Will Stocks Sink If Fed Rate Cuts Seem Delayed After ISM Data?

Will Stocks Sink If Fed Rate Cuts Seem Delayed After ISM Data?

By:Ilya Spivak

Can stock markets stomach delayed Fed interest rate cuts? All eyes turn to ISM data for a clue.

- Wall Street continued to ignore geopolitical risk after the US raid in Venezuela

- Markets in Latin America rose for a second day as crude oil prices tellingly fell

- Fed rate cut bets are back in play, with ISM service sector data now in focus

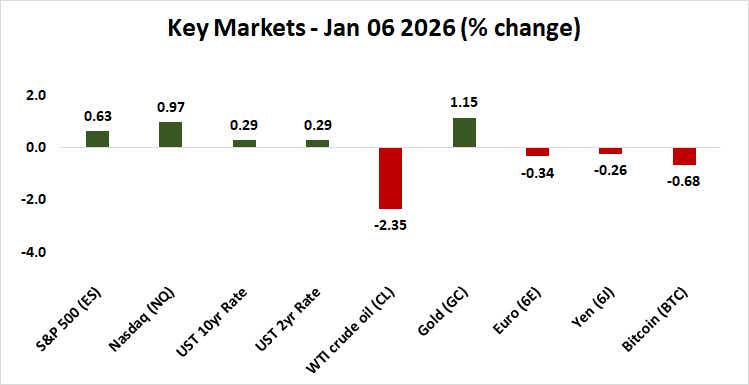

Stock markets continued to drift higher as traders convinced themselves to look past a surprise US raid in Venezuela to capture and extradite president Nicolas Maduro. The S&P 500 rose 0.63%. The bellwether US equities index has now erased all of the losses sustained last week, returning to a range top capping prices since mid-December.

Perhaps most tellingly, Latin American markets roared higher. The iShares Latin America 40 ETF (ILF) is up 3% so far this week. Moreover, markets sped upward in countries that have been unfavorably name-checked by US President Donald Trump. The Global X MSCI Colombia ETF (COLO) and the iShares MSCI Brazil ETF (EWZ) are up 6.43% and 2.83%.

Fed rate cut outlook back in focus as markets look past geopolitics

Meanwhile, crude oil prices erased yesterday’s modest uptick to close at the weakest level in almost two weeks. If there was any real concern about what the US action might mean for energy supply disruption – unlikely though that seemed even at first blush – it now seems to have been put convincingly to rest.

This brings the markets back to familiar territory as a batch of incoming US economic data puts the spotlight back the Federal Reserve and the expected interest rate cut path. The S&P 500 has conspicuously failed to reach a higher high since Fed Chair Powell admonished markets not to over-extrapolate rate cut bets after October’s policy meeting.

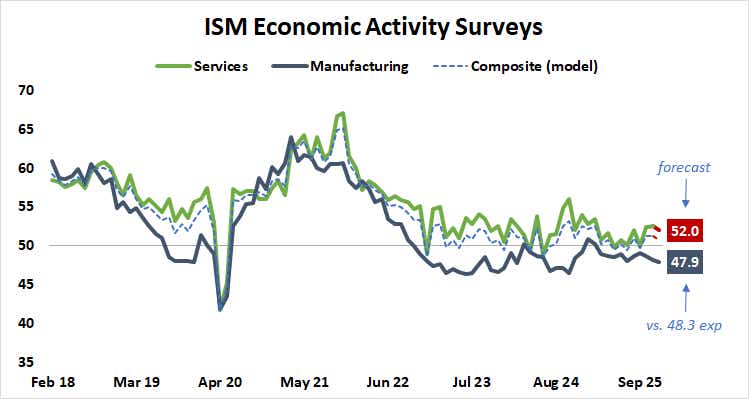

A report from the Institute for Supply Management (ISM) is expected to show that the pace of service sector activity growth slowed a bit in December. Taken together with a companion manufacturing gauge published earlier in the week, that result looks set to bring overall (“composite”) growth to a three-month low.

Will stocks lose steam if solid ISM data points to FOMC standstill?

This is less scary than it sounds. First, services activity growth would be slowing from a nine-month high in this scenario, and only gently so. Second, the economy-wide downtick would only slow activity back to its trend average since the beginning of 2025. That seems benign for the same quarter as the longest US government shutdown on record.

As it stands, the markets seem convinced that the central bank will remain on hold this month. The probability of a 25-basis-point (bps) cut at the late-January gathering of the Federal Open Market Committee (FOMC) is priced at just 17.2% in benchmark Fed Funds futures.

However, traders have discounted two such cuts this year, with the first expected to appear in April and the second no later than September. For their part, FOMC officials have only committed to a single cut in their Summary of Economic Projections (SEP). They’ve stuck to this view since June last year, reaffirming it in September and December.

An ISM result that registers broadly in line with expectations seems unlikely to convince the US central bank to act with greater urgency, leaving the markets disappointed. This could put stock markets under pressure as traders look ahead to the US jobs report as well as consumer confidence statistics due later in the week.

Ilya Spivak, tastylive head of global macro, has over 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive.com or @tastyliveshow on YouTube

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices