Everything You Need to Know About Trading Options in GME & AMC

Everything You Need to Know About Trading Options in GME & AMC

By:Mike Butler

But regardless of strategy, be careful in the world of meme stocks

GameStop and AMC stock prices realized massive gains yesterday.

Roaring Kitty made a return to social media after a long hiatus, which may have sparked a renewed interest in these meme stocks.

When trading options in GME and AMC, it's important to understand how they can behave differently in volatile times compared to other equities and ETFs.

GameStop and AMC trading—recent stock performance

In a shock to many, Roaring Kitty made a social media comeback yesterday, posting a flurry of cryptic movie clips. In response, traders sent activity skyrocketing in GameStop (GME) and AMC Entertainment (AMC) products.

On Friday, May 9, GameStop had closed at $17.46 per share, and AMC closed at $2.91 per share.

On Monday May 13, GME stock reached a high of $38.20 per share and AMC stock reached a high of $5.88 per share.

On Tuesday May 14, GME stock reached a high of $64.83 per share and AMC stock reached a high of $11.88 per share.

WOW! Are meme stocks back?

At least for the time being, I'd say so! Trading activity and, most importantly, implied volatility, have increased substantially in these two products, and anyone paying even the slightest attention to the stock market knows it.

IV Rank helps us put context around changes in implied volatility (IV) over the course of 52 weeks. IV Rank is a calculation that takes the current IV reading and weighs that figure against the low and high IV range over the past year. If IV Rank is 50, that means the current implied volatility is right in the middle of the range it has been in over the course of a year.

Looking at AMC and GME IV Rank, we can see that both are well over 100. That tells us the current IV we're seeing today is setting a new implied volatility range to the upside, and it's not particularly close to the previous high.

With these two products, and most meme stocks for that matter, huge movements to the upside paired with a massive IV spike can usually be tied to some degree of a short squeeze. Just like volatility products, these moves do not typically sustain, and products come back down to earth at some point. But until that happens, expect to see some fireworks!

Both GME and AMC have had intra-day trading ranges today that FAR EXCEED the closing stock price for each product last week. Wild times!

What is a short squeeze in options trading?

If you paid attention to GameStop and AMC during meme stock mania in 2021, you may have heard the term "short squeeze" or "gamma squeeze.”

A short squeeze refers to heavily shorted stocks, generally by larger hedge funds, that are betting against the success of such companies. AMC and GameStop were prime targets many years ago, with little interest from retail traders, and struggling businesses at the core.

If these stocks see an uptick in price, however, it puts pressure on short stock positions that may be seeing losses to the upside. Add a dash of leverage, and you have a scenario where hedge funds may be forced to close positions to limit risk and free up capital.

How do you close a short stock position? You buy it back...

This is how a short squeeze happens. There’s massive short-position buying stock to cover, resulting in immense upside pressure in the stock price.

This phenomenon explains a lot in regard to implied volatility changes, liquidity infusions and much more.

If you're trading options in GME and AMC stock around these volatile times, there are things you need to understand to navigate the markets intelligently.

Trading options in GME and AMC stock

Trading options (or stock) in GME and AMC is not for the faint of heart. Prices fly around and, and they gap up and down when the options market is closed. There are frequently trading halts intra-day when massive moves are realized. On top of that, the bid-ask spreads for options that have a lot of activity can still be wide and difficult to navigate.

These are my rules for trading GME and AMC options:

1) I keep my risk defined

These stocks can go nuts, and I don't want to be on the unlimited risk side of a short squeeze - for that reason, I'm always in a defined risk trade in these products, and I usually play them to the upside. If a stock has 200% IV, that tells you that the market is pricing in a 2x move in the stock price, but stocks can only go to zero. That means there is more perceived "risk" to the upside, at least when it comes to a high-velocity move.

2) I prefer diagonal and calendar spreads

Diagonal spreads and calendar spreads are my preferred strategies when there is a large unknown factor, and implied volatility is skewed into the near-term options expiration cycles. This is no different than an earnings trade setup, where a company announces their quarterly earnings and the stock price reacts (sometimes wildly).

Long diagonal and calendar spreads have a long option that is pushed out in time, and a short option that is usually in the weekly or near-term cycle. In the case of GME and AMC, this means slightly lower implied volatility exposure in the long option and almost pure implied volatility exposure in the short option.

The idea behind these strategies is to maintain or build value in the long option and collect all of the extrinsic value in the short option quickly. The implied volatility environments in GME and AMC play into a strong cost basis reduction with strategies like these, with massive IV in the weekly cycle relative to the longer-term cycles.

Also, when these stock prices rip higher, implied volatility tends to increase, and when they sell off implied volatility tends to decrease, which is another reason I like playing these stocks to the upside—if the stock price increases and IV increases, that's good for the overall value of the long call option in a diagonal spread for example:

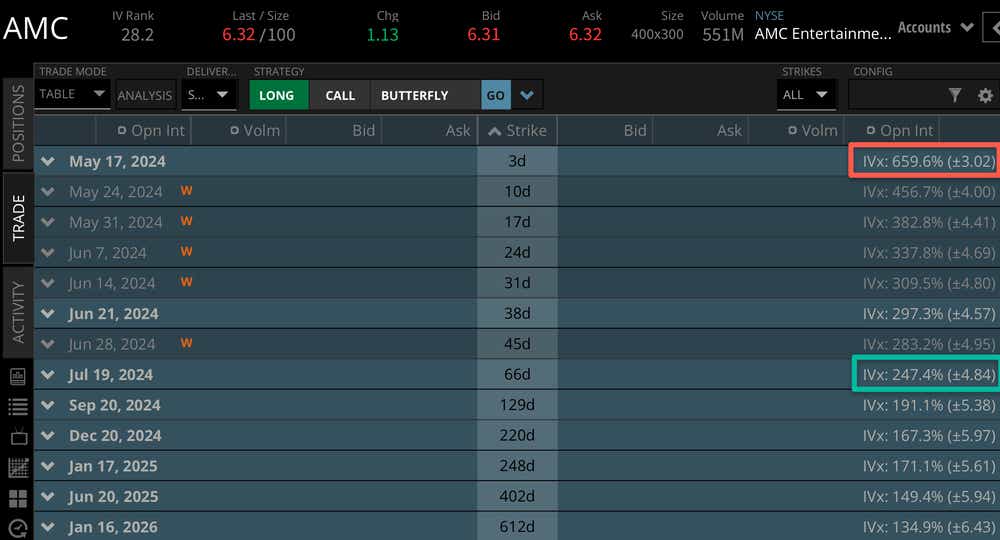

AMC Implied Volatility Structure:

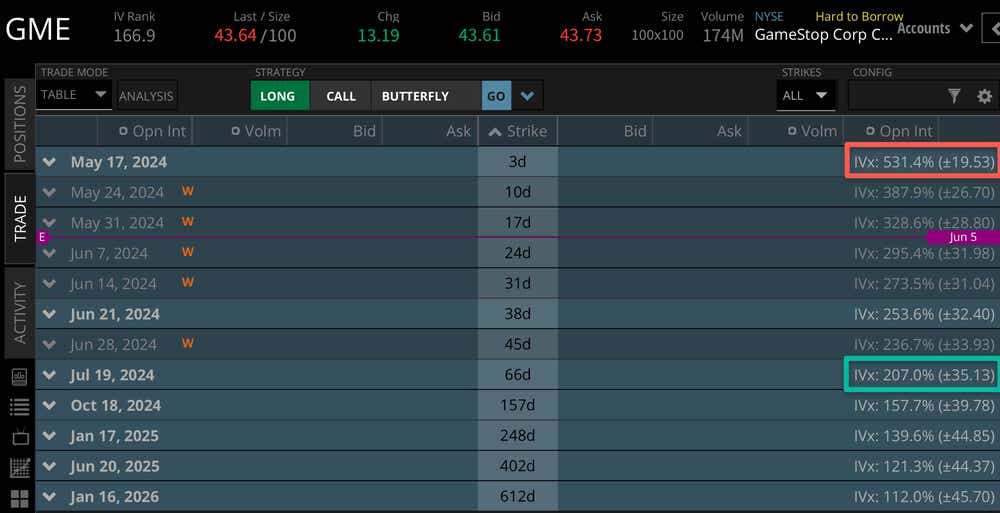

GME Implied Volatility Structure:

As you can see in these images, the expected stock price move and implied volatility for the May 17 options cycles are extremely high relative to the July 19 options cycle. This means options prices are just a bit less expensive in the three-day cycle relative to the 66-day cycle, and there is a clear disparity between the time left to expiration. In other words, selling an option in the weekly cycle against a long-term option will yield a large cost basis reduction on the long option.

3) I intend to have a short-term trade even with long-term options

Similar to volatility products, meme stock movements don't tend to stick around for very long. There's nothing that says they cannot, but historically speaking we see quick pops and quick drops in the stock price. Unlike a regular earnings event, where you might see a stock price skyrocket and sustain the new high price, or drop like a rock and never return back to highs. With this said, I look for quick profits and quick exits day to day or week to week, but these positions are not ones I intent to hold for the long-run.

4) I understand bid-ask spreads may widen, so price discovery is important

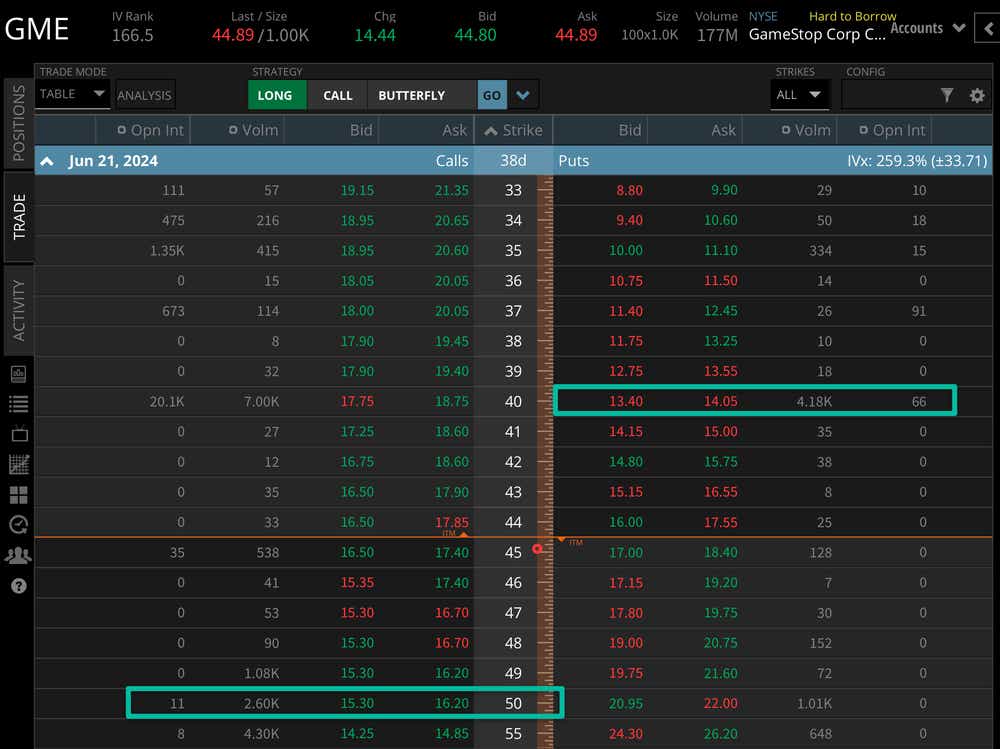

Looking at GME and AMC options, we can see that markets are pretty wide relative to the stock price, and options activity is generally higher at "round number" strike prices like 40, 45, 50, etc.

Here's a look at the June options expiration in GME:

Multi-leg options strategies further emphasize bid-ask spread widths, so it's important to be mindful of this when entering and exiting trades. I don't use market orders in this environment, as this can result in a poor fill price on entry and exit. Instead, I use a price discovery tactic where I start at the mid price or better, and work my way closer to the natural price slowly. For example, I might try to buy a calendar spread for $1.00,and work it to $1.05, $1.10, etc. until the trade is filled.

Regardless of strategy, be careful in the world of meme stocks. Tune in to Options Trading Concepts Live for a look at these stocks as they move around each day this week!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices