EIA Report Trims Oil’s Post-CPI Gains

EIA Report Trims Oil’s Post-CPI Gains

The numbers surprised observers, with the headline figure showing a build of 3.7 million barrels vs. an expected 1.55 million

- Crude oil prices are cutting gains after a bearish EIA report.

- Crack spreads are dropping as implied demand cools.

- Oil prices may reestablish the May 77/81 range.

Crude oil prices (/CLN4) were up over 1% this morning on optimism that cooling inflation would allow the Federal Reserve to cut interest rates at least twice by 2025. However, the commodity quickly trimmed most of its gains after the Energy Information Administration (EIA) released its weekly petroleum status report for the week ending June 7.

The EIA numbers surprised expectations, with the headline figure for crude oil stocks showing a build of 3.7 million barrels vs. an expected 1.55 million-barrel decrease. The build followed a 1.23 million-barrel increase from the previous week, putting commercial crude inventory, excluding the strategic petroleum reserve (SPR), at 459.7 million barrels.

Fuel products, which can be viewed as a somewhat leading indicator for oil, also saw builds. Gasoline stocks rose 2.56 million barrels, beating the expected 1.25 million-barrel increase and up from a 2.1 million-barrel build the previos week. Distillate stocks rose 881,000 barrels, above the 500,000-barrel build the market expected.

Demand remains weak at crucial time

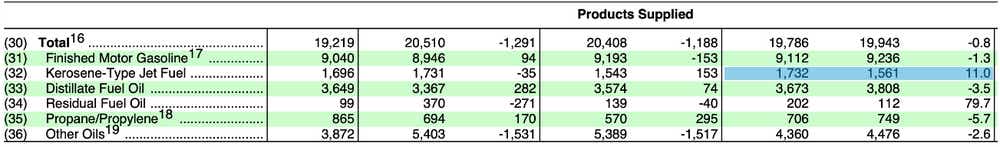

The EIA report underscored weak demand. Total products supplied—a proxy for implied demand—fell 0.8% over the last four-week period, compared to a year ago. Gasoline’s implied demand fell 1.3% over the same period, while distillate fuel decreased by 3.5%.

Jet fuel was the only bright spot, rising 11% over the same period. However, total jet fuel supply represents roughly a tenth of the total demand for gasoline, indicating that despite its strength, jet fuel alone won't sustain overall oil demand.

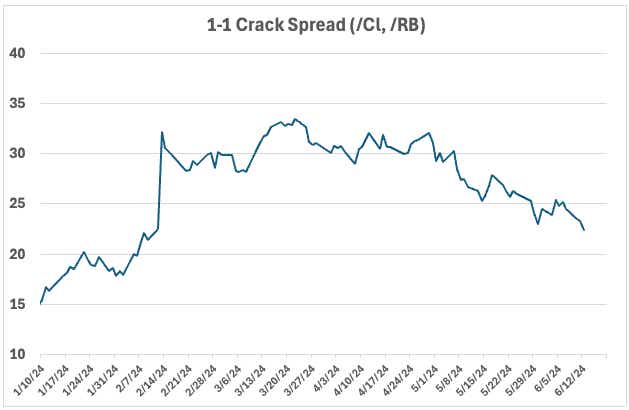

The weakness in fuel products was reflected in crack spreads, which represent a refiner’s theoretical profit margin from buying crude oil and selling the fuel product. The 1-1 crack spread between gasoline futures (/RB) and crude oil futures (/CL) fell over 5%, reaching its lowest level since February.

Focus now turns to today’s Federal Reserve announcement, which will unveil new economic, and inflation targets as well as the so-called dot plot.

Crude oil technical outlook

Crude oil’s intraday high failed at the value area high (VAH) before moving back to its point of control (POC). The volume profile for the chart below is set to the option expiration time profile.

With oil prices back in the 77 to 81 range that was carved out through most of May, prices may reestablish within this range until a clearer outlook develops for oil markets.

However, there is an impending death cross, with the 50-day simple moving average (SMA) on track to cross below the longer-term 200-day SMA. Altogether, this puts a neutral to slightly bearish tilt on oil’s technical structure.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.