Where the Action Lives: Top 10 Micro Futures Ranked by Volatility

Where the Action Lives: Top 10 Micro Futures Ranked by Volatility

Ranking the micros that give traders the most movement—and the most opportunity.

- Volatility is the lifeblood of trading — without movement, there’s no opportunity.

- Micro Bitcoin (/MBT), Micro Nasdaq (/MNQ), and Micro Metals (/MET) consistently rank among the top movers.

- Over the past year, /MBT posted the largest average intraday range in points, while /VXM led in percentage terms.

- In the past month, /MET jumped to the front in percentage moves, proving short-term leaders can shift.

Most traders learn this the hard way: it doesn’t matter how good your technical skills are if you’re trading a product that barely moves. Volatility is the fuel. It’s what creates those big swings, the bursts of opportunity, the setups we chase. Without it, you can be sitting at your desk all day, staring at a dead chart, wondering why nothing’s happening.

That’s why we decided to dig into the data and actually measure it. Instead of just saying “this market feels dead” or “that one always moves,” we ranked the top 10 micro futures by average intraday range — both in points and percentages. We looked across the past year for long-term context and the past month to see what’s moving right now.

The results give traders something powerful: a way to filter the noise and focus on the products that actually deliver the most movement.

Why Volatility Matters for Traders

Think about volatility as a gas tank. If you’re driving a Ferrari

(or Honda) but the tank is empty, you’re not going anywhere. Trading works the same way. You can have the best process, the cleanest strategy, but if the product you’re trading is stuck in a two-point range all day, there’s no real opportunity.

That’s why volatility is every trader’s best friend. It creates the swings we rely on. It fuels the setups. It offers the chance to capture meaningful profits in a shorter time window.

At the same time, higher volatility means higher risk — so it’s not about blindly chasing the biggest mover. It’s about knowing where the fuel is, then deciding how you want to drive. Some traders scale in smaller size in the most volatile products. Others balance their book by pairing high-volatility contracts with steadier ones. The key is awareness — and that’s exactly what this ranking provides.

The Yearly Leaders in Volatility

Looking back over the past 365 trading days, here’s who topped the charts:

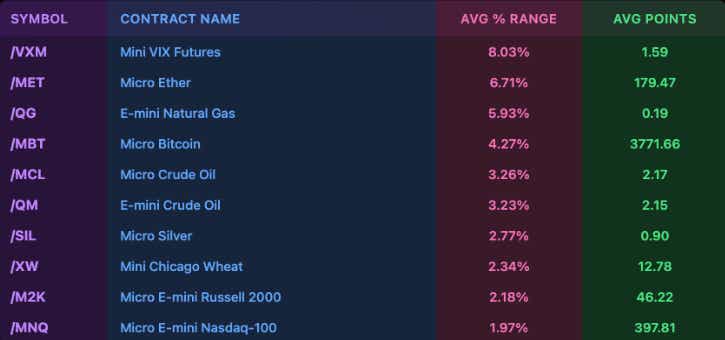

Top 10 by Average Intraday Range:

Interpretation

No surprise here — Micro Bitcoin (/MBT) ran away with the crown in raw point movement, averaging more than 3,700 points a day. On a percentage basis, though, Volatility Index Micros (/VXM) and Micro Metals (/MET) came out on top. That’s an important distinction: a contract can move thousands of points, but if its underlying value is also massive, the percentage impact might not be as meaningful.

For traders, this means thinking in both absolute terms (points) and relative terms (%). Bitcoin has wild swings, but metals are quietly delivering the highest relative bang for your buck.

The Past Month: Short-Term Shifts

Volatility never stands still. The past 30 days told a slightly different story:

Top 10 by Average Intraday Range:

Interpretation

Bitcoin, Nasdaq, and Dow minis are still right there in terms of raw point movement, but Micro Metals (/MET) surged to the top spot in percentage moves. That’s a shift worth paying attention to — it shows how volatility rotates.

Sometimes it’s not about the usual suspects; sometimes an under-the-radar product starts putting up numbers that deserve a trader’s attention. If you only focus on the past year’s averages, you’d miss that metals are suddenly where the most “fuel” is flowing.

How Traders Can Use This Data

This list isn’t just trivia — it’s actionable. Here are three ways to use it:

- Watchlist Building:

- Strategy Matching:

- Adapt to Rotation:

The goal isn’t to chase volatility blindly. It’s to recognize that it’s the fuel of the market — and this ranking is your map to where that fuel is most abundant.

Final Thought

Markets rarely follow a script, but history tells us one thing: volatility is where the opportunity lives. By studying both long-term and short-term leaders, traders can stay ahead of the curve and position themselves in the products that actually move.

This isn’t about predicting the next breakout — it’s about putting yourself in the right arena. And as the data shows, some micro futures are consistently where the action is.

So next time you’re building your watchlist, ask yourself: am I putting my energy where the fuel is, or am I staring at a market that doesn’t move?

Errol Coleman appears on the tastylive network shows Today’s Assignment and Trades on the Go.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices