Fannie Mae and Freddie Mac Shares Surge as Trump Explores Sale

Fannie Mae and Freddie Mac Shares Surge as Trump Explores Sale

Is it time to fully privatize both quasi-governmental mortgage agencies?

President Donald Trump is exploring the sale of the government-controlled mortgage giants Fannie Mae and Freddie Mac, institutions which back about half of the $16 trillion US mortgage market. Both are systemically significant, politically sensitive and persistently controversial. The proposed privatization, while likely requiring Congressional approval, could significantly reshape the housing market.

For new investors, these names may not mean anything. For most more experienced hands, names like Fannie Mae and Freddie Mac have been collecting dust on the shelves for over a decade. So it’s as good a time as ever to review their history. Meanwhile their share prices – FNMA and FMCC, respectively – have surged over 51% and 38% this week alone.

Fannie Mae (FNMA) Daily Chart: April 2024 to May 2025

The Government-Sponsored Era: Built for Liquidity

Fannie Mae was created in 1938 during the Great Depression to provide liquidity to the mortgage market, a public-sector response to a housing credit collapse. Freddie Mac followed in 1970, essentially as a competitor, ensuring liquidity and reducing concentration of risk.

But here’s the nuance: By the late 1960s, the US was dealing with fiscal pressure, the Vietnam War and Great Society programs, and it needed to remove Fannie’s obligations from the federal balance sheet. That’s when the first real privatization happened.

In 1968, Fannie Mae was spun into a shareholder-owned, publicly traded company, with the government keeping its ties through a congressional charter. Freddie Mac underwent a similar transformation in 1989, moving under shareholder ownership but maintaining its quasi-governmental status.

The illusion of privatization

Now, Wall Street loved these entities. They had an implied federal guarantee and could borrow at lower rates. Lenders loved them even more. They could originate a loan, sell it off to a GSE and recycle capital. The privatization was never clean. This was always a kind of hybrid model: private profits, public risk.

They were known as Government-Sponsored Enterprises (GSEs) and operated as state-backed private companies with extraordinary market reach and benefits, including lighter regulatory treatment and tax exemptions.

Freddie Mac (FMCC) Daily Chart: April 2024 to May 2025

2008: The Crash That Exposed the Model

When the housing market imploded in 2008, so did the illusion. Both companies were massively overleveraged and undercapitalized. Losses on subprime and Alt-A mortgages left them insolvent.

The federal government stepped in, placing both into conservatorship under the Federal Housing Finance Agency (FHFA) and injecting $191 billion in bailout capital. For all intents and purposes, they were now government-controlled entities, but still operating in limbo, neither fully public nor private.

Post-crisis tug-of-war

Since then, we’ve been stuck in a policy purgatory. Multiple administrations, from Obama to Biden, have looked at exit ramps, wind-downs, recaps, releases. The first Trump administration likewise made an effort to end the conservatorship, but nothing materialized. Courts, Congress and capital markets have all posed obstacles.

Why? Because it’s not just about ideology. It’s about market stability and housing affordability. The GSEs are deeply embedded in everything from 30-year fixed mortgages to MBS issuance to affordable housing mandates.

2025: Reprivatization returns to the fore

Now in 2025, with Trump back in the White House, there’s renewed talk about privatizing Fannie and Freddie. The market should take this seriously, not because it’ll happen tomorrow but because even the prospect introduces volatility into MBS spreads, housing policy and credit availability.

It’s also going to raise questions:

- What does privatization mean in practice?

- How do we price risk if the government backstop goes away?

- Who steps in to ensure affordable 30-year fixed-rate mortgages if the GSEs pull back?

- What would a restructuring of the mortgage market mean for US homebuilders?

Bottom Line

From a market structure standpoint, Fannie and Freddie represent the most consequential unresolved reform of the post-Global Financial Crisis era. Any move toward privatization isn’t just about political will, it’s about systemic risk, investor confidence and access to credit in the world’s largest housing market.

This isn’t just a policy footnote. It’s a core macro issue, and markets will notice.

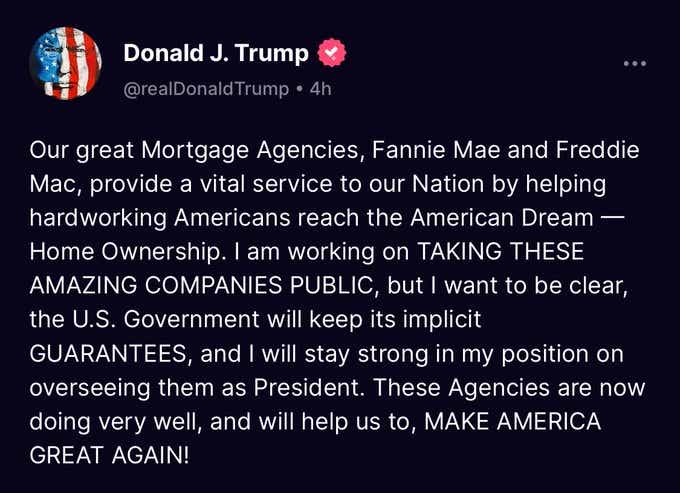

Has President Trump addressed one of the key issues regarding privatization? In a Truth Social post on Wednesday, May 28, the president reiterated his desire to bring Fannie Mae and Freddie Mac public while drawing particular attention to the U.S. government's role as their unofficial backstop. If the U.S. government remains as the implicit guarantor of last resort, then it's more of the same: privatized gains, socialized losses.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices