Nike Earnings Preview—Another EPS Beat Incoming?

.png?format=pjpg&quality=50&width=387&disable=upscale&auto=webp)

Nike Earnings Preview—Another EPS Beat Incoming?

By:Mike Butler

A 7% stock price move is expected after Thursday’s report

Nike is set to report quarterly earnings on Thursday at 3:15 p.m. CDT.

NKE stock is down over 9% in 2024, but the stock is rebounding from lows.

Nike is expected to report an earnings-per-share (EPS) of $0.84 on $12.86 billion in revenue.

Nike has exceeded EPS estimates handily the past three quarters but has had spotty revenue performance from quarter to quarter.

The summer Olympics in July may be a focal point for potential opportunities in Nike sales and marketing.

Nike (NKE) will report earnings on Thursday, and the iconic athletic footwear and apparel company is looking to continue its recent history of earnings-per-share (EPS) beats. The world is looking forward to the 2024 Summer Olympics in Paris next month, and the Nike swoosh will surely be on full display across many events.

Matthew Friend, Nike's executive vice president and chief financial officer, had strong positive remarks during the last earnings announcement.

“Our teams are focused on what matters most to return to strong growth,” he said. “We are taking action to build a faster, more efficient Nike and maximize the impact of our new innovation cycle.”

NKE stock realized a stifling selloff to end the 2023 trading year, and the stock has had a hard time rebounding since. With that said, Nike posted five bullish trading days in a row after the market closed on Monday. The last two earnings reports resulted in bearish stock price movements—can the company rebound from these lows?

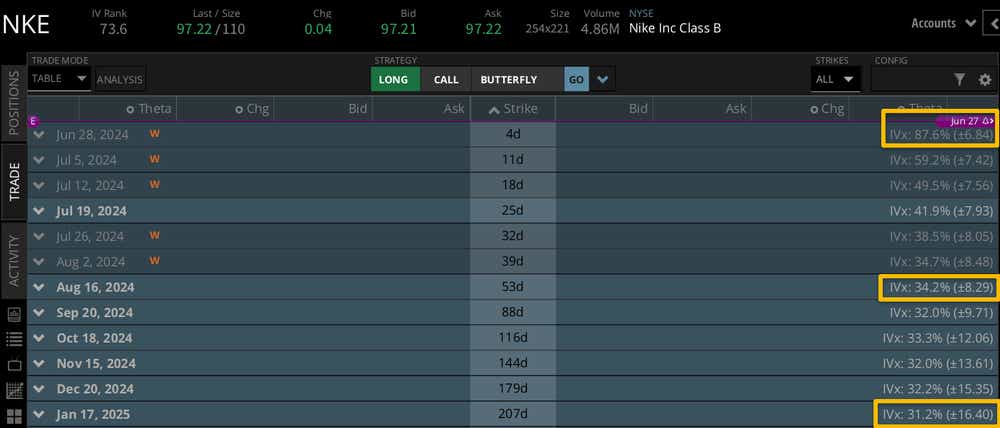

The implied volatility in NKE stock for earnings is in the middle of the range we typically see, which is between 5-10% of the stock price. The expected move for this week sits at +/-$6.84, which is just under 7% of the current stock price of $97 per share. This week's expected move does make up a large chunk of the expected move through the August options expiration of +/-$8.29 and about a third of the expected move through January 2025 of +/-$16.40.

Bullish on Nike for earnings

Active investors who are bullish on Nike ahead of earnings may believe the company's efforts to be more efficient will be realized and that the exposure during the Olympics this summer could drive sales and marketing. With the stock price near annual lows, any sort of strong beat and positive sentiment could result in a rally.

Bearish on Nike for earnings

Market participants who are bearish on Nike may believe this is just another binary earnings event that will end in a selloff—like the last two earnings calls. The premium retail space can be tough when consumers are pinching pennies, regardless of how well-known the brand may be. It would not be surprising to see Nike sell off if there are reports of slowed or reduced performance for the rest of the year, especially if EPS and/or revenue estimates are missed.

Tune in to Options Trading Concepts Live at 11 a.m. CDT every market day for options trading analysis, but especially this Thursday ahead of Nike's earnings report!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.