in our strike selection with straddles. The higher the IV, the more credit we will receive from selling the options. A higher credit ultimately means we will have wider breakeven points, since we can use the credit to offset losses we may see to the upside or downside. At the end of the day, a larger relative credit results in a higher probability of success with this strategy.

Our target timeframe for selling straddles is around 45 days to expiration. Our studies show this is a great balance between shorter and longer timeframes.

Straddle options strategy pros and cons

Long and short straddles are unique because they offer vastly different risk profiles as compared to a traditional long or short stock position.

Some of the main pros and cons of the straddle trading strategy are highlighted below:

Pros

Flexibility: Straddles offer traders flexibility because they can be utilized in vastly different market conditions, including volatility expansions, volatility contractions, or even sideways movement. That means they offer added versatility and can be utilized to express unique market outlooks and volatility expectations.

Hedging: Straddles can also serve as effective hedging tools for traders that may be uncertain about market direction but are expecting increased volatility. By purchasing both call and put options, traders can hedge against potential losses while still capitalizing on price movements. Long straddles profit from significant price movements in either direction, while short straddles profit from stable or range-bound market conditions.

Risk Management: Long straddles allow traders to define their maximum risk upfront, as the maximum loss is limited to the total premium paid for both the call and put options. This helps traders manage their risk exposure effectively. However, it's important to note that short straddles have unlimited risk potential, as the trader may face significant losses if the price of the underlying asset moves significantly beyond the breakeven points.

Cons

Costly: Long straddles can be expensive to implement due to the need to purchase both a call and a put option. Additionally, if the anticipated price movement doesn't materialize or is insufficient to overcome the premiums paid, the position will likely incur losses.

Time Decay: Both long and short straddles are susceptible to time decay, which erodes the value of the options as expiration approaches. While time decay can work against long straddles by reducing the value of both the call and put options, it can actually work to the benefit of short straddles. Short straddles profit from time decay as the options they sold lose value over time, contributing to the maximum profit potential of the strategy. However, traders should still be cautious, as time decay may not fully offset potential losses if the underlying asset moves significantly beyond the breakeven points.

Limited Profit Potential: Short straddles involve the sale of both a call and put option, exposing the trader to unlimited risk if the price of the underlying asset moves significantly beyond the breakeven points. While short straddles offer limited profit potential, the risk of incurring significant losses can be high, especially relative to the potential profit from the premiums received. Therefore, traders should carefully assess the risk-reward profile and employ proper risk management techniques when implementing short straddle strategies. And for long straddles, the underlying usually needs to make a significant gap move, which means they typically offer low probability of profits (POP).

Can you lose money on a straddle strategy?

The straddle trading approach can indeed result in losses depending on market conditions and the specific type of straddle used.

A long straddle, which involves purchasing both a call and put option with the same strike price and expiration date, typically faces losses if the anticipated volatility doesn't materialize or if the price movement of the underlying asset is not substantial enough to overcome the combined premiums paid for both options. Additionally, time decay can erode the value of long straddles as expiration approaches, leading to losses if the price movement doesn't occur within the expected timeframe.

On the other hand, short straddles, which involve selling both a call and put option, are susceptible to losses if the price of the underlying asset moves significantly beyond the breakeven points. The seller of a short straddle is exposed to unlimited risk if the price movement is substantial, potentially resulting in significant losses. Furthermore, high volatility environments can amplify the potential for losses in short straddles, as sharp fluctuations in the underlying asset's price can lead to losses, particularly if the price moves beyond the breakeven points.

Overall, traders should carefully assess market conditions, volatility levels, and risk factors before employing straddle strategies and implement proper risk management techniques to mitigate potential losses.

Straddle key takeaways

The straddle strategy in options involves simultaneously buying (long straddle) or selling (short straddle) both a call and put option with the same strike price and expiration date. The long straddle is employed when traders anticipate increased volatility but are uncertain about the direction of the price movement, while the short straddle is utilized in stable or range-bound market conditions.

Long straddles offer unlimited profit potential if the price of the underlying asset makes a significant move in either direction beyond the breakeven points. However, they can incur losses if the anticipated volatility doesn't materialize or if the price movement is not substantial enough to overcome the combined premiums paid for both options. Additionally, time decay can erode the value of long straddles as expiration approaches, leading to losses if the price movement doesn't occur within the expected timeframe.

Short straddles, on the other hand, have limited profit potential but come with unlimited risk if the price of the underlying asset moves significantly beyond the breakeven points. Traders may face significant losses if the price experiences sharp fluctuations, especially in high-volatility environments. Despite the potential for losses, both long and short straddles offer traders flexibility in profiting from different market conditions and can be effective hedging tools for managing risk exposure.

Determining the appropriate straddle strategy involves the assessment of market conditions, volatility levels, and the investor's outlook for the underlying asset. Long straddles capitalize on expected volatility expansions, while short straddles aim to profit from implied volatility contractions. Both strategies offer distinct risk-return profiles, and investors should carefully consider their risk tolerance and market expectations before implementing a straddle position.

Ultimately, the straddle trading strategy allows traders to capitalize on a wide range of market outlooks and volatility expectations. However, it's essential for traders to carefully assess market conditions, volatility levels, and risk factors before employing straddle strategies and implement proper risk management techniques to mitigate potential losses.

Supplemental Content

EPISODES ON STRADDLE

No episodes available at this time. Check back later!

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices