FOMC Preview: Stocks at Risk but Bonds May Rise as the Fed Dithers

FOMC Preview: Stocks at Risk but Bonds May Rise as the Fed Dithers

By:Ilya Spivak

The central bank will probably hold off on an interest rate cut

- The markets want more urgency from the Fed on interest rate cuts.

- Fed Chair Powell and company probably remain in “wait-and-see” mode.

- Stocks are at risk but bonds may rise as stimulus gets pushed back.

Stock markets are in a defensive mood as all eyes turn a much-anticipated monetary policy announcement from the Federal Reserve. The bellwether S&P 500 stock index seems to encapsulate the mood. It has retraced about 2% lower from a one-month high last week, which capped a blistering nine-day winning streak.

The pullback seems to reflect a kind of defensive rebalancing before critical event risk. The U.S. central bank is overwhelmingly expected to keep its interest target unchanged this time around, putting the spotlight on the interpretive parts of the policy update: officials’ post-meeting statement and a press conference with Chair Jerome Powell.

The Fed is resisting market calls for rate cut urgency

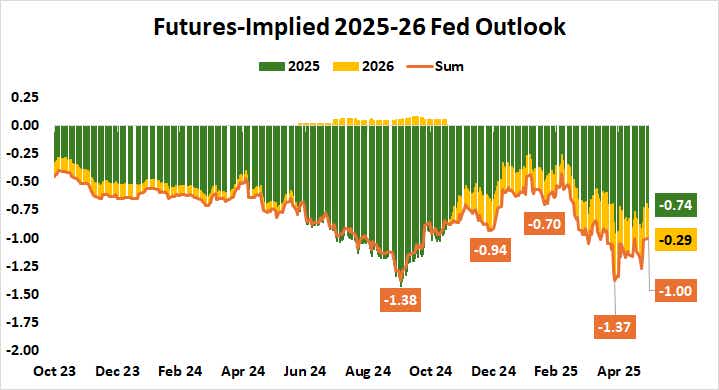

As it stands, the markets are pricing in 100 basis points (bps) in cuts through the end of next year, which neatly lines up with the forecast issued by Fed officials in December and reiterated in March. Traders are pining for greater urgency, however, calling for 75bps this year and 25bps in 2026. Policymakers envision an even 50bps split.

Since March, Powell and company have acknowledged signs of economic stress screaming from business and consumer confidence surveys amid the roughshod rollout of the Trump’s administration’s trade agenda. They’ve resisted leaning against the weakness with rate cuts, worrying aloud about unleashing runaway inflation expectations.

The “hard data” that Fed officials have wanted to clearly beckon stimulus has yet to materialize. First-quarter gross domestic product (GDP) growth disappointed, but tariff-induced anomalies in the numbers cloud the way forward. Jobs growth narrowly outperformed in April, but the result from March was revised lower in almost equal measure.

Political pressure muddies the waters as inflation cools

On the inflation front, the Fed’s favored personal consumption expenditure (PCE) gauge showed core price growth excluding volatile food and energy prices slowed to 2.6% year-on-year in March. That’s the lowest since June last year. Moreover, three- and six-month annualized growth trends are cooling after spiking in February.

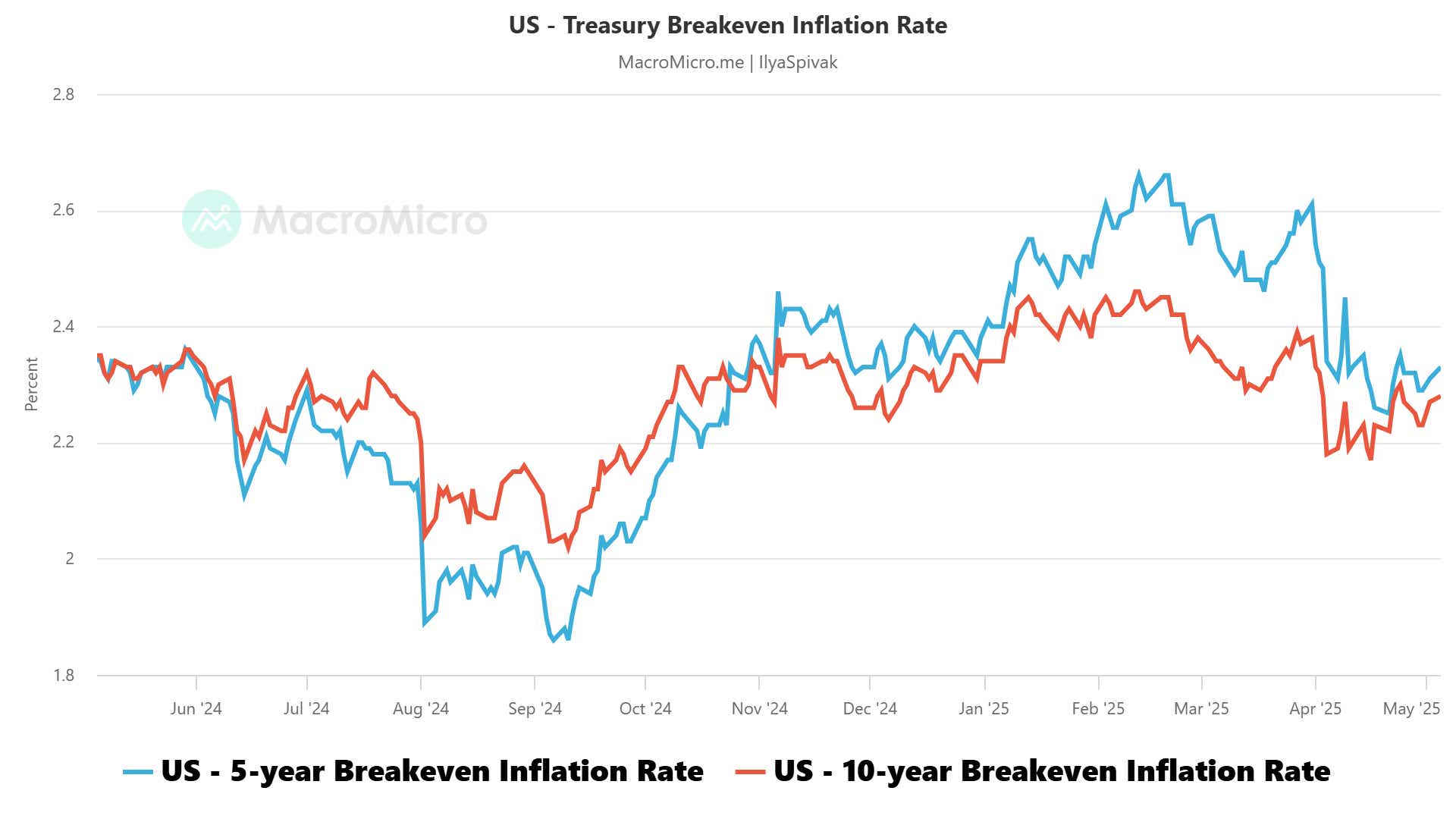

The markets seem to be giving the Fed permission to focus on backstopping economic growth. Inflation expectations priced into the bond market—so-called “breakeven rates”—have trended firmly lower since mid-February. They seem to suggest that any price increases from tariffs will be more than offset by the fall in demand that they then trigger.

That’s probably not enough by itself to spur on a defensively minded Fed keen to avoid the appearance of kowtowing to a belligerent White House.

Policymakers are acutely aware that they are only effective if the markets continue to view the central bank as credibly independent. President Trump has walked back threats to fire Powell, for now.

Stocks at risk but bonds may rise on “more cuts later” Fed view

With all of this in mind, the rate-setting Federal Open Market Committee (FOMC) will probably opt to remain in “wait-and-see” mode, keeping its guidance vague enough for ample flexibility in the months ahead. That seems unlikely to be satisfying for stock markets, which may retrace some more of the sprint higher from April’s lows.

The bond market may prove to be jumpier, however. If traders conclude that the Fed is unduly dragging its feet, they are likely to position for more potent easing downwind as the central bank races to catch up. That may apply outsized pressure to longer-dated Treasury yields, sending the corresponding prices higher. And the U.S. dollar might weaken.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices