Filter

10 Options Strategies Every Trader Should Know

Top 10 Options Strategies For Traders

1. Long Call & Put Options

Long option buyers have the ability to speculate on the theoretical equivalent of 100 shares of stock without putting up nearly as much capital as buying 100 shares of stock outright. Long call buyers speculate on the stock price moving up swiftly, and long put buyers speculate on the stock price moving down swiftly. Let’s dig into each option type a bit deeper below.

A long call is considered to be the most basic options strategy. It’s a contract that gives the owner the right to buy an underlying asset, e.g. 100 shares of a stock, by a certain expiration date, at a predetermined price (called the strike price).

The expiration date and the strike price are two of the three main characteristics of an options contract. The third one is the premium: the amount the buyer pays the seller for the right to hold the theoretical equivalent of 100 shares of stock for a limited period of time. While the buyer has no obligation to exercise the right to actually buy the shares, the counterparty – i.e. the seller – has the obligation to provide 100 shares of stock to the call owner if the stock price is above the strike price at the expiration of the contract. (This is referred to as ‘assignment’).

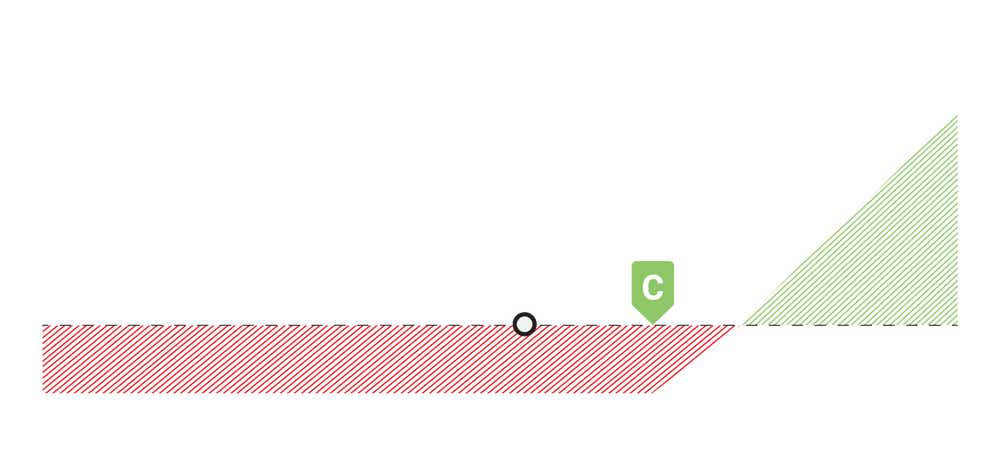

Buyers of long calls typically have a bullish market assumption, and profits are realized when the underlying’s market price is higher than the combined strike price and the premium paid at expiration.

Many traders utilize long call contracts as a speculative instrument and get in and out well before expiration, since long call options lose ALL of their value if they remain out-of-the-money (OTM) at expiration. Call contracts can increase in price on a bullish move in the stock price, even if the stock price never gets to the call strike price, assuming the trader closes the trade prior to expiration. The premium paid for a call option depends on how close to the stock price you are – the closer you are, the more the option will be worth. The further away you are OTM, the less the option will be worth.

Learn more about naked options

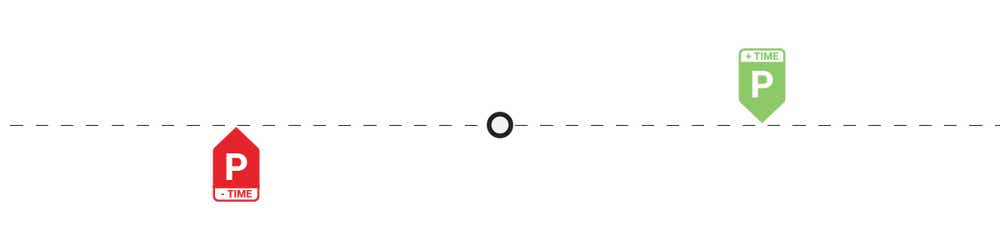

Long Call (OTM) Profit/Loss Chart

2. Short Call & Put Options

Short options are the exact opposite of their long option counterparts. Instead of betting on the movement of a stock price towards or past the strike price, short option sellers are betting against the movement of the stock price to or beyond the strike. Option sellers have a defined profit potential limited to the credit received up front for selling the option and have an undefined loss potential as they assume the risk of 100 shares of long/short stock beyond the strike price. Both put and call sellers are much more neutral directional trades, since both benefit from the stock moving away from the strike price, but they can also absorb a little movement towards the strike price, if the strike expires OTM. Let's dig into short calls and short puts a bit further below.

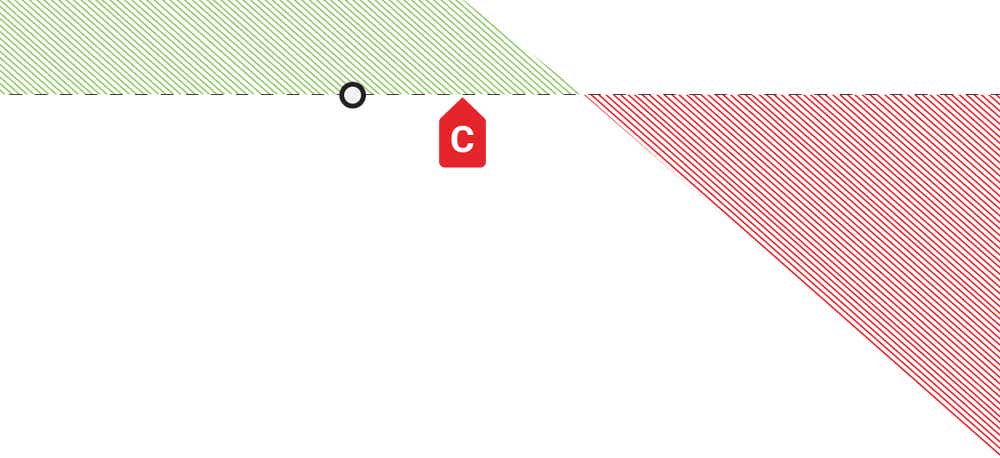

A short call is a neutral to bearish trade, that has a defined profit potential equivalent to the credit received up front, and unlimited risk since there is no cap to how high a stock price can go. Short option sellers are betting against the movement of the stock price rising above the short call by the expiration of their contract, but they can be profitable even if the stock stays the same or goes up a little bit. As long as the contract stays OTM, the call seller keeps the premium collected up front as profit.

If a call seller realizes losses at expiration, it is because the stock price is above the call strike by more than the credit received up front. Short call holders have an obligation to provide 100 shares of stock if their option is exercised, and this is more prevalent near expiration when there is little extrinsic value remaining in the option.

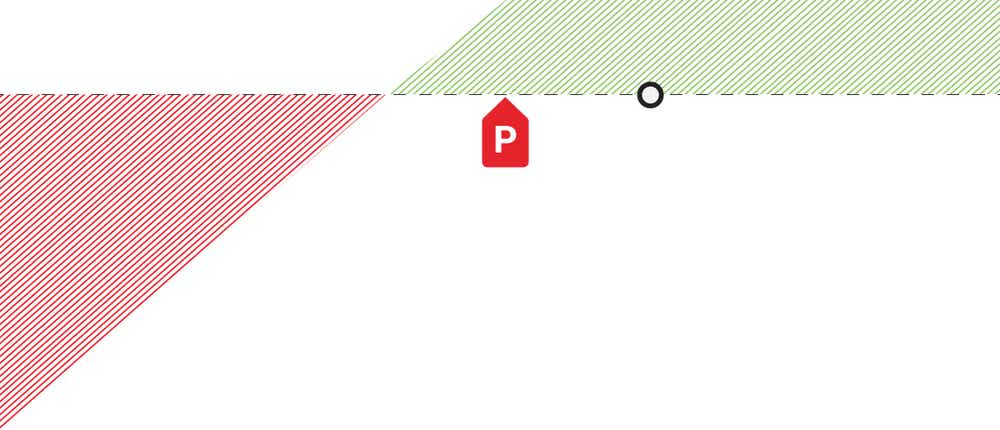

A short put is a neutral to bullish trade, that has a defined profit potential equivalent to the credit received up front, and limited risk to the stock reaching $0.00. Short put sellers benefit from the stock price staying above the put strike through expiration, but these options lose value if the stock price rises quickly, just as calls lose value if the stock price drops quickly.

Short put sellers are obligated to buy 100 shares of stock at their strike price if the stock price drops below the put strike at expiration. This allows traders to utilize short puts as a way to buy 100 shares of stock at a lower cost basis than purchasing the shares outright in the market, so short puts are a popular strategy amongst investors that want to buy 100 shares of the underlying they’re trading at a cheaper price than the market is offering right now.

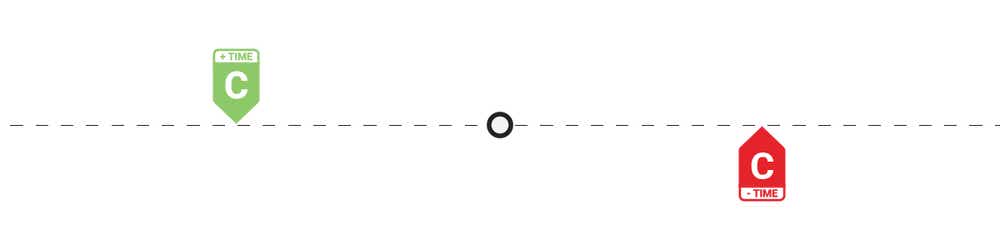

Short Naked Put Profit/Loss Chart

Short Naked Call Profit/Loss Chart

3. Covered Call

A covered call is an options strategy that traders often use to generate income while reducing the risk associated with owning 100 shares of stock. Its structure consists of two parts: buying 100 shares of a stock outright and hedging the risk of owning the shares with a short call option, equivalent to the credit received for selling the call and capping the upside profit potential in the shares above the call strike. So, the underlying of the call option must be the same stock that the trader already owns 100 shares of for the short call risk to be “covered”.

One options contract is equal to the theoretical equivalent of 100 shares of a stock – the strategy setup is the same, i.e. one short call for every 100 shares. Covered calls are typically employed by traders with a neutral-bullish market assumption – particularly those who want to own the stock long term, but aren’t expecting the market price to rise (or increase significantly) by the option’s expiration date. Even if it does, the short call strike can be rolled out in time, up a few strikes, or a combination of both to prevent the shares from being “called away”.

Covered Call Profit/Loss Chart

4. Married Put

The married put options strategy, also known as ‘protective put’ is another way of hedging downside risk of 100 shares of long stock, but in a more definitive way than with a covered call. It’s made up of two parts: buying 100 shares of an asset, e.g. shares of a stock; and buying a put option within the same underlying simultaneously. In the case of stocks, one put represents 100 shares – so, any increments would also be based on the same 1:100 ratio.

Owning the physical asset, in essence, represents a bullish long-term assumption. In the married put options strategy, downside risk of ownership is limited by the bearish long put position (up to the option’s expiration date). The long put defines the downside risk of the 100 shares of stock below the strike price chosen, but you pay a premium for this insurance against the shares.

5. Straddle

A straddle is an options trading strategy used by traders with a neutral directional assumption. It also consists of two simultaneous positions: an at-the-money (ATM) call and an ATM put. This strategy is made up of different types of options, but everything else is the same: both are either both long or short, plus the underlying, strike price and the expiration date is the same.

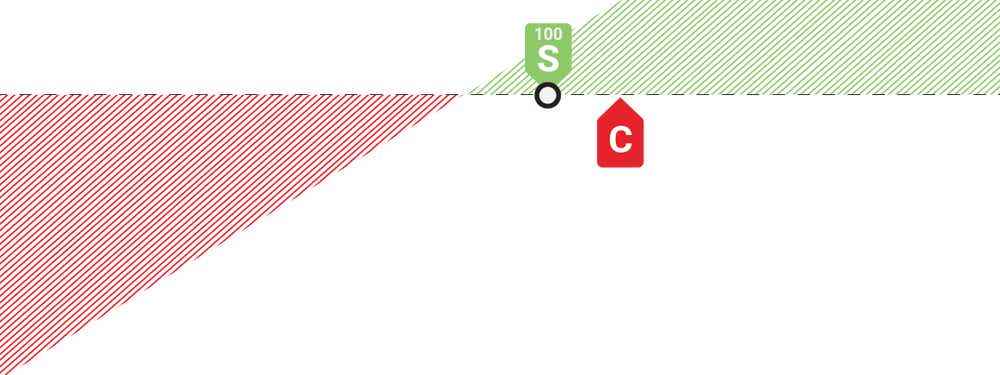

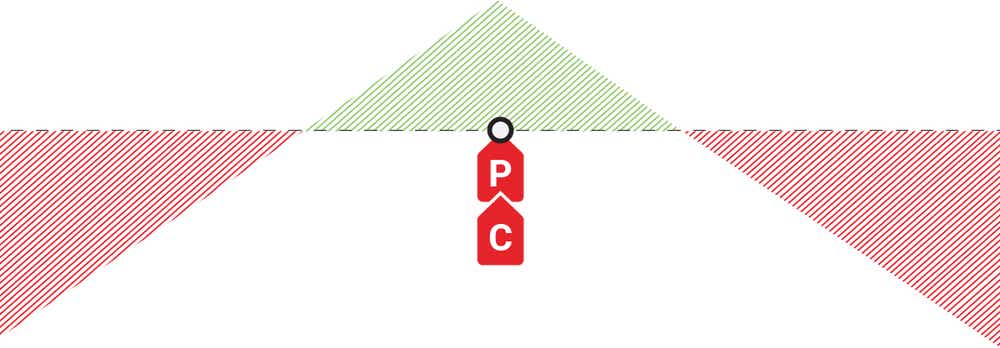

Long straddles provide the holders of the contracts with unlimited profit potential and defined risk. The buyer of a straddle expects the stock price to move well past the strikes, regardless of the direction. In order to profit at expiration, the stock price must move past one of the strikes more than the debit paid to enter the trade.

In short straddles, it’s the other way around: the profit potential is limited to the credit received for selling the straddle, while risk is unlimited. Short straddle sellers expect the stock price to stay within the implied volatility range of the underlying, and therefore it is typically used in more of a high IV environment.

Long straddles are often employed in low implied volatility (IV) environments, where the straddle buyer is betting that the actual movement in the stock price will be greater than the implied movement based on the price of the straddle itself. If the market moves sharply in one direction, the straddle can be sold for a profit.

Short Straddle Profit/Loss Chart

6. Strangle

The strangle options strategy is similar to straddles in some ways. A strangle is a neutral strategy that utilizes a call and a put with the same underlying, expiration date, and both must either be long or short.

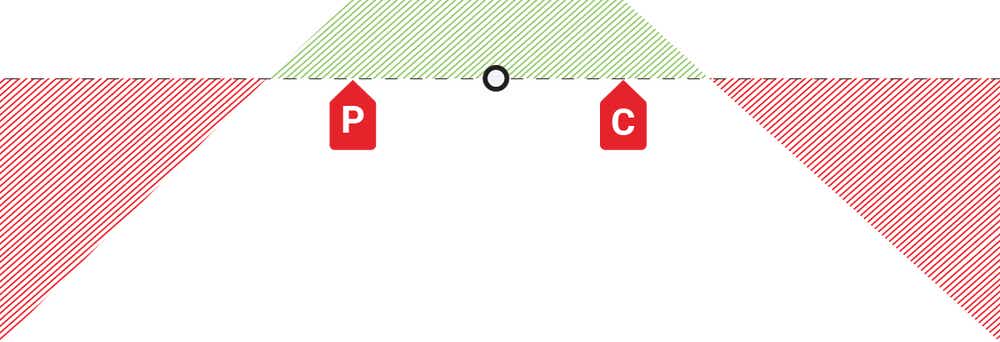

Unlike in straddles, the strike prices are slightly out-of-the-money (OTM). The long strangle strategy is often employed by traders who think that there’ll be high realized volatility in the short term. In long strangles, possible risk is defined, while potential profits are unlimited. Just like straddles, long strangles are typically used in low IV environments where the trader believes realized volatility will exceed implied movement.

Short strangles are typically employed by traders who don’t expect big moves in an underlying’s price. The maximum profit in short strangle is the net premium received if the stock price stays within the short strikes, while risk is undefined. For this reason, short strangles are typically used in high IV environments and traders are betting against the implied movement of the underlying.

Short Strangle Profit/Loss Chart

7. Iron Condor

An iron condor is one of the options strategies that allow traders to manage their capital more efficiently, as it’s a defined risk strategy. Essentially, an iron condor is comprised of a short call vertical spread, and a short put vertical spread, both of which are OTM. A short call vertical spread is bearish and is formed by selling one call and buying another at a higher strike price to define the risk on the short call; whereas a short put vertical spread is bullish, and it’s set up by selling a put and buying another at a lower strike price to define the risk on the short put.

The underlying and expiration date are the same in both spreads, but the strike prices and spread widths can differ. With the bullish and bearish spreads offsetting one another in a directional manner, an iron condor is a neutral strategy. Profits are realized from the underlying trading within the short strikes – max profit is realized at expiration if all options expire worthless, and is limited to the credit received up front for selling the iron condor.

Iron Condor Profit/Loss Chart

8. Broken Wing Butterfly

A broken wing butterfly is a neutral or slightly directional options strategy. In a broken wing butterfly, there is a debit spread and a credit spread, where the short strikes are the same. “breaking the wing” is achieved by making the credit spread wider than the debit spread, and ultimately financing the entire cost of the debit spread we buy and route the trade for a credit. When doing this, we eliminate risk from the OTM side because if all options expire OTM, we still achieve a profit equivalent to the credit received up front.

Max profit is achieved if the stock price is right on the short strikes at expiration, as the long debit spread would be at max value, and the credit spread would be worthless. Max profit is the width of the debit spread plus the credit received up front. Max loss is the width of the credit spread, less the credit received up front, less the width of the debit spread. Max loss is realized if the entire spread is ITM at expiration.

The broken wing butterfly options strategy is typically routed for a credit to eliminate risk to the OTM side. For put broken wing butterflies, this means that if the stock price rises, we have no risk when routed for a credit, but our max profit and risk is to the downside.

For call broken wing butterflies, this means that if the stock price falls, we have no risk when routed for a credit, but our max profit and risk is to the upside.

Put Broken Wing Butterfly Profit/Loss Chart

Call Broken Wing Butterfly Profit/Loss Chart

9. Protective Collar

A protective collar options strategy just like the married put, except instead of paying for the long put outright, we sell an equal value OTM call to finance the cost of the protective put. We still need 100 shares of stock for every collar we have on for the risk to be covered to the upside and protected to the downside. Typically, the expiration date for the call and put is the same in this strategy.

This strategy is often used after an underlying, e.g. shares a stock, experiences a significant market price increase and the share owner wants to protect their potential gains while also capping their upside profit potential. This strategy is also popular around earnings season, where stocks can have significant moves in either direction.

A protective collar offers short-term protection against the downside risk of the long-term stock investment. Selling the call option funds the purchase of the put option, and caps the upside profit potential of the 100 shares past the call contract.

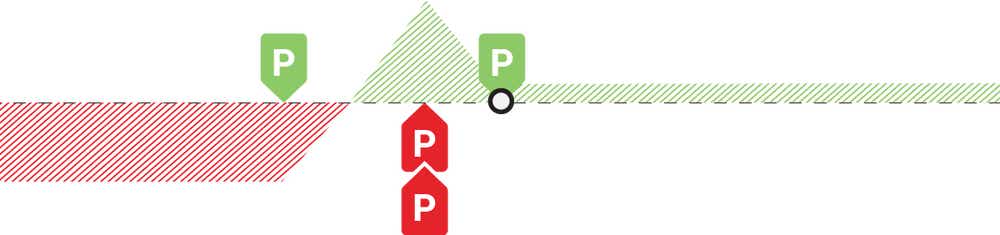

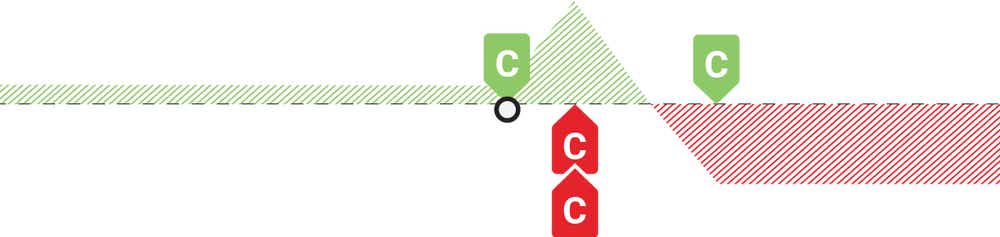

10. Diagonal Spread

A diagonal spread is an options trading strategy that’s made up by buying one long-term call or put that is ITM/ATM/OTM, and selling a shorter-term call or put further OTM to reduce the cost basis of the long option – they have to be options of the same kind (long call and short call, or long put and short put). Ideally, the cost of the entire trade is no more than 75-80% of the width of the spread to ensure that we can profit on a big move in our favor ITM. If the debit paid is more than the width of the spread, losses can be realized on a huge move ITM because the minimum value of the trade is the width of the spread if all extrinsic value goes away.

The maximum profit on a diagonal spread can be estimated by taking the width of the spread if ITM, less the debit paid, and adding any remaining extrinsic value in the long option to the estimation. Since these options are in different expirations, and the short option expires first, it’s hard to put a hard number on max profit since that depends on where the stock price is when the short strike expires.

Max loss is simply the debit paid for the trade, and that is realized if the long option expires OTM.

Put Diagonal Spread Profit/Loss Chart

Call Diagonal Spread Profit/Loss Chart

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices