Filter

Contents

Diagonal Spread Definition

Contents

What is a diagonal spread?

A diagonal spread is an options trading strategy that combines the vertical nature of different strike selections in a vertical spread, with the horizontal nature of different contract durations in a calendar spread.

Diagonal spreads are typically set up like vertical debit spreads, where the long option has a longer duration than the short option. This strategy is typically used to take directional assumptions on products in a defined risk way, while still reducing cost basis aggressively by selling a near-term option against the asset in the trade - the further-dated long option.

Long Put Diagonal Spread Profit/Loss Chart | Long Call Diagonal Spread Profit/Loss Chart |

Diagonal spread strategy: how it works

Diagonal spreads are like vertical spreads in the sense that you want them to move in-the-money (ITM). A long diagonal spread is nothing more than a vertical spread with a longer-term long option. With this in mind, max profit can be more than the width of the diagonal spread, since the short option will expire prior to the long option.

The long option will hold extrinsic value as the short option expires, which is how we think of the trade - like a vertical spread with a potential extrinsic value boost in the long option.

If a long diagonal spread is showing a loss, that means the spread is moving out-of-the-money (OTM) and both the long and short options are losing value. Since there is a time difference between the long and short option, there are plenty of defensive tactics we can deploy to continue to hedge and reduce the cost of the long option that remains. This may involve rolling the short option out in time closer to the long option’s expiration, rolling the short option closer to the long option vertically in the same expiration, or a combination of both.

Diagonal spread types

Diagonal debit spreads can be placed in a bullish or bearish manner using calls or puts.

- For a bullish diagonal spread, calls would be used since we’d want the stock to rise in price and for the spread to move ITM and become more valuable.

- For a bearish diagonal spread, puts would be used since we’d want the stock to drop in price and for the spread to move ITM and become more valuable.

Let’s break down the differences more clearly below.

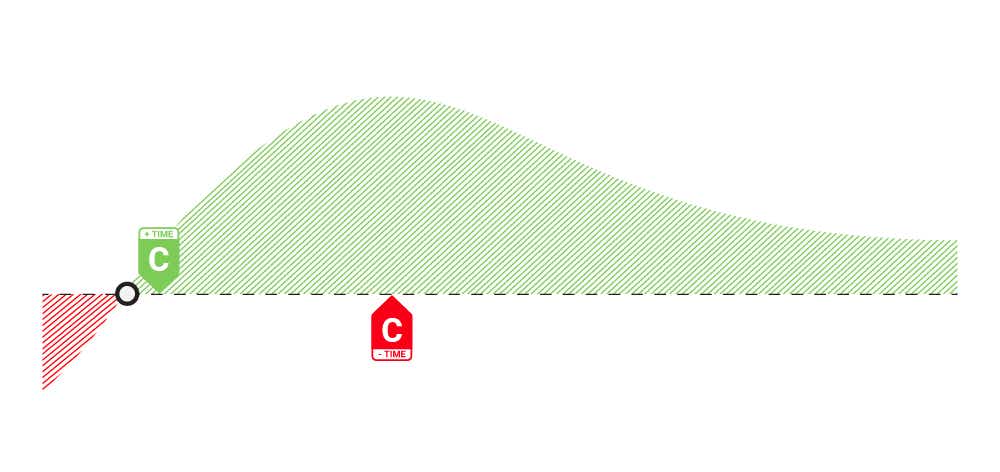

Long Call Diagonal Spread: OVERVIEW AND SETUP

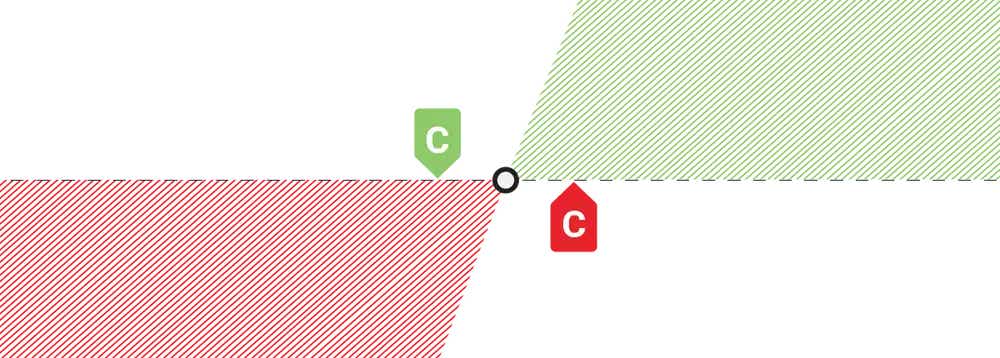

A long call diagonal spread is a bullish, defined risk strategy that involves buying an ATM or ITM call and selling a further OTM call against it with a more near-term expiration cycle to reduce the cost basis on the long call option.

If the spread moves ITM on a stock price rally by the expiration of the short call option, the value of the spread will appreciate to the full intrinsic value of the width of the spread, plus any remaining extrinsic value in the further-dated long option.

Since this is a calendarized vertical spread, we don’t want to pay more than the width of the spread in total debit. This ensures that we are still profitable on a big rally where our spread moves deep ITM and trades for close to intrinsic value.

In the example above, the call diagonal spread is 20 points wide, and the total entry cost for the trade is $18.30. The long option with 50dte is trading for $21, and the short option that expires in one day is trading for $1.97 and is made up of purely extrinsic value. In one day, all of that value will decay to $0.

As you can see in the theoretical risk graph, the best-case scenario here is that the stock price climbs to 310 or above by the following day.

If this happens, the spread will trade for $20 of intrinsic value, plus any remaining extrinsic value in the long 290 call. The profit trails off if the stock climbs too high, because the spread will still trade for $20 of intrinsic value but the long option will start to lose extrinsic value as it slides deeper ITM.

This spread will realize losses if the stock goes down significantly, and at that time the trader would have to decide whether to close the trade for a loss, or defend the long option that still has over a month before it expires.

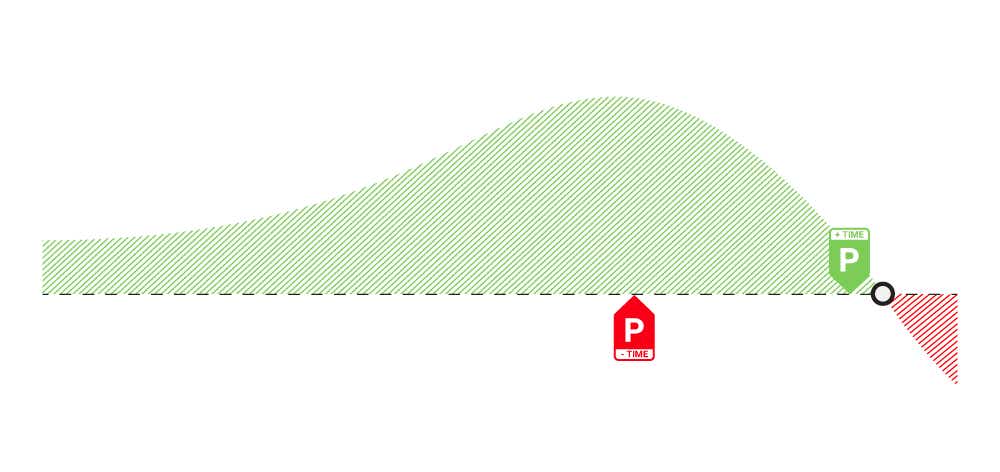

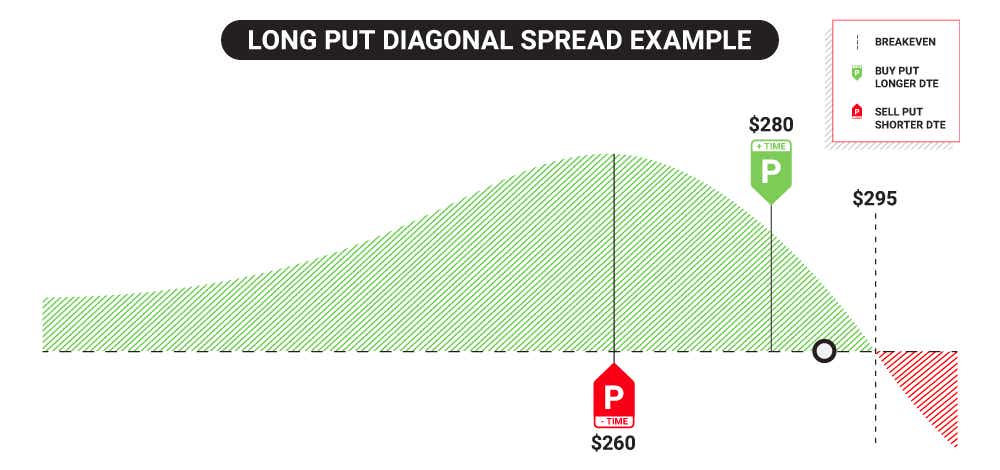

Long Put Diagonal Spread: OVERVIEW AND SETUP

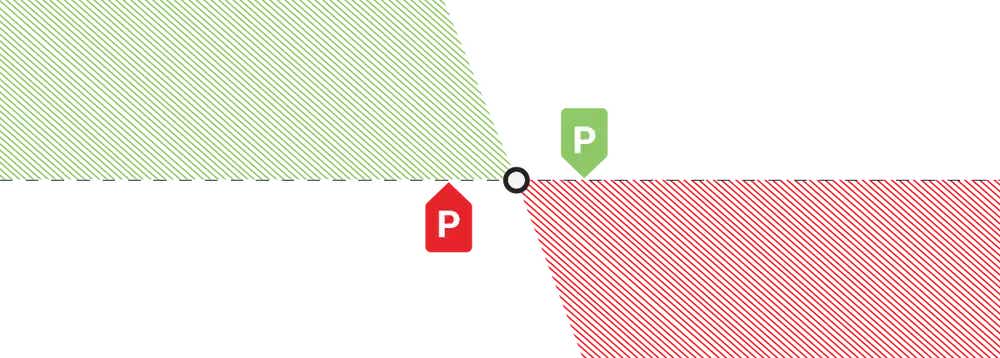

A long put diagonal spread is a bearish, defined risk strategy that involves buying an ATM or ITM further-dated put and selling an OTM near-term put against it to reduce the cost basis on the long put option.

If the put diagonal spread moves ITM on a stock price selloff by the expiration of the short put option, the spread will trade for the intrinsic value difference between the long and short option, plus any remaining extrinsic value in the long option.

In the example above, the asset in the trade is the 280 strike long put with 50 days to expiration, trading for $19.35. The sale of the 260 short put with one day to expiration reduces the cost basis on the long put by $2.10, and that extrinsic value goes away in one day.

The best case scenario for this spread is for the stock to retreat towards or below 260, in which case the spread will trade for the intrinsic value of $20, plus any remaining extrinsic value in the long put.

If the stock rallies, the risk in this trade is the debit paid up front if the long option with 50dte expires worthless. Along the way, traders can continue to reduce the cost basis of the long option by rolling the short option forward in time.

Diagonal Spreads for Trading Earnings

Diagonal spreads can be effective earnings trades if you are directionally correct, and they limit losses if you’re directionally wrong as they’re defined risk debit trades.

Before trading a diagonal spread for an earnings announcement, it is important to be comfortable with volatile profit or loss numbers that naturally occur around earnings announcements and big stock price moves.

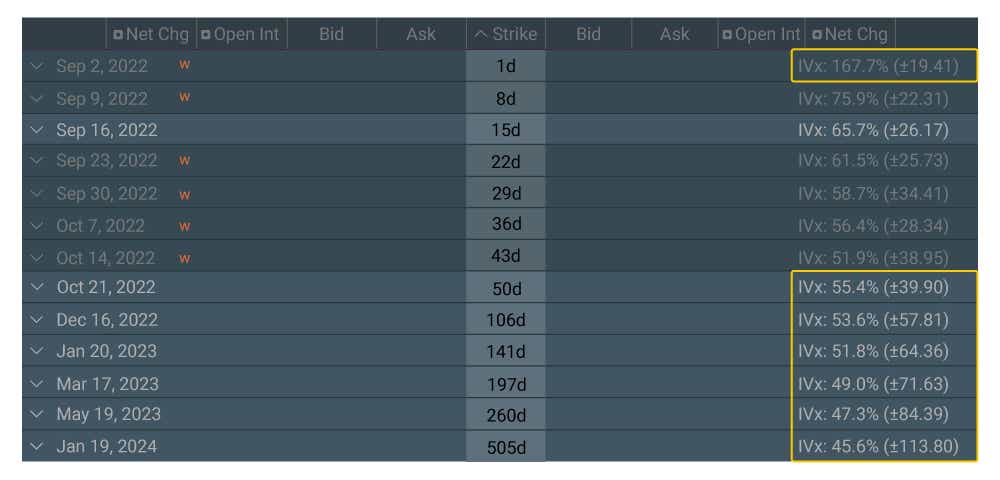

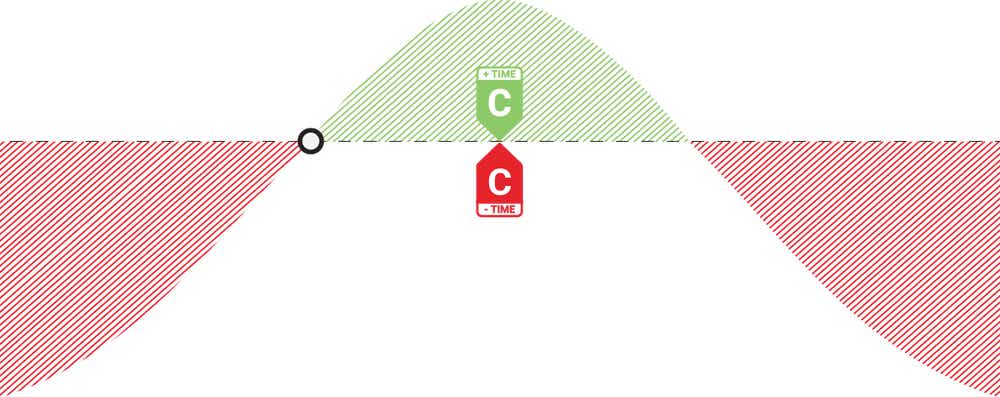

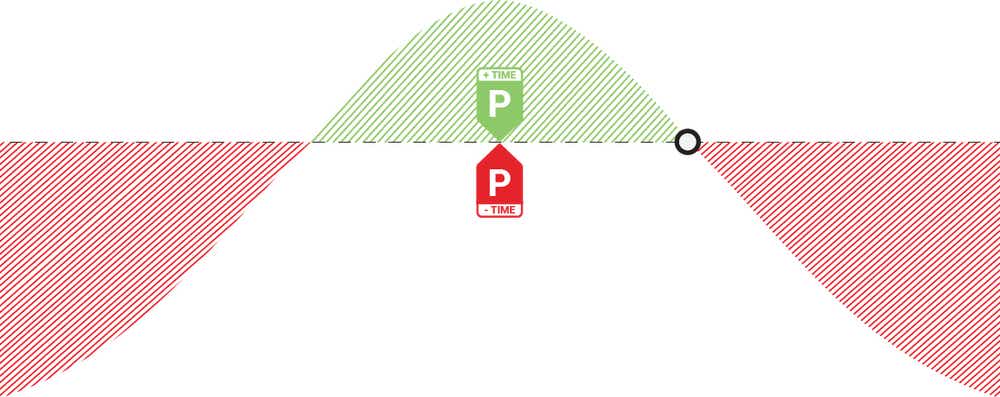

The idea behind a diagonal spread for an earnings call is to capture the inflated implied volatility (top yellow rectangle) with the sale of a near-term short option in the earnings expiration cycle, while establishing a directional delta (long put or long call) in a longer-term expiration cycle (bottom yellow rectangle) that has a much lower exposure to the earnings call implied volatility crush.

In the image above, you can see that the IV% numbers are very inflated with near-term expirations, as almost all of the extrinsic value in these cycles is attached to the earnings announcement itself. Longer-term cycles will hold onto extrinsic value as they still have plenty of time before they expire, and more implied volatility because of this.

To recap trading diagonal spreads for earnings, the strategy can be more stable on a small stock price move if the long option is placed in a cycle that has a baseline IV% that is similar to other long-term expiration cycles. If the weekly cycle has inflated IV%, the expected move will be inflated relative to the time-adjusted expected move in the back month.

In the example above, the expected move for the October cycle with 50dte is +-39.90, where the September 2nd cycle with 1dte expected move is +-19.41. That is a massive chunk of the 50dte expiration cycle, and that is why the premium in the 1dte cycle is so inflated relative to the October cycle.

Diagonal Spread Profit and Loss

Diagonal debit spreads are defined risk directional trades where profit potential depends on the directional movement of the stock price. Since the most we can lose is the debit paid up front, the monetary risk is controlled by the entry price. Let’s dig in deeper below.

Profit Potential

Diagonal spread profit potential relies on the assumption that the spread moves completely ITM, so that the spread appreciates to the full intrinsic value possible. This can be calculated by taking the distance between the long and short option, as a diagonal spread is just a vertical spread where the options have different expiration cycles.

With this in mind, the long option has more time to expiration, so the profit “kicker” can be attributed to the remaining extrinsic value in the long option if you analyze from the short options expiration date.

The max value on an ITM diagonal spread in this case would simply be the distance between the long and short strike, plus any remaining extrinsic value in the long option.

Profit potential can be calculated by taking the max spread value estimate, and subtracting the debit paid up front from that value. This is why it is important to keep the debit cost on trade entry under the spread width. For example, on a $20 wide diagonal spread, we would want the total debit to be under $20.

Loss Potential

Long put and call diagonal spreads are defined risk in nature, where the max loss potential is the debit paid up front if the long option expires worthless. Losses prior to expiration can be seen if the stock moves in the wrong direction and the spread moves further OTM, where both options lose extrinsic value.

The short option in a diagonal spread works to hedge against the cost of the long option, and also against unfavorable moves, but the short option is only worth a fraction of the long option, so the hedge is only temporary.

If the short option has lost most of its value or has expired, another short option can be sold against the long to continue reducing cost basis. Just be mindful of the width of the spread, and to ensure that the net debit still does not exceed the width of the spread if the short strike is moved closer to the long strike.

The spread can be sold to close prior to expiration for less than max loss if the trader’s assumption has changed, or they do not believe the spread will move back ITM prior to the expiration of the long option.

tastylive Approach

The setup of a diagonal spread is very important. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. Once we figure that value, we ensure that the near term option we sell is equal to or greater than that amount. The deeper ITM our long option is, the easier this setup is to obtain. We also ensure that the total debit paid is not more than 75% of the width of the strikes.

We never route diagonal spreads in volatility instruments. Each expiration acts as its own underlying, so our max loss is not defined.

CLOSE / MANAGE

WHEN TO CLOSE

We generally look for 25-50% of max profit when closing diagonal spreads. Profit occurs when the long option moves further ITM and gains value, and/or if implied volatility increases.

WHEN TO MANAGE

We manage diagonal spreads when the stock price moves against our spread. In this case, we look to roll down the short option closer to the breakeven price, so that we can collect more premium and reduce our overall risk.

Diagonal Spread vs Vertical Spread: What’s the difference?

Diagonal spreads and vertical spreads share a similar characteristic in the sense that they both have a long and short option on different strikes.

A vertical spread’s long and short options share the same expiration, whereas a diagonal spread’s long and short options are in different expirations.

Long Call Vertical Profit/Loss Chart | Long Put Vertical Spread Profit/Loss Chart |

Typically, the long option has more time to expiration than the short option. This results in a more costly trade upfront, but much more time for the trade to work out before the long option expires.

Diagonal Spread vs Calendar Spread: What’s the difference?

Diagonal spreads and calendar spreads share a similar characteristic in the sense that they both have long and short strikes in different expirations.

A calendar spread’s long and short strikes share the same strike price, which makes it a cheaper trade on entry compared to a diagonal spread.

Call Calendar Spread Profit/Loss Chart | Put Calendar Spread Profit/Loss Chart |

A diagonal spread’s long and short strikes are on different strikes, and typically mimic a setup of a traditional vertical debit spread. Calendar spreads are much more about theta decay and IV changes, whereas a diagonal spread has a directional nature to it.

FAQs

What is a diagonal spread example?

Suppose a trader is bullish on XYZ’s stock price at $100 over the next few months, so they buy a $95 strike call in November (NOV) for $12, and sell a $105 strike call in October (OCT) for $5. This is a 10-point wide diagonal spread that has a net debit entry cost of $7.

The max loss on this trade is simply the debit paid of $7 or $700 real dollars, and that is realized if the stock falls below $95 by the NOV expiration date.

The max intrinsic value on this trade is $10, and that is realized if the stock climbs above $105.

At the expiration of the short OCT option, if the stock is above $105, the spread will be worth $10 of intrinsic value, plus any remaining extrinsic value that exists in the long 95 strike call that still has time left to expiration, as it is in the NOV cycle.

The max loss on this trade is $7, which is the debit paid up front, and the max profit on this trade is upwards of $3, depending on how much extrinsic value remains in the long option when the short option expires, if the spread is completely ITM.

If the stock doesn’t move, the trader can roll the short option further out in time, to collect more extrinsic value and reduce the initial cost basis of $7 to a lower amount, or close the trade altogether.

Is a diagonal spread profitable?

A diagonal spread trade can be profitable if the spread moves ITM, or appreciates in value, prior to the expiration of the long option. The long option is the asset in the trade that you want to appreciate, and the short option reduces the cost basis on the long option.

The trade reaches profit quickly if the spread moves ITM, and the short option is about to expire worthless, where you keep all the extrinsic value collected in the short option, and gain intrinsic value on the long option you own.

How does a diagonal call spread work?

A diagonal call spread is a vertical debit spread that is blended with a calendar spread, where the long option is placed in a longer-term expiration than the short option.

The goal is for the spread to move completely ITM on a stock price rally so that the spread appreciates to full intrinsic value. Any remaining profit potential above that lies in the remaining extrinsic value of the long option at the expiration of the short option.

Since this is a debit spread trade, the max loss is simply the debit paid upfront to enter the trade, and this is realized if the long option expires OTM.

How do you manage a diagonal spread?

Since the short option decays more quickly than the long option purchased further out in time, management or defense lies in the short option.

Typically, if the trade is not working favorably, the short option can be rolled out in time to collect more extrinsic value and reduce cost basis further on the long option.

The same strike can be used, or the strike can be moved closer to the long option’s strike to create more of a calendar spread feel going forward.

How do you close a diagonal spread?

To close a diagonal spread, you route the opposite order for each strike you hold.

For example, if you own a call diagonal spread, where you’re long the 150 strike October (OCT) call in XYZ, and you’re short the 160 strike September (SEP) call, closing the trade would mean selling the 150 OCT call strike you own, and buying back the SEP call strike you’re short.

This will “flatten” the risk in the position and it will disappear from your account.

Are diagonal spreads better than credit spreads?

Diagonal spreads can have a higher max profit than a credit spread due to the intrinsic value potential a diagonal spread can gain on a beneficial stock price move.

Still, diagonal spreads are very directional trades. OTM credit spreads can reach 100% max profit even if the stock goes against you a bit, whereas a diagonal spread must be completely ITM to realize max profit.

Neither is better or worse, they are just different setups when it comes to risk-reward analysis. Diagonal spreads are more delta-driven trades, whereas OTM credit spreads have a lot more space to be successful.

SUPPLEMENTAL CONTENT

Episodes on Diagonal Spread

No episodes available at this time. Check back later!

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices