The British Pound May Drop Against Dollar as UK CPI Inflation Cools

The British Pound May Drop Against Dollar as UK CPI Inflation Cools

By:Ilya Spivak

While stock markets lick their wounds, currency traders brace for fireworks as the British pound responds to a rapid fall in UK inflation

- Stock markets in a holding pattern after a brutal two-day selloff

- U.K. CPI report may dial up Bank of England rate cut speculation

- British pound may fall further as rate spreads turn more negative

Wall Street has paused for a breath after two days of aggressive selling that pushed the bellwether S&P 500 stock index down 2.7%.

That marked the worst back-to-back performance in over a year. A pause in high-grade U.S. economic data and breathless headlines out of the Middle East may see the spotlight shift elsewhere for now.

As equities collect themselves, the currency markets are eyeing the next chapter in a story about increasingly acute monetary policy divergence between the U.S. and other major economies. While hotter-than-expected inflation has rapidly erased scope for Federal Reserve interest rate cuts, Europe seems to be getting closer to easing.

Cooling UK inflation may stoke Bank of England rate cut bets

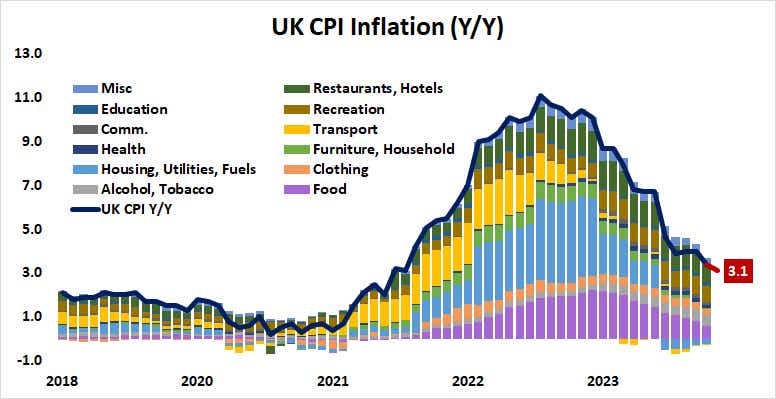

Incoming data from the United Kingdom is expected to show that costs grew at a sharply slower pace in March. The benchmark consumer price index (CPI) gauge is penciled in for a rise of just 3.1% year-over-year, marking the lowest reading since September 2021.

Continued progress looks likely. As with the Eurozone, discretionary spending categories—recreation and hospitality—are now the stickiest areas of price growth as the influence of food costs recedes. Trends in global food prices tend to appear in CPI with a lag of about seven months. As they continue to fall, this part of the basket will continue to dis-inflate.

Lingering problem areas are likely to be susceptible to slowing growth. Purchasing managers index (PMI) data shows that economic activity slowed in March, snapping a four-month upswing.

Numbers out this week showed the economy shed 156,000 jobs in February and the unemployment rate rose to 4.2%, the worst results since August 2023.

All this may amount to fodder for speculation about the sooner onset of Bank of England (BOE) interest rate cuts. For now, benchmark SONIA interest rate futures are pricing in 37 basis points (bps) in stimulus this year. That amounts to one standard-sized 25bps reduction set to appear in August, and a 48% probability of a second one by December.

British pound may extend losses against the U.S. dollar

This calculus is likely to turn more dovish if CPI data underpins the case for inflation to keep cooling. That will widen the spread between expected year-end rates in the U.K. and the U.S., pushing them in the greenback’s favor and punishing the British Pound.

Prices have broken chart support in the 1.2503-21 area, piercing the bottom of a range that has contained them since late November. That seems to open the door for a test of the 1.2342-84 zone, with a further break below that putting lows under the 1.21 figure into view. Establishing a firm foothold back above 1.25 may short-circuit bearish progress.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.