Dark Clouds Dampen Wheat Prices

Dark Clouds Dampen Wheat Prices

Wheat prices see biggest daily drop of 2023.

- Wheat prices see biggest drop of the year.

- Farmers breathe a sigh of relief as rain nears.

- Speculators scale out of short bets on wheat.

Wheat prices (/ZW) were down over 5% Tuesday to $698.2, the largest daily percentage drop this year. The move follows a multi-week rally that saw prices hit the highest since February as bullish speculation resulted from dry conditions across the United States and damaged crops in China.

Despite Tuesday’s decline, front-month wheat futures remain on track to close out June with the biggest monthly gain since February 2022, when Russia's incursion into Ukraine sent grain prices soaring.

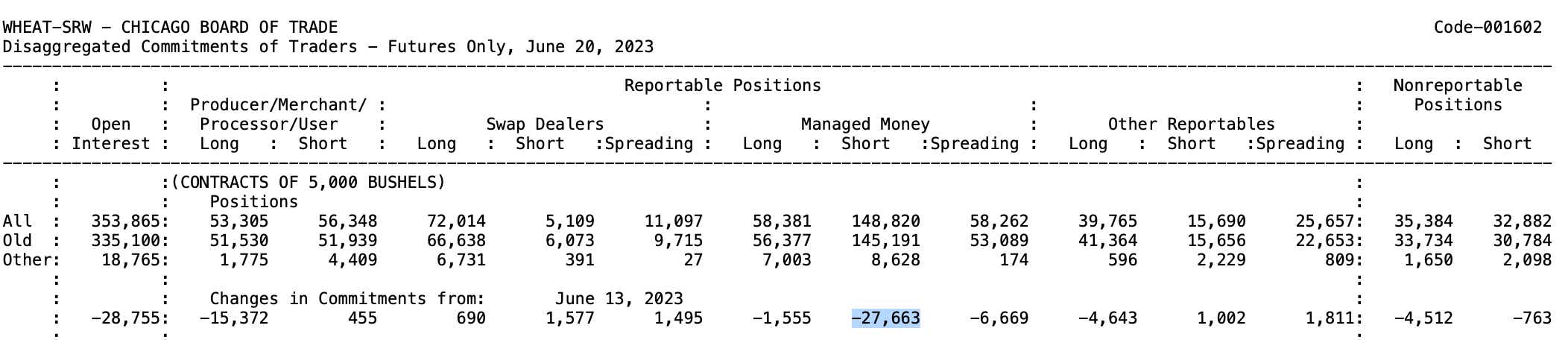

COT data shows speculators culled short bets

Friday’s Commitments of Traders Report (COT) from the Commodities and Futures Trading Commission (CFTC) showed that speculators (managed money) scaled out (-27k) of their short bets on wheat prices (soft red winter—SRW). That likely helped fuel the upside last week, as those traders had to buy back their positions. If prices resume the uptrend, it could force more shorts to cover as the net position among speculators remains tilted to the short side.

wheat cbot

Rain brings relief to drought-stricken crop conditions

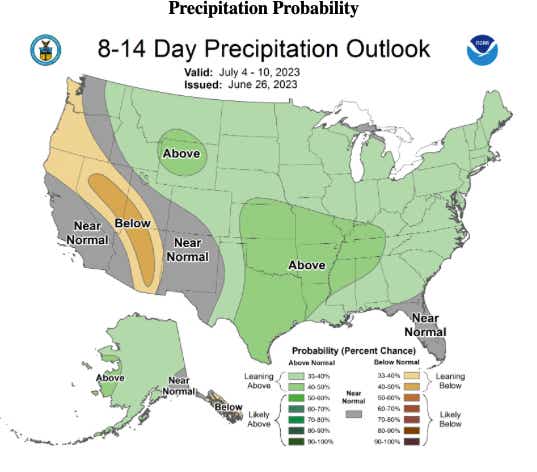

Despite a volatile session to start the week on Monday amid political turbulence in Russia—a top wheat exporter—prices are now cratering after wheat-planting states in the U.S. received a good dousing of rain over the last several days. And according to weather forecasting, more moisture is on the way.

The National Weather Service’s 8-14 Day Precipitation Outlook provided by the National Oceanic and Atmospheric Administration (NOAA), says there is an above-normal probability for precipitation across most of the United States. This is welcome news for farmers who have seen their crops get off to a bad start as drought across the Midwest and Lower Plains has dented crop progress.

The most recent Crop Progress report from the USDA highlights the lackluster start of the crop season for wheat. Spring wheat conditions for the week ending June 25 were rated at 2% excellent and 48% good compared with 6% and 53% at the same time last year. And 9% was rated as poor compared with 5% for the same period. However, these numbers should improve after recent rains.

weather forecast map

Wheat technical chart

Today’s selloff was preceded by a rejection from the falling 200-day simple moving average (SMA), which was only briefly overtaken. That marks a potential turnaround that may extinguish bullish sentiment and cause traders to take profits following the multi-week runup. A drop back to prior resistance from a falling wedge pattern may act as support if prices drop further.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Photo courtesy of Midjourney.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices