The Three Best Blue Chip Stocks to Watch—Disney, Starbucks, Target

The Three Best Blue Chip Stocks to Watch—Disney, Starbucks, Target

By:Mike Butler

Disney, Starbucks and Target all have more than $50 billion in market cap and are within 5% of their 2023 stock price lows.

- Disney reported earnings on Aug. 9, and beat earnings-per-share (EPS) estimates by 6.77%.

- Target reported earnings on Aug. 16, and beat EPS estimates by 26.85%.

- Starbucks reported earnings on Aug. 1, and beat EPS estimates by 5.09%.

Disney

The stock price for Disney (DIS) has dropped below $80 per share five times this year, with the first breach was just a month ago on Sept. 7. The company continues to see pressure from the market to deliver on its product suite, as exemplified in the pre-earnings post by Jermal Chandler, comparing Disney's lack of year-to-date (YTD) performance against other popular streaming companies.

The stock is now down over 10% on the year from the opening price of $88.98, and it's currently trading at $79.86. Disney is celebrating its 100th anniversary this year on Oct. 16, but the stock is trading at levels not seen since the pandemic, so if you're a believer in the company long-term, the price is certainly at a discount relative to the $118.18 stock price high Disney saw in February of this year.

Disney is expected to turn a profit in its streaming business in 2024, and that effort could be boosted with the colder months ahead of us and more people staying inside.

The company is set to report earnings mid-November and will look to build on the 6.77% EPS surprise it reported last quarter. Disney has an expected stock price move of +-$8.63 through January 2024, based on current implied volatility.

Target

Target (TGT) stock is currently trading at $107, after setting the 2023 stock price low just a day ago on Oct. 2. The stock is now down over 28% in 2023 and is having a hard time finding a bottom in this volatile environment. Target reported it is closing some big-market stores after shoplifting incidents, which certainly did not help the bullish sentiment for the stock. Interestingly enough, the company has beat EPS estimates in a big way three times in a row, boasting double digit surprises relative to expectation each time. Last quarter, Target beat EPS estimates by 26.85%.

Similar to other blue-chip stocks, Target's stock price is at levels we haven't seen in over three years. For those who may believe the mounting inflation and economic pressure on the consumer may force consumers to pinch pennies, Target may benefit because it markets itself as an affordable catch-all store.

Target is set to report earnings mid-November and will attempt to post a fourth double-digit EPS surprise. The stock has a +-$14.00 expected move through January 2024, based on current implied volatility.

Starbucks

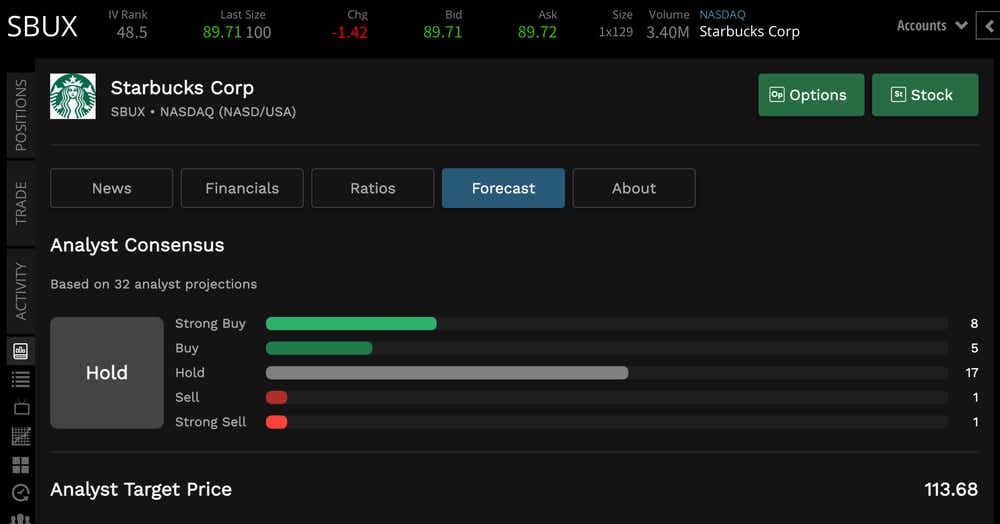

Starbucks (SBUX) stock is down 16% in 2023, and the company set the 2023 stock price low the same day this article was published. Starbucks has beaten EPS estimates twice in a row, and it will look to repeat that next quarter. The stock is still not down nearly as much as some other blue-chip stocks this year, so there's hope for the coffee darling of the United States.

Analysts are signaling the stock is a "hold," although the fast food/drink market has taken a hit this year. Winter months are coming, which may boost hot-coffee sales compared with the summer months, but economic conditions may push people to make their own coffee to save some cash where they can. It will be interesting to see where Starbucks ends the year—higher or lower than $100 per share.

Starbucks is set to report earnings in early November and has a stock price expected move of +-$9.12 through January 2024, based on current implied volatility.

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.