China CPI: Global Recession Eyed as Pricing Power Fades, Stimulus Flops

China CPI: Global Recession Eyed as Pricing Power Fades, Stimulus Flops

By:Ilya Spivak

Chinese inflation may return above zero but fading pricing power and stingy stimulus add to global recession threat

Chinese CPI expected to tick back above zero, but pricing power remains anemic.

- Real GDP growth has surpassed nominal expansion, signaling moribund demand.

- Lackluster stimulus leaves sluggish performance, boosting global recession risk.

Inflation in China is expected to inch back into positive territory in August, with the consumer price index (CPI) seen rising 0.1% year-on-year. That’s after a reading of -0.3% in July marked the first month of outright deflation since February 2021.

A surprise on the soft side that keeps price growth below zero would be well within recent trends. Data from Citigroup shows that Chinese economic data outcomes still tend to disappoint relative to baseline forecasts. Momentum to the downside has faded a bit recently, but this seems to reflect downgraded expectations rather than improving results.

China’s economy is losing pricing power, signaling weak demand

Regardless of whether a positive result materializes, the overall picture will almost certainly remain troubling. Pricing power has rapidly drained from the economy, signaling moribund demand. Real gross domestic product (GDP) growth tellingly topped nominal expansion in the second quarter, implying deflation to the tune of 1.5%.

The authorities in Beijing have been somewhat half-hearted in their attempts to revive activity as hopes for a pickup after scrapping “zero-COVID” restrictions in December rapidly evaporate.

The People’s Bank of China (PBOC) has cut its main seven-day reverse repo interest rate by a meager 10 basis points (bps) since the start of the year. The 1-year medium-term lending facility rate has come down by a similarly stingy 25 bps. A slew of policy tweaks—like lowering barriers for homebuyers–have amounted to little more than tinkering at the margins.

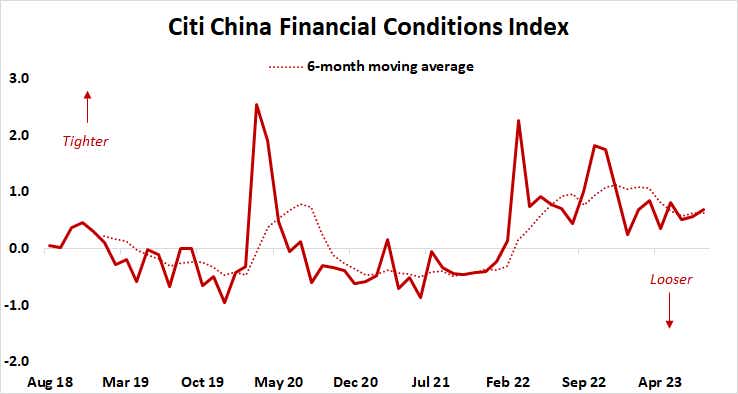

The fact that monetary stimulus has fallen short is plainly on display in July’s lending data. New loans for the month were 49% lower than a year before. Total outstanding debt was down 32.2%. Capital flight has exacerbated this tightening. The PBOC reports that foreign currency deposits fell to $821 billion in July, the lowest since August 2020. Citigroup’s measure of Chinese financial conditions has not strayed from restrictive territory since February 2022.

It appears that investors are losing hope for more proactive relief. The policy path implied in market pricing suggests the seven-day rate will hover within 10 bps above the current setting at 1.8% for the next year, then climb to 2.16% in two years. While that is markedly more dovish than the baseline at the start of economic reopening in December, it is also a dramatic retreat from stimulus expectations envisioning 50 bps in imminent rate cuts priced in as recently as a week ago.

Global recession risk acute as China settles into low-growth status quo

Hopes for some sort of big-splash fiscal effort are slim as well. China’s President Xi Jinping has taken to advocating for “high-quality” rather than “low-quality” growth, implying a focus on long-term investments in innovation and resilience rather than another debt-driven building boom.

All this seems to suggest that Chinese officials are becoming resigned to a prolonged period of anemic growth. That this is the path being set for the world’s second-largest economy bodes ill for the global economy at large, coming just as the Eurozone slips toward recession while the Fed seems keen to quash U.S. inflation at the expense of the labor market, and thereby consumption.

Taken together, this makes a global recession devilishly difficult to avoid.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices