EUR/USD: Euro Will Fall if ECB Rate Hikes Pause Despite Oil Output Cuts

EUR/USD: Euro Will Fall if ECB Rate Hikes Pause Despite Oil Output Cuts

By:Ilya Spivak

The euro may fall if Saudi cuts in crude oil output fail to subvert disinflation, allowing the ECB to end rate hikes

- The goods sector is driving Eurozone inflation, with food prices now in the spotlight.

- Saudi Arabia may struggle to cut output and thus bring lasting gains to crude oil prices.

- The euro will fall if easing inflation brings down the odds of another ECB rate hike.

The euro has dropped to the lowest level in three months against the U.S. dollar. The decline may continue as a deepening economic downturn and shifting inflation dynamics drive markets to rethink the likelihood of another interest rate hike from the European Central Bank (ECB).

August’s purchasing manager index (PMI) data offered a sobering view of the Eurozone economy, suggesting a recession is all but certainly in view. The numbers showed that region-wide activity contracted for a second consecutive month as the service sector crumbled, catching up to weakness seen on the manufacturing side since mid-2022.

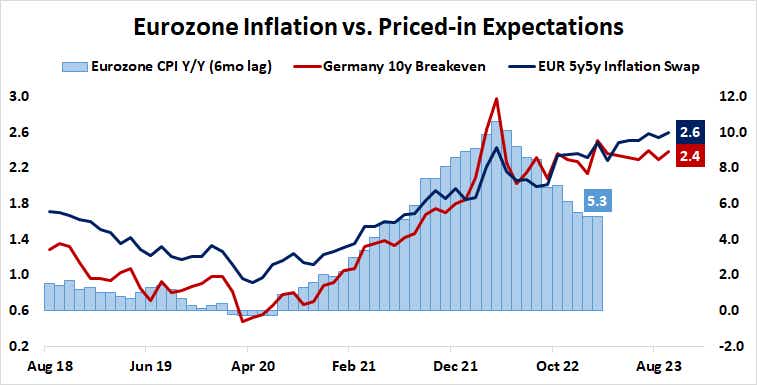

Stubbornly high inflation complicates matters. At 5.3%, the headline consumer price index (CPI) is a long way from the ECB’s 2% objective. Worse still, the markets don’t seem to think the central bank has what it takes to deliver on its mandate. Leading measures of inflation expectations priced into the bond and swaps markets are pointedly trending in the wrong direction.

This has investors positing that another 25-basis-point (bps) interest rate hike is likelier than not before year-end. Overnight index swap (OIS) market pricing puts the probability of such a rise at just over 63%. The euro would probably fall if those odds became longer.

Food prices in the Eurozone

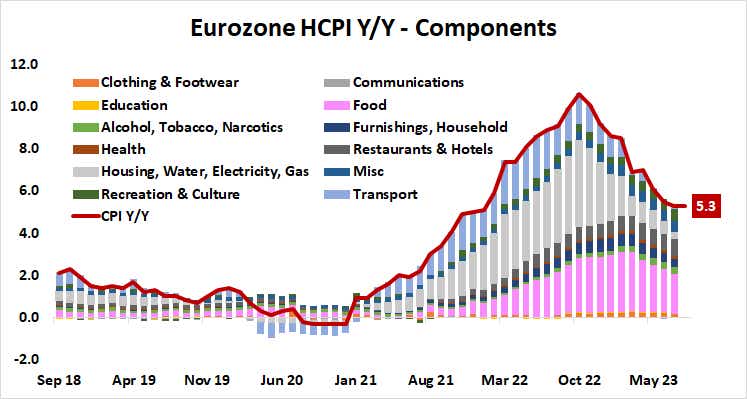

As with Germany—the euro area’s largest economy—most of the region-wide inflation problem is still on the “goods” side of the ledger. That contrasts with services-driven inflation in the U.S. Falling gas prices have been the main driver of disinflation from last year’s highs. Food prices have taken over as the largest contributing factor.

Trying to bring down food inflation with interest rate hikes is a suspect endeavor. There’s not much that the central bank can do with borrowing costs to turn off hunger. However, price action in the commodity markets suggests disinflation may be starting to take shape on its own.

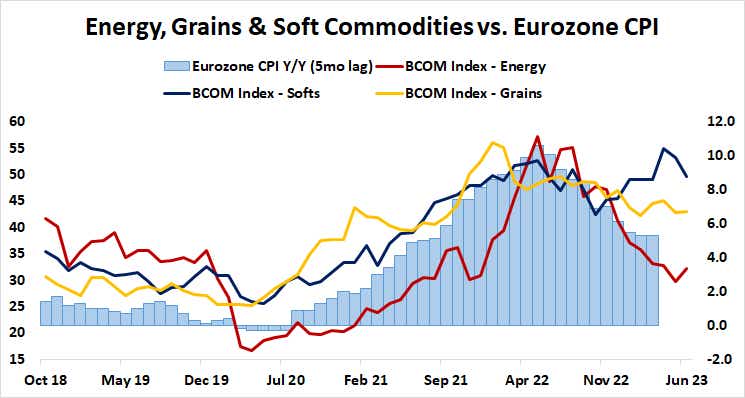

Grain prices peaked in early 2022 when Russia invaded Ukraine and began to trend lower in a move that preceded even the subsequent peak in energy prices. Rising soft commodities costs are a likelier culprit, with a blistering surge in the price of sugar probably most at fault.

Pressure in softs seems to have started easing in the past two months, but a pickup on the energy side now threatens to complicate matters. That comes as crude oil prices rebound thanks to a Saudi Arabia pledge to extend through December the production cutback program of 1 million barrels per day (bpd) unveiled in July.

Will crude oil output cuts keep the ECB in hawkish mode? Not so fast

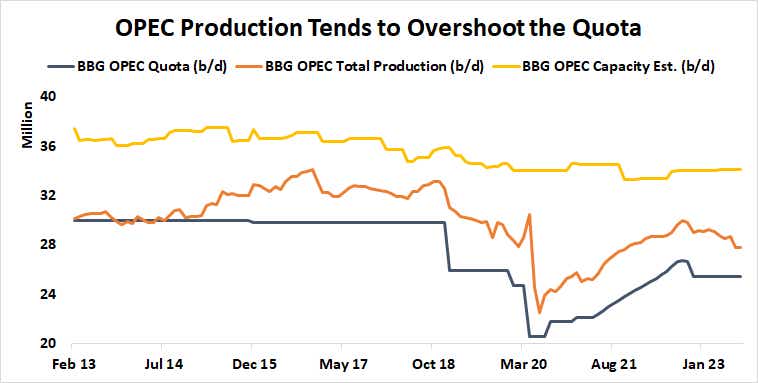

The markets took the move to mean higher energy costs will filter into inflation and delay global central banks’ exit from the rate hike cycle. This reading assumes the output cut can truly make a dent in global supply vs. demand dynamics. History argues otherwise.

The Organization for Petroleum Exporting Countries (OPEC)—the oil cartel with Saudi Arabia in pole position—has been unable to bring production down to its stated target since 2014. So far this year, producers have exceeded their objective by an average of 3.2 million bpd.

The Kingdom must hope its 1 million bpd output cut can still make a dent against this backdrop, even as slowing global growth undercuts demand and pressures prices lower. If the effort fizzles, the ECB may be spared an inflationary handoff from soft to energy commodities.

Traders will surely notice if the cool-off in consumer prices gains momentum in such a scenario and readjust their monetary policy expectations accordingly. That carries bearish implications for the euro as yield differentials widen against currencies where stickier prices underpin greater appetite for tightening (like the U.S. dollar).

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices