Jackson Hole Symposium Preview: How Will Markets React to Fed Chair Powell?

Jackson Hole Symposium Preview: How Will Markets React to Fed Chair Powell?

By:Ilya Spivak

Are the markets afraid of a hawkish Fed? Stocks and bonds say one thing, options say another.

- U.S. stocks retreat after NVDA earnings boost, Fed’s Jackson Hole symposium in focus.

- Jumpy U.S. bond yields suggest that traders are concerned about a more hawkish Fed.

- Options markets disagree, offer a calmer view on how key assets will end the trading week.

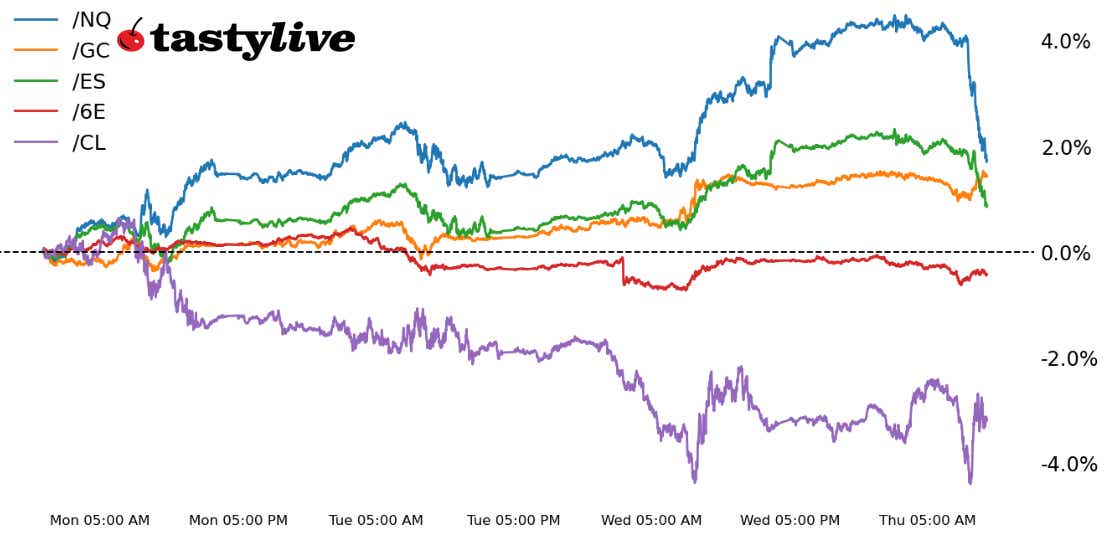

Intraday percent changes for /ES, /NQ, /ZN, /GC, /6E - week of August 21

"Nobody should care about anything in Wyoming unless they go there to ride a horse," quipped tastylive editor James Melton when this week’s annual Federal Reserve gathering in Jackson Hole was raised in a team conversation this morning.

As macro-minded traders (Chris Vecchio & Ilya Spivak), we have expressed our thoughts on the notion that people should ignore the Federal Reserve Economic Policy Symposium in Jackson Hole, Wyoming this week.

Then again, Chris agreed with Tom and Tony on Let Me Explain this week that the Fed’s powwow is likely to be less important than the second-quarter earnings report from Nvidia (NVDA), a darling of the AI hopeful that has helped drive a spirited rise in technology shares recently.

Later, on Overtime, Ilya and Chris disagreed on the extent to which the meeting will be market-moving, though they concurred that the substance of the much-anticipated speech from Fed chair Jerome Powell is unlikely to stray from well-worn platitudes.

Alas, these are all opinions, and everyone has one. The real question is, what are the markets saying?

Ilya’s POV: Yes, the markets do care about Jackson Hole!

The markets cheered another cheery Nvidia earnings report, but optimism proved to be fleeting. Bellwether S&P 500 index futures (/ES) began to retreat as European markets opened for business Thursday. The rout gathered steam as Wall Street joined the fray, with U.S. shares now on pace for their worst trading day this week.

Tellingly, the risk-off price action on the equities side has been accompanied by steepening in the Fed-sensitive front end of the yield curve, the spread between rates on the two-year and three-month Treasury notes. Interest rate futures tell the same story, implying an upshift in the Fed Funds rate expected by year-end. So too does the U.S. dollar—it is on pace for the strongest daily rise in three weeks against an average of its major currency counterparts.

No one can truly know the future, but the markets are clearly concerned enough about what price action might look like after Mr. Powell says his piece to re-adjust portfolios to a more defensive setting.

Here is the key:

The Fed Chair need not say anything novel and probably won’t. This doesn't mean that his remarks will not move markets. Investors need only listen and react where they have been unresponsive previously.

That is quite common.

John Maynard Keynes is famously reported to have said that “the market can remain irrational longer than you can remain solvent.” Veteran trader Yra Harris put it more succinctly: “If you’re right at the wrong time, you’re wrong.” Both sentiments rightly assert that the markets can ignore something for a long time, until they don’t.

![[event jackson hole 0824]](https://images.contentstack.io/v3/assets/blt40263f25ec36953f/blt9556198ddc757422/64e7a0b514f0610da4b3c54e/event-JACKSON-HOLE-0824.png?format=pjpg&auto=webp&quality=50&width=1348&disable=upscale)

Purchasing Manager Index (PMI) surveys offered a grim view of the world economy. They all but confirmed that the Eurozone is already in recession. Growth in the U.S. registered weaker than expected, but still looked better than performance across the Atlantic and in China—the last in the trio of global growth-engine economies. The East Asian giant seems to have gone from bad to worse as it struggles to regain momentum after emerging from COVID lockdowns in December.

Powell need only repeat familiar rhetoric signaling a willingness to stay in the inflation fight, even at the cost of enduring economic contraction.

With no Nvidia earnings or some other would-be straw left to grasp in the near term, traders will have ample headspace to consider that the U.S. central bank is taking direct aim at the one pocket of resilience keeping the global economy afloat.

That consideration might bode ill for risk-oriented assets like stocks, cyclical commodities like crude oil and copper, as well as similarly minded currencies like the Australian and Canadian dollars. Meanwhile, the U.S. dollar may be joined by the likewise anti-risk Japanese yen on the upside.

Chris’ POV: No, the markets do not care about Jackson Hole!

I look forward to the Fed’s Jackson Hole summit every year, don’t get me wrong. But what will Fed chair Powell say that he hasn’t already said for weeks and months now?

The U.S. economy is growing faster than expected, the unemployment rate (U3) is near cycle lows, and inflation remains above target (and could remain there for the next several months given the bump in food and energy prices as well as base effects in the data). At face value, he will be hawkish, but he’s been hawkish, so nothing really changes on that front.

Options markets seem to agree that the odds of a surprise are low, and Fed Chair Powell’s speech at Jackson Hole may not matter all that significantly either.

![[es jackson hole 0824]](https://images.contentstack.io/v3/assets/blt40263f25ec36953f/bltd33172cd1f57cbed/64e7a0b53026ee6e3e6b8767/es-JACKSON-HOLE-0824.png?format=pjpg&auto=webp&quality=50&width=1286&disable=upscale)

/ESU3 options are pricing in a +/39.95 point move through Friday’s close – a +/-0.9% move relative to the current price (4420.00). Through the end of next week, /ESU3 options are pricing in a +/- 74.27-point move – a +/- 1.68% move relative to the current price. For comparison’s sake, these expected moves are no greater than what we’ve seen in recent months ahead of U.S. consumer price index releases, U.S. nonfarm payroll reports releases, or Federal Reserve rate decisions.

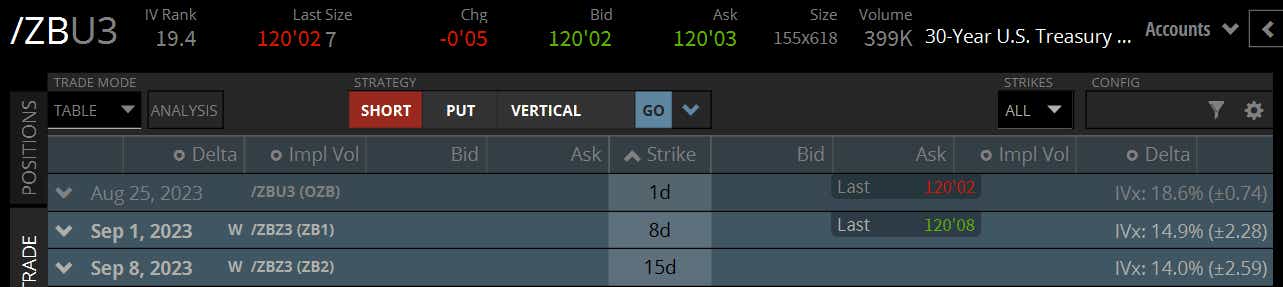

What about the bond market? U.S. Treasuries options are effectively saying the same thing as U.S. equity index options:

Volatility is slightly more elevated in /ZBU3 (IVR: 19.4) than /ESU3 (IVR: 9.7), but the moves aren’t substantial either. /ZBU3 options are pricing in a +/- 0.74-point move (or 23 ticks) through Friday’s close – a +/-0.6% move relative to the current price (120’02).

Through the end of next week, /ZBU3 options are pricing in a +/- 2.28-point move (or 73 ticks)–a +/- 1.88% move relative to the current price. Again, this is not materially different, nor does it exceed the expected moves priced in ahead of key U.S. economic binary events in recent months.

The Federal Reserve Economic Policy Symposium in Jackson Hole, Wyoming will garner a lot of headlines. Markets will move, as they are wont to do. But in terms of being a meaningful turning point or a game changer…well, markets just don’t think this year’s summit matters that much.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices