Nasdaq 100 Slides and Gold Jumps as US-China Talks Deteriorate and Ukraine Hits Russia

Nasdaq 100 Slides and Gold Jumps as US-China Talks Deteriorate and Ukraine Hits Russia

Also, 30-year T-bond, gold, crude oil and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): -0.49%

- 30-year T-bond futures (/ZB): -0.39%

- Gold futures (/GC): +1.97%

- Crude oil futures (/CL): +5.03%

- Japanese yen futures (/6J): +0.68%

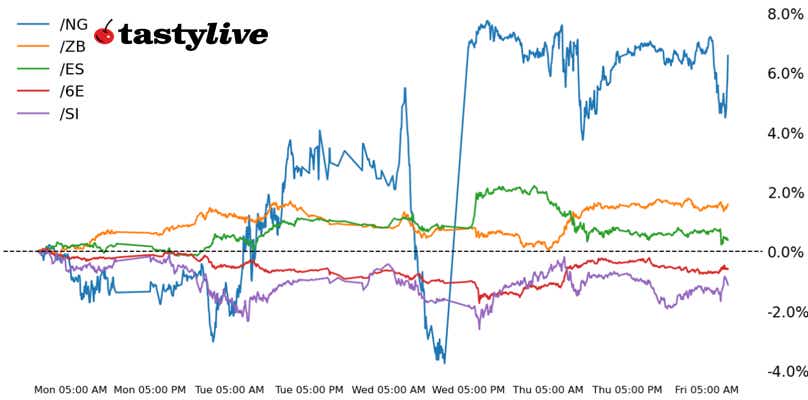

A weekend of bold headlines has given way to a tumultuous market today. Both China and the US have traded barbs in recent days, each side accusing the other of breaching the terms of the mid-May trade détente achieved in Geneva. In a sense, “Sell America” is back in vogue, with stocks, bonds and the US dollar dropping, while gold rallies. But the movements in the commodity sector are likely tied to headline events in Eastern Europe: A Ukrainian drone attack against multiple Russian airbases on Sunday, alongside the election of a less pro-EU president in Poland, has upended public perception around the course of the war in Ukraine.

Symbol: Equities | Daily Change |

/ESM5 | -0.3% |

/NQM5 | -0.49% |

/RTYM5 | +0.02% |

/YMM5 | -0.27% |

Technology stocks managed to get a lift this morning despite setbacks to trade that weighed investors’ confidence over the weekend. Nasdaq 100 futures (/NQM5) rose 0.27% after the opening bell. DraftKings (DKNG) fell over 5% after Illinois passed a tax hike on sports betting. Moderna (MRNA) rose 3% after the Food and Drug Administration (FDA) approved a next-generation vaccine for COVID. Sanofi (SNY) will acquire Blueprint Medicines (BPMC), which saw the stock price for the latter jump 26% in early trading.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 19500 p Short 19750 p Short 23000 c Long 23250 c | 64% | +1155 | -3845 |

Short Strangle | Short 19750 p Short 23000 c | 70% | +5675 | x |

Short Put Vertical | Long 19500 p Short 19750 p | 85% | +575 | -4425 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.26% |

/ZFM5 | +0.02% |

/ZNM5 | -0.14% |

/ZBM5 | -0.39% |

/UBM5 | -0.7% |

After posting a losing month for May, Treasuries fell to start June trading. The long end of the curve saw yields outpace to the upside, with 30-year T-bond futures (/ZBM5) trimming nearly half a percent in early NY trading. Unpredictable policies around trade and the tax and spending package working its way through Congress have bond traders in an uncertain position. Notably, it will be a light week for Treasury auctions.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105 p Short 106 p Short 117 c Long 118 c | 63% | +250 | -750 |

Short Strangle | Short 106 p Short 117 c | 70% | +1109.38 | x |

Short Put Vertical | Long 105 p Short 106 p | 88% | +109.38 | -890.63 |

Symbol: Metals | Daily Change |

/GCQ5 | +1.97% |

/SIN5 | +3.15% |

/HGN5 | +4.86% |

It’s a good start to the week for metals, which are up across the board following the weekend’s headlines about the Russia-Ukraine war and the US-China trade talks breakdown. Copper prices (/HGN5) are having the most impressive session, pacing up nearly 5%. But our attention remains with gold prices (/GCQ5), which have raced toward 3400 again. Elsewhere, silver prices (/SIN5) have held their uptrend from the April and May swing lows, pushing above 34.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3125 p Short 3150 p Short 3650 c Long 3675 c | 67% | +640 | -1860 |

Short Strangle | Short 3150 p Short 3650 c | 74% | +4210 | x |

Short Put Vertical | Long 3125 p Short 3150 p | 84% | +340 | -2160 |

Symbol: Energy | Daily Change |

/CLN5 | +5.03% |

/HON5 | +3.83% |

/NGN5 | +7.72% |

/RBN5 | +3.47% |

Crude oil (/CLN5) rose over 5% in early trading after OPEC+ decided to raise output for July in their latest meeting. About half of the 411,000 additional barrels in July will be provided by Saudi Arabia, Russia and the United Arab Emirates. Saudi Arabia has recently seen an improvement to its exports, but Russia’s seaborne crude shipments have lagged behind. Weakness for oil throughout Asia may complicate efforts to find buyers for additional barrels. Traders will be watching inventory data due later this week along with this week’s jobs report to help assess the outlook for the commodity.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 54 p Short 56 p Short 72 c Long 74 c | 65% | +460 | -1540 |

Short Strangle | Short 56 p Short 72 c | 71% | +1570 | x |

Short Put Vertical | Long 54 p Short 56 p | 77% | +320 | -1680 |

Symbol: FX | Daily Change |

/6AM5 | +0.64% |

/6BM5 | +0.49% |

/6CM5 | +0.14% |

/6EM5 | +0.51% |

/6JM5 | +0.68% |

“Sell America” is back, with the strongest evidence of the theme coming by way of the Japanese yen (/6JM5): Currencies typically move around interest rate differentials, yet the greenback is not benefiting from higher Treasury yields vs. funding currencies like the yen (or Swiss franc in the spot market). At the current level, the broader US dollar ($DXY) would close at its second lowest level of 2025 if today’s price action holds.

Strategy (67DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0066 p Short 0.0067 p Short 0.0074 c Long 0.0075 c | 66% | +300 | -950 |

Short Strangle | Short 0.0067 p Short 0.0074 c | 72% | +875 | x |

Short Put Vertical | Long 0.0066 p Short 0.0067 p | 88% | +125 | -1125 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.