Natural Gas Price Declines, Crude Oil Temporarily Bounces: How to Trade It?

Natural Gas Price Declines, Crude Oil Temporarily Bounces: How to Trade It?

Natural Gas futures decline below $4 amid milder weather outlooks for the month of December. On the flip side, January Crude Oil futures (/CLF2) saw a small bounce Monday following a multi-percent decline beginning in late November. Price action in both commodities is yielding an expansion in implied volatility. Discover a few setups in energy products like XLE, XOP, and more below.

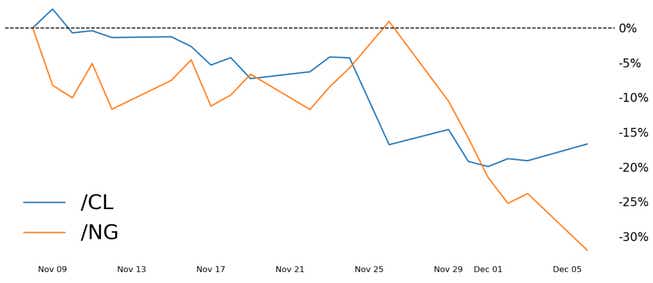

Energy Performance

As Natural Gas prices fell under $3.70/MMBtu as of Monday morning, futures have dropped more than 30% in the last 30 days. And while WTI crude oil is back above $68 for now, /CL futures have waned more than 15% in the same timeframe.

Additionally, the one-month price change in Energy Sector ETF, $XLE, and the Oil and Gas Exploration and Production ETF, $XOP, are down 4.1% and 12.3%, respectively.

Energy Trade Ideas

Depending on a trader’s risk tolerance, account size, and experience, there are a wide number of ways to participate in the price action being seen in the energy sector. Traders can look to highly liquid ETFs like $XOP and $XLE, trade the major futures contracts (/CL and /NG), or utilize mini and small futures such as /QM (mini crude oil), /QG (mini Natural Gas), and /SMO (Small US Crude).

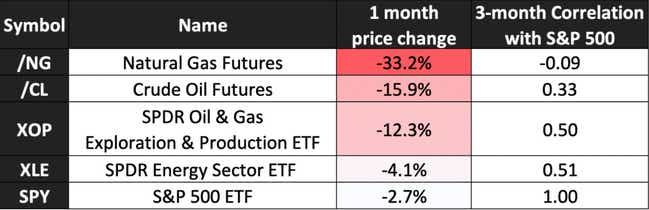

Bullish Energy Setups

To trade a bounce in energy, bullish strategies such as short put vertical spreads, long call vertical spreads, covered calls, short naked puts, and Poor Man’s covered calls. In today’s Alpha Boost email from the Quiet Foundation, one possible setup is Short Put Spread in $XLE, where the maximum possible profit is $1.29 and the max loss is at $250, this trade has no upside risk and a breakeven at $53.71.

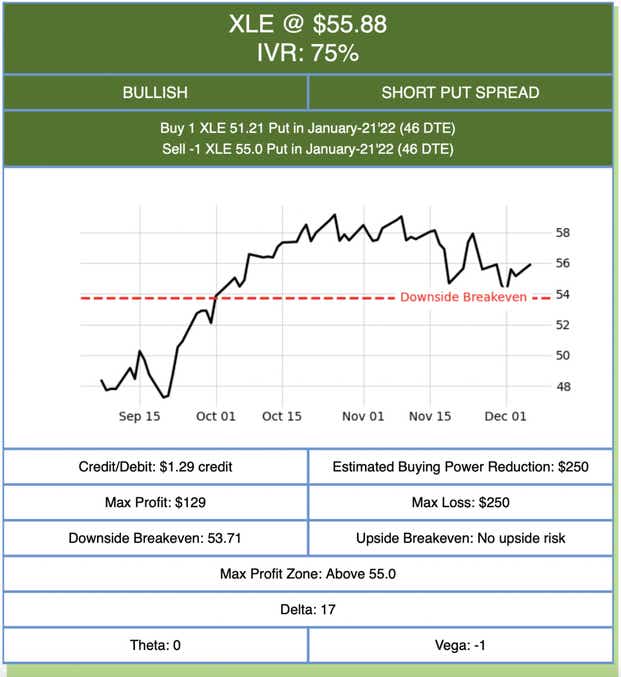

Bearish Energy Setups

If you think there’s still some downside room for energy, a short call vertical spread in $XOP might be more your speed. With IV Rank above 50%, this product is a candidate for a premium selling opportunity. Shorting the 102/104 call spread expiring in January has a breakeven price of $102.67 and a probability of profit great than 60%.

Alternatively, traders looking for a static delta position can look to short /SMO futures. At $1.00 per tick and around $1,600 in buying power, this product enables traders to gain exposure to Crude Oil price action at the fraction of the cost of a major futures contract.

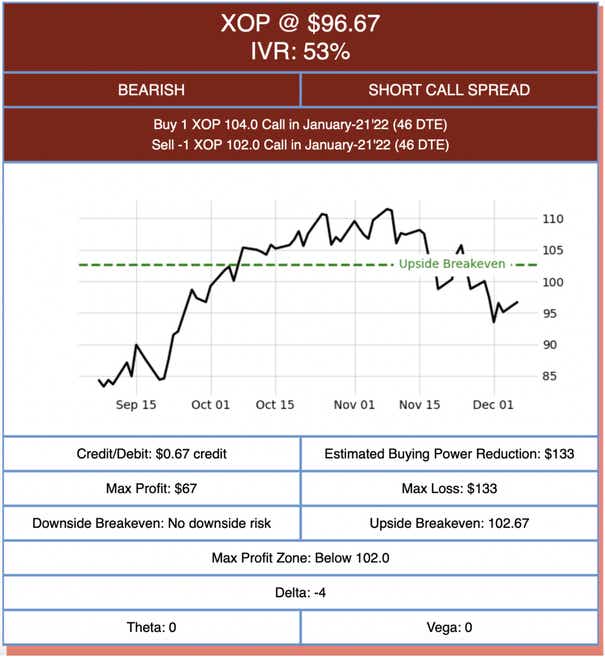

Neutral Energy Setups

Finally, if traders are expecting Crude or Natural Gas to stay in a RANGE over a certain amount of time, Iron Condors and Strangles are also viable strategies and can be customized to fit account size and appetite for risk.

For example, traders in small accounts or those who are new to the price action in energies may look to do a defined risk Iron Condor spread rather than the “undefined” exposure that comes with Strangles. Below is a /CL Futures Options Iron Condor in the JAN 14 expiration. By selling the 60/59 Put Vertical and the 79/80 Call Vertical enables traders to potentially make $330 and lose a maximum of $670.

Sign up for the Alpha Boost newsletter for more trade ideas sent directly to your inbox and check out the Follow Feed on tastytrade for the latest strategies from tastylive co-hosts.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices