Stocks Are in Trouble as PMI Data Renews Recession Worries

Stocks Are in Trouble as PMI Data Renews Recession Worries

By:Ilya Spivak

Global PMI data signals an incoming recession, but the Fed is withholding relief

- September’s PMI data roundup points to a global slowdown in economic growth.

- Emerging markets have fared a bit better than developed ones, but only for now.

- Stocks under pressure as the Fed withholds relief, eyes “higher-for-longer” rates.

The global economy has slowed to near-standstill.

That’s the message for financial markets at the conclusion of September’s cycle of purchasing managers' index (PMI) data. The monthly surveys—mostly from S&P Global but also from the Institute of Supply Management (ISM) in the U.S. and the China Federation of Logistics & Purchasing (CFLP)—offer a glimpse into economic growth trends in a timely way. Those entities provide earlier warnings than gross domestic product (GDP) figures, which tend to come out only quarterly and with a good deal of lag.

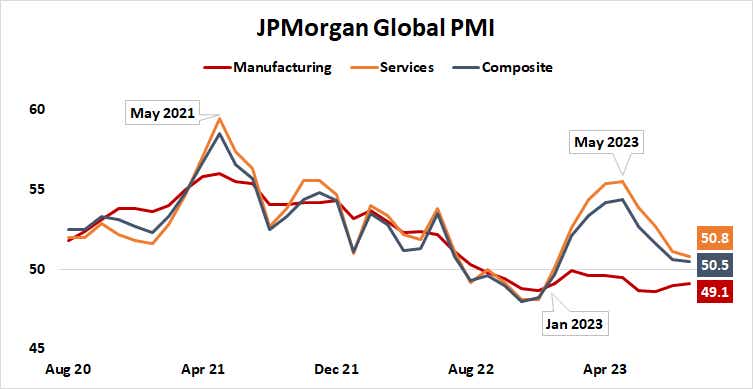

Taking in the worldwide picture, the manufacturing sector shrank for the 13th consecutive month, although the pace of contraction abated to the slowest since May. The service sector remained the dominant driver of the overall trajectory. The pace of economic activity there slowed for the fourth month straight. Altogether, that puts global growth at its weakest since January and tracking within a hair of slipping into negative territory.

The same pattern is broadly playing out across developed and emerging markets, but the rich world is faring nominally worse in that its unraveling of service-sector growth has already tipped the scales into negative territory for the grouping’s overall contribution to the global pie. Emerging markets are still growing, but September marked the second-slowest month this year (expansion in January was nominally slower).

Emerging markets at risk as growth in the rich world fizzles

This disparity probably reflects a degree of sequencing. Vendor economies on the emerging side of the ledger often rely on demand from the developed side to generate growth. This means that recession in the latter is likely to spill over into the former over time, as backlogs of work are cleared, inventories restocked and contracts renegotiated.

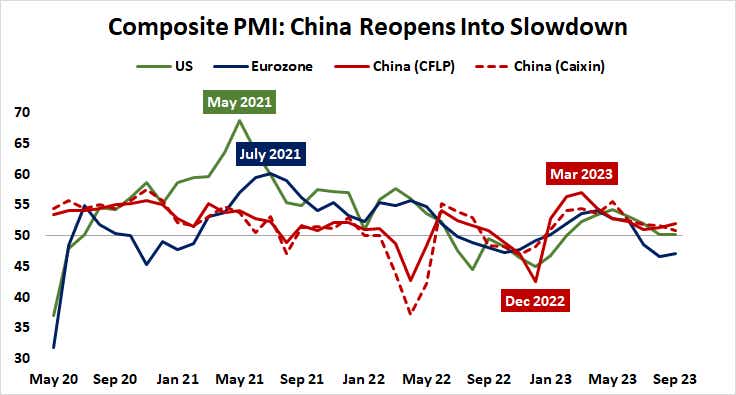

China has been a case in point. Its belated move to scrap COVID restrictions meant it reopened for business nearly 18 months after its main customers in the U.S. and Europe. By then, those markets were making strides toward diversification away from China-dependent supply chains. Hopes for a splashy recovery in the world’s second-largest economy have evaporated.

Against this dismal backdrop, it isn’t surprising that investors are hoping for some support from central banks. Monetary authorities across the developed world—from Australia, Canada, the U.K. and the Eurozone—have all signaled their rate hike cycles have probably ended. It is a reprieve from the U.S. Federal Reserve that markets are most keenly after, however, and on that score, relief looks to be painfully distant.

The Fed has little more than harsh discipline for stimulus-starved markets

Data from the Bank of International Settlements (BIS) suggests close to 88% of global monetary transactions are settled in U.S. dollars. That means when the Fed adjusts the cost of borrowing in terms of its local currency, it sets the trajectory for the cost of capital for most of the world.

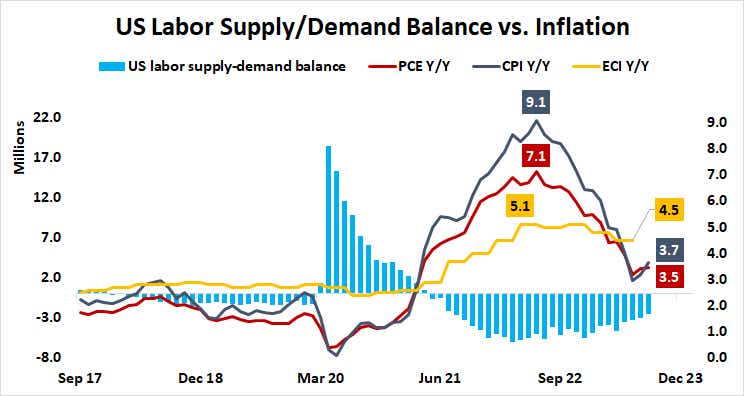

For their part, Fed Chair Jerome Powell and company have strenuously signaled an intent to keep interest rates higher-for-longer, even as the hiking sequence itself has probably ended. That’s because relative resilience in the U.S. labor market has trapped inflation there by way of sticky wages.

September’s U.S. PMI surveys from ISM tellingly showed hiring grew across the economy, with the manufacturing sector expanding payrolls for the first time since May as the services side added staff for a fourth consecutive month. Pricing power has held up accordingly.

The ISM data was not all roses, however. A sharp slowdown in service-sector new orders growth offered a sign of trouble ahead. On the manufacturing side, orders shrank for the 13th month in a row.

The beatings will continue until morale improves

Uncertainty about how long it will take for this weakness to eat into labor market demand and produce the Fed’s desired adjustment—and how closely the global economy must come to recession in the meantime—has taken a toll on financial markets. Stocks slumped as term premium in the Treasury market turned positive after last month’s policy announcement from the U.S. central bank laid out its vision of a “higher-for-longer” interest rate trajectory (as expected).

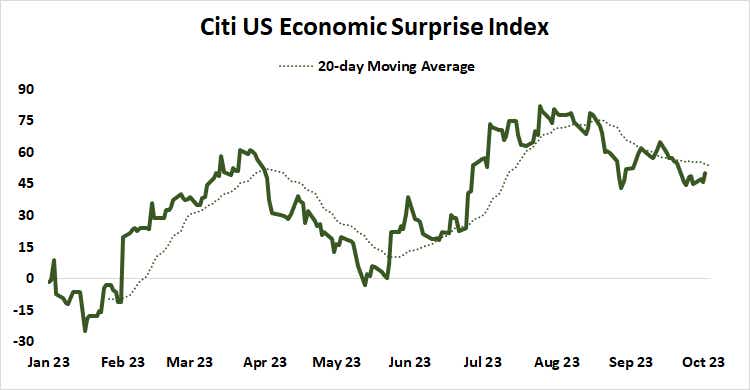

Data from Citigroup suggests U.S. economic news flow still tends to surprise on the topside relative to baseline forecasts. Until acute signs of deterioration force a rethinking of Fed policy, the path of least resistance points to more of the same ahead.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices