Micron (MU) Stock: What to Expect from Q2 Earnings?

Micron (MU) Stock: What to Expect from Q2 Earnings?

Micron Technology (MU) is set to report Q2 2022 earnings next Tuesday (March 29th) after the market close. Traders can expect to see MU shares moving in the after-hours session that afternoon.

Micron Technology is one of the largest semiconductor firms in the world, with a current market capitalization of $86 billion. MU holds the 35th spot in the Nasdaq 100 slot, behind Advanced Micro Device in the 18th slot at a $192 billion market cap, and Nvidia (NVDA) which boasts a $691 billion market cap and is the 7th largest Nasdaq company.

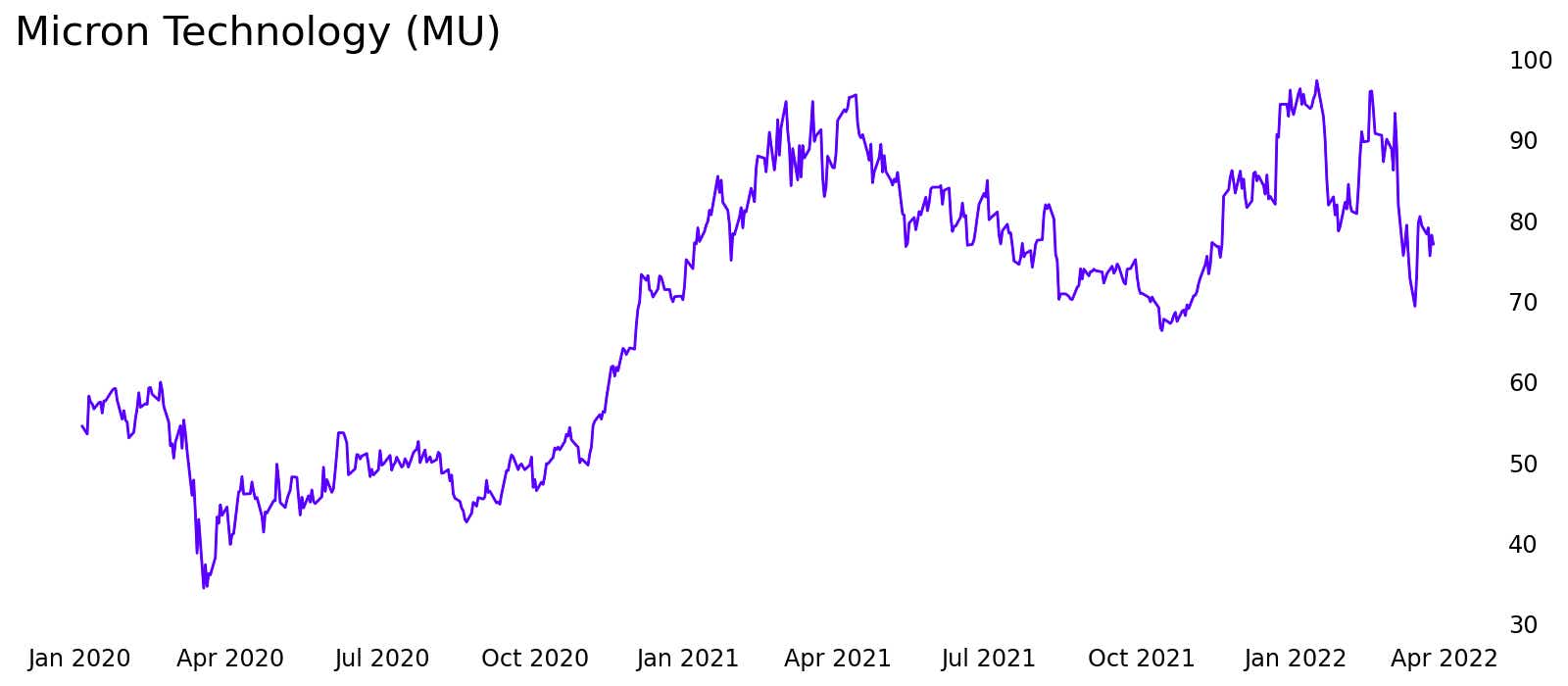

After the initial pandemic slump, MU participated in the technology rally of late 2020 and early 2021. Though things turned around and the stock fell again for much of 2021 before another surge that commenced in October 2021 and lasted until January. On January 5th MU hit an all-time high of $98.45 before selling off, trying to recover, and then dropping again. The selloffs this year were multi-pronged and are a common story among technology stocks.

A shift to a higher interest rate environment in 2022 and 2023 means that technology companies that relied on cheap debt to fuel new projects and growth will see their borrowing costs increase. Additionally, MU will continue to feel the force of broader moves in equities, much of which right now are dictated by fears around the war in Ukraine.

Micron Stock: 12 Month Performance Lags Behind Competitors, Where Next?

Year to date, Micron is underperforming other semiconductor stocks as well as the overall technology sector and Nasdaq 100. Longer term investors who held Micron for multiple years are still seeing positive terms, but recent buyers are likely in desperate need of a rally at this point.

Micron Stock Fundamental Analysis

Despite the supply chain constraints that hampered semiconductor makers ability to get products in customers’ hands, Micron’s recent revenue and earnings per share growth was strong. Year over year revenue grew by 89% and 105% for Q4 2021 and Q2 2022, respectively.

The operating profit also saw substantial growth, meaning the revenue has grown with limited additional costs associated with increased sales. Operating profit for Q1 2020 was $514 million, growing to $866 million last year and $2.6 billion this prior quarter.

Earnings per share for Q1 2022 was $2.04, a 187% increase from last year and a 370% increase compared to Q1 2020. MU also trades at a much lower price to earnings (PE) ratio compared to both Nvidia and AMD. MU has a current PE ratio of 11, versus 50 for Nvidia and 40 for AMD.

Micron (MU) Stock Price Outlook: What to Expect from Q2 Earnings

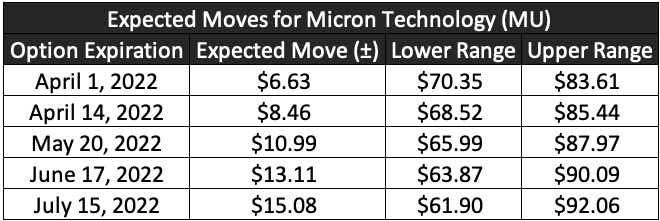

While bullish traders and investors naturally hope the earnings announcement pushes MU shares back towards that $98 high, there is a wide range of possible movement for MU in the coming weeks and months:

Given the current options pricing the markets indicate a there is a possibility of MU reaching making new highs over the next few months. There is a 27% chance of MU touching $100 by July expiration and a 34% chance of MU reaching $100 by September expiration (September 16).

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices