From Forums to Digital Gold: Reddit’s AI-Driven Breakout

From Forums to Digital Gold: Reddit’s AI-Driven Breakout

Reddit is turning online conversations into cash—and the market is pricing it like an AI heavyweight.

Reddit is transforming from a forum-based social hub into a strategic player in performance advertising, AI data licensing and search—leveraging its base of authentic, high-intent user conversations.

In Q2, the company posted its strongest revenue beat since it went public, with sales up 78%, ARPU accelerating and guidance that underscored a durable growth trajectory.

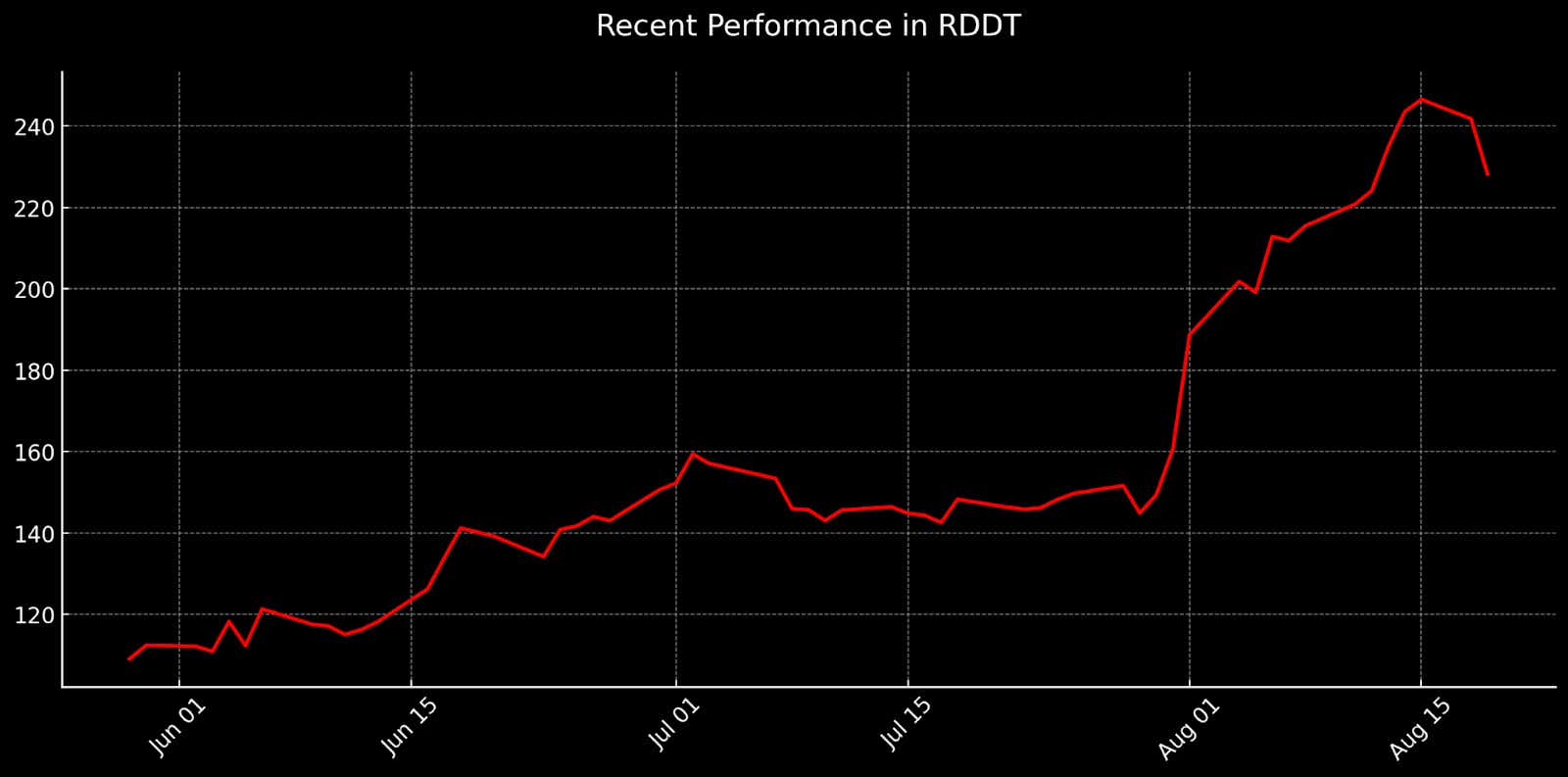

Shares have surged nearly 300% over the past year, leaving valuation stretched, but its unique positioning in the AI ecosystem lends support to the premium—while more risk-averse investors might gravitate toward AI-adjacent names like Qualcomm or Applied Materials.

It doesn’t run ads for others, or build AI models itself, but Reddit (RDDT) powers both. As the internet’s largest network of user-driven communities, it’s become a go-to destination for advertisers seeking high-intent audiences and AI companies training the next generation of models. Now, with engagement surging, ad performance improving and data licensing gaining momentum, Reddit is broadening its reach well beyond its “front page” roots.

That momentum is reflected in the stock—up 30% year-to-date and nearly 300% over the past 12 months. Today, we unpack the company’s latest quarter—which delivered its biggest top-line beat since going public—and examine whether that premium valuation still holds water after such a remarkable run.

Reddit’s transformation into an advertising and AI powerhouse

Reddit may have earned its reputation as the internet’s “front page,” but in 2025 it’s becoming something more: a must-have for advertisers, a goldmine for AI companies, and a rising player in internet search. Built on a network of user-run communities, Reddit thrives on authentic, real-time conversations—now a rarity in the age of curated feeds and algorithm-driven content. That authenticity has become its edge, drawing both advertisers seeking high-intent audiences and AI developers hungry for human-generated data.

While platforms like Meta (META) and TikTok dominate in reach and entertainment, Reddit occupies a distinct niche—blending the engagement of a social network with the depth and utility of a search engine. Its sprawling network of topic-specific forums (subreddits) functions as a living archive of consumer sentiment, product feedback and advice. It’s a space where brands can connect with users mid–purchase journey, and where AI firms can license structured, high-signal conversation data to train and refine large language models.

Over the past year, Reddit has sharpened its focus, pivoting from the user economy toward three high-impact priorities: becoming a go-to search destination, expanding globally, and strengthening its core advertising platform. The payoff is already visible. Core search now services about 70 million weekly users, while Reddit Answers—its AI-powered conversational search—has surged from 1 million to 6 million users in just one quarter. Meanwhile, machine translation now supports 23 languages, paving the way for a broader international presence.

For advertisers, Reddit is converting its conversational depth into measurable ROI. New Dynamic Product Ads are driving about twice the sales per dollar versus standard conversion formats. The Conversation Summary tool is lifting click-through rates by more than 10%, while a Smartly.io integration streamlines campaign management. These aren’t just inventory upgrades—they’re designed to support premium pricing and push average revenue per user higher, a metric that has risen sharply in recent quarters.

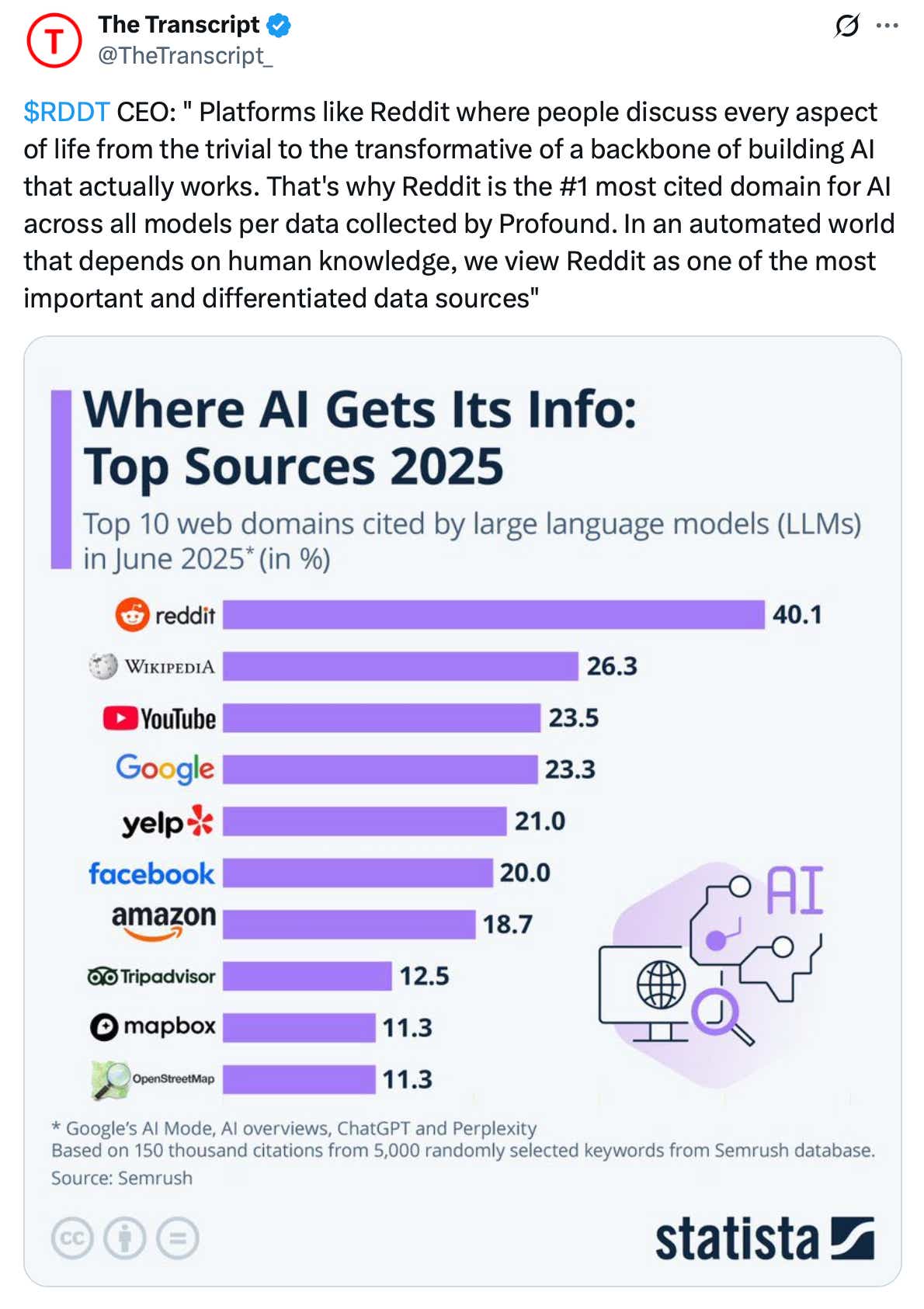

However, one of the most significant developments is Reddit’s rise as the most-cited domain in AI model training (illustrated below). In a world where generative AI depends on rich, real-world language, Reddit’s vast, constantly updated archive of discussions has become essential infrastructure. Data licensing—once an experimental revenue stream—is scaling rapidly, generating $35 million last quarter and offering the potential for durable, high-margin growth. For AI developers, Reddit isn’t just another dataset; it’s a living, structured map of human knowledge and sentiment.

That mix—authentic content, accelerating global reach and proprietary data coveted by the AI industry—puts Reddit in a league few rivals can match. It’s no longer just a social platform vying for ad dollars; it’s embedding itself in multiple high-growth markets at once. With its strategic pivots already showing results, the company is now focused on turning that momentum into a durable, long-term growth engine.

A blowout quarter that reinforced the bull case

If there were any lingering doubts about Reddit’s growth story, the Q2 results erased them. After the July 31 report, shares surged more than 40%, including an 18% pop the day after earnings. It wasn’t just a beat—it was the biggest top-line surprise in Reddit’s short history as a public company.

Last quarter, revenue climbed 78% year-over-year to $500 million—a full 17% ahead of Wall Street expectations. Advertising, which still makes up the bulk of Reddit’s business, jumped 84% from last year, fueled by the rapid adoption of Dynamic Product Ads and higher returns for advertisers. “Other revenue”—driven largely by data licensing—rose 24% to $35 million, underscoring the growing relevance of Reddit’s AI-era content moat. On top of that, GAAP earnings came in at $0.45 per share, more than doubling consensus estimates, while net income hit $89 million as compared to a loss of $10 million in the same period last year.

Forward guidance only reinforces the bullish narrative. For Q3, management projects revenue of $535–$545 million—about 14% above analyst expectations—and adjusted EBITDA of $185–$195 million, well ahead of forecasts. That points to continued margin expansion, with operating margin swinging to 13.6% from negative territory a year ago. User growth was equally strong: global daily active users climbed 21% to 110.4 million, while average revenue per user jumped 47% to $4.53. U.S. sales hit $409 million, smashing estimates, and international revenue inched up to $91 million.

Beneath the headline figures, management’s commentary reinforced the strategic shifts already underway. CEO Steve Huffman credited the acceleration to product improvements in AI-powered search, a sharper focus on advertiser tools, and early wins from international expansion. The Reddit Answers feature—central to the company’s search strategy—now counts 6 million weekly users, up from 1 million last quarter, and will be integrated more deeply into the core experience. On the ad side, tools like Conversation Summary and AI-powered analytics are driving double-digit improvements in click-through rates, giving Reddit more pricing power.

Despite the above positives, the quarter wasn’t without headwinds. Huffman acknowledged that Google’s ongoing experiments with AI-powered search features have been a variable factor in referral traffic. But he also noted that “Reddit” remains one of the most searched-for terms on Google, and the company is working to shift more discovery directly onto its platform. That strategic pivot—from relying on outside search to owning the search experience—could be critical in sustaining engagement as the broader search ecosystem evolves.

Taken together, Q2 confirmed that Reddit is making progress on multiple fronts—accelerating user growth, sharpening monetization, and building a high-margin revenue stream in data licensing. Forward guidance points to momentum gaining pace, with the numbers supporting the view that Reddit’s strategic repositioning is translating into real financial leverage.

Richly valued, with AI potential in the driver’s seat

On traditional metrics, Reddit’s valuation is steep. The stock trades at a GAAP trailing P/E of roughly 194—nearly nine times the sector median of about 21. Its price-to-sales ratio is 24 versus a sector median of 1.3, and its price-to-book is 18 compared with the industry’s 2.0. Trading around $220 per share, Reddit sits above the average analyst target of $200, with 18 of the 29 analysts covering the stock rating it “buy” or “overweight.”

Those multiples reflect two key dynamics. First, Reddit is still in the early stages of scaling monetization, with modest profits relative to its sizable addressable market. Second, it’s carving out a distinctive position in the AI economy—serving as both a high-intent advertising platform and a source of proprietary, continuously refreshed conversational data for model developers. In a market willing to pay up for credible AI exposure, Reddit’s scarcity value in that niche has fueled a pronounced upward rerating of the shares.

Whether those elevated multiples are sustainable depends on execution and the durability of the AI narrative. The bullish case rests on Reddit maintaining 20%-plus user growth, continuing to push ARPU higher through premium ad formats and rapidly expanding its high-margin data licensing revenue. If those trends hold, today’s valuation will appear less stretched over time—especially if revenue growth maintains the recent pace.

The bear case is simple: if AI enthusiasm cools or adoption slows, Reddit—whose premium rests heavily on that single theme—could face sharp multiple compression. A move back toward sector-average valuations would likely align the stock with more cautious growth forecasts. That risk is hard to ignore after a rally that’s carried shares well beyond consensus price targets.

For now, investors seem willing to pay up for scarcity, momentum and optionality. Reddit isn’t valued like a traditional social platform—it’s priced like an emerging infrastructure play in the AI economy. That lens helps explain the premium, but it also leaves less margin for error should the growth narrative falter.

Investment takeaways

Reddit’s second-quarter performance didn’t just beat expectations—it reset them. The company is showing it can rapidly grow users, turn engagement into higher-value ad formats, and scale a high-margin data licensing business, all while sharpening its focus on search, AI integration and global expansion. That positions Reddit squarely at the intersection of two of tech’s most coveted growth themes: performance advertising and AI infrastructure.

Still, the stock’s current valuation leaves little room for missteps. At roughly 200 times trailing earnings and well above the average analyst price target, Reddit is valued as if the latest momentum will not only continue, but accelerate. That may be warranted if user growth holds north of 20% and ARPU keeps expanding at double-digit rates, particularly with AI-driven products still ramping. But if AI sentiment cools—or if Reddit’s monetization cadence slows—the market could quickly re-rate the stock toward more conventional multiples.

For investors looking to tap into AI’s growth curve, Reddit offers a rare and differentiated asset—but one with risks that match its premium valuation. Those seeking AI-adjacent upside at a more reasonable multiple might consider Qualcomm (QCOM), which is integrating AI at the device level and trades at a fraction of Reddit’s earnings multiple. In either case, execution will be key, though QCOM likely offers more cushion if the AI growth narrative loses steam.

Andrew Prochnow has traded the global financial markets for more than 15 years, including 10 years as a professional options trader.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices