Russia, Ukraine and Global Wheat Prices

Russia, Ukraine and Global Wheat Prices

By:Ilya Spivak

No panic yet for the wheat market as Russia moves to cut Ukraine out

- Russia delivers on threats by suspending Black Sea grain deal.

- Wheat prices are staying in downtrend despite Ukraine shut-out.

- Moscow’s market-share push is keeping key exports cheap.

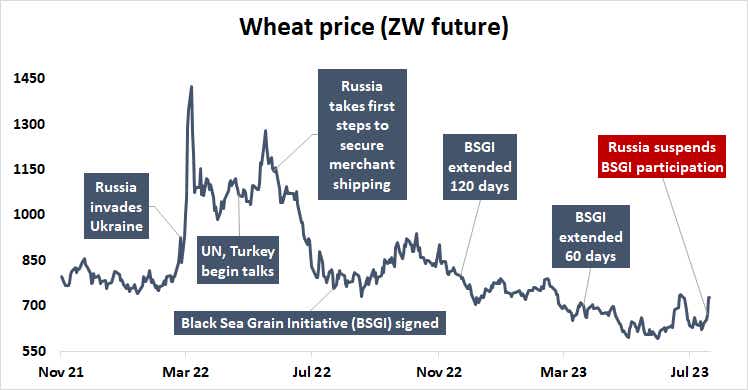

Wheat prices seemed somewhat unimpressed as Russia finally made good on months of on-and-off saber-rattling and suspended its participation in the Black Sea Grain Initiative (BSGI). This is a United Nations- and Turkey-sponsored scheme meant to allow safe passage for Ukrainian grain exports to global markets in wartime without Russian molestation.

Wartime grain deal ends with a whimper

A bit of a panicky pop was certainly registered: the benchmark ZW wheat futures contract jumped 8.5% on the day the Kremlin’s decision went into effect. That sounds like a very large rise at first. In fact, it only marginally exceeds the recent baseline range of +/- 6% to 7% swings prevailing since March 2022, when the initial shock of Russia’s invasion of Ukraine began to settle. The 11% to 22% daily seesaw clocked in the first few weeks of the conflict was far more dramatic.

Perhaps most importantly, the move fell short of clearing the most recent swing high in late June and kept the structural downtrend in play for the past 14 months firmly intact. In 2021—the last full pre-war year—Ukraine was the world’s fifth largest wheat exporter, accounting for 9.5% of global shipments. That is no trivial contribution, so it seems natural to wonder why a stronger reaction was not had.

Ukrainian wheat exports hobbled by conflict, BSGI or not

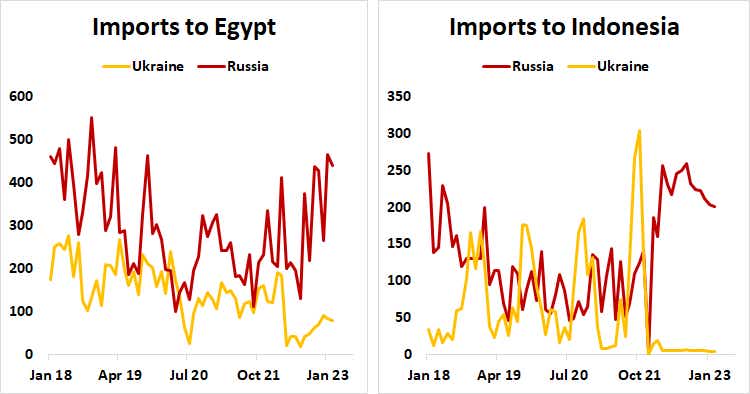

A look at how trade flows from Russia and Ukraine to the world’s top wheat importers have evolved over the course of the conflict make the answer obvious as well as tragic: Ukrainian contribution to the global wheat trade has been hobbled to such an extent—with BSGI active or without it—that the scheme’s end seems unlikely to make a material dent in global supply.

As much can be readily seen from overall import volumes to Egypt and Indonesia, the world’s largest and third-largest wheat buyers, where Russia and Ukraine were reasonably competitive with each other before the conflict. Markets like China, Turkey and Nigeria rounding out the top five global importers have maintained a strong preference for Russian product for years before the war’s beginning.

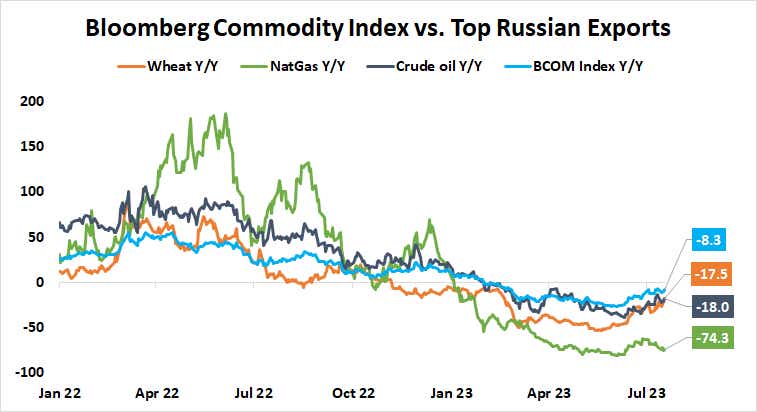

Top exports on discount as Russia fights for market share

Meanwhile, trying to keep commodities cheap on global markets when Russia is a dominant exporter seems to be a part of the Kremlin’s military strategy. Prices for the top three—wheat, crude oil and natural gas—are down significantly more year-on-year than the Bloomberg average of global raw materials costs.

Moscow is probably trying to protect its market share even as it is hamstrung by Western sanctions. It has but a few outlets left to raise money, including for the war. Giving up ground would be doubly damaging since the main competition in key markets is from countries backing Ukraine in the conflict, most notably the United States. It commands a 12.7% slice of the market, second only to Russia itself.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices