China Stimulus Unlikely to Reduce Global Recession Risk

China Stimulus Unlikely to Reduce Global Recession Risk

By:Ilya Spivak

Economic growth now relies on the U.S. as the Eurozone limps along.

China has announced a new stimulus program to revive its anemic economy.

But global economic growth now relies on the U.S. as the Eurozone limps along.

Finding a safety net in China appears unlikely as its policy easing falls flat yet again.

China unveiled a raft of new stimulus measures in a bid to revive its ailing economy, which has yet to rebuild momentum after starting to reopen from stringent “zero COVID” lockdowns in late 2022. The People’s Bank of China (PBOC)—he country’s central bank—cut interest rates, lowered bank reserve requirements and pushed out support for housing.

China’s target seven-day reverse repo interest rate came down from 1.7% to 1.5% and the weighted average reserve requirement ratio (RRR) for the country’s banks declined from 7% to 6.6%. The PBOC also cut the rate payable on existing mortgages by an average of 0.5% and reduced the down payment required on second homes from 25% to 15%.

The central bank also sought to shore up the stock market. It said that it will offer 500 billion yuan ($71 billion) in financing for Chinese firms to buy local shares. It will also set up a swap facility unlocking close to 800 billion yuan ($114 billion) in liquidity for securities companies, funds and insurers to finance equities purchases.

No safety net: global economic growth relies on the U.S.

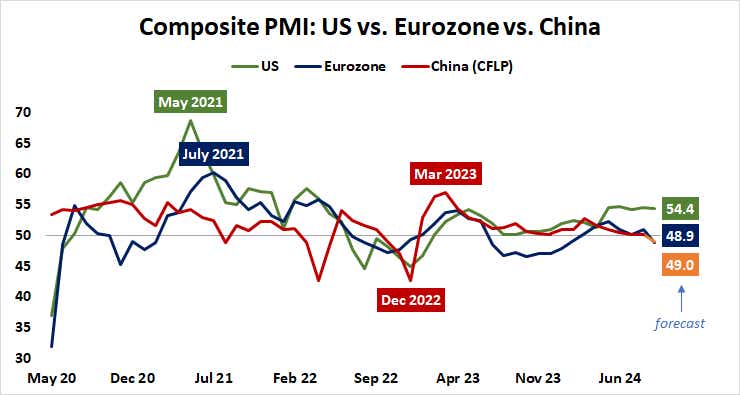

These efforts come at a time when the world economy can ill afford another headwind. Purchasing managers’ index (PMI) data released earlier in the week showed divergent performance in the Eurozone and the U.S. Those two economies along with China make up about 50% of global output, making conditions there defining for the fate of the whole.

The figures showed growth in the U.S. remained well-supported in September. The pace of economic activity expansion jumped to a one-year high in May and has held up there for four months now, underpinned by a resilient service sector offsetting a deepening slump in manufacturing.

Meanwhile, this month marked the second-worst performance of the year for the Eurozone. The regional economy shrank for the first time since February, and at the fastest pace since January. Service sector growth slowed to a near standstill while conditions on the manufacturing side continued to deteriorate, hitting the worst levels since December.

Reviving China’s economy: too little, too late … again

If China’s stimulus push were to succeed it that would amount to a crucial safety net for the world economy at a time of near-singular reliance on U.S. demand. Unfortunately, recent experience suggests the new effort will amount to another in a series of half-measures that fail to deliver lasting results.

Local stocks dutifully jumped as the PBOC made its announcement. They did the same when China directed the sovereign wealth fund to buy into local markets and later replaced the head of its securities regulator. All those gains have been erased. A stream of interest rate cuts since mid-2021 has failed to revive lending.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

That’s because the economy is fundamentally lacking in demand. A PBOC survey of depositors showed saving future income was favored by a margin of 58% over consumption (24.5%) and investment (17.5%). Households’ bank deposits rose to a record high of 132 trillion yuan by the middle of this year.

China has flouted the example of Western countries, where vast sums were spent on fiscal demand replacement to power economies through the pandemic and its aftermath. As a result, it has suffered from economy-wide deflation—a sign of absent demand—for five quarters straight. The PBOC’s latest moves are unlikely to change that trend.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices