Forget Tariffs: Gloomy U.S. Consumers Are The Risk to Watch

Forget Tariffs: Gloomy U.S. Consumers Are The Risk to Watch

By:Ilya Spivak

Whatever happens with the trade war, the U.S. economy is in trouble if consumers retreat

- Treasury bonds rise as markets move to lock in two Fed rate cuts for 2025

- U.S. retail sales, PPI, and jobless claims data hint at economic headwinds

- Stocks may struggle if U.S. consumer confidence data points to weakness

A slew of U.S. economic data releases lit a fire in the Treasury bond market as stocks maintained an uneasy hover near weekly highs. Across three reports, the numbers painted a worrying picture of U.S. consumption trends, and thereby of the economic growth trajectory. A timely check of consumer sentiment now looms ahead.

Rates fell across the yield curve even as Federal Reserve Chair Jerome Powell hinted that the U.S. central bank’s new policy framework might jettison the concept of average inflation targeting, implying less tolerance for deviations from the 2% objective. Fed funds futures moved to cement expectations for two 25-basis-point (bps) cuts this year.

A worrying view of U.S. consumers emerges in retail sales and PPI data

U.S. retail sales data showed a rise of just 0.1% in April, a modest overshoot of expectations calling for a flat result. Nevertheless, this marks a stark slowdown from an upwardly revised 1.7% surge in the prior month. Tellingly, the kind of tariff front-running that powered that result did not carry over even as trade war worries sharpened.

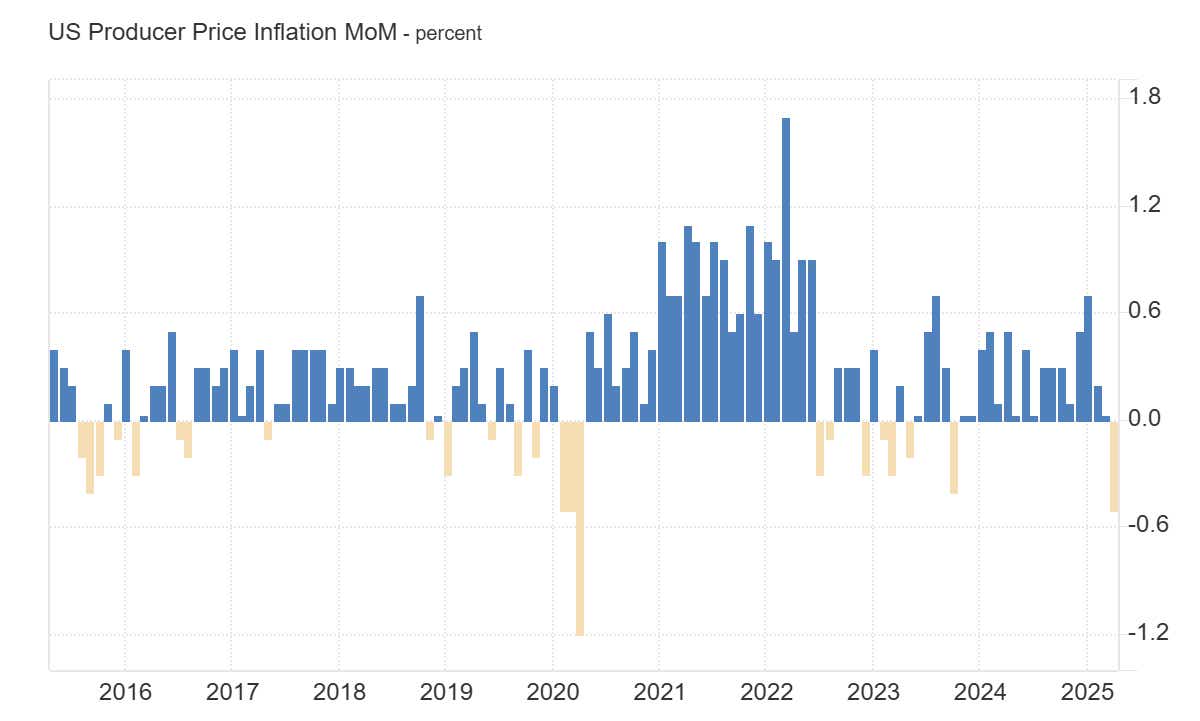

Separately, producer price index (PPI) figures showed an unexpected drop in wholesale inflation. Prices fell 0.5% in April from the prior month, marking the first negative reading since October 2023 and the largest drawdown since the shock 1.2% plunge in April 2020 amid the COVID-19 outbreak.

A sharp drop of 0.7% in services costs was behind the PPI miss. In turn, that came thanks to a 1.6% decrease in margins on trade services. That component mainly reflects the price of running products through the supply chain. Contraction here suggests that businesses are absorbing higher input costs amid tariff hikes rather than pass them on.

U.S. jobless claims data warns labor market stress is building

Finally, jobless claims data showed deeper cracks appearing in the labor market. Weekly changes initial and continuing claims were relatively modest and broadly in line with economists’ expectations. However, the four-week average tracking broader trends rose to the highest in nearly seven months.

Taken together, this seems to say that consumers were unwilling chase tariff deadlines even after the White House shook up policy with “Liberation Day” reciprocal duties, then offered up a 90-day pause to front-load purchases. Their stance may have been more defensive still were the impact of tariffs not blunted as businesses ate the balance.

Signs of weakness in the jobs market make sense against this backdrop: companies losing margins to insulate consumers from higher prices are unlikely to be enthusiastic about hiring. This then adds to pressure on consumption, which further presses firms to resist passing on higher input costs lest that destroys fragile demand.

Are the markets ready to worry about recession again?

A closely watched survey of consumer confidence from the University of Michigan (UofM) will now shed some initial light on how these worrying trends continued to evolve in May. It is expected to show that sentiment continued to hover near the three-year low set in April, where it fell as one-year inflation expectations jumped to a lofty 6.5%.

Household consumption accounts for a commanding 68.5% of U.S. economic growth. First-quarter gross domestic product (GDP) data revealed the weakest contribution from this engine in nearly two years. Signs of deepening retrenchment may into the second quarter might weigh on stocks as recession worries re-emerge.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices