Alphabet Earnings Preview — Will AI Search Affect the Bottom Line?

Alphabet Earnings Preview — Will AI Search Affect the Bottom Line?

By:Mike Butler

AI search results are going to be a major talking point over the next few quarters

- Alphabet (GOOGL) will report quarterly earnings on Wednesday after the market closes.

- The company is expected to announce earnings-per-share of $2.14 on $79.19 billion in revenue.

- The stock has recovered from lows, but turbulence still remains as uncertainty looms

Alphabet (GOOGL) is set to announce quarterly earnings after the market closes on Wednesday, and investors expect decent numbers for the quarter. The company is expected to report earnings-per-share (EPS) of $2.14 on $79.19 billion in revenue. Both of these figures are over 10% higher than last year's results. While earnings are expected to come in strong, the threat of AI and how people are searching the internet these days could be cause for concern for short-term traders and long-term investors alike. Can the company withstand and adapt to the rise in AI searches?

GOOGL stock has had a turbulent 2025, currently sitting around $190 per share after crashing to a low of $140.53 from the high of $207.05. We've seen a strong rebound from the tariff frenzy lows, and the stock now sits right where it opened the trading year.

Still, there are questions to be answered as many internet users now look to AI solutions for common and complex questions. Perhaps users are more prone to use an AI solution simply because they can create images, tables, code on your behalf, and much more. Long gone are the days of simple search results and search engine optimization. Now, AI results are starting to take off and many companies are shifting their focus to show up in AI search results compared to classic links.

Sundar Pichai, Alphabet CEO, offered positive words after a strong Q1 earnings call: “We’re pleased with our strong Q1 results, which reflect healthy growth and momentum across the business. Underpinning this growth is our unique full stack approach to AI. This quarter was super exciting as we rolled out Gemini 2.5, our most intelligent AI model, which is achieving breakthroughs in performance and is an extraordinary foundation for our future innovation. Search saw continued strong growth, boosted by the engagement we’re seeing with features like AI Overviews, which now has 1.5 billion users per month. Driven by YouTube and Google One, we surpassed 270 million paid subscriptions. And Cloud grew rapidly with significant demand for our solutions."

Clearly, Google is still a behemoth and it will take a lot to lose a large chunk of market share. Google search results do feature AI Overviews first now, which gives Google an AI feel with simple search queries. Still, it's not comparable to the ability of other AI offerings, and we'll have to see if there is commentary on the topic on Wednesday.

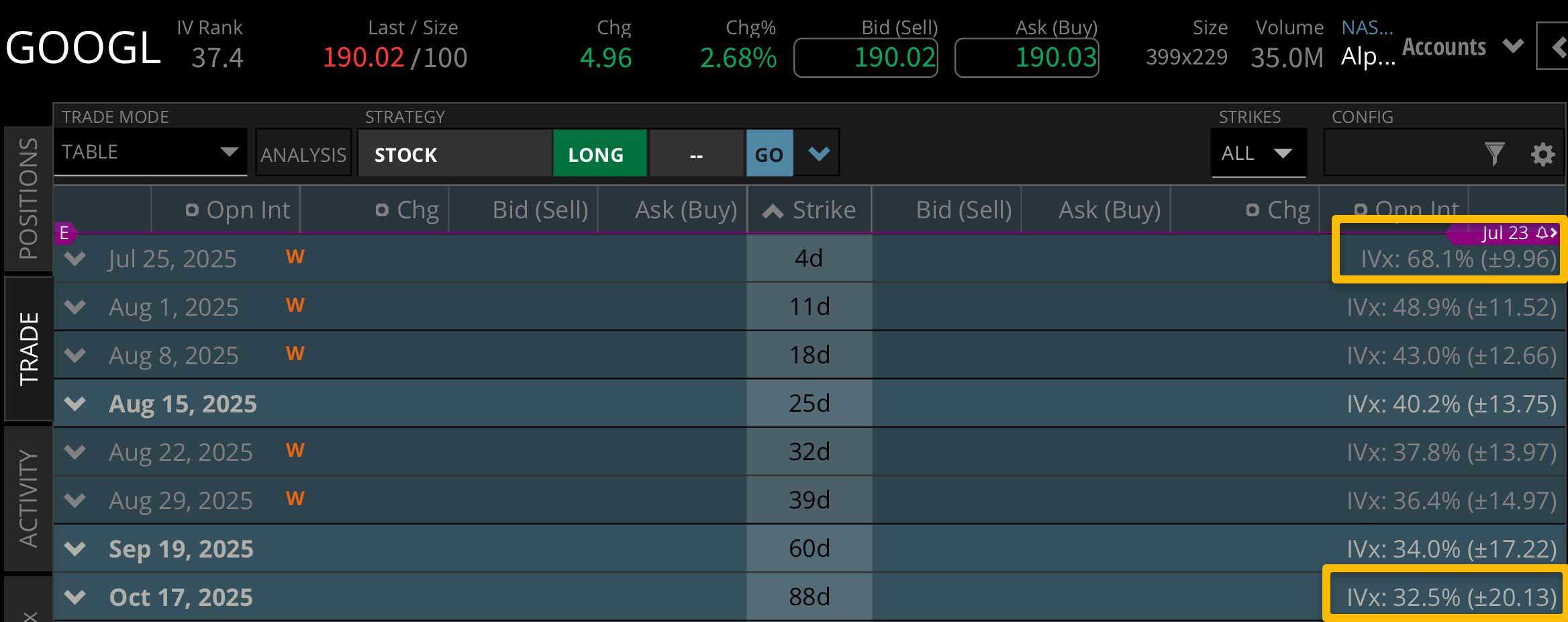

Opinions aside, we can always look at the implied volatility of the options market to determine market sentiment ahead of the earnings call/. As it stands, we're seeing a +- $10 expected stock price range for the earnings call this week. This is about 5% of the notional value of the stock price, which puts Google earnings on the lower end of the range for tech earnings this quarter.

With that said, we're still only seeing an expected stock price range of +/- $20 for October's option cycle, which is 88 days away. In other words, this week's implied volatility for the earnings call accounts for half of the implied volatility for the next few months. Implied volatility may be low, but it's certainly concentrated around this earnings call.

Bullish on Alphabet stock for earnings

If you're bullish on Alphbet stock for earnings, you're looking for a strong earnings report from an EPS and revenue perspective. You're also looking for executives to front-run AI concerns with a solid plan to integrate more AI-centric results and features into the main google search interface. The fact that the general market is calm helps quell the fears of investors, but Google really needs to post strong numbers if we're expecting for the rally to continue.

Bearish on Alphabet stock for earnings

If you're bearish on Alphabet stock for earnings, you're looking for a miss in the EPS and revenue departments. You're also looking for a slowdown in growth or sentiment from executives, and more turbulence on the lawsuit front. It seems the company is in the headlines for the wrong reasons these days, and any new report or update from current investigations could send investors fleeing, given the positives we're seeing for many other tech stocks.

Tune in to Options Trading Concepts Live at 11 a.m. CDT on Wednesday ahead of GOOGL earnings for some in-depth options trading strategy ideas.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices