Nasdaq 100 Drop Won’t Stop as Tech Earnings and Eco Data Weigh on Sentiment

Nasdaq 100 Drop Won’t Stop as Tech Earnings and Eco Data Weigh on Sentiment

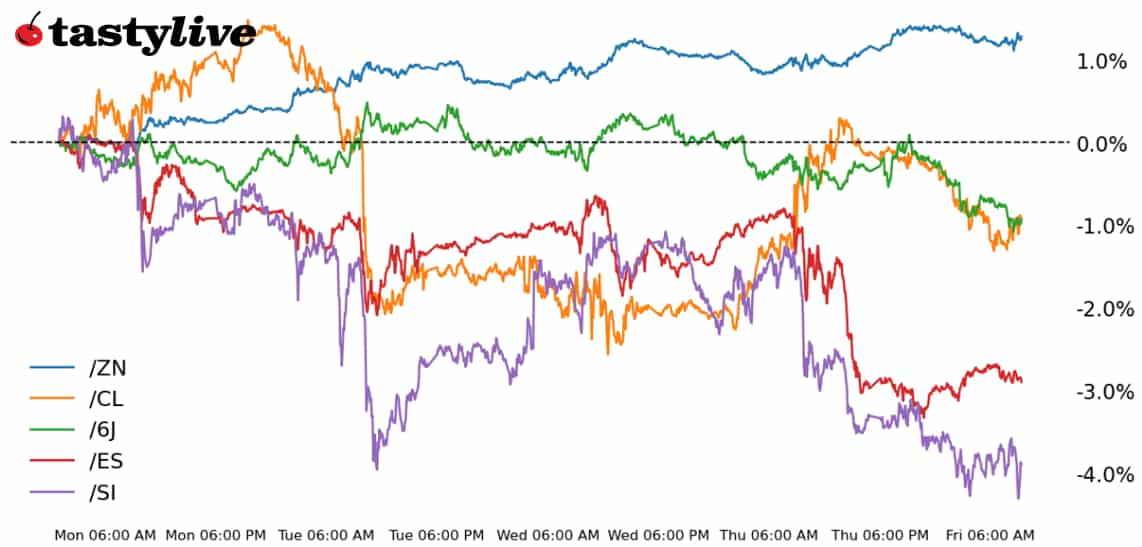

10-year T-note, gold, crude oil and euro futures

- Nasdaq 100 E-mini futures (/NQ): -1.99%

- 10-year T-note futures (/ZN): -0.06%

- Gold futures (/GC): -0.71%

- Crude oil futures (/CL): +0.72%

- Euro futures (/6E): +0.35%

Disappointing tech earnings and more confusion over the timing and impact of Trump’s tariffs have markets zig-zagging today. U.S. equity markets have started to move off their lows after Commerce Secretary Howard Lutnick said goods covered under the USMCA trade deal will be exempted from the tariffs, adding a new contour to the defining trading narrative. The on-again, off-again nature of the tariff announcements is doing no favors for the U.S. dollar, which is pacing for its worst weekly loss since October 2022.

Symbol: Equities | Daily Change |

/ESH5 | -1.56% |

/NQH5 | -1.99% |

/RTYH5 | -1.85% |

/YMH5 | -1.27% |

The consequences of the new administration’s job cuts became evident this morning with the latest data on initial jobless claims. That is spooking the market ahead of tomorrow’s jobs report. Nasdaq 100 futures (/NQH5) fell nearly 2% in early trading, reversing the bulk of yesterday’s gains. The trend for the market is clearly lower as concerns about growth consume any lingering bullish sentiments. Market observers see the consequences of tariffs as a negative, and the uncertainty is driving volatility higher, causing investors to flee from stocks. Marvell Technology (MRVL) fell 20% after the company disappointed the market with its guidance. Chip makers as a group fell, reflected by a 3% down move in the VanEck Semiconductor ETF (SMH) alongside news that Alibaba (BABA) revealed a new AI model that is on par with DeepSeek R1.

Strategy: (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18300 p Short 18600 p Short 22250 c Long 22500 c | 66% | +1475 | -4525 |

Short Strangle | Short 18600 p Short 22250 c | 73% | +6845 | x |

Short Put Vertical | Long 18300 p Short 18600 p | 86% | +790 | -5210 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.04% |

/ZFM5 | -0.01% |

/ZNM5 | -0.06% |

/ZBM5 | -0.29% |

/UBM5 | -0.41% |

The 10-year T-note futures (/ZNM5) fell slightly this morning as borrowing costs in Europe continued to rise on the back of a plan from Germany that will boost defense and infrastructure spending. Meanwhile, bond traders continue to mull over the details of tariffs, which could put inflation pressures back into the economy. The uncertainty around the intent of the U.S. administration has kept market participants on their toes, and U.S. Treasury Secretary Scott Bessent will speak today.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 108.5 p Short 112.5 c Long 114 c | 64% | +486.75 | -1031.25 |

Short Strangle | Short 108.5 p Short 112.5 c | 70% | +781.25 | x |

Short Put Vertical | Long 107 p Short 108.5 p | 89% | +203.13 | -1296.88 |

Symbol: Metals | Daily Change |

/GCJ5 | -0.71% |

/SIK5 | +0.03% |

/HGK5 | +0.17% |

Gold is facing some headwinds as Treasury yields and borrowing costs abroad rise. The metal is ripe for profit taking as it hovers just below its recent all-time highs. Gold futures (/GCJ5) trimmed earlier losses in early New York trading but remained negative through the first hour of the Wall Street cash session. Gold’s fundamentals remain bullish, but the metal requires a catalyst to clear levels just below the psychologically imposing 3,000 level. Tomorrow’s jobs report could be one possible trigger for the metal to find a new direction. Meanwhile, copper prices (/HGK5) continued to see bids after a positive overnight session in Chinese equities.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2750 p Short 2765 p Short 3110 c Long 3125 c | 65% | +420 | -1080 |

Short Strangle | Short 2765 p Short 3110 c | 73% | +3380 | x |

Short Put Vertical | Long 2750 p Short 2765 p | 87% | +180 | -1320 |

Symbol: Energy | Daily Change |

/CLJ5 | +0.72% |

/HOJ5 | +0.82% |

/NGJ5 | -2.09% |

/RBJ5 | -0.17% |

Crude oil futures (/CLJ5) rose about 0.72% this morning as the market digested news from the U.S. about plans to reduce the flow of Iranian oil by inspecting oil tankers from the country, according to a report from Reuters. President Trump has vowed to take a maximum pressure approach against the Middle Eastern nation. The move comes after the U.S. imposed additional sanctions on Iranian oil just a couple of months ago, targeting Iran’s shadow tanker fleet that sails without the required insurance and licensing from Western nations.

Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 59.5 p Short 61 p Short 74 c Short 75.5 c | 66% | +390 | -1110 |

Short Strangle | Short 61 p Short 74 c | 73% | +1430 | x |

Short Put Vertical | Long 59.5 p Short 61 p | 80% | +240 | -1260 |

Symbol: FX | Daily Change |

/6AH5 | -0.02% |

/6BH5 | -0.02% |

/6CH5 | -0.07% |

/6EH5 | +0.35% |

/6JH5 | +0.8% |

As widely expected, the European Central Bank (ECB) cut rates by 25 basis points (bps) today, and it likewise delivered relatively staid economic projections. But the ECB has a history of ignoring fiscal policy intentions until pen hits paper, so the recent news of the German fiscal spigot opening isn’t part of the forecasts. To that end, the dramatic shift in near-term growth expectations—higher in Europe, lower in the U.S.—continues to drive the dramatic collapse in the U.S. dollar, now on pace for its worst week since October 2022.

Strategy (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.04 p Short 1.055 p Short 1.115 c Long 1.13 c | 64% | +537.50 | -1337.50 |

Short Strangle | Short 1.055 p Short 1.115 c | 71% | +1237.50 | x |

Short Put Vertical | Long 1.04 p Short 1.055 p | 90% | +212.50 | -1662.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices