Lackluster Growth of China GDP May Disappoint Markets Yet Again

Lackluster Growth of China GDP May Disappoint Markets Yet Again

By:Ilya Spivak

Markets linked to China’s economy may suffer as growth struggles and stimulus underwhelms.

- Markets are confident China’s latest stimulus efforts will be short-lived.

- Economic data on inflation, trade and lending has missed the mark this week.

- Soft third-quarter GDP figures may keep China-linked assets under pressure.

China sent financial markets into a frenzy in September when policymakers in Beijing appeared to get serious about lifting the world’s second-largest economy out of its ongoing post-COVID slump. The central bank announced a raft of measures to tempt economic activity with cheap credit and earmarked money to force up the stock market.

It was a hint at the belated embrace of fiscal stimulus that really cheered investors, however. China’s economy has languished in a deflationary spiral for over a year, and monetary inducement had already failed to rouse it before the latest push. A big dose of government spending to inject demand has long been hoped for.

Beijing’s stimulus push misses the mark, again

Tidbits emerging from a special meeting of the Politburo—China’s core leadership group of 24 officials—signaled President Xi Jinping and company have finally overcome their reluctance to throw money at the problem but left out the specifics. Nevertheless, local stock markets jumped nearly 40% in a mere six trading days.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

A follow-on announcement from the Ministry of Finance has since underwhelmed. Pledges to shore up municipal finances as well as buy up idle land and commercial properties stopped short of direct demand generation. Once again, Beijing seemed to offer inducements to tempt everyone but the central government to spend.

Meanwhile, incoming economic data has continued to disappoint. September’s inflation figures showed consumer price growth unexpectedly slowed to 0.4% year-on-year, the weakest in three months. Wholesale prices slumped deeper into deflation mode, sinking at the fastest pace since March.

Trade figures brought more pain. Export growth slowed to a paltry 2.4% and imports added a meager 0.3% year-on-year, marking the weakest readings since April and June, respectively. Loan growth increased, but less so than economists expected. Moreover, loan growth dropped to the slowest since at least 1998 at 8.1% year-on-year.

Chinese GDP data: another disappointment ahead?

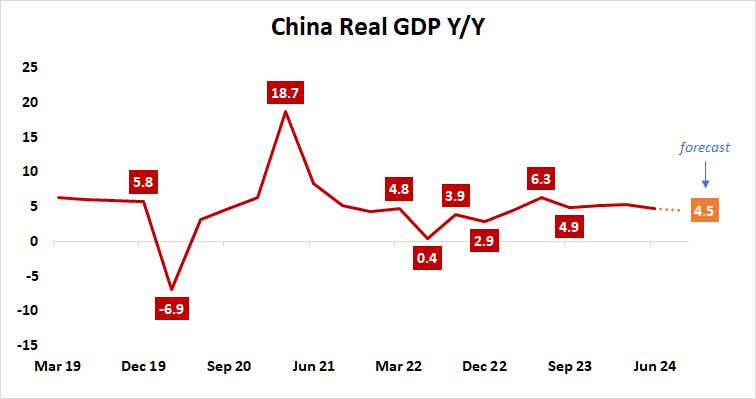

The spotlight now turns to third-quarter gross domestic product (GDP) data. Economic growth is expected to slow for a second consecutive quarter, registering at 4.5% year-on-year. Analytics from Citigroup show Chinese data outcomes continue to trend toward disappointment relative to forecasts, hinting at the risk of downside miss.

A soft result on GDP data might weigh on proxy assets sensitive to Chinese economic trends, such as the Australian dollar and copper. Local stock markets may face pressure, too, having already erased more than half of September’s surge.

However, officially backed firefighting efforts might dilute the price transmission mechanism.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices