Filter

What is the SPDR S&P 500 (SPY) ETF and How Does it Work?

What is the SPDR S&P 500 (SPY) ETF?

The SPDR S&P 500 (SPY) is an Exchange Traded Fund (ETF) that tracks the performance of one of the most popular US indices, the Standard & Poor's 500 (S&P 500).

Stock market indices represent a subset of the broader stock market, and are used to measure and track the performance of that specific subset.

The S&P 500 is widely regarded as the best gauge of overall performance in large-capitalized US equities, and is comprised of 500 American companies representing a wide range of diverse market sectors.

While indices themselves cannot be bought or sold, financial products that track their value are accessible to investors and traders. For example, the SPDR S&P 500 ETF Trust (SPY) is a widely utilized exchange-traded fund (ETF) that tracks the S&P 500.

First established in January of 1993, SPY was the first index ETF listed in the United States. Index ETFs are simply exchange-traded funds that seek to passively track the performance of a benchmark index.

In addition to SPY, some other well-known index ETFs include the SPDR Dow Jones Industrial Average ETF Trust (DIA), the Invesco QQQ Trust Series 1 (QQQ) and the iShares Russell 2000 ETF (IWM).

How does the SPY ETF work?

Index ETFs are exchange-traded funds that seek to passively track the performance of a benchmark index. The SPDR S&P 500 ETF Trust (SPY) is a widely utilized exchange-traded fund (ETF) that tracks the S&P 500.

ETFs are a type of pooled investment security that operate much like a mutual fund. They are designed to track an index, a sector, a commodity, or a group of assets. For example, the aforementioned SPY is an index ETF.

ETF shares trade like single stocks on exchanges, and can be bought or sold throughout the trading day at fluctuating prices.

Accordingly, if one were to buy the SPY, that would effectively be taking a long position in the S&P 500, whereas selling SPY would effectively be taking a short position in the S&P 500.

Like many single stocks, index ETFs such as SPY also have associated options.

How to trade and invest in the SPY ETF

Due to their wide acceptance and deep liquidity, index ETFs like SPY are used by a wide variety of market participants, and they are utilized to deploy a wide range of strategies.

At a high level, the most common trading/investing approaches for index ETFs include the following:

- Speculation

- Hedging

- Day Trading

- Options/Volatility

Speculation in an index ETF like SPY isn't much different than any other major asset. Bulls purchase index ETFs such as SPY when they think stock prices are set to increase. Alternatively, an investor/trader that is bearish on stock prices might decide to sell or short the SPY.

On the other hand, some market participants use index ETFs to hedge risk in their portfolios. For example, a trader holding a significant short gamma or short vega position might decide to deploy a short position in SPY to protect the portfolio in the event of an unexpected market correction.

Investors and traders also use index ETFs like SPY to deploy a wide range of day trading strategies, such as scalping, news trading, trend trading, mean reversion and money flows.

Because SPY has listed options, that means the full spectrum of options trading strategies is also available to investors and traders in this ETF. For example, speculating on direction using naked calls/puts, or leveraging a volatility-focused approach such as a calendar spread.

What are the SPY ETF’s top 10 holdings?

As mentioned earlier, the SPY ETF aims to track the performance of the S&P 500 index which comprises of 500 large cap stocks in the US. The list is subject to change and every year around 20 to 25 stocks will leave the index and are replaced by other stocks.

As of March 2023 the top 10 holdings of the SPY ETF are:

| Name | Symbol | Weight |

|---|---|---|

Apple Inc. | AAPL | 7.16% |

Microsoft Corporation | MSFT | 6.26% |

Amazon.com Inc. | AMZN | 2.67% |

NVIDIA Corporation | NVDA | 2.03% |

Alphabet Inc. Class A | GOOGL | 1.91% |

Alphabet Inc. Class C | GOOG | 1.67% |

Berkshire Hathaway Inc. Class B | BRK.B | 1.63% |

Tesla Inc. | TSLA | 1.57% |

Meta Platforms Inc. Class A | META | 1.38% |

UnitedHealth Group Incorporated | UNH | 1.33% |

Source: Yahoo Finance

What is the SPY average return?

The SPDR S&P 500 ETF Trust (SPY) is a widely utilized exchange-traded fund (ETF) that tracks the S&P 500. As such, the average return in SPY closely mirrors that of the S&P 500.

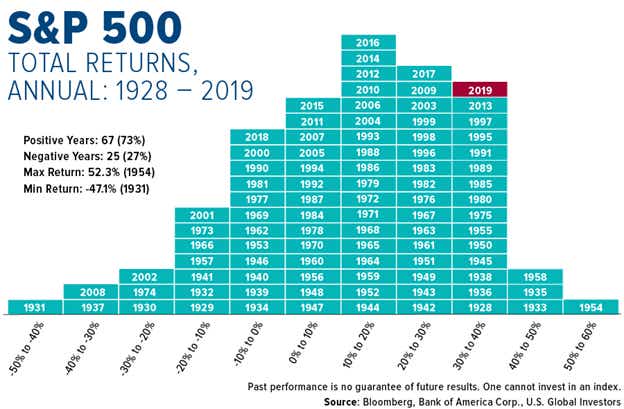

The S&P 500 assumed its current size and name in 1957, however, its origins as a composite index date back to the 1920s. The S&P 500 has been a composite index (tracking 90 stocks) since 1926.

Going back to the 1920s, the average annualized return in the S&P 500 is 9.80%. Since it was expanded to include 500 stocks in 1957, the average annualized return in the S&P 500 is closer to 10.10%.

That means the average annualized return in SPY is roughly 10%. Additional return details are highlighted below.

SPY ETF alternatives

Stock market indices represent a subset of the broader stock market, and are used to measure and track the performance of that specific subset.

In the United States, the most widely followed stock market indices are the Dow Jones Industrial Average, the S&P 500, the Nasdaq 100, and the Russell 3000.

While indices themselves cannot be bought or sold, financial products that track their value are accessible to investors and traders. For example, the SPDR S&P 500 ETF Trust (SPY) is a widely utilized exchange-traded fund (ETF) that tracks the S&P 500.

In addition to SPY, some other well-known index ETFs include the SPDR Dow Jones Industrial Average ETF Trust (DIA), the Invesco QQQ Trust Series 1 (QQQ) and the iShares Russell 2000 ETF (IWM).

Equity index futures are another avenue for traders and investors to access exposure to stock market indices. These products were first introduced in 1982.

In the United States, equity index futures are available on the S&P 500, the Nasdaq 100, the Dow Jones Industrial Average and the Russell 2000. Equity index futures are also available on foreign stock market indices (i.e. Germany, Japan, Hong Kong, United Kingdom, etc...).

FAQs

What does SPY ETF mean?

In the United States, the most widely followed stock market indices are the Dow Jones Industrial Average, the S&P 500, the Nasdaq 100, and the Russell 3000.

While indices themselves cannot be bought or sold, financial products that track their value are accessible to investors and traders. For example, the SPDR S&P 500 ETF Trust (SPY) is a widely utilized exchange-traded fund (ETF) that tracks the S&P 500.

Equity index futures are another avenue for traders and investors to access exposure to stock market indices.

In the United States, equity index futures are available on the S&P 500, the Nasdaq 100, the Dow Jones Industrial Average and the Russell 2000.

How does SPY ETF work?

Index ETFs are simply exchange-traded funds that seek to passively track the performance of a benchmark index. The SPDR S&P 500 ETF Trust (SPY) is a widely utilized exchange-traded fund (ETF) that tracks the S&P 500.

What does SPDR stand for?

SPDR is a trademark of Standard and Poor's Financial Services LLC. SPDR is an acronym for the first member of the Standard and Poor’s family, the Standard & Poor's Depositary Receipts. For example, the SPDR S&P 500 ETF Trust (SPY).

Is the SPY ETF safe?

Risk is fundamental to the investment and trading process, which means there’s associated risk when taking a position in SPY—whether it be long, short, or an options-focused position.

Going back to the 1920s, the average annualized return in the S&P 500 is 9.82%. Since it was expanded to include 500 stocks in 1957, the average annualized return in the S&P 500 is closer to 10.15%. That means the average annualized return in SPY is roughly 10%

The average annualized return doesn’t guarantee that investors in SPY will make a profit, it only reports the average return in this product since its inception. Historically, SPY has also marked years in which it posted a negative annual return.

Like any market investment, SPY fluctuates in value over time, which means investment risk is inherent in this product, like any other stock, ETF, or mutual fund.

What is the SPY ETF expense ratio?

As it relates to ETFs and mutual funds, the expense ratio represents the fees that holders pay for the management of the fund. This includes all administrative, marketing and management fees.

The expense ratio is typically presented as a percentage, and it is calculated by dividing the total operating expense by the total assets under management. To calculate how much one will pay in fees, one simply multiplies the expense ratio by the amount of money invested in the fund or ETF.

For example, if an investor purchased $10,000 worth of a fund that has an expense ratio of 1%, that means that $100 in fees ($10,000 x 0.01 = $100) will be deducted from the investment on an annual basis

In the case of SPY, the expense ratio is 0.0945%, meaning that roughly $9.45 in fees ($10,000 x 0.00945 = $9.45) would deducted from the total investment on an annual basis—assuming an original investment of $10,000.

Does the SPY ETF pay a dividend?

The SPDR S&P 500 ETF (SPY) pays a quarterly dividend—all dividends received from SPY holdings are held in a non interest bearing account until the time of payout. At the end of the fiscal quarter, when dividends are due to be paid, the SPDR S&P 500 ETF (SPY) pulls those dividends from the non-interest-bearing account and distributes them proportionally to the investors.

What is the dividend yield of SPY?

Dividend yield is the amount of money a company pays shareholders for owning a share of its stock divided by its current stock price.

The current dividend yield in SPY is approximately 1.60%.

That means if SPY was trading $400/share, the annual dividend would equate to roughly $6.52 ($400 x 0.0163 = $6.52).

The dividend yield is calculated by taking the total annual dividend and dividing it by the current share price of SPY.

The current trailing twelve months (TTM) dividend payout for SPY is $6.32 (as of March 2023). And with SPY currently trading at roughly $396/share, that means the current dividend yield is 1.60% ($396/$6.32 = 1.60%).

Is SPY ETF a good investment?

Risk is fundamental to the investment and trading process, which means there’s associated risk when taking a position in SPY—whether it be long, short, or an options-focused position.

Going back to the 1920s, the average annualized return in the S&P 500 is 9.82%. Since it was expanded to include 500 stocks in 1957, the average annualized return in the S&P 500 is closer to 10.15%. That means the average annualized return in SPY is roughly 10%.

The average annualized return doesn’t guarantee that investors in SPY will make a profit, it only reports the average return in this product since inception. Historically, SPY has also marked years in which it posted a negative annual return.

Like any market investment, SPY fluctuates in value over time, which means investment risk is inherent in this product, like any other stock, ETF, or mutual fund.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices