Are Stocks and Bonds Done Falling? Look to the Japanese Yen for Clues

Are Stocks and Bonds Done Falling? Look to the Japanese Yen for Clues

By:Ilya Spivak

How the Japanese yen reacts as local inflation slows may offer a major clue about what’s next for global stock and bond markets

- Japanese yen is under pressure as Treasury yields rise and hawkish BOJ bets scatter.

- December CPI data is expected to signal Japanese monetary policy will stay firmly dovish.

- If the yen holds up as inflation cools, a peak in global rates may be in view.

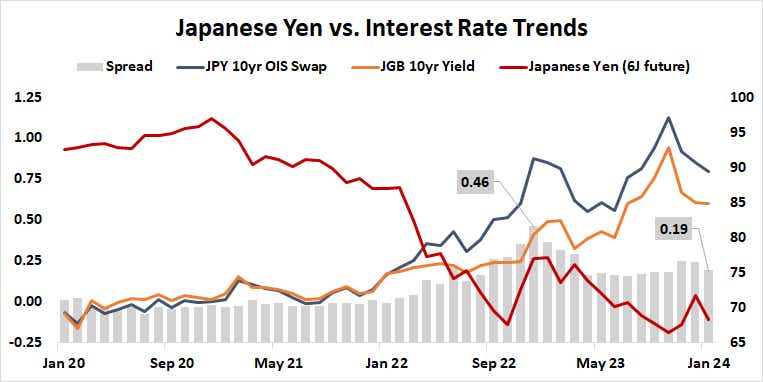

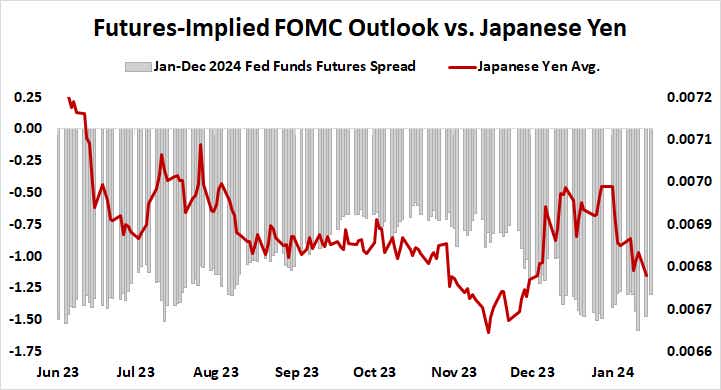

The Japanese yen roared higher in November and December amid an upswell of interest rate cut bets. Midway through January, it has erased well over half of that advance. While much of the reversal surely tracks with a rebound in Treasury yields as dovish speculation moderates, a local story seems likewise at play.

The currency suffered punishing losses in 2022 as the Bank of Japan (BOJ) stood aside while the Federal Reserve led most major central banks on a rapid tightening campaign. It also spent most of 2023 on the defensive as the U.S. central bank saw “higher for longer” rates until finally relenting in the last two months of the year.

Bank of Japan: sea change in the works?

An interlude of explosive yen strength at the close of 2022 marked an interruption that still haunts financial markets. Then-BOJ Gov. Haruhiko Kuroda surprised financial markets by loosening the central bank’s commitment to cap yields on 10-year Japanese government bonds (JGBs) at 0%, the so-called “yield curve control” (YCC) program.

Traders have long speculated that an unwind of YCC will precede a move away from negative interest rates by the perennially dovish Japanese monetary authority. It took three months for them to conclude that a change is not immediately at hand, enabling the yen to refocus on the Fed and wind the upswing.

Nevertheless, the specter of a sea change in BOJ policy continues to haunt the markets.

The arrival of new Gov. Kazuo Ueda stoked the flames as investors posited that the unusual choice of an academic instead of a career bureaucrat to lead the central bank—especially one from the stable of transformative economists mentored by Stanley Fischer—meant something dramatic was afoot. Fischer’s other acolytes include former Federal Reserve and European Central Bank (ECB) leaders Ben Bernanke and Mario Draghi, respectively.

For his part, Ueda has tacitly encouraged hawkish speculation, launching a comprehensive policy review widely believed to set the stage for a fundamental reorientation of the BOJ’s approach and continuing to weaken the YCC commitment incrementally. Still, he has argued that tightening will only come if inflation has returned in earnest.

Inflation in Japan: less than meets the eye

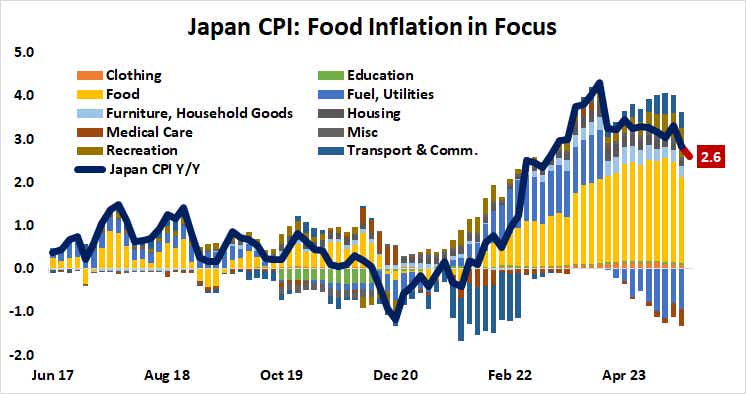

Here is wheere hawkish mythmaking runs into trouble. December’s consumer price index (CPI) data is set to show a headline inflation reading of 2.6% year-on-year, marking the 21 consecutive months above the central bank’s 2% objective. However, price growth is running hot for all the wrong reasons.

Strip out food prices, and the headline consumer price index (CPI) rate drops to just 0.6%. Japan produces less than 40% of its own food, making this an imported problem. The BOJ officials have stressed that they need to see sustainable, domestically driven price growth to consider abandoning their dovish stance.

What about the ongoing weakening of YCC? The symmetrical thresholds for BOJ-tolerated departures from the 0% cap have been incrementally widened from 0.25% to 1%. This was done to avoid pitting the central bank against a hawkish Fed, whose rate hike cycle pressured yields higher globally.

Now that this pressure has evaporated alongside speculation that the U.S. central bank is finished raising rates and will begin to cut them, YCC seems to have outlived its usefulness. The BOJ is likely to sunset the program at the end of its policy review. Beyond that, Japan’s demographics will make any normalization slow and modest.

Japanese yen vs. stock and bond markets: a signal in the noise

A dovish shift in priced-in Japanese monetary policy expectations in the fourth quarter suggests traders are coming around to the idea that a tectonic hawkish breakthrough is probably a pipe dream. Still, there appears to be a bit of market-moving potential in the story. For example, the yen tellingly weakened on soft wages data just last week.

How the currency reacts as the higher-profile CPI report tells the same story may prove to be telling, for Japanese markets and beyond. If it holds up despite the obvious implications of softer inflation on the BOJ trajectory, two key conclusions follow. First, that hawkish speculation has been truly scattered. Second, that global rates may turn lower anew.

A yen that has been freed from breathless BOJ prognostication will once again revert to trading as a foil for Treasury yields. If this return to form bookends the latest selloff, a parallel conclusion might be that January’s moderation in Fed rate cut expectations has run its course. That’s something global stocks and bonds may celebrate.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices