Coinbase Earnings Preview - Bitcoin Selloff Brews Worry

Coinbase Earnings Preview - Bitcoin Selloff Brews Worry

By:Mike Butler

Coinbase (COIN) Earnings Preview

- Coinbase will report quarterly earnings on February 12th, after the market closes

- COIN stock boasts a high implied volatility for the quarter, with a +-8.5% stock price range

- Coinbase is expected to report an earnings-per-share of around $1.15 on $1.96 billion in revenue

- Robinhood's 11% selloff on Wednesday after earnings could be a sign of what's to come for COIN stock

Coinbase Trading Near Multi-Year Lows

Coinbase had a stellar Super Bowl advertisement from a marketing perspective, channeling the attention of anyone at a bar or large gathering with their karaoke-style commercial that got crowds singing along, but that may be the only highlight to start the year for the cryptocurrency exchange. The stock price is down to $152 on Wednesday, with earnings ready to be announced on Thursday, February 12th. Coinbase (COIN) stock reached a low of $142.58 during the tariff market selloff of April 2025, and rallied as high as $444.64 just a few months later. Robinhood (HOOD) released earnings on Monday after the market closed, and the stock price is trading 11% lower on Tuesday. Coinbase is following suit with a sympathy selloff, down over 5% on the trading session.

Coinbase is expected to report an earnings-per-share (EPS) of around $1.15 on $1.96 billion in revenue on Thursday, February 12th.

Coinbase (COIN) Stock Downgraded by JP Morgan

As if Coinbase wasn't already facing a tough earnings call on Thursday, JP Morgan recently downgraded the December 2026 price target from $399 to $290 per share citing USDC growth slowdowns, and weak crypto trading volume. In the last earnings call in October 2025, the sentiment was pretty positive as the stock price was almost $200 higher than it's trading now. An excerpt from the shareholder letter tells the story:

"We laid out our vision of an Everything Exchange last quarter, and made progress in Q3 by increasing the number of tradable spot assets, expanding our derivatives offerings, and continuing to lay the groundwork for additional pillars. By increasing tradable spot assets, our platform now covers approximately 90% of total crypto asset market capitalization. Our derivatives business reached an all-time high share across several markets, including U.S. crypto futures and global crypto options, with the launch of U.S. perpetuals and 24/7 futures trading, and the close of the Deribit acquisition. We are accelerating payments through stablecoin adoption, which we anticipate will continue given policy tailwinds, and ongoing adoption from financial institutions and corporates for payment and treasury needs. In Q3, USDC reached an all-time high of $74 billion in market capitalization, and average USDC held in Coinbase products reached an all-time high of over $15 billion."

While it can be true that Coinbase has delivered on expanding their product offering, it's still apparent that the stock price is closely tied to the interest and performance of popular cryptocurrencies like ethereum & bitcoin - the chart above shows the overlay of COIN stock compared to the price movement of the bitcoin ETF (IBIT).

Coinbase Earnings Implied Volatility

Although it seems unlikely that COIN stock will rally during a bleak crypto environment, anything is possible with earnings announcements. The market could be expecting a horrible report, and yet the report could be less horrible than the market expects and the stock price can rally. We've seen it before and we'll see it again - that is the unknown, volatile nature of earnings calls. With that said, it's important to understand the options market and how that looks prior to an earnings call. We can see the implied volatility relative to the stock price for the week to determine the magnitude of the move priced in, and we can compare the weekly implied volatility to a later-dated cycle to weigh the earnings call against more time-based expiration cycles.

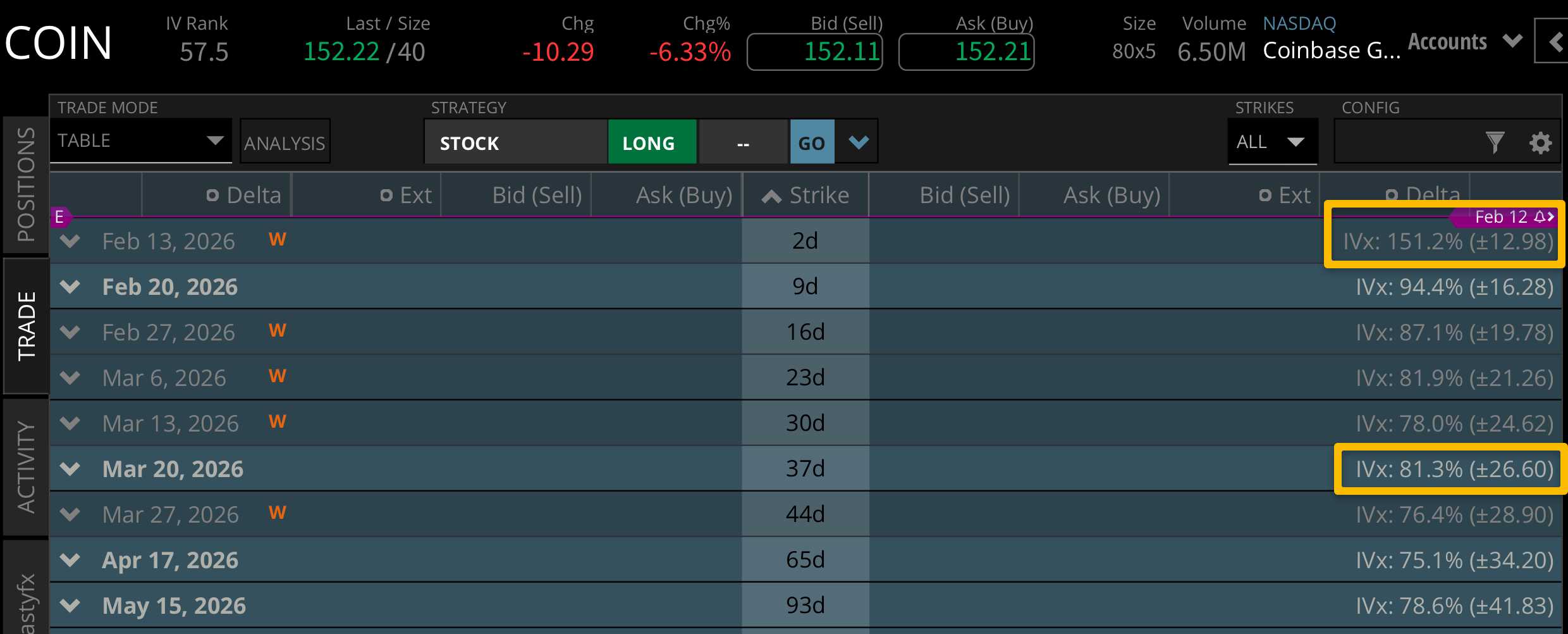

Looking at the chart above, we can see that COIN has an earnings implied volatility of +-$12.98. This is about 8.5% of the notional value of the stock price, which puts COIN earnings on the higher end of the range for this earnings quarter. Most companies have an implied volatility that falls within 5-10% of the stock price, with some higher and lower than that range. Looking further to the March 2026 expiration cycle, we can see a +-$26.60 implied stock price move, which is about 17% of the stock price. This tells us that about half of the implied volatility priced into the 37 day cycle is priced into the two day cycle. Even though implied volatility is high across the board in COIN stock, we're seeing a large implied volatility for this earnings announcement after the close on Thursday.

Bullish on Coinbase for Earnings

If you're bullish on COIN stock for earnings, you want the earnings call to be less dreary than expected. It feels like the market is expecting turmoil, especially after the downgrade from JP Morgan and Robinhood's failure to keep the stock afloat after their earnings call. If the EPS & revenue figures come in better than expected, we could see the stock price bounce off of recent lows.

Bearish on Coinbase for Earnings

If you're bearish on COIN stock for earnings, you expect that EPS & revenue figures will be missed, and the landscape of the crypto space is just too much for Coinbase to overcome at this time. Even though we could see a stock price rally down the road, a $66k bitcoin price is turning away active traders and that's impacting the bottom line for Coinbase to say the least.

Regardless of your assumption, be sure to tune in to Options Trading Concepts Live on Thursday, February 12th at 11am CST as we walk through bullish, bearish, and neutral options trade ideas ahead of the announcement after the close.

Mike Butler, tastylive director of market intelligence, has been trading the markets for a decade. He appears on Options Trading Concepts Live, Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices