Are These The 10 Best Dividend Stocks to Watch?

Are These The 10 Best Dividend Stocks to Watch?

By:Zani Smit

Dividends are often seen as the blueprint for longevity and building wealth due to the source of income they provide. Find out which dividend-paying companies are on investors’ radar in 2022.

WHAT’S ON THIS PAGE?

- Dividend stocks: what you need to know

- 10 best dividend stocks to watch

- How to trade and invest in dividend stocks

- Dividends: maximizing income and returns

DIVIDEND STOCKS: WHAT YOU NEED TO KNOW

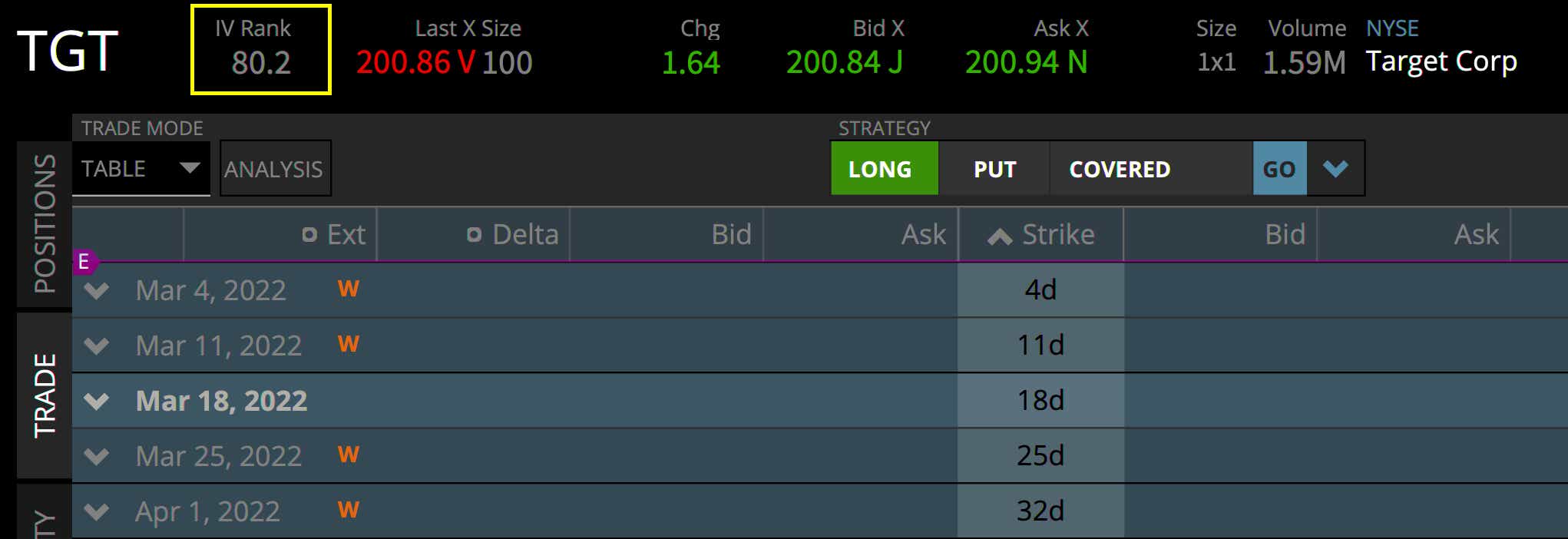

Dividend stocks are seen as a steady way to earn additional income by many investors. At tastytrade, you can buy and sell outright shares of dividend stocks or create options strategies to capitalize on extremes in volatility as well as stock price.

Choosing dividend-paying companies takes more effort than just looking for a list of dividend aristocrats, which are public companies that have consistently raised dividends every year over the long term. Shareholders will look at the dividend yield, displayed as a percentage, to see what amount of money they will get each year relevant to the stock price.

When a company is able to pay regular dividends to shareholders from its net profit, it is perceived to have a good track record, and this often attracts more investors. Studying a company’s dividend payouts can thus give you some insight into its financial strength and management style.

WHAT ARE DIVIDEND STOCKS?

Dividends stocks are a regular distribution of a publicly listed company’s earnings to their shareholders who own their stock. The pay-out can be a cash distribution, usually annually or quarterly as approved by their board of directors.

10 BEST DIVIDEND STOCKS TO WATCH

- NiSource (NI)

- Duke Energy (DUK)

- Southern Company (SO)

- Consolidated Edison (ED)

- Johnson & Johnson (JNJ)

- Coca-Cola (KO)

- Target (TGT)

- 3M (MMM)

- PepsiCo (PEP)

- Realty Income (O)

You can trade all of the above common stock or common dividend at any major brokerage firm, like tastytrade. To get started, open an account and search for your chosen company on the award-winning tastytrade platform.1

The companies mentioned on this page aren’t necessarily the best stocks per se. Rather, they’ve been selected taking a number of factors into

consideration, e.g. market demand, market cap, macroeconomic environment, investors’ interest and historical performance data.

Not interested in purchasing shares in dividend stocks? No worries! We’ll share some options trading information along the way.

![]()

NISOURCE (NI)

NiSource is considered one of the largest fully regulated utility companies in the United States. As of early February 2022, NiSource had a $11.07 billion market capitalization (total value of all a company's shares of stock).

When it comes to generating energy, NiSource uses traditional (coal) and renewable sources (wind, hydroelectric and natural gas). Their latest financial reports show their current revenue at $4.53 billion.

Its 2021 net operating earnings per share (non-GAAP) is between $1.32 and $1.36.2 Shareholders received 23.5 cents per share in the last quarterly dividend payout in February 2022 (an increase of 7%) from 2021. With this, the annual common dividend payout is 94 cents per share.

Since the start of 2022, the stock has traded in the mid to upper 20s, reaching highs of $30.19 in early February.

![]()

DUKE ENERGY (DUK)

A major player in the utility industry, Duke Energy is an electric power distributor with a $75.10 billion market capitalization. It was founded in the early 1900s by Dr. W. Gill Wylie, James Buchanan Duke and William States Lee. They had a shared vision of an integrated electric system of hydro-powered generating stations in the South.

Today the company is an industry leader in sustainable innovation that’s dedicated to providing clean, reliable and affordable energy in seven states across the Southeast and

Midwest.

Duke Energy generally pays dividends to shareholders quarterly. Their track record shows that they’ve paid a quarterly cash dividend 96 consecutive times, the last quarterly payment in September 2021 of $0.985, was an increase of $0.02 per share. In the last year, $DUK stock has traded as high as 108.38 and as low as $85.56.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

SOUTHERN COMPANY (SO)

Southern Company is a very strong competitor in the electric and natural gas utilities industry with a $66.62 billion market capitalization as of February 2022. Its core business consists of electric utilities, natural gas distribution, customized distributed energy solutions and fiber optics and

wireless communications.

Southern Company’s message to potential investors is strong – they’re focused on energy efficiency. The company is the only electric utility in the U.S developing a portfolio of generation resources – natural gas nuclear, and renewables such as wind and solar.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

CONSOLIDATED EDISON (ED)

Consolidated Edison is the second largest solar-power producer in North America with $29.88 billion in market capitalization since February 2022. It has paid their shareholders quarterly for 46 consecutive years. The company also offers investors with a minimum of 50 shares eligibility towards their automatic dividend reinvestment and cash payment plan (DRIP).

Learn More about Dividend Reinvesting at tastytrade

The company’s main focus is on climate change and reducing greenhouse gas emissions through robust investing in renewable energy. Consolidated Edison supports a transition to clean heating alternatives and are working towards using renewable gas where possible.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

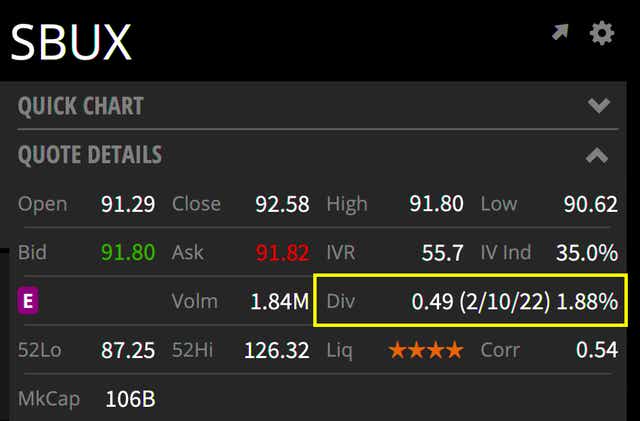

JOHNSON & JOHNSON (JNJ)

Johnson & Johnson has been around for 135 years and recently took the top spot on the pharmaceutical industry list. The company’s market cap is $436 billion as of February 2022, making it the world’s 15th most valuable company by market cap. Annual dividend yield is 2.43% and investors will receive $1.06 per stock as a quarterly dividend amount.

tastytrade account holders can view Market Cap and Dividend information on the “Overview” Tab on the downloadable platform.

Its core business is providing consumer health products for skin health, self-care and essential health brands; medical devices and a wide range of pharmaceutical products.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

COCA-COLA (KO)

The Coca-Cola company has been refreshing the world with their products and making a long-lasting mark as a total beverage

company with their branding for over 135 years.

Their most famous product, the Coca-Cola soft drink, has a global brand value of over $71 billion. Coca-Cola has a dividend yield of 2.71% and total market cap of $266.37 billion as of February 2022 making it the 31st most valuable company in the world. Its shareholders are paid quarterly and receive approximately $0.42 accordingly.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

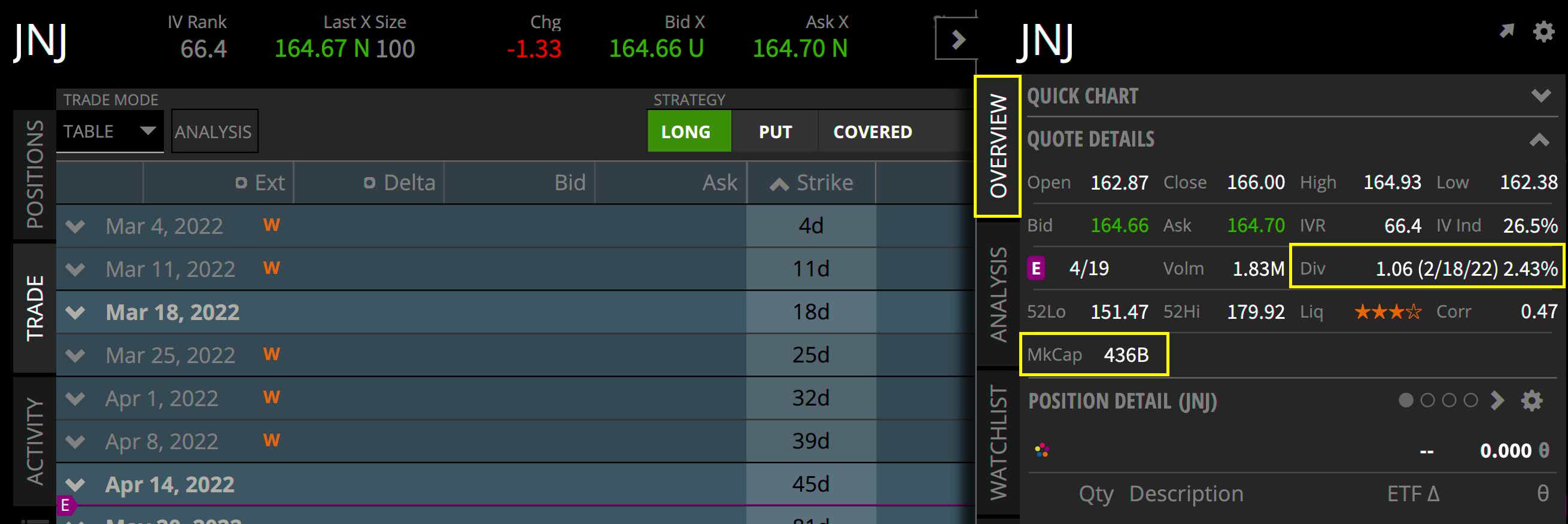

TARGET CORPORATION (TGT)

Target corporation was founded in 1902 by George Draper Dayton who was active in growing the company until his death in 1938. Today, this American retail giant sells a wide variety of food and general merchandise and has more than 1,926 stores in over 50 US states.

Shareholders received a $0.90 quarterly cash payout in February 2022 with a dividend yield of 1.68%.

Currently, IV Rank in $TGT sits high at 80%. IV Rank is used to help put context around current and historic IV levels. This could be seen as an attractive options premium selling opportunity for traders looking to incorporate probability and theta into their portfolio.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

3M COMPANY (MMM)

3M is a Fortune 500 listed American conglomerate founded in 1902 with its headquarters in St. Paul, Minnesota, corporate operations in 70 countries and sales in 200 countries. The company has a diverse slate of businesses and their core segment includes home improvement products, industrial products, office supplies, personal safety items. 3M aims to prioritize science and innovation in its 60,000 products used in homes, businesses,

schools and hospitals .

It’s had 63 years of consecutive annual increase and over 100 years of paid dividends without interruptions. Shareholders received $1.48 each quarter in 2021 with a dividend yield of 3.68%.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

PEPSICO (PEP)

PepsiCo forms a large part of the non-alcoholic beverage and convenient food industry with its world-renowned brands like Pepsi-Cola, Lays, Doritos, Cheetos, Gatorade, Mountain Dew, Quaker, and SodaStream.

The company’s products are found in over 200 countries and are consumed more than one billion times a day. The company generated $8.14 billion in net revenue in 2021 for the twelve months ending

September 30.

Shareholders received a quarterly dividend of $1.075 per share in January 2022, a 5% increase compared to the same quarter in 2020. This was the 49th consecutive annual dividend increase and consistent with PepsiCo’s annual dividend increase announcement to $4.30 per share from $4.09 per share. Since 1965, the company paid consecutive quarterly cash dividends.

.png?format=pjpg&auto=webp&quality=50&width=30&disable=upscale)

REALTY INCOME (O)

Realty Income, the monthly dividend company, started out by using the rent collected from commercial properties held under long-term leases to support monthly dividends to shareholders. The founders, William and Joan Clark, grew this simple idea into paying an impressive 618 consecutive monthly dividends since the company was founded in 1969 until December 2021.

The compound average annual growth rate (CAGR) of Realty Income is 4.5% with 97 consecutive quarterly increases to December 2021. Realty Income’s property portfolio includes 11, 000 properties that are generally freestanding buildings located throughout all 50 states the UK, Spain and Puerto Rico.

HOW TO TRADE OR INVEST IN DIVIDEND STOCKS

You can start trading and investing in dividend stocks with these five steps:

- Learn about dividend stocks and how to trade them via stock and options

- Create a tastytrade account or learn more about opening an account at tastytrade

- Create a trading plan and a risk management strategy

- Choose a dividend stock and open your position

- Monitor and close your position

You can earn money from dividend stocks either by owning the dividend-yielding shares or by trading options on dividend stocks. Rather than collecting a dividend, options traders profit by speculating on what will happen to the price of the underlying as well as any changes in volatility. Here’s a breakdown of the difference between becoming a company shareholder (investing) and options trading.

Learn more about what happens to long and short options around dividend dates.

DIVIDENDS: MAXIMIZING INCOME AND RETURNS

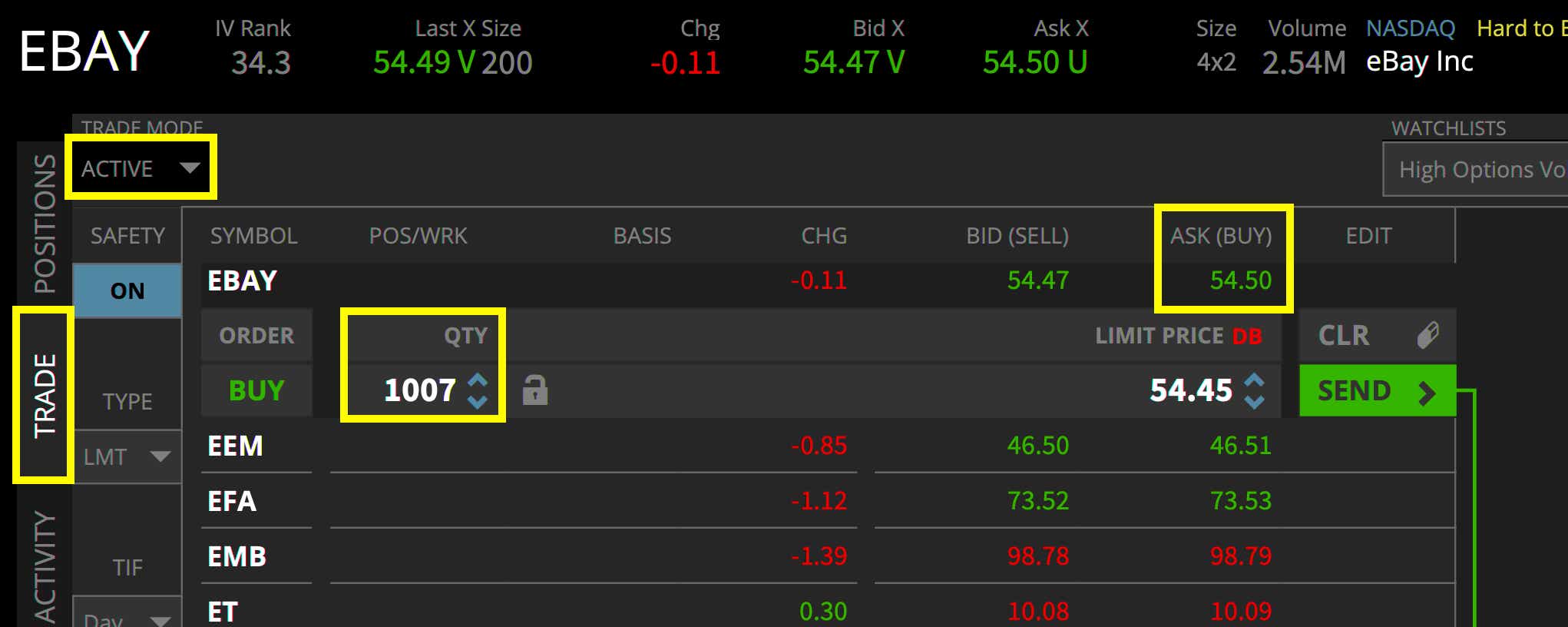

When it comes to maximizing income and returns with dividends, traders need to determine how many shares are needed from a specific company in order to generate a certain level of cash-flow per month.

The calculation for dividend yields is as follows: dividend per share divided by share price times 100.

Traders can also utilize options on dividend-producing stocks to accentuate or reduce the number of shares needed.

For example, if you want to earn $150.00 per month with $55.00 stock from Company XYZ who has a 3.25% dividend yield, you can use the formula in the below image.

Shares required | = 12 x Desired monthly received | = 12 x $150 =1,007 shares |

$ amount needed | = Shares required x Share price | = 1,007 x $55 = $55,385 needed |

On tastytrade, traders can use the various trading interfaces to buy and sell stock at any lot size preferred.

You can then accentuate the monthly cash-flow by selling covered calls. It’ll require less shares by using covered calls to replace some of the divided cash flow.

BEST DIVIDEND STOCKS SUMMED UP

- You can invest in stock with dividends or trade options on dividend-producing stocks

- If an investor owns stock of a dividend-yielding company, they can expect cash payouts from the company’s earnings

- Dividends are influenced by several factors such as corporate actions, market sentiment (bullish or bearish price trends), fundamentals and the long-term economic outlook

- With options on dividend stocks, it’s important to know when a dividend paying out, to see whether or not your option position is at risk

- Historically, utility-based stocks are on the forefront of many investor’s watchlists.

1 Named the Best Online Broker by Investor’s Business Daily (IBD) in its ninth annual survey.

2 NiSource Annual Report, 2011

tastytrade, Inc. and tastylive, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices