Crude Oil Price Forecast: Back into the Symmetrical Triangle – What’s Next?

Crude Oil Price Forecast: Back into the Symmetrical Triangle – What’s Next?

SLOWDOWN VERSUS SUPPLY

Global energy markets continue to experience volatility as market participants weigh competing interests: the growing odds of a widespread economic slowdown across developed economies versus a lack of improvement in energy supplies in the near-term. The net-result has been a wash, with crude oil prices holding around $105.00/brl, a level touched for four consecutive weeks. The overarching thesis remains: “the global economy remains undersupplied on the energy front, and no amount of monetary tightening can fix global supply chains upended by Russia’s invasion of Ukraine or China’s zero-COVID strategy.”

OIL VOLATILITY, OIL PRICE CORRELATION REMAINS WEAK

Crude oil prices have a relationship with volatility like most other asset classes, especially those that have real economic uses – other energy assets, soft and hard metals, for example. Similar to how bonds and stocks don’t like increased volatility – signaling greater uncertainty around cash flows, dividends, coupon payments, etc. – crude oil tends to suffer during periods of higher volatility. Stability in oil volatility amid a washout following a rebound in crude oil prices has left correlations mostly unchanged, if not still weak.

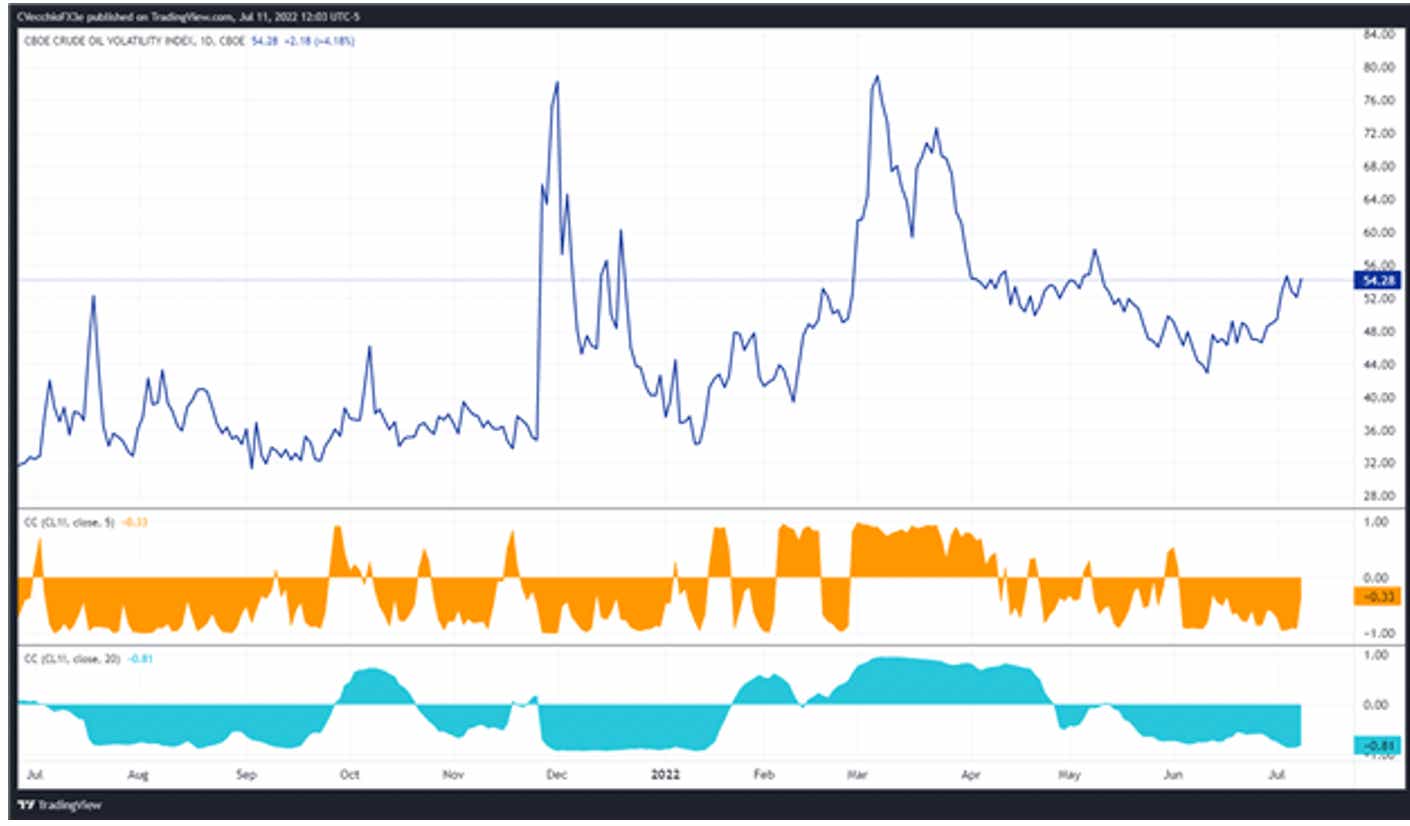

OVX (OIL VOLATILITY) TECHNICAL ANALYSIS: DAILY PRICE CHART (JULY 2021 TO JULY 2022) (CHART 1)

Oil volatility (as measured by the Cboe’s gold volatility ETF, OVX, which tracks the 1-month implied volatility of oil as derived from the USO option chain) was trading at 54.28 at the time this report was written, holding near its highest level since early-May. The 5-day correlation between OVX and crude oil prices is -0.38 while the 20-day correlation is -0.82. One week ago, on July 5, the 5-day correlation was -0.95 and the 20-day correlation was -0.80.

CRUDE OIL PRICE TECHNICAL ANALYSIS: DAILY CHART (JULY 2021 TO JULY 2022) (CHART 2)

Crude oil prices remain below the rising trendline from the December 2021, April 2022, and May 2022 lows, but have clawed their way back into the symmetrical triangle in place since the end of February. Technical damage has been done, but not enough to suggest that bullish outcomes are still unlikely. Crude oil prices are back above their daily 5- and 8-EMAs, but below their daily 13- and 21-EMAs; the EMA envelope remains in bearish sequential order. Daily MACD continues to decline while below its signal line, but daily Slow Stochastics have started to climb back towards their median line. Momentum is starting to turn the corner, but not enough to suggest that a workable low has been established.

CRUDE OIL PRICE TECHNICAL ANALYSIS: WEEKLY CHART (MARCH 2008 TO JULY 2022) (CHART 3)

On the weekly timeframe, momentum continues to cool. Crude oil prices are below their weekly 4- and 8-EMAs, but remain above their weekly 13-EMA. The weekly EMA envelope is in neither bearish nor bullish sequential order. Weekly MACD continues to decline while well-above its signal line, and weekly Slow Stochastics are holding around their median line. As was the case in late-June, “if a failed bearish breakout did indeed transpire, the weekly timeframe may not reflect such a development; paying attention to 4-hour and daily timeframes is logical.”

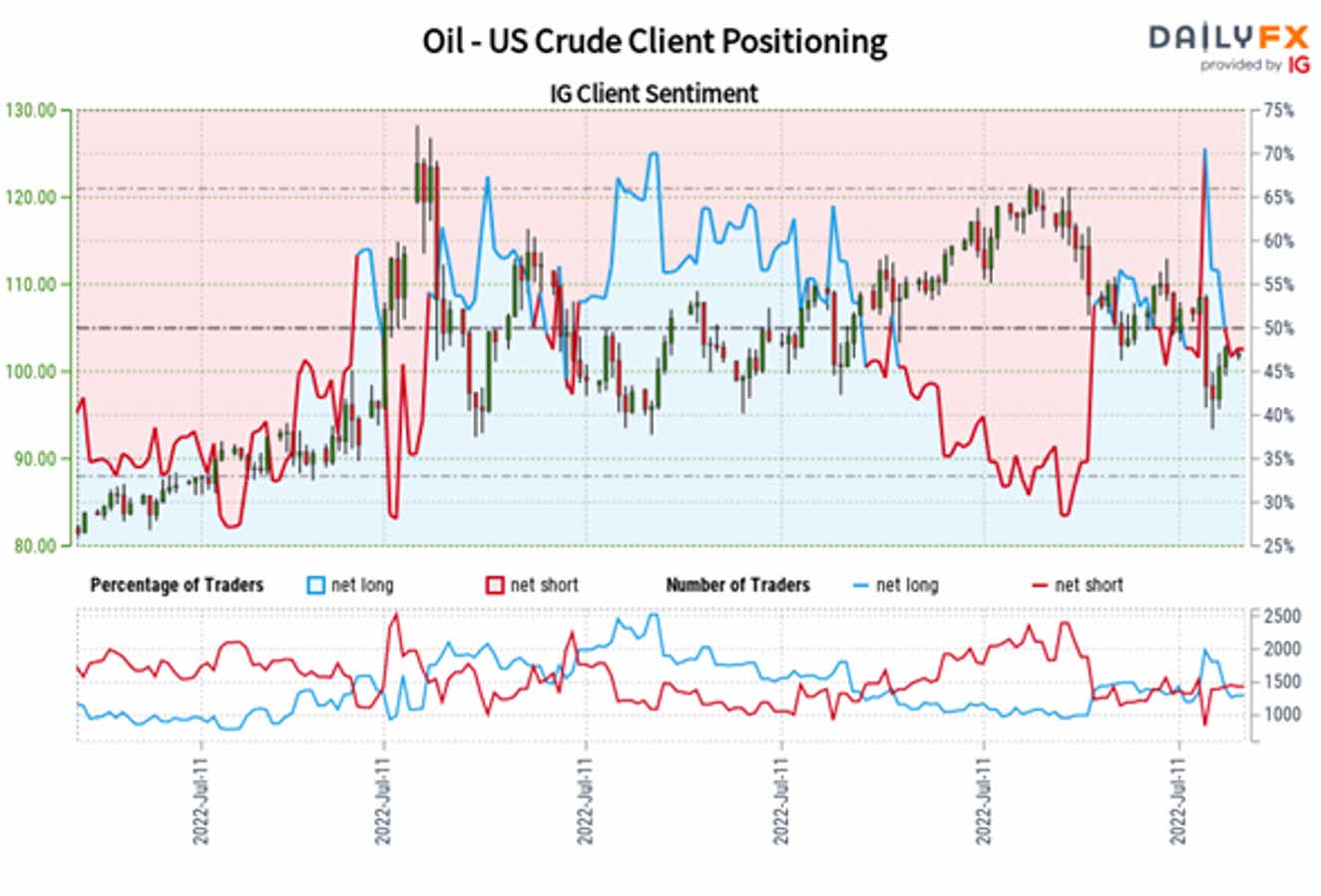

IG CLIENT SENTIMENT INDEX: CRUDE OIL PRICE FORECAST (JULY 11, 2022) (CHART 4)

Oil - US Crude: Retail trader data shows 49.20% of traders are net-long with the ratio of traders short to long at 1.03 to 1. The number of traders net-long is 5.78% higher than yesterday and 0.65% higher from last week, while the number of traders net-short is 1.34% higher than yesterday and 0.49% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Oil - US Crude prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current Oil - US Crude price trend may soon reverse lower despite the fact traders remain net-short.

--- Written by Christopher Vecchio, CFA, Senior Strategist

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices