Stocks and Bonds are Little Moved by Powell’s Jackson Hole Speech

Stocks and Bonds are Little Moved by Powell’s Jackson Hole Speech

So, what's next?

- Fed Chair Jerome Powell’s Jackson Hole speech sounded hawkish, although he stopped short of promising another rate hike.

- In a sense, Powell said what he has been saying for months; the speech was light on new information.

- U.S. equities are marginally lower, and U.S. bond yields are mixed; the 2s10s spread is moving deeper into inversion territory.

Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Economic Policy Symposium was one of the top-billed macro events this week. However, traders expecting significant volatility around the event may be walking away disappointed: All four major U.S. equity indexes have moved between gains and losses, while U.S. Treasury bonds have sold off slightly.

In a sense, Fed Chair Powell’s speech offered little new information. Outside of his firm commitment to keeping the Fed’s inflation target steady at 2% over the medium-term—chiming in on a debate currently making its way through macro circles about shifting the inflation target to 3%—everything Powell saidFriday was a regurgitation of his comments dating back to the June Federal Open Market Committee (FOMC )meeting.

Here are the key comments:

- “It is the Fed's job to bring inflation down to our 2% goal, and we will do so.”

- “We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

- “Getting inflation sustainably back down to 2% is expected to require a period of below-trend economic growth, as well as some softening in labor market conditions.”

- “We expect this labor market rebalancing to continue. Evidence that the tightness in the labor market is no longer easing could also call for a monetary policy response.”

- “At upcoming meetings, we will assess our progress based on the totality of the data and the evolving outlook and risks.”

- “Based on this assessment, we will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data.”

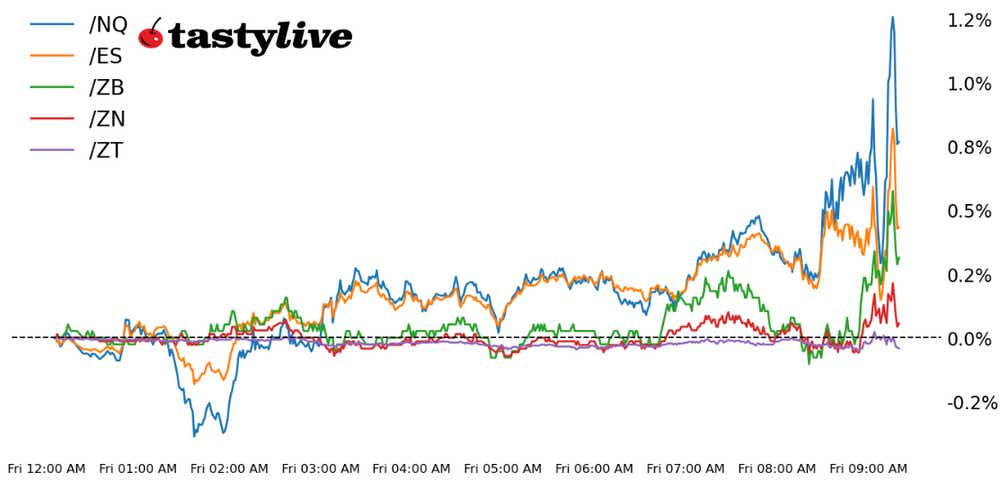

How Have Markets Reacted?

The reaction to Powell’s speech has been mixed, whereby stocks and bonds across the curve initially rallied but have since fallen back. Now, markets are mostly unchanged: the S&P 500 is down by 0.21% on the day; the U.S. Treasury 10-year yield is higher by 5 basis points (bps )when this note was written.

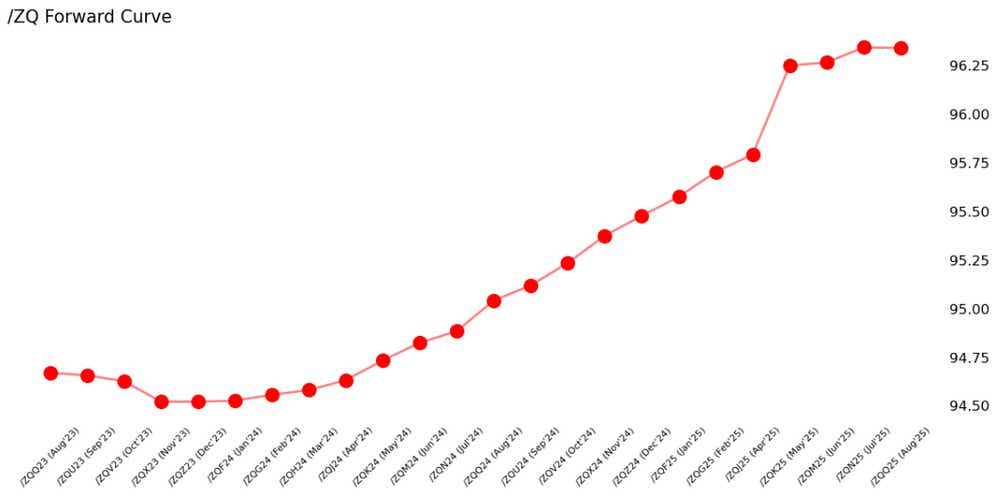

Thus far, the mixed reaction to the report has not done much to shift Fed rate hike expectations in the near-term: Yesterday, markets were pricing in a 19% chance of a 25-bps rate hike in September; today, there is a 16% chance, according to Fed funds futures. Odds of a November rate hike have increased marginally, from 49.3% to 50.3%.

/ZQ Fed Funds Futures Forward Curve (August 2023 to August 2025)

What Does the Fed Do Next?

The Fed is data dependent—period, end of story. There are numerous data releases before the September FOMC meeting, including the August U.S. consumer price index and the August U.S. nonfarm payrolls report. We’ll see numerous weekly jobless claims figures, and the August U.S. Institute for Supply Management (ISM) surveys as well. If the data continue to run hot (the Atlanta Fed GDPNow growth tracker for 3Q’23 is a searing hot +5.9% annualized in real terms), traders can’t dismiss another rate hike in September, but more likely November.

Regardless, none of this is new information, because Powell didn’t tell market participants anything that they didn’t already know—as one of us expected.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices